Guide to Capital Gains Tax Foreign Property: What You Need to Know

Selling a property you own in another country is a big deal, and it comes with a tax puzzle you'll need to solve. When you sell for a profit—what the tax world calls a capital gain—you'll almost certainly have to report it. The catch? You might have to report it in two different places: where you live and where the property is.

The real challenge isn't just filing the paperwork, but figuring out how the tax rules of both countries interact. This is where things can get tricky, but understanding the system is the key to making sure you don't pay tax twice on the same profit.

Understanding Your Tax Obligations Abroad

Selling property in a different country creates a financial situation where two governments have a potential claim on your profit. Think of it this way: the country where your property is located feels it has a right to tax the income generated on its soil, while your home country expects to tax your income, no matter where you earn it. This is the heart of why capital gains tax on foreign property can feel so complicated.

A 'capital gain' is just the profit you make from selling an asset—like your property—for more than you originally paid for it. A 'foreign property' is simply any real estate you own outside the country where you're a tax resident.

Why Two Countries Are Involved

The country where the property is physically located (the source country) almost always claims the first right to tax any profit made from its sale. This is a basic principle of international tax law; they want to ensure that economic activity happening within their borders benefits their own treasury.

At the same time, your home country (your country of residence) likely taxes you on your worldwide income. This means they're interested in all your financial gains, whether you made them down the street or halfway across the globe. This overlap is what creates the potential for the same profit to be taxed by both nations.

The central challenge for any international property owner is not just calculating the gain, but understanding how two separate sets of tax laws interact. The goal is to comply with both without paying tax twice on the same income.

Building a Strong Foundation

To get this right, you need to understand a few core concepts. These are the building blocks for any smart strategy when dealing with capital gains on an overseas property. For example, if you're thinking about the tax implications of selling one of the beautiful apartments available in Portugal, you'd need to be clear on both Portuguese rules and the laws back home.

Here are the key pieces we'll build on:

- Defining the Gain: The first step is always knowing how to calculate your profit. This means figuring out your 'cost basis' (what you initially invested) and subtracting it from the final sale price.

- Local Tax Laws: The rules in the country where the property is located are your starting point. You need to know their tax rates, exemptions, and reporting requirements.

- Residency Tax Laws: Next, you have to understand how your home country requires you to report that foreign gain and what credits or relief might be available.

- Tax Treaties: These international agreements are your best friend. They're designed specifically to prevent double taxation and clarify which country's rules take precedence.

Once you break it down like this, a complex tax issue becomes a series of manageable steps. This framework will give you the confidence to make smart decisions and get the best possible financial outcome from your sale.

So, what really drives your final tax bill? It boils down to a handful of critical elements.

Here's a quick table to summarize the main things that will shape your tax liability.

Key Factors Determining Your Tax Liability

| Factor | How It Affects Your Tax Bill |

|---|---|

| Your Residency Status | Your home country's rules for taxing worldwide income depend entirely on whether you're considered a tax resident. |

| Property's Location | The source country almost always gets the first opportunity to tax the gain, and its local laws set the initial rate. |

| Double Taxation Treaties | These agreements determine how taxes paid in one country can be credited against what you owe in the other. |

| Holding Period | Many countries offer lower tax rates for long-term gains (property held over a year) versus short-term gains. |

| Property's Use | Was it a primary residence, a vacation home, or a rental? Each classification can trigger different tax rules or exemptions. |

Understanding these factors is the first step toward creating a clear picture of what you'll owe. They are the core variables in the capital gains equation for any international property owner.

How Global Tax Rules Differ by Country

When it comes to capital gains tax on foreign property, geography is destiny. The rules for selling a chic Parisian apartment are worlds apart from those for a modern condo in Singapore. Every country writes its own playbook, creating a complex global patchwork that international investors simply have to navigate.

This means a one-size-fits-all strategy is doomed from the start. Your bottom line can swing dramatically based on the tax regime where your property sits. Some countries are notorious for high tax rates on property gains, while others have built reputations as havens for investors by keeping taxes minimal or even non-existent.

