Your Guide to Buying a House in Italy

For many people in Europe, buying a home in Italy is the ultimate dream. It’s a vision filled with romantic notions of sun-drenched terraces and a slower, sweeter way of life. But turning that dream into a reality is a practical process, one that’s completely achievable if you know what to expect.

From sorting out your finances and getting your head around the legal side, to the thrill of the property hunt and finally closing the deal, it’s a journey. Think of it as more than just a transaction; it's an investment in the famous Italian lifestyle, la dolce vita.

Your Italian Dream Home: A Practical Guide

Let's cut through the fluff. Forget the generic travel brochure talk and focus on what you actually need to do to get the keys to your very own casa. This guide is a real-world roadmap for European buyers, breaking down the essential stages you’ll encounter on your path to owning a slice of Italy.

We'll look at the real reasons driving this huge life decision—whether you're after a holiday hideaway, a smart investment property, or you're planning a full-time move. It's a journey that's equal parts exciting and complex, so going in with your eyes wide open is key.

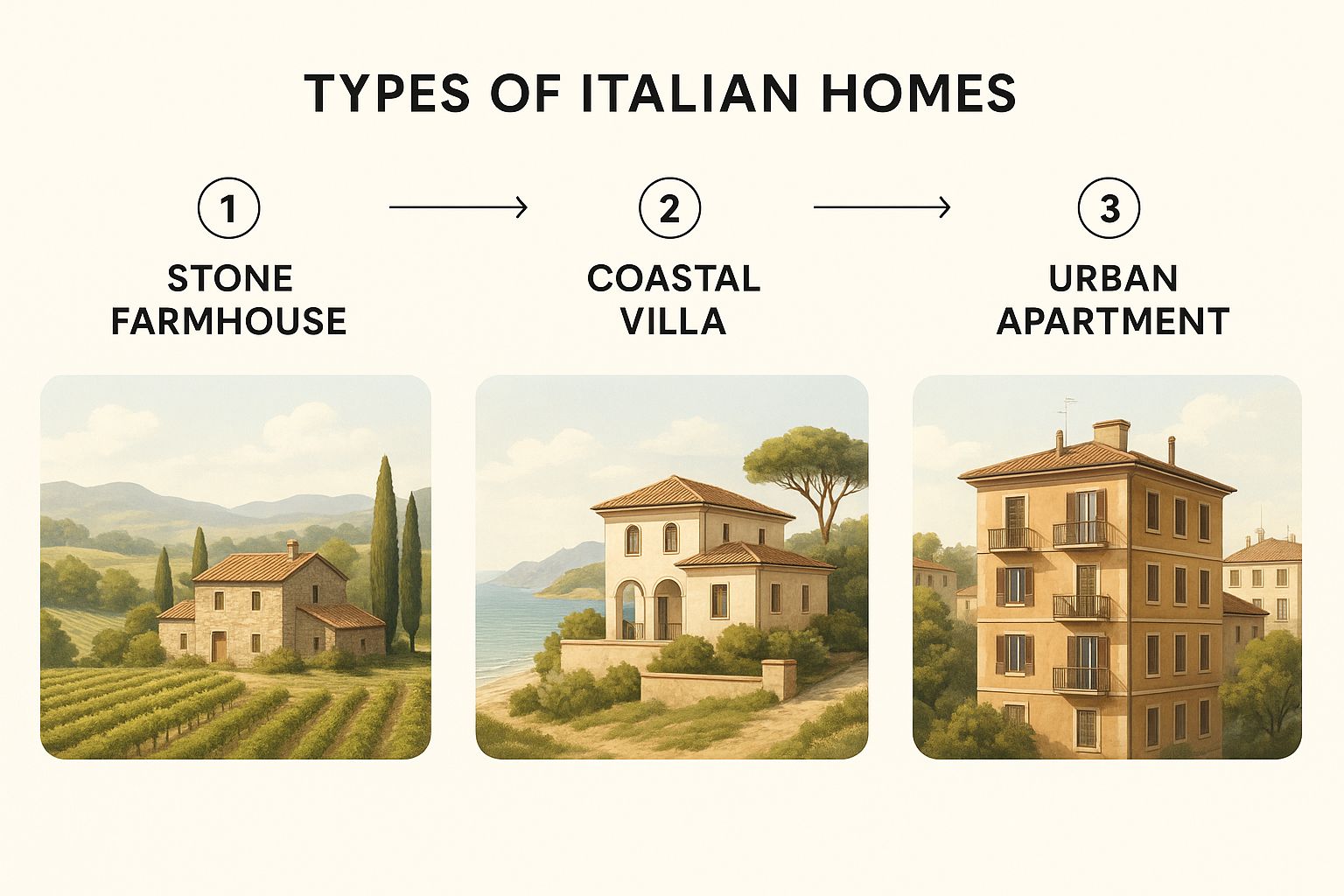

As you start to imagine your new life, you’ll discover an incredible variety of properties, from rustic stone farmhouses in Umbria to chic city apartments in Milan or breezy coastal villas in Sicily.

