Investing in European Real Estate - A Guide

Investing in European real estate isn't just about buying bricks and mortar. It's a chance to diversify your portfolio with tangible assets, tapping into the stability of mature Western European markets while also getting in on the ground floor of emerging opportunities in the East. For anyone looking to secure long-term value, Europe's property landscape is as compelling as it is dynamic.

Why Invest in European Real Estate Now

Think about owning a piece of a continent known for its rich cultural history, economic strength, and incredible quality of life. An investment here is more than a financial transaction; it’s a stake in a diverse and constantly evolving market. You could be looking at a chic apartment in Paris, a modern flat in Berlin, or a sun-drenched villa in Portugal—each with its own distinct appeal and investment potential.

Consider this guide your roadmap. We'll navigate the key factors that make Europe such an attractive spot for property investors right now, from major economic shifts to a clear return of market confidence. The goal is to give you a real-world picture of the returns and diversification you can achieve.

A Market Regaining Its Footing

After a recent period of adjustment, the European property market is bouncing back. Investor confidence is on the rise, and with assets being repriced to more attractive levels, new doors are opening for sharp-eyed buyers. You can feel the energy returning to the market.

The numbers tell the story. European real estate transaction volumes recently hit €183 billion. That’s a solid 22% jump from the €150 billion recorded the year before. While we're not quite back to the peak highs, the trend is undeniably upward. In fact, some forecasts predict volumes will push toward the €200 billion mark soon. You can dig deeper into this market recovery data to see the trend lines for yourself.

Key Drivers Fueling the Opportunity

A few powerful forces are coming together to create this window of opportunity. Getting a handle on them is crucial to understanding the long-term potential.

- Stabilizing Interest Rates: Central banks are signaling a more predictable approach to monetary policy, which means financing costs are settling down. This stability makes it much easier to secure a mortgage and map out your financial strategy without constantly worrying about rate hikes.

- A Stubborn Supply-Demand Gap: Across Europe's major cities and most sought-after regions, there simply isn't enough quality housing to go around. This classic imbalance between supply and demand creates a solid floor for rental income and is a powerful engine for long-term property value growth.

- Diversification and Stability: Let's be honest, markets can be a rollercoaster. Real estate offers a tangible, less volatile alternative to stocks and bonds. Spreading your investments across different European countries adds another layer of protection, smoothing out the bumps and reducing your overall risk.

By mixing investments between established Western European economies and high-growth Eastern European nations, you can build a truly resilient portfolio. This strategy aims for both steady rental income and the potential for serious capital growth—it's the cornerstone of smart cross-border property investing.

What Kind of Returns Can You Actually Expect?

When you buy a property in Europe, you're not just buying bricks and mortar; you're buying a financial engine. So, how exactly does this engine make you money? Getting a clear picture of how returns work is the first step to setting goals you can actually hit and making decisions with confidence.

Your total return is really a two-part story. Think of it like owning a small orchard. You have the apples you sell every year (your income), and you have the trees themselves growing bigger and more valuable over time (your asset growth). In real estate, we call these rental yield and capital appreciation.

Rental Yield: The Lifeblood of Your Investment

Rental yield is the cash your property puts in your pocket, right here and now. It’s the rent you collect from tenants, after you’ve paid for all the operational costs—things like maintenance, insurance, and any property management fees. This is what keeps the investment running, providing a steady stream of cash that can cover your mortgage and other bills.

A solid rental yield is your financial safety net, making sure the property pays for itself month after month. For a lot of investors, this is the main draw. It's predictable, reliable, and forms the foundation of your investment's performance.

Take a city with a constant housing shortage, for example. The demand for quality rentals stays high, which means you can count on a remarkably stable income, even when the broader economy gets a little shaky. People always need a place to live.

Capital Appreciation: Playing the Long Game

While rental income keeps the lights on, capital appreciation is where real wealth is often made. This is simply the increase in your property’s value over time. It’s definitely a slower burn, but the payoff can be massive.

Imagine you bought a flat in an up-and-coming neighborhood in Lisbon. As new cafes, better transport links, and cool shops pop up, the area becomes more desirable. Fast forward five or ten years, and the value of your flat could have shot up, making up a huge chunk of your total return.

Capital appreciation isn't magic. It's driven by real-world market forces—limited housing supply, a growing population, and a strong local economy all conspire to push property values up over the long haul.