A Tale of Three Cities: High Taxes vs. Low Taxes

To really see how much these rules can diverge, let’s look at a few popular spots for property investment. Imagine you’ve just made a nice profit from a sale—how much of that you actually get to keep is entirely up to the local laws.

The differences are stark. In France, for example, your real estate gains could be taxed at a rate of up to 34% if you're a high earner. Head over to Japan, and the combined national and local taxes can push that figure closer to 40%. Then you have hubs like Singapore and Hong Kong, which famously charge zero capital gains tax on real estate. It’s no wonder they’re magnets for investors focused on tax efficiency. You can discover more insights about these global comparisons and see how various markets stack up.

This isn't just about the numbers on a tax form; it reflects a country's entire philosophy. Some governments view property gains as a vital revenue stream, while others use tax incentives as a tool to attract foreign capital and fuel their real estate markets.

Understanding the specific tax environment of your property's location is not just a good idea—it is a fundamental requirement for accurately projecting your investment returns and avoiding costly surprises.

Common Areas of Variation

Beyond the headline tax rate, the devil is truly in the details. Countries differ on all the little things that can add up to a big impact on your final tax bill. Knowing what to look for is half the battle.

Here are a few of the most common ways the rules change from one border to the next:

- Tax Rates for Non-Residents: It's common for countries to apply different—and often higher—tax rates to non-residents than they do to their own citizens.

- Allowable Deductions: What can you subtract from the sale price to reduce your taxable gain? Some jurisdictions let you deduct renovation costs and agent fees, while others are far more restrictive.

- Exemptions and Reliefs: You might get a tax break if the property was your main home, but the rules for qualifying (like how long you had to live there) will be unique to that country.

- Holding Period Rules: How long you’ve owned the property often matters. Many tax systems have lower rates for long-term gains compared to short-term profits made from a quick flip.

These variables create a unique tax equation for every single property in every country. For instance, the UK’s "private residence relief" can completely wipe out your tax bill, but only if you meet a strict set of conditions. In Spain, a seller from outside the EU might face a higher tax burden than an EU citizen would.

Why Country-Specific Knowledge is Essential

Navigating capital gains tax on foreign property means you have to think like a local. Before you even think about listing your property, you need to do some deep, country-specific research—or, even better, talk to a tax professional who specializes in that region.

Trying to apply your home country's rules to a foreign sale is a recipe for disaster. The definitions, deadlines, and paperwork will all be different. By investing a little time upfront to understand the local landscape, you give yourself the power to make smart decisions, plan your sale effectively, and make sure you’re meeting all your legal obligations while keeping as much of your profit as possible.

Avoiding Double Taxation with Tax Treaties

Imagine this for a moment: you sell your overseas property, celebrate a nice profit, and then get hit with the full capital gains tax bill. Twice. Once in the country where the property is, and again back home. It's the biggest fear for any international investor, a scenario called double taxation that could chew up a massive chunk of your returns.

Luckily, there’s a system designed to stop this from happening.

The solution comes in the form of Double Taxation Treaties (DTTs). These are formal, legally binding agreements between two countries that act as a rulebook for who gets to tax what. For anyone with a capital gains tax on foreign property liability, these treaties are your best friend. They ensure you’re taxed fairly, not punished for investing across borders.

How Tax Treaties Actually Work

At their heart, a DTT is all about assigning taxing rights. When it comes to real estate, the rule is almost universal: the country where your property is physically located (the "source" country) gets the first bite of the apple. They have the primary right to tax the profit from the sale. It makes sense, right? The value was generated on their soil.

But your home country (the "residence" country) will still want to know about that gain. This is where the treaty kicks in with one of two main mechanisms to prevent you from paying the full tax again.

- Foreign Tax Credit: This is the most common approach. Your home country will let you subtract the taxes you've already paid abroad from the taxes you owe them. Say you paid $15,000 in tax to the source country and your tax bill at home would have been $20,000. You don't pay $20,000 again; you just pay the $5,000 difference.

- Exemption Method: A bit less common, but powerful. With this method, your home country simply agrees to not tax your foreign property gain at all, acknowledging it has already been taxed where it was earned.

