Ultimate Real Estate Due Diligence Checklist for Secure Investments

Embarking on a European property purchase is an exciting venture, whether it's a Tuscan farmhouse, a Parisian apartment, or a coastal villa in Spain. However, beneath the romantic allure lies a complex process where careful investigation is paramount. A thorough due diligence process is not merely a formality; it's the critical foundation that separates a dream investment from a potential financial nightmare. This comprehensive real estate due diligence checklist is designed for international buyers, providing a structured roadmap to navigate the intricacies of acquiring property across diverse European markets.

This guide moves beyond generic advice to provide actionable steps tailored to the unique challenges and opportunities within Europe. From verifying legal titles and ownership structures in Italy to understanding local zoning laws in France, each item on this checklist is crucial for protecting your capital and ensuring your purchase aligns with your long-term goals. We will cover the essential inspections, financial analyses, and legal verifications that form the backbone of a secure transaction.

For investors, retirees, and families alike, this detailed checklist serves as your primary tool for risk mitigation. Using a platform like Residaro can streamline your initial search for properties across various European countries, but the ultimate responsibility for in-depth verification remains with you, the buyer. This guide will empower you to ask the right questions, engage the necessary local experts, and proceed with the confidence that your investment is sound, secure, and truly the dream you envisioned. Let's delve into the specifics of what makes a successful property acquisition.

1. Legal Title and Ownership Verification

The absolute cornerstone of any real estate due diligence checklist is verifying legal title and ownership. This foundational step ensures the seller possesses the undisputed legal right to sell the property and that you, the buyer, will receive a "clear and marketable title." Without this verification, you risk inheriting costly legal disputes, hidden debts, or restrictions that could severely limit your use of the property.

A comprehensive title search is the primary tool used in this process. A specialized attorney or title company meticulously examines historical records, deeds, and public documents to trace the property's chain of ownership. The goal is to uncover any potential issues that could cloud the title.

Uncovering Hidden Liabilities

The true value of this step lies in identifying problems before they become your financial burden. Imagine these real-world scenarios:

- Commercial Buyer: A company planning a new retail outlet discovered an undisclosed utility easement running directly through their proposed parking expansion area. Identifying this early saved them an estimated €45,000 in architectural redesigns and project delays.

- Residential Purchaser: A family buying a home in a historic district found two unpaid contractor liens totaling €15,000 attached to the property from a previous renovation. This discovery allowed them to demand the seller clear the debt before closing.

- Industrial Investor: An investor identified that a portion of the warehouse they intended to buy was built in violation of local zoning setbacks. This required a variance application and €90,000 in corrections, a cost negotiated out of the final purchase price.

These examples highlight how a thorough title review acts as a crucial financial safeguard. It provides the leverage needed to negotiate, demand resolutions, or walk away from a problematic deal.

Actionable Steps for Title Verification

To ensure a seamless process, follow a structured approach:

- Order Immediately: Commission a title search and preliminary report as soon as your purchase agreement is executed.

- Engage Counsel: Meticulously review the preliminary report with your real estate attorney, paying close attention to any "exceptions" or listed encumbrances.

- Cross-Reference: Compare the property survey with the legal description in the title documents to check for any discrepancies in boundary lines or encroachments.

- Insure Adequately: Always secure a title insurance policy that covers the full purchase price of the property to protect against future claims.

Key Insight: Title verification is not just a formality; it is your primary defense against inheriting someone else's legal and financial problems. It establishes the legal certainty upon which your entire investment rests.

The process involves specific timelines and costs. This quick reference provides a general overview of what to expect during a typical title investigation.

As the data shows, a proper title search is a multi-week process that requires looking back several decades, confirming why it's essential to start early. For those investing in countries with complex property laws, understanding these local nuances is critical. For a deeper look into a specific country's process, you can explore detailed guides; for instance, you can learn more about buying a house in Italy and its unique title verification requirements.