Each type of home offers its own unique character and a connection to the local culture, giving you a real sense of place.

The Key Stages of Your Purchase

The path to owning a home in Italy follows a very structured route, which can feel quite different from the property-buying process back home. Getting familiar with these stages right from the start will help you manage your expectations and feel prepared for each milestone. It’s a lot less daunting when you know what’s coming up next.

To give you a clear overview, here’s a quick summary of the main phases a European buyer will typically go through.

Key Stages of Buying Property in Italy

| Phase | Key Action | Average Timescale |

|---|---|---|

| Financial Preparation | Obtain a Codice Fiscale (tax code) and secure mortgage pre-approval. | 1-2 months |

| Property Search | Engage an estate agent and conduct viewings in chosen regions. | 1-6 months |

| Making an Offer | Submit a proposta d'acquisto (purchase offer), often legally binding. | 1-2 weeks |

| Preliminary Contract | Sign the compromesso and pay the caparra (confirmatory deposit). | 2-4 weeks after offer |

| Due Diligence | The notaio (notary) and your lawyer verify legal and property status. | 2-4 weeks |

| Final Deed | Sign the rogito notarile (final deed), pay the balance, and receive the keys. | 1-3 months after compromesso |

| Post-Purchase | Register the deed, set up utilities, and arrange tax payments. | 1-2 months post-closing |

This table lays it all out, but it's worth remembering that things don't always run perfectly to schedule.

It's important to realise that while the stages are sequential, flexibility is key. Delays can happen, especially with older properties requiring extensive checks. Patience and a good local team are your most valuable assets.

Budgeting Beyond the Asking Price

Before you get swept away by romantic visions of a rustic farmhouse in Umbria, let's ground your dream in financial reality. A solid, realistic budget is the foundation of any successful property purchase in Italy. This isn't just about the asking price; it's about understanding the full, all-in cost of your investment.

The very first piece of admin you need to tackle is getting a Codice Fiscale, Italy's tax identification code. Think of it like a National Insurance number—it's absolutely essential. Without one, you can't open an Italian bank account, sign a contract, or even connect the utilities. The good news is that you can get this sorted at an Italian consulate before you even start looking at properties. Get this done first.

Understanding Your Mortgage Options

For most people buying from Europe, financing is a major part of the puzzle. While getting a mortgage in Italy as a non-resident is definitely possible, the rules of the game are quite different from what you might be used to. Italian banks tend to be more cautious when lending to foreign nationals.

You'll need to be ready with a significant deposit. Banks will typically look for a down payment of at least 20-40% of the property's value. So, for a home listed at €250,000, you'd need to have between €50,000 and €100,000 in cash just for the deposit, before you even think about other fees. My advice? Get a mortgage pre-approval sorted early. It gives you a crystal-clear idea of your budget and shows sellers you're a serious buyer.

Uncovering the Hidden Costs of Buying

The single biggest mistake I see foreign buyers make is underestimating the "hidden" costs. The price you see on the property listing is just the starting point. All the extra fees and taxes can easily add another 10-15% to your total bill, a nasty surprise if you haven't planned for it.

Let's break down the main costs you absolutely must budget for:

- Purchase Taxes: The big one is the imposta di registro (registration tax). If this is a second home for you (which most holiday homes are), you'll pay 9% of the property's cadastral value—a figure from the land registry that is often, helpfully, a bit lower than the market price.

- Estate Agent Commission: Known as the provvigione, this fee is usually split between the buyer and the seller. You should budget for around 3% of the purchase price, plus Italian VAT (IVA).

- Notary Fees: The notaio is a public official who is legally required to oversee the sale. Their fees can run from 1-2.5% of the property value and are non-negotiable for a legally sound transfer.

- Legal Fees: While you don't have to hire your own independent lawyer (avvocato), I strongly recommend it. They provide a crucial layer of due diligence and protection, typically costing 1-2% of the sale price.