Across Europe, the signs are looking good. Recent data shows that real estate returns are back in the green, thanks to strong yields and steady rent increases. Rents in all property sectors across the continent climbed by about 4% this past year, with residential and logistics leading the pack.

Looking ahead, experts are forecasting European all-property total returns to land somewhere between 7.4% and 7.9%. Over a five-year period, those annualized returns are expected to be even stronger, at 8.7% to 9.5%. You can dig into the numbers yourself in this European real estate outlook here.

How Financing Pours Fuel on the Fire

One of the most powerful tools in real estate is leverage—using the bank's money to finance your purchase. When you can get a good loan, it acts as an incredible amplifier for your returns.

Here’s a quick breakdown of how it works:

- Your Stake: You put down a 20% deposit on a €300,000 property. That's €60,000 of your own money.

- Your Control: But you now control the full €300,000 asset.

- The Growth: Let's say the property value goes up by 10% to €330,000. Your profit is €30,000.

That €30,000 gain was generated from your €60,000 investment, which (before costs) is a massive 50% return on your cash. This is the magic of leverage.

When you combine consistent rental income with long-term growth and smart financing, you start to see why European real estate is such a powerful strategy for building serious, lasting wealth.

Choosing The Right European Market For You

Diving into European real estate isn't a "one-size-fits-all" game. The continent is a rich mosaic of markets, each with its own economic heartbeat, local rules, and unique investment personality. Think of it less like buying a stock and more like choosing a business partner—you need a market that clicks with your financial goals, comfort with risk, and long-term vision.

The whole thing boils down to a fundamental trade-off: stability versus growth. Some markets deliver the reliable, steady returns of a blue-chip company, while others offer the high-octane potential of a startup. Neither is better than the other; the right one for you depends entirely on what you're trying to achieve.

Established Versus Growth Markets

Let's break down the two main flavors you'll find. First up, you have the established, mature markets of Western Europe. Places like Germany, France, and parts of the UK are known for their rock-solid economies, transparent legal systems, and deep, active property markets.

Investing here is often about preserving wealth and securing a predictable income stream. You’re not likely to see eye-popping short-term gains, but you can count on consistent rental demand and slow, steady appreciation over the long haul. These markets are perfect for investors who want to sleep well at night, prioritizing low risk above all else.

Then you have the dynamic growth markets, which you'll often find in Southern and Eastern Europe. Countries like Portugal, Spain, and Poland are buzzing with economic development, rapid urbanization, and a fresh wave of foreign investment. These areas offer the potential for much juicier rental yields and significant capital growth as they catch up with their western neighbors.

The catch, of course, is a bit more risk and the potential for a bumpier ride. But for investors willing to do their homework and take a calculated chance, the rewards can be well worth it. For a closer look at specific hotspots, our guide on the best countries to buy property in Europe gets into the nitty-gritty, country by country.

To get a clearer picture of how these differences play out in the real world, let's take a look at a snapshot of a few key markets.

European Real Estate Market Snapshot

This table offers a bird's-eye view of what you can expect in different corners of the continent, from the type of market to what investors are currently focused on.

| Country/Region | Market Type | Primary Investment Sector | Typical Prime Yield Range | Key Investor Considerations |

|---|---|---|---|---|

| Germany | Established | Residential & Logistics | 2.5% - 3.5% | Stability, strong rental demand, complex regulations. |

| France (Paris) | Established | Prime Residential & Office | 2.8% - 4.0% | Global hub status, high entry costs, tenant-friendly laws. |

| Spain | Growth/Mature | Tourism & Residential | 3.5% - 5.5% | Strong lifestyle appeal, seasonal demand, economic sensitivity. |

| Portugal | Growth | Residential & Hospitality | 4.0% - 6.0% | Golden Visa impact, tourism-driven, rising construction costs. |

| Poland | Growth | Logistics & Industrial | 4.5% - 6.5% | Strategic location, strong economic growth, emerging market risk. |

As you can see, your potential returns and the factors you need to worry about change dramatically depending on where you look. Choosing a market isn't just about the numbers; it's about understanding the story behind them.

A Tale Of Three Cities

To make this even more tangible, let's compare what an investment could look like in three very different, but equally interesting, European cities. Each one tells its own story.