2. Environmental Site Assessment (Phase I ESA)

An essential step in any commercial real estate due diligence checklist, the Phase I Environmental Site Assessment (ESA) identifies potential environmental contamination liabilities. This investigation, governed by standards like ASTM E1527, is a non-intrusive review of a property's history and current state. It protects buyers from inheriting costly cleanup responsibilities and environmental legal battles that could render a property undevelopable.

A qualified environmental consultant conducts the Phase I ESA by reviewing historical records, government databases, and historical land use maps, such as Sanborn Fire Insurance maps. They also perform a thorough site inspection and interview past and present owners. The goal is to identify any Recognized Environmental Conditions (RECs) that suggest the presence or likely presence of hazardous substances or petroleum products.

Uncovering Hidden Liabilities

The true power of a Phase I ESA is its ability to uncover massive, unseen financial risks before they become your problem. Consider these scenarios:

- Commercial Developer: The assessment of a former gas station site revealed significant contamination from leaking underground storage tanks. The discovery led to a demand that the seller complete a €200,000 cleanup before the deal could proceed, protecting the developer from future liability.

- Industrial Buyer: A Phase I ESA for a manufacturing facility identified contamination migrating from an adjacent dry cleaner. This allowed the buyer to negotiate a €500,000 price reduction to cover potential remediation and legal costs.

- Retail Investor: Before an €85 million acquisition, a Phase I ESA found no RECs, providing the buyer and their lender with the crucial assurance needed to close the high-stakes transaction confidently.

These examples underscore how a Phase I ESA is a critical risk-management tool. It provides the evidence needed to negotiate price, demand remediation, or cancel a purchase agreement to avoid a financial disaster.

Actionable Steps for a Phase I ESA

To effectively manage environmental risk, a structured approach is necessary:

- Hire Certified Professionals: Engage an environmental consulting firm that adheres to ASTM E1527 standards.

- Review Historical Uses: Insist on a thorough review of historical documents, including aerial photographs and city directories, to understand past industrial or commercial activities on or near the site.

- Include Contract Contingencies: Add an environmental contingency clause to your purchase agreement, allowing you to terminate the deal or renegotiate if the Phase I ESA uncovers significant issues.

- Budget for Phase II: If the report identifies RECs, be prepared for a potential Phase II assessment, which involves physical sampling of soil and groundwater to confirm contamination.

Key Insight: A Phase I ESA is not an optional expense; it is a fundamental safeguard that protects your investment from unseen environmental liabilities that could cost millions and stall development indefinitely.

3. Property Condition Assessment (PCA)

While a standard inspection is common for residential homes, a comprehensive Property Condition Assessment (PCA) is an indispensable part of any serious real estate due diligence checklist for commercial or high-value properties. This engineering-based evaluation goes far beyond a simple visual check. It provides a detailed analysis of the building's physical condition, including major systems like HVAC, plumbing, electrical, structural elements, and site improvements.

The primary goal of a PCA, often guided by standards like ASTM E2018, is to identify immediate repair needs, deferred maintenance, and the capital expenditures required over the next 10 to 12 years. This detailed forecast gives a potential buyer a true understanding of the total cost of ownership, not just the purchase price.

Uncovering Hidden Liabilities

The PCA is a powerful negotiation tool and a critical risk-management step. It translates physical deficiencies into clear financial figures. Consider these scenarios:

- Commercial Buyer: An investor evaluating an office building received a PCA revealing that the central HVAC system was nearing the end of its life, with immediate repairs costing €300,000. This data allowed them to successfully negotiate a significant price adjustment.

- Industrial Investor: An assessment of a warehouse identified €150,000 in deferred roof maintenance required over the next five years. This information was crucial for accurately modeling the investment's long-term cash flow and profitability.

- Retail Purchaser: A PCA for a small retail center uncovered multiple ADA (Americans with Disabilities Act) compliance issues, including ramp inclines and restroom access, requiring €75,000 in modifications. The buyer negotiated for the seller to cover these costs before closing.

These examples show how a PCA moves beyond a simple "pass/fail" inspection to provide a sophisticated financial roadmap for the property's future.

