A Guide to Property Taxes in Italy for Buyers and Owners

So, you’re dreaming of a sun-drenched villa in Tuscany or a chic apartment in Rome? That dream is absolutely within reach, but the first step to making it a smart reality is getting to grips with property taxes in Italy. It might sound daunting, but the system is actually quite logical once you break it down.

Essentially, you'll encounter two types of taxes: those you pay once when you buy the property, and those you pay every year you own it.

Your Financial Roadmap to Italian Real Estate

Before you start planning the decor for your terrace, let's talk numbers. The Italian tax system can feel like a maze at first glance, but it's all about understanding the key milestones. Think of this guide as your compass, pointing you in the right direction and helping you avoid any nasty surprises down the road.

The entire process boils down to two distinct phases: the purchase and the ownership. Each has its own set of taxes with specific Italian names and rules. Getting familiar with them now will save you headaches and help you build an accurate budget. If you want to zoom out and see the bigger picture, our comprehensive guide on buying a house in Italy walks you through every step.

A System in Evolution

It's important to know that Italy's property tax structure isn't set in stone; it's evolved quite a bit. A major overhaul back in 2012 completely changed the game for homeowners. Before then, total tax revenues from primary homes were around €1 billion between 2010 and 2011.

After the reform? That figure shot up to approximately €4.2 billion in 2012 alone. That's a fourfold increase that fundamentally reshaped the financial responsibilities of owning property in Italy.

The core idea behind these taxes is to fund the local municipalities (comuni). The money you pay for things like waste collection and street lighting goes directly back into maintaining the beautiful community where your new home is located.

To keep things simple, let's sort the taxes into two main buckets:

- Acquisition Taxes: These are one-off costs you'll handle at the closing table. They include the Registration Tax (Imposta di Registro), Land Registry Tax (Imposta Ipotecaria), and Cadastral Tax (Imposta Catastale), or in some cases, Value Added Tax (VAT).

- Annual Ownership Taxes: These are the recurring costs of homeownership in Italy. The main ones to know are IMU (the principal municipal property tax) and TARI (the waste tax). An older tax, TASI, has mostly been folded into IMU.

To give you a quick, clear overview, here’s a table summarizing the essential taxes you'll encounter.

Quick Guide to Key Property Taxes in Italy

This table provides an at-a-glance summary of the primary taxes involved in buying and owning property in Italy.

| Tax Name | What It Covers | Who Pays It | When It's Paid |

|---|---|---|---|

| Registration Tax | Transfer of property ownership | Buyer | At the time of purchase |

| IMU | Municipal property ownership | Property Owner | Annually (in installments) |

| TARI | Waste collection services | Property Occupier/Owner | Annually (in installments) |

| Capital Gains Tax | Profit from selling property | Seller | At the time of sale (if applicable) |

This simple breakdown gives you a solid foundation as we dive deeper into what each of these taxes means for your wallet.

Understanding Your Annual Property Tax Obligations

So, you've got the keys to your new Italian place. Congratulations! Now, your attention will naturally shift from the one-time costs of buying to the regular, ongoing expenses of ownership. It's best to think of these annual taxes not just as bills, but as your contribution to the local community—the very place that makes your Italian dream possible.

The system is built on three main pillars, each funding different parts of local life.

These property taxes in Italy are all handled locally, which means the rules and rates can change quite a bit from one charming village to the next. The groundwork for the current system was laid back in 1993 with a big reform that introduced the Municipal Property Tax (ICI). To give you an idea of its importance, between 1993 and 2007, these taxes brought in an average of €12.7 billion each year. That's a lot of funding for local services. If you're curious, you can dig into the historical data on Italian tax revenue trends and see the economic impact for yourself.

Let's break down the three main annual taxes you'll be dealing with.

IMU: The Main Municipal Property Tax

The big one you need to know about is IMU (Imposta Municipale Unica). This is the primary property tax that most owners will encounter. Think of it as Italy's version of a council tax or general property tax.