-

Berlin, Germany: Germany's residential market is the gold standard for stability. In cities like Berlin, a chronic housing shortage and a powerhouse economy create non-stop rental demand. What's fascinating here is the gap between regulated "in-place" rents for existing tenants and the much higher open market rates. Some reports show market rents in Berlin are a staggering 170% higher than in-place rents. This gives investors a clear, predictable path for rental income growth for years to come, making Berlin a magnet for anyone focused on income and avoiding risk.

-

Lisbon, Portugal: Portugal has exploded onto the scene as a hub for both lifestyle and investment. Its popular Golden Visa program, a booming tourism sector, and its appeal to digital nomads have sent the property market soaring. An apartment in Lisbon could easily offer a higher rental yield than one in Berlin, especially if you're looking at short-term holiday lets. The potential for property values to climb is also strong, though the market is more exposed to shifts in tourism and the wider economy. This is a place for investors chasing growth who don't mind a more hands-on approach.

-

Warsaw, Poland: As one of Eastern Europe’s economic engines, Poland offers a totally different kind of opportunity. Its logistics and warehousing sector, for example, is on fire, thanks to the country's prime location and the e-commerce boom. An investment in commercial property here could deliver returns that leave traditional residential investments in Western Europe in the dust. It’s a more specialized, high-yield play for those looking to think beyond apartment buildings.

The lesson here is simple: your personal investment strategy should be your compass. Are you trying to build a stable foundation for retirement, or are you looking to aggressively grow your capital over the next ten years? Your answer will point you to very different spots on the European map.