The end result is that while you have to navigate two tax systems, you don't pay the maximum rate in both.

A Double Taxation Treaty doesn't make your tax bill disappear. It coordinates it. Think of it as a roadmap that tells two countries how to share the tax revenue from your investment so you don't get caught in the middle.

Finding and Reading the Fine Print

Here’s the catch: while the principles are similar, the details are everything. The treaty your home country has with France won't be identical to the one it has with Portugal. You need to pull up the specific DTT that applies to your situation and find the key clauses related to property.

Look for these specific articles in the treaty document:

- Article 6 (Income from Immovable Property): This is the section that almost always establishes the source country's primary right to tax.

- Article 13 (Capital Gains): This article gets more specific, laying out the rules for taxing gains from asset sales and confirming the treatment for real estate.

- Article 23 (Elimination of Double Taxation): This is the most important one for you. It spells out exactly how you'll get relief—either through a tax credit or an exemption.

You can usually find these treaties on the websites of your country's tax authority or finance ministry. A quick search will arm you with the information needed to file correctly and confidently claim the protection you're entitled to. In fact, understanding which of the best countries for property investment have investor-friendly treaties with your home nation should be a core part of your strategy from day one.

Calculating Your Foreign Property Capital Gain

So, you've sold your overseas property and made a profit. Great! Now comes the less exciting part: figuring out what you owe in taxes. This isn't just a simple matter of subtracting what you paid from what you sold it for. To get to the real taxable figure, you need to understand two key concepts: your Adjusted Basis and the surprisingly big role currency exchange rates play.

Getting this right is absolutely fundamental to correctly reporting your capital gains tax on foreign property.

At first glance, the formula seems straightforward enough:

Sale Price - Adjusted Basis = Capital Gain

But the devil is in the details, especially when it comes to calculating that "Adjusted Basis." It’s a lot more than just the number on the original sales contract.

What Exactly Is Your Adjusted Basis?

Think of your adjusted basis as your total financial investment in the property over the entire time you owned it. It starts with the purchase price, sure, but it also includes the cost of any significant improvements you made along the way. Meticulous record-keeping here is your best friend—a higher basis means a lower taxable gain, which ultimately leaves more money in your pocket.

So, what counts? Here are the main things that increase your basis:

- The Initial Purchase Price: This is the anchor—the original amount you paid.

- Capital Improvements: We’re talking about major upgrades that add real value, like a new roof, a complete kitchen remodel, or a new extension. This isn't the same as routine upkeep, so a fresh coat of paint doesn't count.

- Major Legal and Closing Costs: Remember all those fees from when you bought the place? Things like title insurance and specific legal fees can often be included.

By keeping a detailed file of these expenses, you ensure your adjusted basis is as high as it can legally be. That's just smart tax planning.