The money collected from IMU is essentially the lifeblood of the local municipality (comune), paying for all sorts of public services. But here’s the most important part: whether you actually have to pay it depends entirely on how you use the property.

IMU is almost exclusively for second homes and investment properties. If you buy a home and officially declare it as your primary residence (prima casa), you are generally exempt from paying IMU. This is a massive benefit for anyone planning to make Italy their full-time home.

There is, however, one catch: luxury properties. If your home falls into the cadastral categories of A/1 (prestigious homes), A/8 (villas), or A/9 (castles and palaces), you'll still have to pay IMU even if it's your main residence, though usually at a lower rate.

Key Takeaway: For most international buyers using their property as a holiday home or rental, IMU will be a yearly tax. The key to avoiding it is making the property your official residence—unless, of course, you've bought a castle.

TARI: Paying for Your Bins to Be Emptied

Next on the list is TARI (Tassa sui Rifiuti). This one is simple—it’s the waste collection tax. It pays for the garbage trucks to come around and for everything else involved in managing the town's refuse.

Unlike IMU, TARI is paid by whoever is actually living in the property, whether that's the owner or a tenant. The logic is that everyone produces waste, so everyone chips in to have it taken away.

The amount you pay is typically based on two things:

- The size of your property in square meters. Bigger homes tend to pay more.

- The number of people living there. More people usually means more waste.

Each town sets its own TARI rates and adjusts them every year based on what they expect their waste management services to cost.

TASI: For Services We All Share

The last one is TASI (Tributo per i Servizi Indivisibili). This tax was created to cover the costs of "indivisible" services—things everyone in the community benefits from, like streetlights, road repairs, and the local police.

For a few years, TASI and IMU were two separate taxes, which frankly made things a bit confusing for property owners. Thankfully, the system was simplified in 2020, and TASI was essentially rolled into the IMU.

What this means for you today is that you probably won't see a separate bill for TASI. Its costs are now typically included in the IMU calculation for second homes. And since primary homes are exempt from IMU anyway, you won't pay TASI on them either, except in very rare local situations. This change has definitely made paying annual taxes in Italy a little more straightforward.