Actionable Steps for a Property Condition Assessment

To maximize the value of a PCA, follow a structured process:

- Hire Experts: Engage an engineering firm with specific experience in the relevant property type (e.g., industrial, retail, multi-family).

- Be Present: Accompany the inspectors during their site visit to ask questions and gain firsthand insights into their observations.

- Prioritize Findings: Focus on items affecting safety, critical operations, and major capital needs that will impact your budget and returns.

- Negotiate Wisely: Use the PCA findings to negotiate for seller-funded repairs, price concessions, or credits at closing.

- Plan Ahead: Incorporate the assessment's long-term capital expenditure forecast into your property management and asset improvement plans.

Key Insight: A Property Condition Assessment transforms physical due diligence from a simple inspection into a strategic financial analysis. It quantifies future costs, empowering you to negotiate effectively and budget accurately for the entire life of your investment.

4. Financial Performance and Rent Roll Analysis

For any income-producing property, a deep dive into its financial health is a critical component of the real estate due diligence checklist. This step moves beyond the physical asset to scrutinize the numbers that determine its value and profitability. By analyzing rent rolls, operating statements, and lease agreements, you can verify the seller's income claims and accurately project future cash flow.

A thorough financial analysis involves dissecting the property's economic engine. Specialized software like ARGUS Enterprise is often used to model cash flows, while platforms like CoStar provide market data for benchmarking. This process ensures the investment is not just sound on paper but is supported by a stable and predictable revenue stream.

Uncovering Hidden Liabilities

The true value of this analysis is in exposing financial weaknesses or identifying untapped potential before you commit. Consider these real-world scenarios:

- Retail Investor: An analysis of a shopping center's rent roll revealed that 40% of the total income came from a single anchor tenant with a poor credit rating. This high concentration risk significantly impacted the financing terms offered by lenders.

- Office Building Buyer: A review of an office building's leases discovered that most tenants were paying rents 15% below the current market rate. This identified a clear opportunity for significant rental income growth upon lease renewals.

- Industrial Purchaser: An examination of an industrial property's historical financials showed a consistent occupancy rate above 95% for five years, justifying a premium valuation and supporting the seller's asking price.

These examples show how detailed financial scrutiny can either raise red flags or confirm an investment's upside, empowering you to negotiate from a position of strength.

Actionable Steps for Financial Analysis

To conduct a robust financial review, implement a structured approach:

- Request Documents Early: Ask for certified rent rolls, historical operating statements (at least 3 years), and copies of all lease agreements as soon as possible.

- Verify Expenses: Scrutinize major expense line items. Cross-reference property tax figures with municipal records and ask for invoices or service contracts for large recurring costs like maintenance or management fees.

- Analyze Tenant Quality: Evaluate the tenant mix, focusing on creditworthiness, lease expiration dates, and any tenant concentration risks.

- Benchmark Performance: Compare the property’s income, vacancy rates, and operating expenses against industry benchmarks from sources like IREM or BOMA to gauge its performance relative to the market.

Key Insight: Financial analysis is not just about verifying past performance; it's about stress-testing the property's future profitability and ensuring the investment can withstand market fluctuations and tenant turnover.

This rigorous examination of financial documents is a cornerstone of any successful acquisition. For those new to this type of analysis, it’s beneficial to understand the broader context of what makes a strong asset; you can learn more by exploring guides on investing in European real estate and its financial nuances.

5. Zoning and Land Use Compliance Verification

Just as important as legal title is ensuring the property aligns with municipal regulations, making zoning and land use verification a critical part of any real estate due diligence checklist. This step confirms that the property's current or intended use is legally permitted by local authorities. Overlooking this can lead to significant operational barriers, fines, or the inability to execute your business or development plans.

A thorough zoning review involves examining the local planning code, zoning maps, and the property's specific Certificate of Occupancy. The goal is to identify the property's exact classification (e.g., residential, commercial, industrial, mixed-use) and understand the associated rules, such as setback requirements, building height limits, parking obligations, and permissible business activities.

