How to Verify Property Ownership: Essential Guide

Before you even think about making an offer on that charming European villa, your very first step is to confirm one simple fact: does the person selling it actually own it? This might sound obvious, but you'd be surprised how often things get complicated. The definitive source for this information is the country's official Land Registry, sometimes known as a Cadastre.

This government-run database is the master record for all property ownership. It’s where you’ll find the cold, hard facts.

Getting Started With Property Ownership Checks

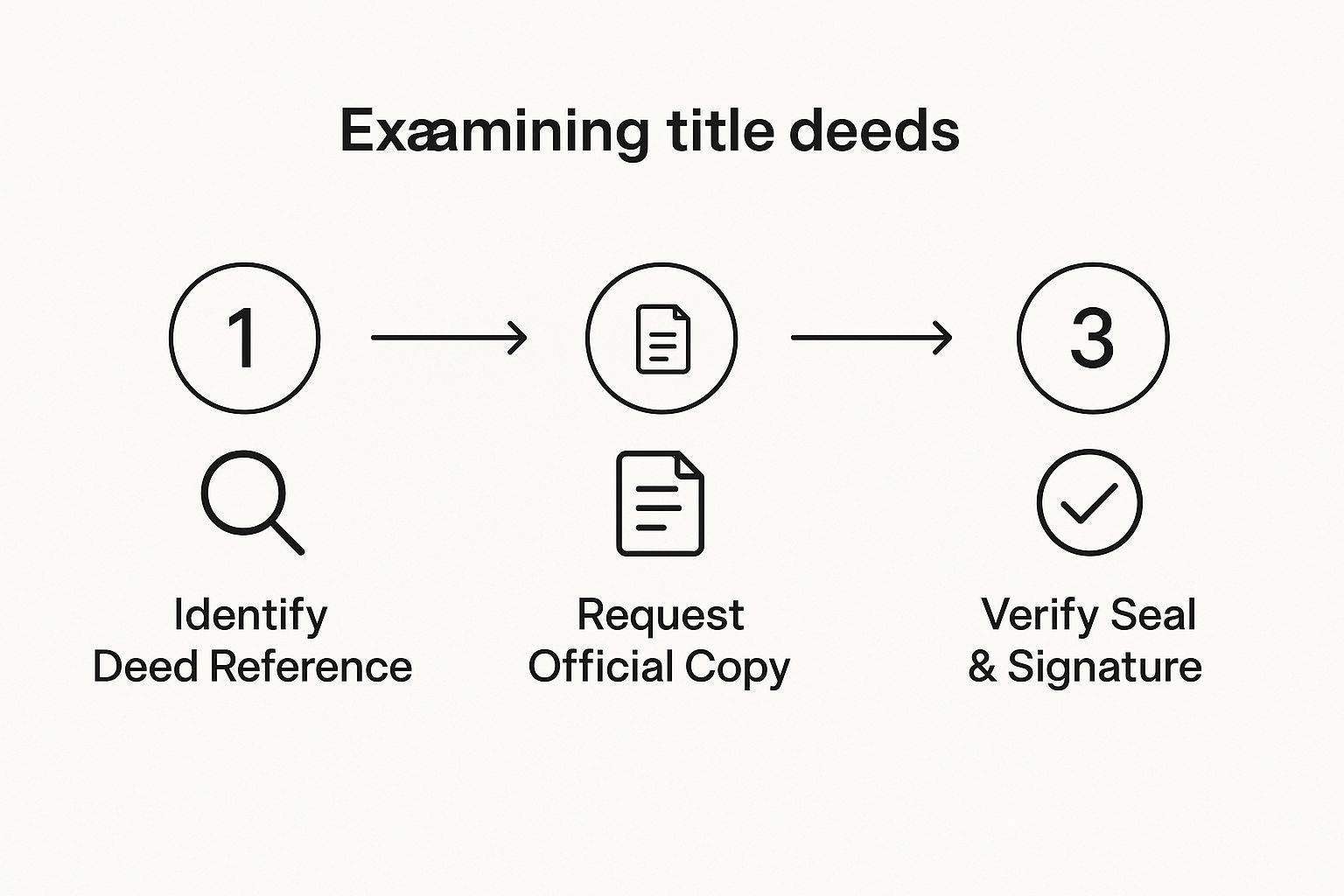

Your mission is to get your hands on an official copy of the Title Deed or Title Register for the property. This isn't just a piece of paper; it's the legal backbone of your potential purchase. Think of it as the property's passport—it proves its identity, history, and legal status.

This document is your first line of defense. It tells you who has the legal right to sell, what the exact boundaries are, and if there are any outstanding debts tied to the property. This process is a non-negotiable part of due diligence everywhere, whether you are buying a house in Italy or a flat in France.

What to Look For in a Title Deed

Once you have the Title Register, it’s time to put on your detective hat. You’re scanning for specific details to make sure everything lines up perfectly.

- The Registered Owner's Name: Does the name on the title exactly match the seller's passport or official ID? Even a small discrepancy, like a missing middle name, needs to be questioned and clarified. This is your first and most important check.

- Property Boundaries: The deed must clearly define the property's physical limits, often with a detailed plan or map. This is crucial for avoiding stressful and costly disputes with neighbors down the line.

- Mortgages or Charges: This section reveals any financial claims against the property, like an outstanding mortgage. These are called 'charges' and absolutely must be paid off by the seller before the ownership can be transferred to you. Otherwise, you could inherit their debt.

A Title Register is packed with critical information that protects you as a buyer. It's essentially a snapshot of the property's legal and financial health.

Here’s a simple breakdown of what to expect and why it matters.

What a Title Register Tells You

| Information Type | What It Reveals | Why It's Critical |

|---|---|---|

| Title Number | A unique identifier for the property. | Ensures you are looking at the correct records for the specific property you intend to buy. |