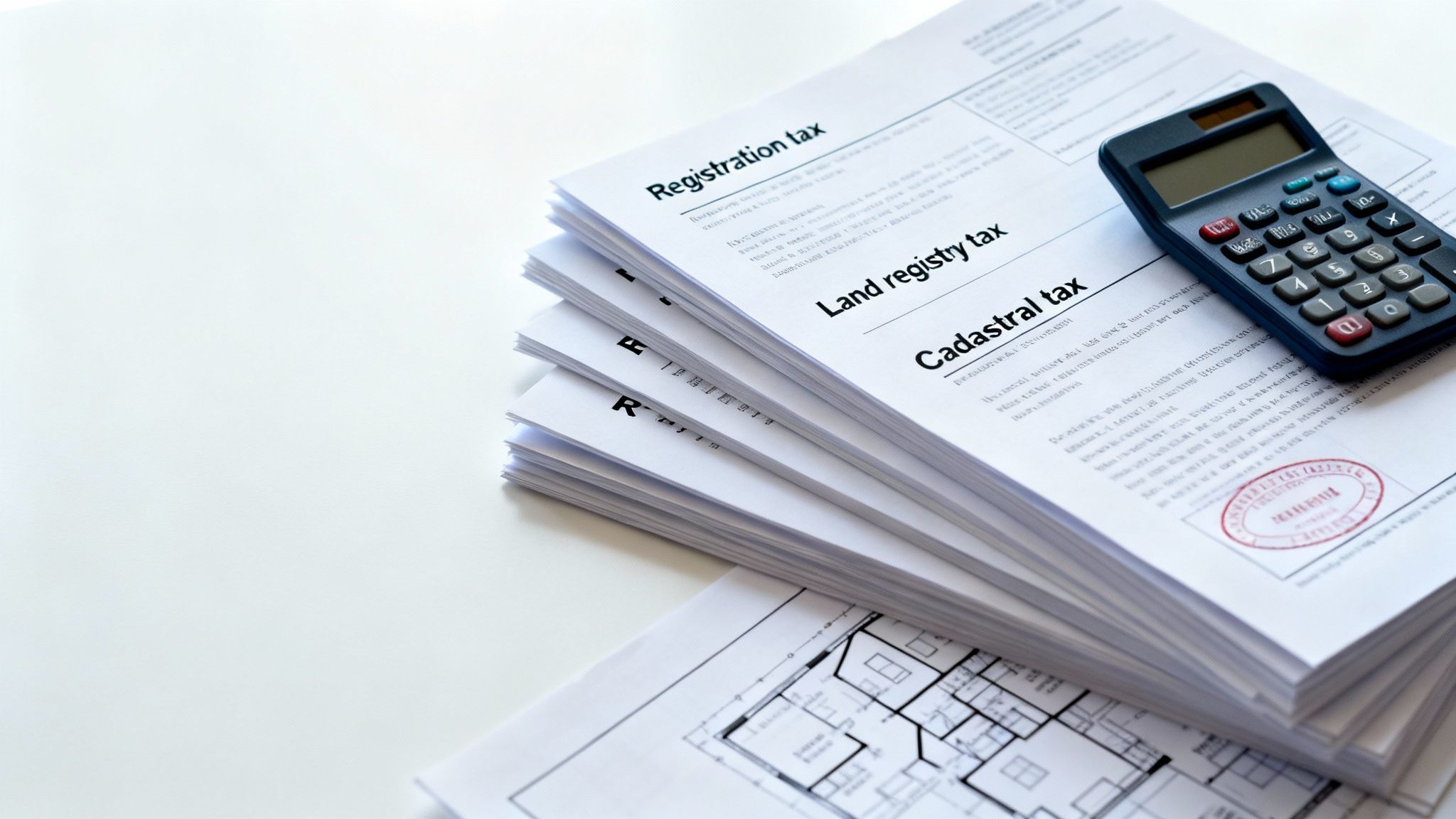

Getting to Grips with One-Time Purchase Taxes

Beyond your annual property tax obligations, the initial purchase of your Italian home triggers a handful of one-time fees. Think of these as the administrative costs of getting the property legally transferred into your name. It’s absolutely crucial to budget for these from the get-go, as they form a hefty chunk of your total closing costs.

The main taxes you'll face are a trio: the Registration Tax, Land Registry Tax, and Cadastral Tax. But here’s the key thing to know: the final bill depends entirely on who you are buying from. The rules are different if you're buying from a private individual versus a construction company.

First, Let's Talk Cadastral Value

Before we jump into the tax rates, you need to understand a fundamental concept in Italian real estate: the cadastral value (or valore catastale). This is not the market price you agree to pay the seller.

Instead, it’s a much lower, government-assessed value used purely for calculating these purchase taxes. For buyers, this is a huge advantage. It means your tax liability is based on a far more favorable number than the actual price tag of the home.

The cadastral value comes from a formula that takes the property’s official rendita catastale (a figure on its land registry documents) and multiplies it by a set coefficient.

It’s a bit abstract, so here’s a simple example. A home you buy for €300,000 might have a cadastral value of only €80,000. All the percentage-based taxes are then calculated on that €80,000 figure, not the full €300,000. You can see how that leads to some serious savings.

This system is a core part of Italian property law and is quite different from countries where tax is simply based on the full purchase price.

Buying from a Private Seller: The Standard Path

When you buy a home from another private individual—which is the most common path for international buyers—you'll pay three taxes based on that handy cadastral value. If you've ever looked into buying property elsewhere, you can think of these as Italy's version of a property transfer tax.

The rates hinge on whether the property will be your main home (prima casa) or a second home.

- Registration Tax (Imposta di Registro): This is the big one. For a second home, it’s 9% of the cadastral value. But if it’s your primary residence, the rate plummets to just 2%.

- Land Registry Tax (Imposta Ipotecaria): This covers the cost of officially registering the sale. It’s a flat €50, whether it's a primary or second home.