Uncovering Hidden Liabilities

A zoning analysis reveals opportunities and restrictions that directly impact a property's value and utility. Consider these real-world scenarios:

- Commercial Buyer: An entrepreneur planning to open a new bistro discovered the target property's zoning in a quaint French village did not permit alcohol sales without a special use permit. This early finding allowed them to budget an extra €12,000 and a three-month delay to navigate the complex application process.

- Industrial Purchaser: A logistics company found that an older warehouse in Germany was a "legal non-conforming use," meaning its current industrial function was grandfathered in but could not be expanded or rebuilt if significantly damaged. This restricted their future growth plans and led them to pursue another site.

- Residential Investor: An investor in Spain identified that their target apartment building had excess parking spaces beyond what zoning required. This knowledge unlocked the potential to apply for a variance to build an additional small residential unit, adding an estimated €85,000 in value.

These examples show how zoning verification protects against unforeseen limitations and can even uncover hidden development potential, directly influencing your investment's financial outcome.

Actionable Steps for Zoning Verification

To conduct a proper zoning and land use analysis, follow a structured process:

- Consult Officials: Schedule a meeting with the local planning or zoning department early in the process to discuss your intended use for the property.

- Review Recent Changes: Examine the municipality’s records for recent zoning amendments or pending proposals that could affect the property in the near future.

- Verify Occupancy Permit: Ensure the current Certificate of Occupancy (or its local equivalent) matches the property's actual, current use to avoid immediate compliance issues.

- Engage an Expert: For complex projects or properties with non-conforming use status, hire a local land use attorney or consultant who understands the regional nuances.

Key Insight: Zoning compliance is not a static check; it is a forward-looking assessment of what you can and cannot do with your property, defining its ultimate potential and operational viability.

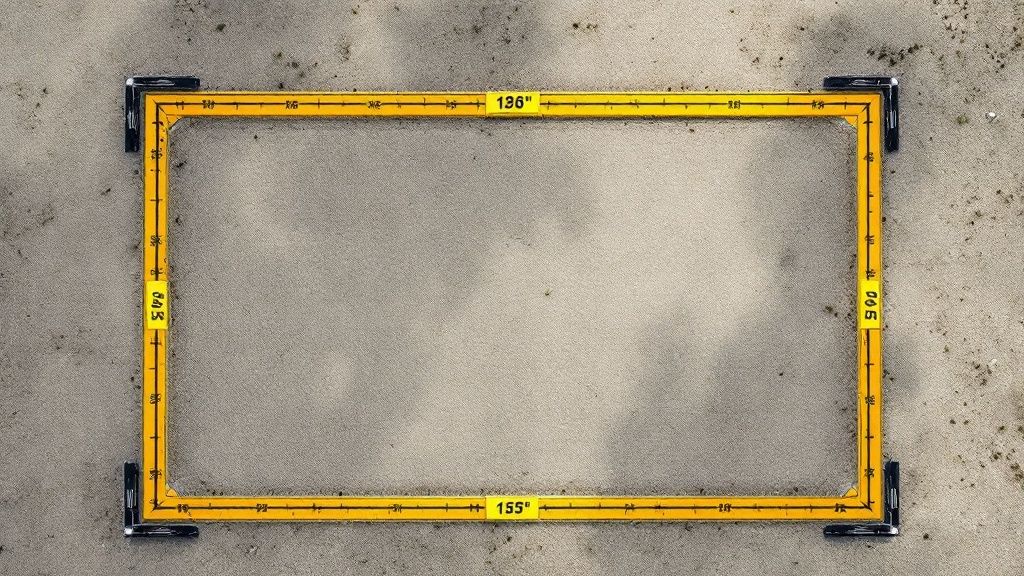

6. Survey and Boundary Verification

While a title report confirms legal ownership, a physical survey verifies the tangible boundaries and improvements on the land. This crucial step in any real estate due diligence checklist involves commissioning a detailed map, often to ALTA/NSPS standards for commercial properties, from a licensed surveyor. It provides a precise depiction of boundary lines, easements, setbacks, and the exact location of all structures, preventing costly disputes and ensuring what you see is what you legally own.