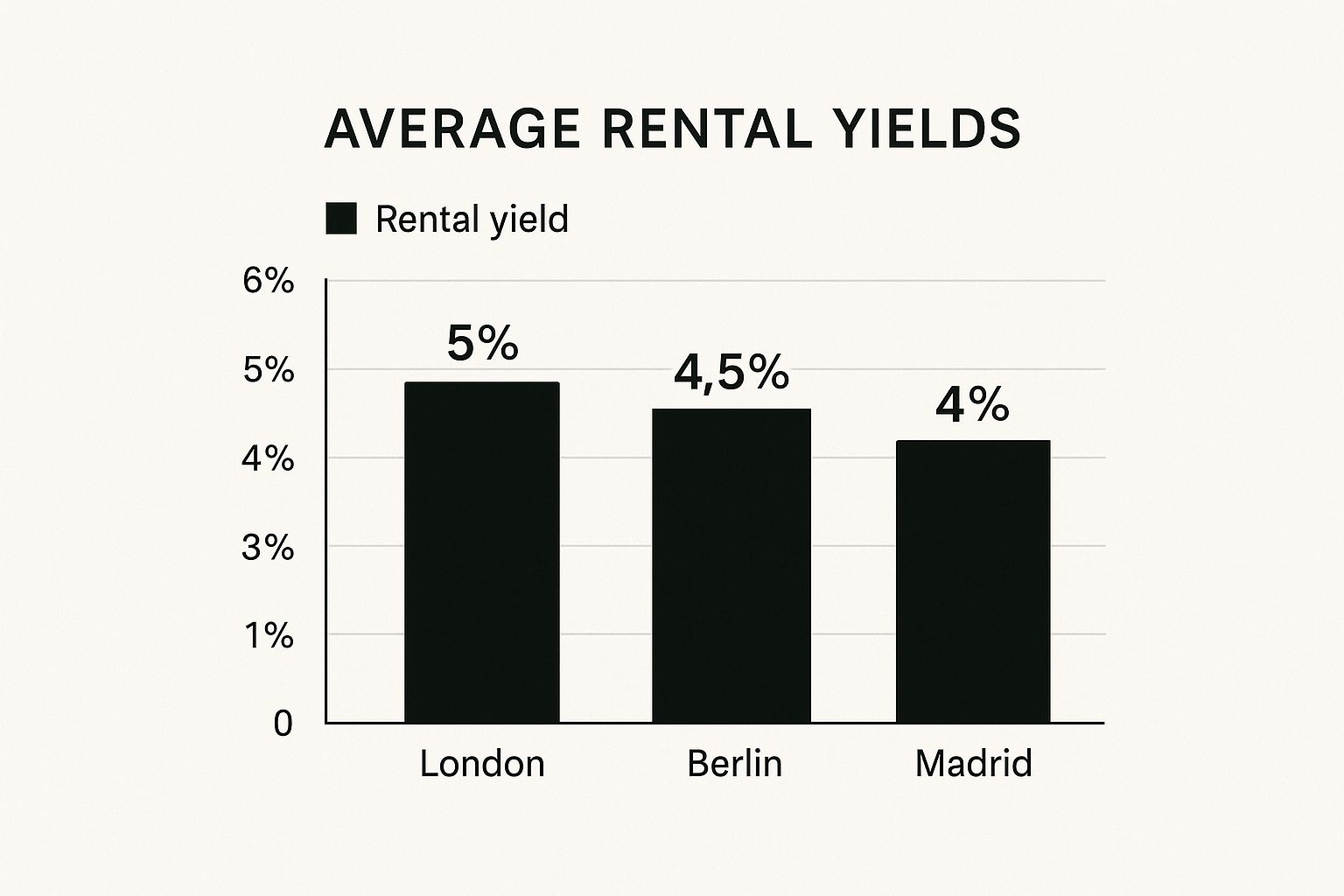

The chart below shows just how much rental yields can vary across some of Europe's major cities.

This side-by-side comparison makes it clear that even among well-known markets, the potential returns are all over the place. It really hammers home the need to do targeted research that aligns with exactly what you want to accomplish financially.

Spotlighting Top-Performing Property Sectors

Choosing the right country is only half the battle when you're investing in European real estate. Just as critical is picking the right property sector—the specific type of real estate that's riding the wave of powerful economic trends. Not all properties are created equal, and knowing where the smart money is flowing can make all the difference to your returns.

Think of it like picking stocks. You wouldn't just throw your money at "the market." You’d zero in on specific industries, like tech or healthcare, that are showing real growth signals. The same exact logic applies here. Right now, a couple of sectors are consistently leaving the others in the dust, and it's all thanks to deep, structural changes in how we live and shop.

The Logistics Powerhouse

Logistics and industrial properties have become the undisputed darlings of the European market. We're talking warehouses, massive distribution centers, and those crucial last-mile delivery hubs. What's fueling this fire? The relentless, unstoppable rise of e-commerce.

Every time someone clicks "buy now," that item needs a physical place to be stored, sorted, and shipped from. This has created an almost insatiable demand for modern logistics facilities. This isn't just some passing fad; it's a fundamental rewiring of consumer behavior. Retailers are in a frantic race to build smarter, faster supply chains, and that means leasing prime warehouse space near major cities.

So, what does a top-tier logistics asset look like? You’ll want to hunt for a few key features:

- Strategic Location: Being close to major motorways, ports, and big urban centers is non-negotiable. It's all about speed.

- Modern Specs: High ceilings, plenty of loading docks, and enough space for automation are what today's high-volume operators demand.

- Rock-Solid Tenants: A lease with a major international retailer or a logistics giant means a secure and reliable income stream for you.

This sector really offers a compelling mix of high rental demand and long-term leases, which is why it's become a cornerstone for so many institutional investment portfolios.

The Unshakeable Residential Market

While logistics is grabbing the headlines, the residential sector remains the bedrock of stability for many investors. The reason is simple and powerful: a chronic housing shortage across nearly every major European city.

Population growth, more people moving to cities, and a slowdown in new construction have created a classic supply-and-demand squeeze. The result? Incredibly strong and consistent rental demand. People will always need a place to live, making residential property one of the most defensive assets you can possibly own. It provides a reliable income stream that tends to hold its own, even when the broader economy gets a bit shaky.

The real opportunity in many European cities lies in the gap between the regulated rents existing tenants pay and the much higher open-market rates. In a city like Berlin, market rents can be over 170% higher than what's currently being collected, offering a clear, built-in path for future income growth.

This structural shortage isn't going to vanish overnight. That gives residential investors a huge amount of long-term confidence in both their rental income and the potential for their property's value to grow. It’s a fundamental human need that translates directly into investment security.

Other Sectors Capturing Attention

Beyond these two giants, other niche sectors are also turning heads. The hospitality sector, especially in the sun-drenched tourist hotspots of Southern Europe, is bouncing back with a vengeance as global travel resumes. Boutique hotels and serviced apartments, in particular, are tapping into the huge demand for unique travel experiences.