| Registered Owner(s) | The full legal name(s) of the person or entity that owns the property. | Confirms you are dealing directly with the individual(s) who have the legal right to sell. |

| Property Description | The official address and a description of the land and buildings. | Verifies the physical property matches the legal documentation, preventing mix-ups. |

| Rights and Covenants | Details any rights of way, restrictions on use, or obligations tied to the land. | Informs you of any limitations, like a shared driveway or a ban on certain types of construction. |

| Mortgages and Charges | Lists any loans or financial claims secured against the property. | Protects you from inheriting the seller's debt. These must be cleared upon sale. |

Understanding these elements is non-negotiable. It’s the difference between a smooth transaction and a legal nightmare.

Legal vs. Beneficial Ownership: A Key Distinction

Here’s where things can get a bit more complex. You need to understand the difference between a legal owner and a beneficial owner.

The legal owner is the name on the deed—the person or company officially registered at the Land Registry. The beneficial owner, however, is the person who actually enjoys the benefits of the property. This could mean living in it, collecting rent, or having the ultimate right to the sale proceeds.

This distinction is incredibly important when a property is held in a trust or owned by a company. For example, a company might be the legal owner, but an individual behind the scenes is the beneficial owner. You need to be sure the person signing the sale contract has the authority from all parties.

Ignoring this can lead to massive problems. The legal owner might not have the right to sell without the beneficial owner's express consent. Taking the time to verify the complete ownership structure saves you from potential fraud and future legal battles. It’s a foundational step you simply cannot afford to skip.

How to Navigate European Land Registries

Trying to verify property ownership across Europe can feel like you're dealing with a different set of rules every time you cross a border. It's not a single, unified system. Instead, you're faced with a patchwork of national land registries, each with its own procedures, access levels, and quirks. My experience in one country rarely translates directly to the next.

For example, some countries have incredibly user-friendly online portals that let almost anyone pull up property details with a few clicks. But in other places, the system is much more guarded, restricting access to certified legal professionals or requiring you to formally prove a "legitimate interest." Figuring this out is your first, and most important, step.