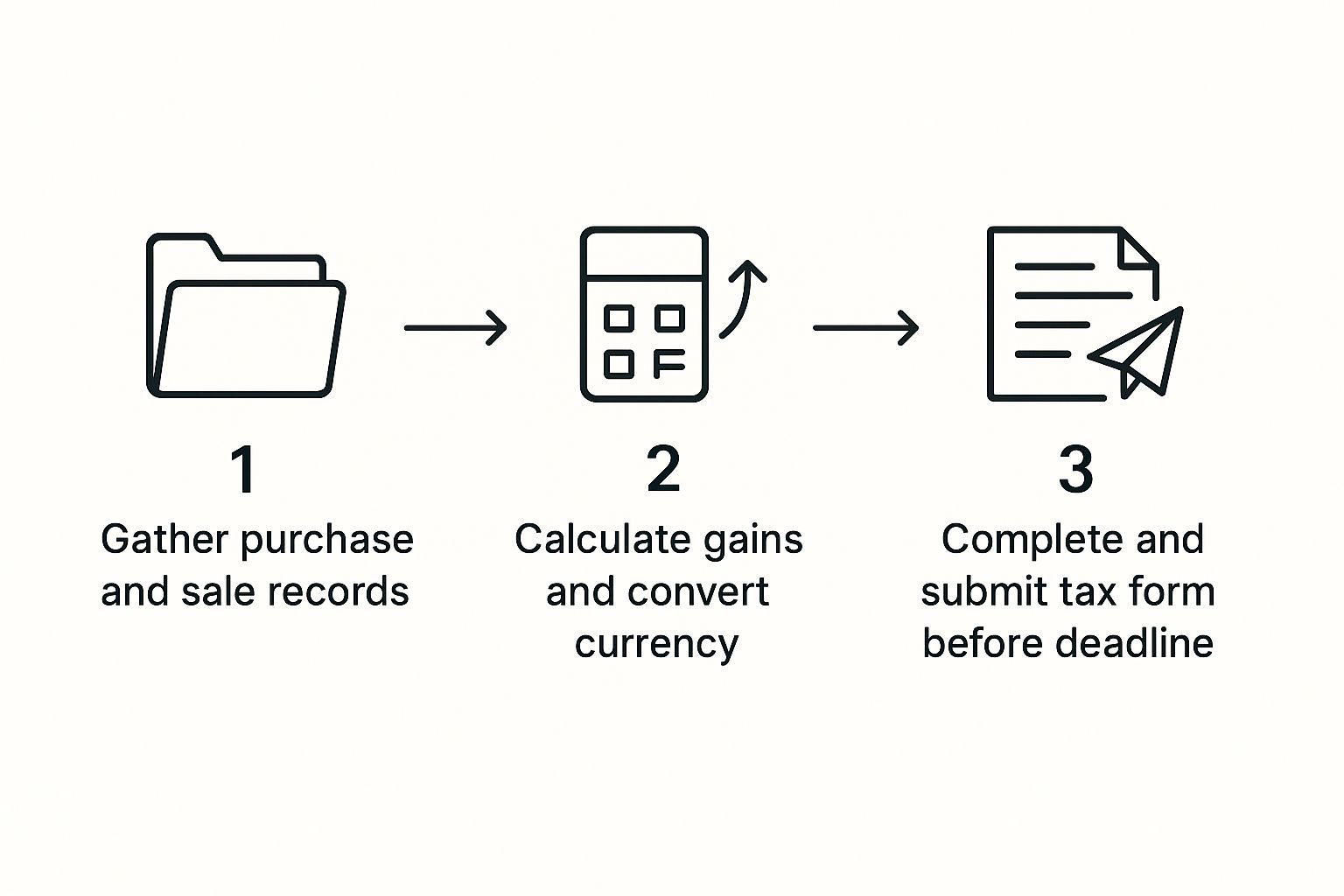

This infographic breaks down the entire process into three clear steps, from gathering your records to filing the final return.

As you can see, the whole thing hinges on diligent record-keeping, careful calculation, and making sure you file on time.

The Critical Role of Currency Conversion

This is where things can get tricky. Your home country’s tax authority (like the IRS in the U.S. or HMRC in the U.K.) wants to see everything in its own currency. You can't just do the math in euros, pounds, or yen and call it a day.

You have to convert every single transaction into your home currency using the exchange rate from the exact date the transaction happened.

This applies to three crucial numbers:

- The Original Purchase Price: Converted based on the exchange rate on the day you closed the purchase.

- The Cost of Improvements: Each improvement has its own conversion, based on the rate on the day you paid for the work.

- The Final Sale Price: Converted using the exchange rate on the day the sale was finalized.

Since currency values are constantly in flux, this process can create a "gain" or "loss" from currency movement alone, completely separate from the property's actual market value. You could sell a property for the exact same price you bought it for in the local currency and still end up with a hefty taxable gain if the exchange rate moved in your favor.

Putting It All Together: A Practical Example

Let's walk through a scenario to make this crystal clear.

Imagine you're a U.S. resident who bought a vacation home in Spain a while back.

- Purchase Date: June 1, 2015

- Purchase Price: €200,000

- Exchange Rate on Purchase Date: 1 EUR = 1.10 USD

- USD Cost Basis (Initial): €200,000 x 1.10 = $220,000

A couple of years later, you decide the kitchen needs a complete overhaul.