Elsewhere, niche areas like life sciences real estate—think specialized lab and research facilities—are gaining serious traction as Europe doubles down on innovation. These assets can offer very attractive returns, but they definitely require a deeper level of market knowledge.

Looking at the numbers, the industrial and residential sectors have been on a tear. Recent data shows some pan-European property fund segments delivering double-digit total returns, with specific markets like Stockholm residential clearing 10%. The most recent quarterly data showed returns hitting 1.8%, nicely outpacing the long-term quarterly average of 1.3%. You can dive deeper into these European real estate market trends here.

By getting a feel for these sectoral dynamics, you can build a diversified portfolio that isn't just resilient but is perfectly positioned to catch Europe's most profitable real estate currents.

Getting to Grips with the Legal and Tax Side

Investing in European real estate is an exciting step, but this is where the real groundwork happens. Let's be honest, dealing with the legal and tax rules of a cross-border purchase can seem daunting at first. It’s not just about finding a great property; it’s about making sure your investment is secure.

Think of it less like a legal minefield and more like a smart checklist. The idea here is to give you the right questions to ask the local experts you'll have on your team—the real estate agents, lawyers, and accountants who know the lay of the land.

Why Due Diligence is Non-Negotiable

Before a single euro changes hands, you need to do your due diligence. This isn't just a fancy term; it's the fundamental homework that confirms the property you're buying is what the seller claims it is. It's exactly like getting a trusted mechanic to check out a used car before you buy it—you need to know what’s under the hood.

This process is all about verifying the critical details to protect yourself from expensive headaches later. A local lawyer is your best friend here, as they'll dig into the essentials for you.

- Confirming True Ownership: Who actually has the legal title to the property? Your lawyer will make sure the seller has the undisputed right to sell it, so no old claims or ownership squabbles can pop up later.

- Searching for Debts or Liens: Are there any unpaid mortgages, back taxes, or other debts tied to the property? A title search is crucial to ensure you don’t accidentally inherit someone else's financial baggage.

- Checking Building Rules: Does the property meet local zoning laws and building codes? This is incredibly important, especially if you have plans to renovate or build an extension down the line.

Due diligence is your financial shield. It turns a potentially risky foreign purchase into a transparent, secure deal by uncovering any hidden problems before you put your money on the table. It’s the bedrock of any successful cross-border investment.

The Main Financial Hurdles to Expect

Once you’re confident the property is a solid buy, it’s time to look at the numbers involved in the transaction itself. Every country in Europe has its own specific set of taxes and fees, and knowing what they are is key to creating an accurate budget.

The two big ones you’ll almost always encounter are property transfer taxes and capital gains taxes. They vary massively from one country to the next, which is why local advice is so important. To see how these costs affect a country's overall appeal, take a look at our detailed breakdown of the best countries for property investment in Europe.

These taxes will have a direct impact on how much you pay upfront and how much profit you keep when you sell.

Understanding Property Taxes Across Europe

Property transfer tax—often called stamp duty—is a one-time tax you pay when the property officially becomes yours. This can be as low as 1% in some places or climb to over 10% in others, which obviously makes a huge difference to your total cost. For instance, on a €400,000 property, a 7% transfer tax means forking over an extra €28,000.

Then there's capital gains tax. This is the tax you’ll pay on the profit you make when you eventually sell the property. The rates and rules are all over the map. Some countries give you a tax break if the property was your main home, while others will tax your profit at a flat rate no matter what. Getting the ownership structure right from day one can go a long way in legally minimizing this tax bill in the future.

Ultimately, a successful European property investment comes down to navigating these legal and tax waters with confidence. By mastering the basics of due diligence and knowing which taxes to plan for, you'll be building your investment on solid, secure ground.

Your Action Plan for Investing in Europe

Alright, let's move from theory to practice. A great strategy is one thing, but turning it into a successful investment takes a clear, step-by-step plan. This is your roadmap for breaking down the process and making it manageable, so you can confidently manage your new property from anywhere in the world.

Think of yourself as the CEO of this project. You can't be on the ground for every little detail, so you need to build a high-performance team to act on your behalf. Your success truly depends on the quality of that team and the clarity of your instructions.

Step 1: Nail Down Your Investment Thesis

Before you even glance at a property listing, you need to define what a "win" looks like for you. This is your investment thesis—a sharp, focused statement of your goals that will guide every single decision you make from here on out. Are you hunting for high rental yields to get cash flow now, or are you playing the long game, betting on capital growth in an up-and-coming market?