A real-world example: Say you've fallen for a gorgeous apartment listed at €200,000. Forgetting the other costs could be a disaster. A realistic budget would factor in an additional €20,000 to €30,000 to cover taxes, agent fees, and the notary. Your total immediate outlay is closer to €230,000, not including your mortgage deposit.

A Practical Budget Example

To really illustrate this, let's map out the costs for a hypothetical €180,000 farmhouse.

| Cost Item | Estimated Percentage | Estimated Cost |

|---|---|---|

| Purchase Price | - | €180,000 |

| Purchase Tax (9%) | 9% of Cadastral Value | ~ €9,000 |

| Estate Agent Fee (3% + IVA) | ~3.6% | ~ €6,480 |

| Notary Fee | ~1.5% | ~ €2,700 |

| Legal Advice | ~1.5% | ~ €2,700 |

| Estimated Total Cost | - | ~ €200,880 |

As you can see, the "hidden" costs tack on nearly €21,000 to the final bill. Building a budget that anticipates these figures from day one is the difference between a smooth, exciting journey and a stressful financial scramble. Taking the time to do the sums properly ensures your Italian dream starts on solid ground.

How to Find Your Perfect Italian Property

The Italian property market is a vibrant mosaic. You’ll find everything from sleek city-centre appartamenti in Milan to the iconic cone-roofed trulli of Puglia. Finding the right fit is about more than just browsing listings; it’s about understanding this incredible diversity. Your real journey begins once you’ve pinpointed where and what you’re looking for.

One of the first things you'll notice is the dramatic difference in price from region to region. This is a massive factor for European buyers. In recent years, property in northern hotspots like Lombardy and Tuscany has often averaged over €3,000 per square metre. Head south, though, and it’s a different story. Regions like Calabria or the islands offer fantastic value, with prices sometimes dropping below €1,000 per square metre. Getting your head around this north-south price gap is key to setting a realistic budget.

Ultimately, the region you choose will define your entire experience. It’s not just about the house but the lifestyle that comes with it. While many dream of Tuscany’s rolling hills, others might discover that the sun-drenched south offers better value and a completely different kind of charm, making it one of the best countries to buy property if you’re seeking affordability.

Navigating the Italian Property Search

Most people’s search starts online, and in Italy, that means two websites: Immobiliare.it and Idealista.it. Think of them as the Italian Rightmove or Zoopla. They’re the go-to portals, listing properties from thousands of estate agents all over the country.

While these sites are brilliant for getting a feel for the market, don’t rely on them exclusively. There's simply no substitute for a good local estate agent (agente immobiliare). A well-connected agent on the ground can be your secret weapon, giving you access to off-market properties and sharing local insights you’ll never find online.

My personal tip is to look for agents who are part of a professional association like FIAIP or FIMAA. It’s not a guarantee, but it often signals a higher level of professionalism and accountability, which can give you some much-needed peace of mind.

Understanding Different Property Types

As you start browsing, you’ll come across a whole new vocabulary for different types of homes. Learning the lingo will help you narrow your search and know exactly what you’re looking at.

- Appartamento: An apartment or flat within a larger building.

- Villa: A larger, detached house, often with a garden. Can be modern or historic.

- Casale or Cascina: A rustic farmhouse or rural building, usually made of stone and found in the countryside. These often need a bit of work.

- Rustico: A rural building that needs a complete, top-to-bottom restoration. A real project for the brave!

- Trullo: The iconic cone-roofed stone home you'll only find in the Puglia region.

A listing for a casale implies a totally different project and lifestyle from an appartamento. Be brutally honest with yourself about the amount of work you’re willing to take on. A charming rustico can very quickly turn into a renovation nightmare that drains your time and money.

The Crucial Role of the Geometra

Once you've found a property that makes your heart skip a beat, it’s time to bring in one of the most important people in your Italian property-buying team: the geometra. This role is a unique Italian blend of surveyor, architect, and project manager. Honestly, hiring one is a step I’ve seen far too many foreign buyers skip, often to their regret.

A good geometra is your expert on the ground. Their main job is to carry out a full technical survey to make sure the property is structurally sound and, just as importantly, legally compliant. They’ll check that the property’s registered plans at the land registry (catasto) actually match the physical building.

Here’s what a geometra will verify for you:

- Legal Compliance (Conformità Urbanistica): They confirm that all past extensions and renovations had the correct permits. Unauthorised work is a surprisingly common problem in older Italian properties and can become a legal nightmare for a new owner.

- Structural Integrity: The geometra assesses the condition of the roof, walls, foundations, and key systems, giving you a clear picture of any repairs you’ll need to budget for.