- Improvement Date: July 15, 2017

- Improvement Cost: €25,000

- Exchange Rate on Improvement Date: 1 EUR = 1.15 USD

- USD Improvement Cost: €25,000 x 1.15 = $28,750

Your Adjusted Basis is now the sum of these two USD amounts: $220,000 + $28,750 = $248,750.

Fast forward to today, and you sell the property.

- Sale Date: September 1, 2024

- Sale Price: €280,000

- Exchange Rate on Sale Date: 1 EUR = 1.08 USD

- USD Sale Proceeds: €280,000 x 1.08 = $302,400

Now, we can finally calculate your capital gain in U.S. dollars.

$302,400 (Sale Price) - $248,750 (Adjusted Basis) = $53,650 (Capital Gain)

This $53,650 is the magic number you have to report to the IRS. As you can see, getting it right requires careful attention to every date, cost, and currency conversion. It’s the only way to file an accurate and compliant tax return.

Special Tax Considerations for US Expats

If you're an American living abroad, selling a property is more than just a real estate transaction—it’s a US tax event. This often comes as a surprise. The United States is one of the few countries that uses citizenship-based taxation.

What does that mean for you? In short, if you hold a US passport, the IRS wants to hear about your income from anywhere in the world. That absolutely includes the profit you make from selling your foreign home, regardless of where you live or where that property is. Selling a villa in Tuscany or a condo in Tokyo? You'll need to report it on your US tax return.

The good news is that the IRS generally treats the sale of foreign real estate the same way it treats a domestic one. The tax rates you'll face hinge on two things: how long you owned the property and your total income for the year.

Understanding US Capital Gains Rates

First, let's look at the holding period. If you owned your foreign property for one year or less, the profit is a short-term capital gain. This gets taxed at your regular income tax rates, which can be quite high.

But if you owned it for more than a year, it qualifies as a long-term capital gain. This is where the real savings are. Long-term gains get special, lower tax rates. Depending on your income, that rate could be 0%, 15%, or 20%. That’s a huge difference, making the timing of your sale a critical part of your strategy.

The Powerful Primary Residence Exclusion

Now for the best tool in an expat's toolkit: the Primary Residence Exclusion. Officially known as the Section 121 exclusion, this tax break can slash—or even completely wipe out—your US tax bill on the sale of your foreign home.

It’s a genuine game-changer. A single person can exclude up to $250,000 of gain from their income. For married couples filing jointly, that number doubles to an incredible $500,000.

Of course, you have to qualify. The IRS has two main requirements:

- The Ownership Test: You must have owned the home for at least two of the five years just before you sell it.

- The Use Test: You must have actually lived in the property as your main home for at least two of those same five years. The months don't even have to be all in a row.

This incredible benefit applies just as much to your primary residence abroad as it does to one in the States. For many expats, successfully claiming this exclusion means the difference between writing a big check to the IRS and owing them nothing at all.

Connecting the Dots to Avoid Double Taxation

At this point, you're probably wondering, "But I already paid tax on the sale in the country where the house is!" This is a common and completely valid concern. Thankfully, the US tax system has a built-in fix to prevent you from being taxed twice on the same profit.

This is where the Foreign Tax Credit comes into play. You can claim a credit on your US return for the income taxes you paid to the foreign government on the sale. It’s a dollar-for-dollar reduction of your US tax bill.

Think of it this way: if your US tax on the gain is $10,000, but you already paid $8,000 in taxes to Spain, you can use a foreign tax credit to reduce your US bill. You'd only owe the IRS the remaining $2,000. Understanding how these capital gains rules apply to foreign property sales for US taxpayers is key to meeting your obligations without overpaying.

Smart Ways to Lower Your Tax Bill

Knowing the rules of international tax is one thing, but using them to your advantage is where you can really make a difference. Let's move from theory to action and look at some proven ways to legally reduce your capital gains tax on foreign property. It really boils down to good timing, great records, and using the system as it was designed.

The simplest move? Timing the sale. In most countries, there's a huge difference between short-term and long-term gains. If you hold onto a property for more than a year, your profit often gets taxed at a much lower rate. A little bit of patience can literally save you thousands of dollars. It’s that straightforward.