- Cadastral Tax (Imposta Catastale): This is for updating the government's property maps and records. It’s also a flat €50.

It's pretty clear that having the prima casa status saves you a significant amount of money right at the closing table, not just on your yearly tax bills.

Buying from a Developer: The VAT Alternative

Now, let's look at the other scenario. If you buy a brand-new property directly from a developer or construction company (within five years of its completion), the tax structure flips. Instead of the Registration Tax, the sale is subject to VAT (IVA).

And here’s the critical difference: VAT is calculated on the full purchase price, not the lower cadastral value.

Here's how those rates look:

- VAT (IVA):

- 10% of the purchase price for a second home.

- A reduced 4% rate if it's your primary residence.

- For designated luxury properties, the rate jumps to 22%.

- Registration, Land Registry, and Cadastral Taxes:

- These become fixed fees of €200 each, for a total of €600.

Because VAT is tied to the actual sales price, this route can sometimes end up being more expensive, even if the percentage looks lower at first glance. It’s always smart to run the numbers for your specific deal to see which scenario works out better for you.

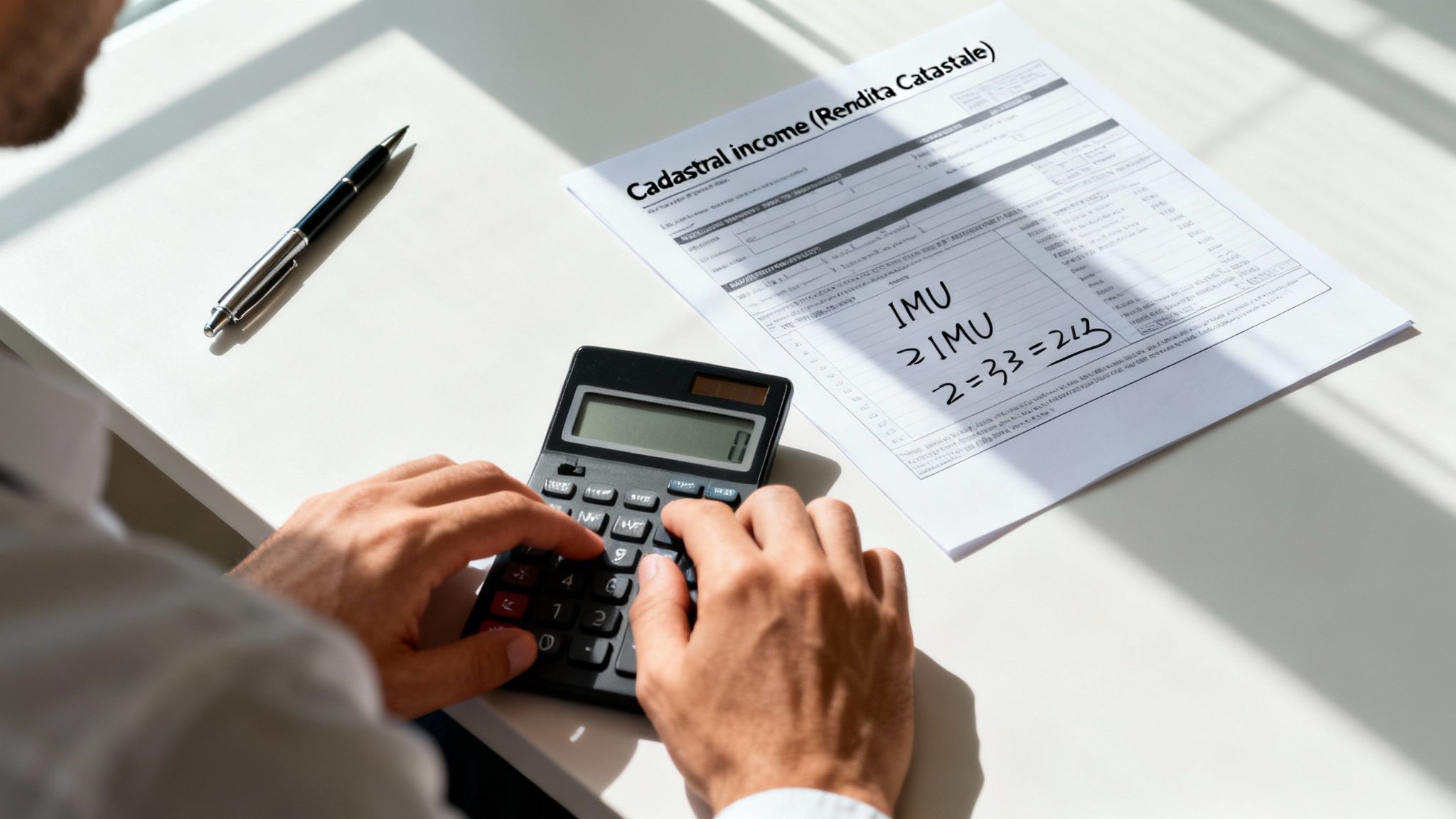

How to Calculate Your Italian Property Taxes

Alright, let's move from theory to reality. Seeing how the numbers work is the best way to get a handle on the real-world cost of owning property in Italy. Calculating your tax bill, especially for the annual IMU, isn't as scary as it sounds once you know the formula. It all boils down to one key figure.

The entire calculation for your annual property taxes in Italy is built on a number called the Rendita Catastale. Think of it as the property's official "taxable income" in the eyes of the government. It has very little to do with the home's market price or what you could earn renting it out.

You’ll find this number on the property’s deed (atto) or by requesting a document called a visura catastale from the land registry (catasto). Once you have it, you have the cornerstone for figuring out your IMU tax.

The Three-Step IMU Calculation

With the Rendita Catastale in hand, calculating your estimated IMU is a surprisingly straightforward, three-step process. You'll just need to adjust this base number, apply a standard multiplier, and then factor in the local tax rate.