A comprehensive survey is your defense against encroachments and boundary discrepancies that legal documents alone cannot reveal. It translates the abstract legal description from the deed into a concrete, on-the-ground reality. This verification is essential for lenders, title insurers, and any future development plans.

Uncovering Hidden Liabilities

The survey's true value is in identifying physical issues before they become legal and financial nightmares. Consider these real-world scenarios:

- Industrial Buyer: An investor discovered a neighbor's security fence encroached by three meters onto their prospective industrial lot. This finding prompted a pre-closing boundary line agreement, preventing a future lawsuit and securing the land needed for lorry access.

- Office Investor: A survey for a suburban office building revealed its primary car park extended onto an adjacent parcel owned by a different entity. This required the negotiation of a formal easement agreement costing €25,000, a cost the seller had to cover.

- Retail Developer: A developer planning an extension to a retail center used a new survey to confirm that the proposed structure met all municipal setback requirements. This avoided a potential €70,000 in fines and redesign costs had the violation been discovered after construction began.

These examples show how a professional survey provides the clarity needed to address physical property issues, negotiate solutions, and ensure your investment is built on a solid foundation.

Actionable Steps for Survey Verification

To integrate this step effectively into your due diligence process, follow a clear plan:

- Order Early: Commission the survey immediately after executing the purchase agreement, as it often has a long lead time.

- Specify Standards: For commercial or high-value properties, insist on a survey that meets ALTA/NSPS Land Title Survey standards or the equivalent local high standard.

- Conduct a Joint Review: Carefully review the completed survey with your attorney and title company representative to identify and understand any encroachments, easements, or discrepancies.

- Address Issues Promptly: Any identified boundary issues or encroachments must be formally resolved through legal agreements or corrective actions before closing.

Key Insight: A property survey is the physical proof that validates the legal promises of a deed. It protects you from the costly assumption that fences, driveways, and buildings are accurately placed.

7. Lease Agreement and Tenant Documentation Review

For any income-producing property, a meticulous review of lease agreements and tenant documentation is as crucial as a physical inspection. This step dives into the contractual relationships that generate the property's revenue, verifying rental income streams, tenant obligations, and any hidden risks or opportunities. A thorough lease audit ensures the financial projections for your investment are grounded in reality, not just optimistic assumptions.

The process involves a comprehensive examination of all active lease agreements, amendments, tenant correspondence, and financial records. This analysis confirms the stability of your future cash flow and reveals the true nature of the landlord-tenant relationships you will inherit. Without this, you could acquire a property with problematic tenants or unfavorable lease terms that undermine its profitability.

Uncovering Hidden Liabilities

The value of this review is in identifying contractual details that directly impact your bottom line. Consider these scenarios:

- Commercial Buyer: An investor purchasing an office building discovered that three major tenants had early termination rights tied to their company's stock performance. This finding significantly increased the property's risk profile and led to a 10% reduction in the purchase price.

- Residential Portfolio Purchaser: A review of a multi-family apartment complex revealed that security deposits were not held in legally compliant separate accounts, exposing the new owner to potential fines and tenant lawsuits. The seller was required to rectify this €35,000 issue before closing.

- Retail Investor: An analysis of shopping center leases uncovered that several key tenants had co-tenancy clauses, allowing them to break their lease if an anchor store vacated. This insight prompted the buyer to secure a long-term commitment from the anchor tenant as a condition of the sale.

These examples show how a deep dive into tenant files can protect an investor from inheriting significant financial and operational liabilities. It provides the clarity needed to accurately value the property's income stream.

Actionable Steps for Lease Review

To conduct an effective lease audit, follow this structured approach:

- Request Estoppels: Immediately request signed estoppel certificates from all tenants. These legally binding documents confirm key lease terms, such as rent amount and expiration date, directly from the tenant.

- Create Lease Abstracts: Develop a summary sheet or "abstract" for each lease, highlighting critical data points like rent schedules, renewal options, expense pass-throughs, and critical dates for easy comparison.