Get really specific with your criteria:

- Budget: What’s your absolute maximum? Remember to factor in not just the sticker price but all the extras: taxes, legal fees, and potential renovation work. A good rule of thumb is to budget an extra 10-15% of the property's price for these costs.

- Target Location: Based on your goals, zero in on a few specific countries or even cities. If you want rock-solid stability, you might be looking at Germany. If you’re after growth potential, maybe Portugal is the right fit.

- Property Type: Decide what you're after. A city apartment? A vacation villa? A multi-family building? Each has its own management style and risk profile.

Step 2: Assemble Your Local A-Team

You simply can't invest successfully from abroad without a trusted team on the ground. These are the people who will be your eyes, ears, and local experts, navigating the market for you. Finding the right people is arguably the most critical part of this whole adventure.

Your essential team members include:

- A Reputable Real Estate Agent: Find someone who specializes in working with international buyers. They need to know your target area inside and out.

- An Independent Lawyer: This is non-negotiable. Your lawyer works for you and you alone, protecting your interests during the due diligence and contract stages.

- A Mortgage Broker (if needed): Getting a loan in a foreign country is tricky. A great broker knows which banks are open to non-resident investors and can hunt down the best possible terms for you.

Building this team isn't about speed; it's about trust. Take your time. Interview several candidates for each role, check their references, and make absolutely sure they understand your investment goals.

Step 3: Secure Your Financing and Manage Risk

With your plan and team ready, it's time to get into the nuts and bolts of money and risk. If you need a loan, get the pre-approval process started immediately. European banks will want to see detailed proof of income and a solid financial history, so get all your paperwork organized ahead of time.

Beyond the mortgage, you have to actively manage your risks. For international investors, currency fluctuation is a big one. If the Euro strengthens against your home currency, your mortgage payments and other expenses will go up. It's smart to talk to a currency specialist about hedging against these kinds of shifts.

Finally, think about your exit strategy from day one. How and when do you plan to eventually sell the property? Having a clear exit plan keeps you focused on your long-term goals and helps you avoid making decisions based on emotion. By following these steps, you can confidently take the leap into the rewarding world of European property investment.

And for those looking to start their search, our guide to finding cheap homes in Europe can offer some great initial inspiration.

Frequently Asked Questions

Stepping into the European property market for the first time will naturally spark a few questions. Let's tackle some of the most common ones we hear from investors to help you move forward with clarity and confidence.

Can Foreigners Easily Buy Property In Europe?

Absolutely. Most European countries are quite open to foreign buyers. Places like Portugal, Spain, and France, for example, have very clear and well-trodden paths for non-residents looking to purchase property.

That said, every country has its own nuances. You might find certain restrictions on buying agricultural land or historically significant buildings. This is where a good local lawyer who specializes in foreign investment becomes your most valuable asset. They'll navigate the local legal landscape for you, ensuring every step of the process is handled correctly.

What Is The Most Stable European Real Estate Market?

If you're looking for a safe harbor, Germany consistently tops the list. Its powerhouse economy, rock-solid legal system, and chronic housing shortages in key cities like Berlin all contribute to an exceptionally predictable market.

The German residential scene is built on steady rental demand from a large, reliable tenant base. You might not see the dramatic price jumps of emerging markets, but for long-term, stable growth and wealth preservation, it’s hard to beat.

A unique advantage in cities like Berlin is the gap between regulated rents for existing tenants and the much higher rates on the open market. This creates a built-in roadmap for future rental income growth, adding another layer of security to your investment.

Which Property Type Offers The Best Returns?

Right now, two sectors are really shining: logistics and residential. The unstoppable rise of e-commerce has lit a fire under the logistics market, creating huge demand for modern warehouses and distribution hubs. This has translated into strong rent increases and very low vacancy rates.

At the same time, you can't go wrong with residential property. Persistent housing shortages in nearly every major European city make it a fundamentally sound investment. People always need a place to live, which keeps rental income flowing and makes the asset class incredibly resilient, even when the broader economy gets a bit shaky.

Ready to explore your options? At Residaro, we connect international buyers with exceptional properties across Europe, from sun-drenched Spanish villas to historic French chateaux. Begin your search for the perfect European property today at https://residaro.com.