Let's walk through it:

- Revalue the Rendita Catastale: First, you bump up the Rendita Catastale by 5%. This is a standard revaluation that applies to all properties.

- Apply the Cadastral Multiplier: Next, you multiply that new figure by a coefficient (moltiplicatore) which changes based on the property’s official category. For most residential second homes (cadastral group A, but not A/10 office spaces), this multiplier is 160.

- Apply the Municipal Tax Rate: The final step is to multiply your result by the local town's tax rate, called the aliquota. This is where things can really vary.

The national average for this municipal rate has hovered around 0.437% (often expressed as 4.37 per thousand), but local governments have a lot of freedom here. They can raise the rate up to a ceiling of 1.06% or, in some cases, even drop it to zero. This flexibility is a core feature of Italy's tax system, giving local communes control over their own revenue streams. If you're interested in the history, you can find more detail on how these reforms took shape by reviewing studies on Italian property tax structure.

A Practical Example: A Countryside Home in Umbria

To see how this works in the real world, let’s imagine you’ve just bought a charming holiday home in the Umbrian countryside.

- Property: Second home (not your primary residence)

- Rendita Catastale: €500

Now, we just follow the three steps:

- Revalue: €500 x 1.05 = €525

- Apply Multiplier: €525 x 160 = €84,000 (This new total is your official taxable base, or base imponibile).

- Apply Municipal Rate: Let's say the local comune has set its standard IMU rate at 0.86%.

- €84,000 x 0.0086 = €722.40

Just like that, your estimated annual IMU bill for this lovely Umbrian getaway comes to €722.40. This amount is usually split into two payments—a deposit in June and the final balance in December.

What if it were a primary residence? The calculation itself would be identical, but the final outcome is completely different. Because it would qualify as your prima casa (and assuming it’s not a luxury property), it would be 100% exempt from IMU. This really drives home the huge financial benefit of making your Italian property your official home.

To give you a better feel for the numbers, the table below shows how different municipal rates can impact the final tax bill, using the same taxable base from our example.