Understanding the Differences in Access

The biggest variable you'll face is who is allowed to see the information. Imagine you're looking at a property in Spain; their Registro de la Propiedad is fairly open. Now, compare that to Germany, where the Grundbuch is kept under much tighter control. You might be able to get what you need yourself in Spain, but you’ll almost certainly need a local notary to do the exact same thing in Germany.

These distinctions boil down to each country's unique take on data privacy and security. While the EU offers some high-level guidance, the actual hands-on process is always a local matter. This is why you absolutely must understand the specific regulations of the country you're interested in before you even begin.

The European e-Justice Portal is a decent starting point for getting a feel for each member state's system.

Think of the portal as a directory—it gives you links and basic summaries for national registries. But what it really shows you is just how fragmented property data still is across Europe.

The Challenge of Data Standardization

Another roadblock I've run into time and again is the complete lack of standardized, machine-readable data. If you're looking at a large portfolio or trying to run cross-border checks, this makes life very difficult. Even if you're only focused on a single property, this underlying issue is what makes the process so manual and country-specific.

This isn't just a European problem, either. It’s a global issue. Research consistently points to major gaps in data accessibility. The Opacity in Real Estate Ownership (OREO) Index 2025 found that even major economies like Germany, China, and Turkey don't make their real estate registers fully public. Instead, they limit access to authorities or qualified professionals.

The bottom line is this: always plan on needing local expertise. The subtle variations in registry access and legal interpretation make a local solicitor or notary an indispensable partner, not just a nice-to-have.

These hurdles are part of the due diligence process. Knowing about them upfront allows you to properly budget your time and resources, making sure your journey into investing in European real estate starts on solid, verified ground. You're not trying to avoid roadblocks—you're preparing to navigate them smoothly.

Going Beyond the Title with Legal Due Diligence

Getting that land registry report back is a great first step, but don't pop the champagne just yet. A clean title tells you who owns the property, but it doesn't tell you the whole story. This is where a deep dive into legal due diligence, handled by a sharp solicitor, becomes the single most important part of your purchase.

This investigation is all about uncovering the hidden baggage that a simple title search will never show you. It's the difference between buying a dream home and inheriting a nightmare.

What Legal Checks Actually Uncover

Let me paint you a picture. You find a stunning cottage in the countryside. The deal goes through. A month later, you discover a public footpath runs straight across your back garden. That's not just annoying; it's a permanent legal right-of-way that craters your privacy and resale value.

This is exactly the kind of expensive, soul-crushing surprise that proper legal checks are designed to prevent.

A good solicitor isn't just confirming ownership. They're scrutinizing every single detail that could impact how you use, enjoy, or sell the property down the line. They do this by commissioning a series of official searches that build a complete legal profile of the asset.

Think of your solicitor's due diligence as your shield. It's what confirms that a gorgeous new extension actually has planning permission, that the land isn't contaminated from a long-forgotten factory, or that a new motorway isn't about to be built at the end of your garden.

These checks are non-negotiable for any serious buyer. For a comprehensive look at everything involved, our detailed real estate due diligence checklist breaks down every crucial step.

Key Searches Your Solicitor Will Conduct

The exact searches your solicitor runs will change a bit depending on the country, and sometimes even the specific region. However, they almost always fall into a few critical categories, each designed to answer a different set of questions about the property's past, its surroundings, and any strings attached.

This is how to verify property ownership in the truest sense—by protecting yourself from future legal battles and financial black holes. Here are the big ones:

-

Local Authority Searches: This is a direct query to the local government. It's how you find out about planning permissions (or lack thereof), building code violations, or if the property is in a conservation area with strict rules.

-

Environmental Searches: A crucial check that flags risks you can't see, like land contamination from past industrial use, flood risks, or ground stability issues like subsidence. Any of these can make a property uninsurable, unmortgageable, or even unsafe.