Beef Up Your Cost Basis with Great Records

Another powerful strategy is to increase your property's "adjusted basis." Your basis isn't just what you paid for the house. It's the total sum of your investment, and that includes any major improvements you've made along the way.

This is where keeping meticulous records pays off. Every receipt for a big project—a new roof, a kitchen remodel, adding an extension—gets added to your cost basis. Think of it this way: every dollar you can prove you spent on improvements is a dollar you don't have to pay tax on. A higher basis means a smaller taxable gain, which means a smaller tax bill.

Proactive financial management isn't just about making a profit; it's about protecting that profit from unnecessary taxation. Diligent record-keeping and strategic timing are your two most effective tools in managing your liability from a foreign property sale.

Make Full Use of Tax Treaties and Credits

Don't forget about Double Taxation Treaties (DTTs). These agreements exist specifically to prevent you from being taxed twice on the same income, and you should take full advantage of them.

Make sure you claim every available foreign tax credit for the taxes you've already paid in the country where the property is located. This isn't a deduction—it's a direct, dollar-for-dollar reduction of the tax you owe back home. It's a critical step.

For more complex situations, especially with high-value properties, you might want to explore advanced strategies with a professional. These could include:

- Ownership Structuring: Sometimes, holding a property through a trust or a limited liability company can offer tax benefits, depending on the laws of both countries involved.

- Installment Sales: You might be able to structure the sale to receive payments over several years. This can help spread out the tax burden and potentially keep you in a lower tax bracket each year.

Ultimately, these strategies are just a starting point. Navigating the tax landscape for beautiful villas for sale in Portugal, for example, requires specific, local expertise. The best thing you can do is talk to a qualified tax advisor who understands the rules in both your home country and the property's location. They can give you advice that’s truly tailored to your situation, making sure you stay compliant while keeping as much of your return as possible.

Got Questions? We've Got Answers

Thinking about capital gains tax on foreign property can feel like opening a can of worms. Let's tackle some of the most common questions that pop up, so you can move forward with a bit more confidence.

Am I Going to Get Taxed Twice on the Same Sale?

It's a fair question, and thankfully, the answer is usually no—at least not on the full amount. You'll almost certainly have to file paperwork in both your home country and where the property is located, but you won't be paying the same tax twice.

This is where Double Taxation Treaties come into play. Generally, the country where the property sits gets the first crack at taxing your profit. Back home, your country will typically give you a foreign tax credit for what you already paid abroad. This credit offsets your domestic tax bill, often reducing it significantly or even wiping it out completely.

How Does Currency Fluctuation Affect My Capital Gain?

This is a big one, and it trips a lot of people up. Your local tax authority doesn't care about euros, pounds, or francs; they want to see everything reported in your home currency. That means you have to convert the original purchase price, any money spent on improvements, and the final sale price using the exchange rate on the exact date of each transaction.

It's entirely possible to have a huge profit in the local currency that shrinks—or even becomes a loss—once you convert it back to your own. The opposite can happen, too. This is why keeping meticulous records of transaction dates and historical exchange rates isn't just a good idea; it's essential.

Imagine you bought a place for €200,000 when the exchange rate was strong. Your cost basis in your home currency would be much higher than if you'd bought it when the rate was weak. This seemingly small detail can have a massive impact on your final tax bill.

What Happens if the Property Was an Inheritance?

Selling a property you've inherited is a completely different ballgame. In many countries, like the US, you benefit from something called a "stepped-up basis," which can be a massive financial advantage.

Instead of your cost basis being what the original owner paid for it decades ago, the basis is "stepped up" to its fair market value on the date of their passing. This single adjustment can slash your taxable capital gain, sometimes eliminating it entirely.

But be careful—rules around inheritance and basis adjustments are not universal. You absolutely must check the laws in both the country where the property is and your own country of residence to get the calculation right.

Ready to find your own slice of Europe? At Residaro, we make discovering your dream home abroad simple and transparent. Explore thousands of listings across the continent's most desirable locations. Start your journey today.