Sample IMU Calculation Scenarios

This table gives a side-by-side look at estimated annual IMU taxes, showing how much of a difference the local rate makes on the same property.

| Property Scenario | Assumed Cadastral Value (€) | Applicable Tax Rate (%) | Estimated Annual IMU (€) |

|---|---|---|---|

| Second Home in a Low-Tax Town | €84,000 | 0.76% (Base Rate) | €638.40 |

| Second Home in an Average Town | €84,000 | 0.86% (Standard) | €722.40 |

| Second Home in a High-Tax City | €84,000 | 1.06% (Maximum Rate) | €890.40 |

| Primary Residence (Non-Luxury) | €84,000 | N/A | €0 (Exempt) |

As you can see, simply by following this formula, you can get a very reasonable estimate of your yearly tax obligations. This makes it much easier to budget properly as you plan your new life in Italy.

Tackling Taxes on Rental Income and Capital Gains

Once you’ve settled the annual ownership taxes, the next layer of financial planning involves any money your Italian property makes for you. Whether you're letting it out to holidaymakers or planning to sell it down the line, getting a handle on the tax rules is key to protecting your investment returns.

How to Handle Rental Income

When it comes to taxing rental income, Italy gives you a choice between two very different systems. It really comes down to your personal financial picture.

The traditional route is to declare your rental earnings on your annual Italian tax return. This income gets bundled with any other earnings you have in Italy and is taxed at the standard progressive IRPEF rates, which climb from 23% to 43%.

The Simpler Flat-Tax Option: Cedolare Secca

Most landlords, however, go for a much simpler, and often cheaper, alternative called the cedolare secca. Think of it as a flat-tax shortcut that replaces the complicated IRPEF system for rental income.

If you’re renting your property out long-term, the flat tax is a straightforward 21%. For short-term and holiday lets, the rate is 26%. For anyone who would otherwise be in a higher income bracket, this can mean serious savings.

The real beauty of the cedolare secca is that it’s an all-in-one tax. It covers not just the income tax but also the registration and stamp duties you'd normally pay on a rental contract. It cleans up the paperwork nicely.

What About Capital Gains When You Sell?

If you decide to sell your Italian property, you could be looking at a capital gains tax, or plusvalenza as it's known locally. This is a tax on the profit you make—the difference between what you paid for the property and what you sell it for.

But here’s the most important rule to remember, and it’s great news for long-term investors: capital gains tax only applies if you sell the property within five years of buying it.

Hold onto the property for longer than five years, and any profit you make on the sale is entirely tax-free. This five-year rule is a huge incentive for people to invest in Italy for the long haul. It's an especially important factor now, with Italy's property market trends showing a steady 3.93% year-over-year price increase as of mid-2025. Timing your sale can make all the difference.

If you do sell within that five-year window, your profit is taxed at a flat rate of 26%. There's another handy exemption, though: if the property was your main home (prima casa) for most of the time you owned it, you're off the hook for capital gains, even if you sell before the five-year mark.

For a complete breakdown of this topic, our guide on capital gains tax on foreign property has you covered.

A Practical Guide to Paying Your Property Taxes

Knowing what you owe is one thing, but how do you actually get the money to the right place? Paying property taxes in Italy can feel intimidating at first, but once you get the hang of it, it's a pretty straightforward system with predictable deadlines.

The key to everything is a form called the Modello F24. Don't let the official name scare you; it’s not a complex tax return. Think of it more like a universal payment slip used for nearly all taxes in Italy. This standardized form tells the Italian tax authorities exactly who you are, what tax you're paying, and for what property.

Getting to Grips with the Modello F24

When you look at a Modello F24, you'll see fields for specific codes (codici tributo) that identify the tax you're paying, whether it's IMU, TARI, or something else. You'll need to enter your personal details, the property's cadastral information, and the precise amount owed. Even a small mistake here can send your payment into a bureaucratic black hole.

This is exactly why most foreign owners hire a local accountant, or commercialista. They're worth their weight in gold. A good commercialista will not only calculate your taxes using the latest local rates but will also prepare the Modello F24 for you, making sure every detail is perfect.