-

Encumbrance Checks: A title search shows the mortgage, but what else is lurking? A deeper encumbrance check looks for things like unlisted rights-of-way (easements), restrictive covenants that dictate what you can (and can't) do with the land, or ongoing boundary disputes with the neighbors.

At the end of the day, this isn't just about ticking boxes on a form. It’s about building a complete, honest picture of the property so you can sign on the dotted line with total confidence, knowing there are no skeletons hiding in the closet.

Why You Absolutely Need a Professional on Your Side

Let's be blunt: trying to verify property ownership on your own, especially in a foreign country, is a massive and unnecessary risk. You might think a few online searches will cover you, but they barely scratch the surface. This is one of those times where hiring a qualified solicitor or notary isn't just a good idea—it's essential to protect your investment.

Think of them as your first line of defense. They're trained to spot the hidden issues, decode the dense legal jargon, and sniff out potential fraud long before you'd ever see it coming.

Solicitor vs. Notary: Know Who You're Hiring

One of the first things you'll realize is that the role of a legal professional can change dramatically depending on where you're buying. This isn't a minor detail; it's a critical distinction to grasp right from the start.

In many European countries, a notary is a neutral, state-appointed official. Their job isn't to be on your side, but to ensure the entire transaction follows the letter of the law for both buyer and seller.

In other places, like the UK and Ireland, you need to hire your own solicitor. This person's one and only job is to fight for you. They represent your interests, conduct deep due diligence, and are there to warn you about any potential pitfalls. Mixing these two roles up could leave you without anyone truly in your corner.

Having someone who is legally and ethically bound to protect your interests is invaluable. They're paid to catch the subtle red flags in contracts and title deeds that the average person would skim right over. That expertise is precisely what you're paying for.

Regulatory Gaps Can Be a Playground for Fraud

A local expert doesn't just read documents; they understand the entire regulatory system, including its flaws. The rules for monitoring property deals across Europe are shockingly inconsistent, leaving loopholes that criminals are more than happy to exploit. This is where professional due diligence becomes absolutely critical.

The OREO Index 2025 paints a pretty stark picture. It found that only a handful of countries, like Germany and Spain, have robust Anti-Money Laundering (AML) checks at every single stage of a property transaction.

Now, compare that to places like Australia, England & Wales, and the UAE. In these markets, the system allows for certain property deals to slip through without a professional being required to perform those same mandatory checks.

This kind of regulatory patchwork means it’s far easier for dirty money to flow into some property markets, often hidden behind confusing company structures. Without an expert who knows these local risks, you could accidentally walk into a fraudulent deal. They do more than just stamp paperwork—they are the crucial security layer that ensures your purchase is clean, clear, and legally yours.

Common Red Flags to Watch Out For

A little healthy skepticism can save you from a world of trouble down the line. When you're figuring out how to verify property ownership, think of yourself as a cautiously optimistic detective. Most sellers are genuine, of course, but your best defense is spotting the warning signs early on.

The biggest red flag—and often the first one you'll encounter—is a seller who hesitates to provide official documents. If they're making excuses, dragging their feet on sending over the title deed, or getting cagey with direct questions, your alarm bells should be ringing. A legitimate owner has absolutely no reason to hide this information.

Another classic warning sign is when the documents don't quite match up. For instance, the land registry might list the owner as "Jonathan M. Smith," but the ID you're shown simply says "John Smith." It could be an innocent difference, but it's a discrepancy that needs to be ironed out immediately. You can't afford to make assumptions.

Deceptive Ownership Structures

Sometimes, the way the property is owned is a red flag in itself. You need to tread very carefully if the ownership is tied up in a complicated web of corporations or an offshore company. While this can be done for legitimate tax purposes, it's also a go-to tactic for obscuring the real owner or laundering money.