- Land Boundaries: For rural properties, they will verify the exact boundaries of your land. This simple check can prevent huge disputes with neighbours down the line.

The small investment in a geometra's report can save you from making a catastrophic financial mistake. They provide the technical due diligence that a lawyer or notary simply doesn't cover, ensuring the house you’re about to buy is exactly what it claims to be. For me, this is a non-negotiable step for a safe purchase.

Getting Serious: The Offer, the Contracts, and the Notary

Right, you've found the one. After navigating the local market and getting a geometra to give it an initial once-over, you're ready to make it official. This is where the Italian property-buying process takes a sharp turn away from what you might be used to at home, so paying close attention to the sequence of events is absolutely critical.

We're now entering a world of legally binding documents and serious financial commitments. It’s a formal dance with three distinct parts: making the offer, signing the preliminary contract, and finally, meeting the all-important public notary.

The Purchase Offer: More Than Just a Proposal

Your first move is to submit a written offer, the proposta d'acquisto. Now, here’s a crucial difference from home: while an offer back home is just that—an offer, with no real teeth until you exchange contracts—in Italy, it’s a whole different ball game.

Once the seller puts their signature on your proposta d'acquisto, it often transforms into a legally binding agreement. Let that sink in. You can’t just walk away without facing financial penalties. This is precisely why your offer must always include get-out clauses, known as clausole sospensive.

These conditional clauses are your safety net. They make the deal hinge on specific conditions being met. For example:

- Subject to Mortgage: The purchase only goes ahead if your bank gives the final green light for your mortgage.

- Subject to Surveys: The deal is conditional on your geometra and lawyer finding no nasty surprises during their checks.

When you submit the offer, you'll also hand over a small deposit (caparra) to show you're serious. The estate agent usually holds onto this until the seller officially accepts.

The Big Commitment: Signing the Compromesso

With your offer accepted, you move on to the next major milestone: the compromesso, or preliminary contract. This isn't just a simple agreement; it's a heavyweight document that cements the terms of the sale and locks both you and the seller into the deal. I always advise my clients to have their independent lawyer either draft this from scratch or, at the very least, review it with a fine-tooth comb.

The compromesso lays out everything in minute detail: a full legal description of the property, the final agreed price, the completion date, and a record of all payments made. It's not just a private agreement either—it has to be officially registered within 20 days to be legally binding.

This is also the moment you pay the main deposit, the caparra confirmatoria. This is a substantial amount, typically between 10% and 30% of the purchase price.

This deposit has real legal power. If you, as the buyer, decide to pull out after signing the compromesso, the seller has the legal right to keep your entire deposit. On the flip side, if the seller gets cold feet and backs out, they are obligated to pay you back double the deposit amount.

It’s a powerful system that gives both sides a strong incentive to see the sale through to the end.

The Central Role of the Notaio

In Italy, every single property transaction is overseen and finalised by a notaio, or notary. A notaio is a public official, appointed by the state, who acts as a neutral referee to ensure the entire transaction is above board for both buyer and seller.

Their job includes:

- Verifying everyone's identity.

- Confirming the seller legally owns the property and has the right to sell it.

- Conducting final checks for any debts, like a mortgage (ipoteca), or other claims registered against the property.

- Calculating and ensuring all property taxes are paid correctly.

- Witnessing the final signatures on the deed and officially registering you as the new owner.

But here’s a key piece of advice: while the notaio guarantees legality, they don't work for you. They work for the state to ensure the process is correct. This is why hiring your own independent lawyer (avvocato) is such a wise move. Your lawyer is in your corner, protecting your specific interests.

Your Final Checks: The Last Look Before You Leap

Before any ink dries on those final contracts, your team needs to complete its due diligence. This is your last chance to unearth any hidden issues that could turn your Italian dream into a bureaucratic nightmare.

Your geometra will be checking that the property is accatastato—that every part of it is correctly registered with the land registry (catasto). They also verify the conformità urbanistica, which ensures all building work, past and present, has the correct planning permissions. This is non-negotiable; any illegal extensions or alterations become your problem the moment you own the place.

At the same time, your lawyer and the notaio will run final legal and financial searches on the property. These checks give you the peace of mind to move forward to the best part: signing the final deed and finally getting the keys to your new home in Italy.

Closing the Deal and Getting Your Keys

The final step in your Italian property adventure is the rogito notarile, or the final deed of sale. This is the big day. All the paperwork, checks, and back-and-forth negotiations lead to this single meeting at a notary’s office. It’s a formal affair, but it’s also the moment you officially become a homeowner in Italy.