Key Payment Deadlines and Structure

Most annual property taxes, like IMU, are split into two payments. This makes the financial hit a bit easier to manage throughout the year.

- Acconto (First Installment): The first payment is due by June 16th. This is essentially a down payment, and it's usually based on the previous year's tax rates.

- Saldo (Final Balance): The second and final payment is due by December 16th. This payment squares you up for the year, taking into account any new tax rates the municipality announced since your first payment.

This two-part system is actually quite clever. It allows you to get a head start on your tax bill without having to wait until the very end of the year for the final rates to be confirmed.

How to Actually Make the Payment

Once your Modello F24 is filled out and ready to go, you have a few ways to pay.

- Through an Italian Bank Account: If you have an account in Italy, this is the easiest route. You can pay directly through your online banking portal or just walk into a branch.

- At the Post Office (Poste Italiane): You can take your completed Modello F24 to any post office and pay over the counter. It's a very common way to handle bills in Italy.

- Let Your Commercialista Handle It: Many accountants will handle the payment for you as part of their service. They pay on your behalf, and you simply reimburse them.

For anyone managing their property from abroad, having a commercialista handle the payment is almost always the best bet. It completely removes the stress of navigating Italian banking systems and language barriers.

Got Questions About Italian Property Taxes? We've Got Answers.

Diving into the world of Italian property taxes can feel a bit daunting, especially if you're buying from abroad. It’s only natural to have a few questions pop up. Let's walk through some of the most common ones I hear from clients, so you can feel more confident about your purchase.

Do I Still Owe Tax on a Home I'm Renovating?

Yes, generally you do. The IMU is tied to ownership, not whether the property is currently livable. But there's a key exception worth knowing about.

If a property is officially declared "uninhabitable" (inagibile) by the local municipality, you can get a 50% reduction on your IMU tax base. This isn't something that happens automatically, though. You need to get a formal certification from the town's technical office (ufficio tecnico del comune). My advice? Work with a local professional to get this handled correctly from the start.

What Is This "Prima Casa" Tax Benefit I Keep Hearing About?

The "prima casa" (first home) benefit is hands-down one of the best tax breaks you can get in Italy. It offers massive savings on your purchase taxes and can eliminate your annual property tax bill entirely.

So, how do you qualify? There are a few main conditions:

- Residency is key: You have to register as an official resident in the same municipality as the property within 18 months of buying it.

- No luxury homes: The property can't be classified as a luxury dwelling (that's cadastral categories A/1, A/8, or A/9).

- One-time deal: You can't already own another property in Italy where you've used the "prima casa" benefits before.

Nail these requirements, and you'll see your purchase taxes drop dramatically. Better yet, a qualifying "prima casa" is completely exempt from IMU.

How Can I Figure Out the Tax Rates for My Town?

Here’s a classic Italian twist: each of the country's nearly 8,000 municipalities (comuni) sets its own IMU tax rates (aliquote) every single year. That means the rate in one town can be completely different from the one right next door.

The only truly reliable source is the official website of the municipality where your property is. You'll want to look for the "Tributi" (Taxes) section and find the official resolutions (delibere). If your Italian isn't quite there yet, the easiest path is to ask a local accountant (commercialista) or a tax assistance center (CAF). They will have the exact, up-to-the-minute rates ready for you.

What If I Accidentally Miss a Tax Payment?

It happens. If you miss a deadline for property taxes in Italy, you'll face penalties and interest. The good news is that Italy has a system called "ravvedimento operoso," which is basically a way to self-correct. You can pay what you owe plus a reduced penalty to get back on track.

The penalty is tiered, so it gets bigger the longer you wait. It's always best to sort out late payments as soon as you realize the mistake to keep the extra costs as low as possible. A commercialista can calculate the exact amount you owe, including any fines, to make sure you're fully paid up and compliant.

Ready to find your perfect Italian home without the stress? At Residaro, we simplify your search for properties across Europe. Explore our curated listings and start your journey today by visiting https://residaro.com.