- Verify Security Deposits: Confirm the amount and location of all tenant security deposits and ensure they are properly accounted for and will be transferred to you at closing.

- Analyze Terms vs. Market: Compare existing lease terms, such as rental rates and annual escalations, against current market standards to identify any below-market leases that represent future upside potential.

Key Insight: Lease review is not just about confirming rental income; it is a forensic analysis of the property's core business asset. It transforms the numbers on a rent roll into a clear picture of financial stability and future potential.

This process is fundamental for traditional long-term rentals, but the principles of verifying agreements and income are just as critical for other models. For instance, managing short-term leases requires its own specialized approach. You can learn more about the specifics of property management for vacation homes to understand these unique requirements.

8. Insurance and Risk Assessment Review

A often-overlooked yet critical part of any real estate due diligence checklist is a thorough insurance and risk assessment. This goes beyond simply confirming the property is insurable; it involves a deep dive into existing policies, claims history, and potential liabilities. A proper review ensures you are not inheriting unmanageable risks and can secure adequate, cost-effective coverage from day one.

This process involves evaluating the seller's current insurance policies and claims history to identify recurring issues or hidden defects. It also requires obtaining forward-looking insurance quotes to accurately forecast operational expenses and confirm the property meets modern underwriting standards. This step is crucial for protecting your investment against property damage, liability claims, and other unforeseen events.

Uncovering Hidden Liabilities

The true value of this step is in translating insurance data into actionable insights about the property's physical and financial health. Consider these real-world scenarios:

- Commercial Buyer: An analysis of a warehouse's claims history revealed three major water damage claims in five years. This prompted a deeper roof inspection, which uncovered systemic issues requiring a €75,000 replacement, a cost the buyer negotiated for the seller to cover.

- Residential Purchaser: A family looking at a coastal villa in Spain discovered it was in a recently re-designated high-risk flood zone. The new, mandatory flood insurance premium would be over €8,000 annually, significantly altering their net operating income projections and making the deal less attractive.

- Industrial Investor: A manufacturing facility required specialized environmental liability coverage due to its history of chemical storage. Obtaining quotes pre-purchase revealed a €20,000 annual premium, a significant operational cost that was factored into the final offer.

These examples show how an insurance review acts as a powerful diagnostic tool, exposing risks that a standard physical inspection might miss and preventing costly post-acquisition surprises.

Actionable Steps for Insurance and Risk Assessment

To conduct a comprehensive review, follow a structured approach:

- Request Loss Runs: Immediately ask the seller for at least five years of "loss run" reports (like an ACORD form) from their insurer. These provide a detailed history of all claims filed against the property.

- Engage a Broker: Work with an experienced commercial insurance broker who specializes in your property type and geographic region. They can analyze the risk profile and shop for competitive quotes.

- Evaluate Specific Risks: Assess the need for specialized coverage beyond standard property and liability, such as flood, earthquake, or environmental insurance, based on the property's location and use.

- Secure Binders Early: Obtain insurance binders (temporary agreements) well before closing to ensure there are no gaps in coverage the moment you take ownership.

Key Insight: Insurance and risk assessment is not just about getting a policy; it's a forensic tool for uncovering a property's hidden history and predicting its future financial stability.

8-Point Real Estate Due Diligence Checklist Comparison

| Item | Implementation Complexity | Resource Requirements | Expected Outcomes | Ideal Use Cases | Key Advantages |

|---|---|---|---|---|---|

| Legal Title and Ownership Verification | High (legal expertise needed) | Title companies, attorneys, surveys | Clear ownership, identification of liens/issues | All property transactions | Prevents legal disputes, ensures clear title |

| Environmental Site Assessment (Phase I ESA) | Moderate (requires certified consultants) | Environmental consultants, records | Identification of contamination risks | Commercial, industrial properties | Protects from environmental liability |

| Property Condition Assessment (PCA) | Moderate to High (technical inspections) | Engineers, inspectors | Detailed condition report, repair and capex needs | Commercial properties, lending | Helps negotiate price, budget future costs |