This meeting is a non-negotiable legal requirement. You, the seller, any lawyers involved, and the estate agent will all gather in front of the notaio. The notary will read the entire deed of sale out loud to make sure everyone is on the same page and agrees with every clause.

A word of warning: if your Italian isn't fluent, you must have an officially appointed translator present. The notary can usually help arrange this, but it will come at an extra cost. Don't try to wing it; this is a legal proceeding.

The Final Payment and Transfer of Ownership

On closing day, you won't be doing a quick bank transfer or writing a personal cheque. The final payment is serious business and requires one or more assegni circolari – essentially guaranteed banker's drafts. You'll need to arrange these with your bank ahead of time, made out directly to the seller for the remaining balance.

Once the rogito has been read and everyone gives their nod of approval, it’s time to sign. You, the seller, and the notary will all put pen to paper. The second that final signature hits the page, the property is legally yours. The seller hands over the keys, and that’s it. Congratulations, you’ve just bought a house in Italy!

It can feel quite formal and is often over surprisingly quickly. The notary isn't there to take sides; their job is to act as an impartial state official, verifying that the whole transaction is legal. They will have already collected all the necessary taxes from you to pay the state, so everything is buttoned up.

Life After the Rogito: Your First Steps as an Owner

Holding the keys is a fantastic feeling, but the admin isn't quite over. While the notaio takes care of registering your new deed with the land registry (Conservatoria dei Registri Immobiliari), you've got a few practical things to sort out.

Now’s the time to get your new life set up. Here’s a quick to-do list:

- Set Up Utilities: You’ll need to switch the electricity (luce), gas (gas), and water (acqua) contracts into your name. This is called a voltura and is usually quite straightforward.

- Arrange Waste Collection Tax: Pop down to your local council (comune) to register for the waste tax, known as TARI.

- Update Your Residency: If Italy is your new permanent home, you'll need to register your residency at the local registry office (anagrafe).

This is where the dream really starts to take shape. It’s also where you can feel the real-world impact of market trends. For years, British buyers have flocked to Italy, drawn by the lifestyle and the simple fact that you get more for your money than back home. While property prices in European hotspots went through the roof, Italy offered an affordable alternative, creating a steady flow of Brits looking for a better quality of life and a smart place to put their money.

Finally, start getting your head around your annual property tax obligations, such as the IMU (Imposta Municipale Unica), which is due on second homes. Getting these post-purchase tasks ticked off early means you can start your new life in Italy smoothly, leaving you free to enjoy your new home.

If all this has you inspired to begin your own search, you can explore a wide variety of homes across the country by looking at some of the stunning properties for sale in Italy currently available.

Common Questions About Buying Property in Italy

Diving into the Italian property market for the first time always throws up a few questions. I get it. As a European buyer, some parts of the process will feel familiar, but others are distinctly Italian. Let's walk through some of the most common queries I hear to get you some clear, straightforward answers.

Do I Really Need an Italian Bank Account?

Technically, no, you don't have to have one to complete the final purchase. The final payment is handled with a banker's draft (assegno circolare), which your lawyer can help you sort out. But honestly, trying to manage without one makes life so much more complicated.

Think about what happens after you get the keys. An Italian bank account is pretty much essential for setting up utilities like electricity, water, and gas. It also makes paying your annual property taxes, like IMU and TARI, a simple direct debit rather than an international headache. Getting an account is usually straightforward once you have your Codice Fiscale (tax code).

What Annual Property Taxes Will I Pay?

Owning a home in Italy means you'll have ongoing tax responsibilities. For a second home (which is what your property will be unless it's your main residence), there are two main annual taxes to budget for:

- IMU (Imposta Municipale Unica): This is the main council tax for second homes. The rate varies from one municipality to another and is based on the property's cadastral value, but it's a key cost to factor into your annual budget.

- TARI (Tassa sui Rifiuti): This is your local waste collection tax, which you'll pay directly to your local council (comune). The amount depends on the size of your property and the number of people registered there.

These ongoing costs are a crucial part of the financial picture, especially if you're planning for retirement. For those weighing their options, our guide on the best places to retire in Europe offers some fantastic insights into living costs and lifestyles across the continent.

Ready to find your own piece of la dolce vita? At Residaro, we connect discerning buyers with exceptional properties across Italy's most beautiful regions. Explore our portfolio of villas, apartments, and country homes to start your journey. Discover your dream Italian property on Residaro today.