Trying to untangle these complex structures is a difficult and costly exercise. If you can't get a straight answer on who ultimately profits from the sale, it's probably a good time to reconsider the deal. That complexity is often there for a reason.

Watch out for manufactured urgency. If a seller is pushing you to close the deal at lightning speed, encouraging you to skip inspections, or trying to bypass standard legal checks, they're likely trying to hustle you past a problem they hope you won't notice. Property deals should move at a diligent pace, never a frantic one.

Questions to Keep You Safe

You have to be an active player in your own due diligence. Never feel shy about asking direct, pointed questions. An honest seller will be prepared for them and have the answers at hand.

Here are a few essential questions you or your solicitor should be asking:

- Can you provide the complete chain of title? This reveals the property's entire ownership history and can highlight any strange gaps or suspicious transfers.

- Is the property currently involved in any litigation or disputes? You don't want to inherit a nasty, ongoing legal battle with a neighbor over a boundary line.

- Are there any unrecorded liens or debts against the property? Most should be on the official record, but asking the question directly can sometimes uncover issues that haven't been formally registered yet.

Asking these questions puts you in control. You stop being a passive buyer and become an informed investigator—precisely the mindset you need to verify ownership and protect your investment.

Your Questions on Property Verification Answered

When you're navigating the complexities of buying a property in Europe, it's completely normal for questions to bubble up. In fact, it's a good sign. Asking the right questions is the first step toward making a smart, secure investment.

Let's walk through some of the most common queries I hear from buyers, so you can move forward with confidence.

What Is a Title Search, and Do I Really Need One?

Think of a title search as a background check for your potential new home. It's a deep dive into public records to confirm who the legal owner is. More importantly, it uncovers any nasty surprises—like financial claims or liens—that might be tied to the property.

So, do you really need one? Absolutely. Without it, you're buying blind. You could end up inheriting the previous owner's unpaid property taxes, an outstanding mortgage, or even a messy legal judgment. It's the most critical step you can take to protect yourself.

A clean title is your green light. It’s the official confirmation that the property is free from any hidden financial baggage that could become your problem the moment you get the keys. This process is the bedrock of how to verify property ownership the right way.

How Long Does This Whole Verification Thing Take?

This is a classic "it depends" situation. The timeline can vary dramatically based on the country, the property's history, and how efficient the local professionals are.

In a country with a fully digitized system, you might get a preliminary look at the records in just a few minutes online. But don't mistake that for the full picture. A thorough due diligence process, with a solicitor digging through all the necessary documents and local records, will realistically take several weeks. Be sure to build this buffer into your buying timeline to avoid any last-minute scrambles.

Can I Just Verify Everything Myself Online?

While it’s tempting to rely on online searches, they're only the first step. Many European countries have fantastic online land registries that are great for an initial peek. They can give you a quick snapshot, but they don't tell the whole story.

Online databases often have blind spots. For instance, they might not show:

- Recent Filings: There’s often a delay between a document being filed and it appearing online.

- Pending Legal Issues: An ongoing dispute with a neighbor or other litigation won’t show up on a basic title summary.

- Zoning & Planning Details: Crucial information about building restrictions or upcoming developments is usually held by the local authorities, not the central land registry.

So, use online tools to get your bearings, but always bring in a legal professional to provide that crucial, comprehensive safety net.

What's the Big Deal About Freehold vs. Leasehold?

Getting your head around this is absolutely essential because it dictates what you actually own.

Freehold is straightforward: you own the property and the land it stands on, forever. It's the most complete form of ownership you can have.

Leasehold is different. You're essentially buying the right to live in the property for a very long time—a lease term, which could be anything from 99 to 999 years. But you don't own the land. The land belongs to the freeholder (or landlord), and you might have to pay them an annual ground rent. This distinction has a huge impact on your rights, your obligations, and the property’s value over the long run.

Ready to find your dream home in Europe with confidence? At Residaro, we connect you with incredible properties and provide the insights you need to navigate the market. Start your search today at https://residaro.com.