| Financial Performance and Rent Roll Analysis | High (extensive financial review) | Financial analysts, market data | Verified income, risk identification | Income-producing properties | Supports accurate valuation and cash flow |

| Zoning and Land Use Compliance Verification | Moderate (legal and planning knowledge) | Planning departments, attorneys | Verification of permitted uses, identify restrictions | Development, change of use | Prevents violations, reveals expansion potential |

| Survey and Boundary Verification | Moderate to High (field work needed) | Licensed surveyors | Accurate boundaries, easement and encroachment ID | All property transfers | Prevents boundary disputes, required for title insurance |

| Lease Agreement and Tenant Documentation Review | High (legal and document review) | Attorneys, property managers | Verified lease terms, tenant obligations | Leased income properties | Ensures rental income security, identifies risks |

| Insurance and Risk Assessment Review | Moderate (insurance expertise) | Insurance brokers, risk consultants | Identification of coverage gaps and risk exposures | All property ownership | Optimizes insurance coverage and costs |

From Checklist to Closing: Your Next Steps in European Property Ownership

You have navigated the intricate landscape of European property acquisition, methodically working through one of the most comprehensive real estate due diligence checklists available. From verifying legal titles and scrutinizing environmental reports to assessing the structural integrity and financial viability of a property, you are no longer just an interested buyer. You are now an informed, strategic investor equipped with the knowledge to act with confidence. This checklist is more than a series of tasks; it is a foundational framework for mitigating risk and maximizing your investment potential across the continent's diverse markets.

The journey doesn't end here. The data you have painstakingly gathered from your due diligence process becomes the bedrock of your negotiation strategy and long-term ownership plan. Think of it as a strategic asset. Each discovery, whether a minor repair noted in the Property Condition Assessment or a clause in a tenant lease agreement, is a potential point of leverage.

Turning Due Diligence into Decisive Action

The true power of a thorough real estate due diligence checklist lies in its application. As you move toward closing, your focus must shift from investigation to implementation.

- Refine Your Offer and Negotiation: Armed with concrete findings, you can now justify your offer with precision. Did the survey reveal a boundary encroachment? This is a valid reason to renegotiate the price or demand a resolution before closing. Are there unexpected maintenance costs on the horizon? Factor these into your financial model and adjust your offer accordingly.

- Build Your Local Professional Network: Your due diligence process likely introduced you to a team of local experts, including lawyers, surveyors, and inspectors. These relationships are invaluable. Maintain them. They will be your on-the-ground support system for managing the property, navigating local regulations, and handling any future challenges that arise.

- Develop a Long-Term Asset Management Plan: Whether your goal is a peaceful retirement villa in Tuscany or a high-yield rental apartment in Berlin, your due diligence findings inform your future strategy. The financial analysis helps you project cash flow, the property assessment outlines a capital expenditure schedule, and the zoning review confirms your plans for future development or use are permissible.

Key Takeaway: Due diligence is not a one-time hurdle to overcome. It is the beginning of a proactive ownership strategy. The insights you gain are not just for closing the deal; they are for successfully managing your investment for years to come.

The Unseen Value of Diligence: Peace of Mind

Ultimately, the most significant benefit of this exhaustive process is not purely financial. It is the peace of mind that comes from knowing you have left no stone unturned. The European property market is filled with incredible opportunities, but its complexity can be daunting, especially for international buyers. Each country, from Spain to Estonia, has its own unique legal systems, building codes, and cultural nuances.

By diligently applying this checklist, you transform ambiguity into certainty. You replace assumptions with facts. You are not just buying a property; you are making a well-vetted, strategic investment poised for success. You are securing a tangible piece of your future, whether it's a family home, a source of passive income, or a holiday retreat. Your dream property in Europe is within reach, and with this disciplined approach, you can secure it with the confidence and clarity you deserve.

Ready to find the perfect European property to apply your due diligence knowledge to? Start your search on Residaro, a platform designed to connect you with premium listings across Europe. Residaro simplifies the discovery process, giving you a powerful starting point to find properties worthy of your comprehensive real estate due diligence checklist.