8 Real Estate Investment Tips for Beginners in Europe (2026)

Embarking on a real estate investment journey can be both thrilling and daunting, especially for those just starting out. The European market, with its diverse cultures, economies, and property types, presents a unique landscape of opportunities. From a charming country house in France to a modern villa in Spain, the potential for building long-term wealth is immense. However, success in this arena is not accidental; it hinges on a solid foundation of knowledge and a well-defined strategy.

This guide provides actionable real estate investment tips for beginners, tailored specifically for navigating the complexities and rewards of the European property scene. We will move beyond generic advice to offer practical, detailed steps designed to help you make informed decisions, minimize risks, and confidently take your first step into property investment. This article is your roadmap to understanding the critical components of a successful venture, from financing and market analysis to building a reliable local team.

You will learn how to set clear goals, analyze a deal's profitability using metrics like the 1% rule, and prepare for the financial realities of property ownership. Whether you're exploring options on various platforms or just beginning your research, these insights will equip you to build a successful and sustainable real estate portfolio.

1. Tip 1: Master Hyper-Local European Market Research

National real estate trends offer a bird's-eye view, but the real secret to successful European property investment lies in the details. One of the most critical real estate investment tips for beginners is to go beyond country-level data and conduct "hyper-local" research. This means immersing yourself in the specific city, neighborhood, or even the street where you plan to invest, as the market dynamics can vary dramatically within just a few kilometers.

This granular approach ensures you understand the unique forces at play. For example, a property in Tuscany, Italy, operates under different rental pressures and heritage regulations than a modern apartment in Portugal's Algarve. Similarly, analyzing rental yields in Lisbon's tourist-heavy Alfama district versus Porto's up-and-coming Cedofeita neighborhood will reveal vastly different investment potentials.

Why Hyper-Local Research is Non-Negotiable

This deep dive is essential before you commit any capital. It helps you identify genuine opportunities and avoid costly assumptions. Understanding local zoning laws in rural France could be the difference between a successful renovation project and a bureaucratic nightmare. Likewise, reviewing a city's development plans for new metro lines or business parks can help you anticipate future appreciation in an otherwise overlooked area of a Spanish city.

Key Insight: The best deals are often found by understanding micro-market drivers that national reports miss, such as a new international school opening or a specific street becoming pedestrianized.

Actionable Steps for Your Research

- Focus Your Scope: Start by concentrating on one or two countries, such as Spain and Italy, to avoid becoming overwhelmed. Use comparison platforms like Residaro to analyze regional pricing trends.

- Digital Reconnaissance: Before visiting, digitally immerse yourself. Study at least 50 properties online in your target area to understand pricing, features, and inventory levels.

- Tap into Local Knowledge: Follow expat forums and local real estate blogs. These resources provide unfiltered, on-the-ground insights you won't find in official reports.

- Build Your Team Early: Connect with local real estate agents and legal professionals who specialize in assisting foreign investors. Their expertise is invaluable for navigating bureaucracy and cultural nuances.

2. Set Clear Investment Goals and Strategy

Venturing into European real estate without a clear plan is like sailing without a compass. One of the most foundational real estate investment tips for beginners is to define your precise goals and strategy before you even start browsing listings. This means deciding what you want to achieve, your timeline, your risk tolerance, and the specific path you'll take to get there.

A well-defined strategy guides every decision, from the type of property you buy to the location you choose. For instance, an investor aiming for long-term passive income might target a buy-and-hold apartment in a stable German city. In contrast, someone seeking rapid capital gains might pursue a "fix-and-flip" project in an up-and-coming neighborhood in Lisbon, Portugal. Your personal financial situation and goals dictate the best approach.

Why a Defined Strategy is Non-Negotiable

A clear strategy prevents emotional decision-making and keeps you focused on your financial objectives. It helps you filter out unsuitable properties and markets, saving you time and effort. For example, if your goal is to generate €1,500 in monthly cash flow within three years, you can immediately dismiss properties in high-cost, low-yield areas. This clarity is crucial when navigating the complexities of investing in European real estate. It transforms a vague wish into a measurable, executable plan.

Key Insight: Your investment strategy should be a written document you can refer back to. It should clearly state your financial goals, risk tolerance, and the criteria a property must meet to be considered.

Actionable Steps for Your Strategy

- Define Your "Why": Write down your primary objective. Is it for retirement income, capital appreciation, a vacation home that pays for itself, or diversification? Be specific.

- Quantify Your Goals: Attach numbers and timelines. For example, "Acquire two rental properties in Spain within five years that generate a combined net annual cash flow of €12,000."

- Assess Your Resources: Honestly evaluate your available capital, how much time you can dedicate to management, and your comfort level with debt and market volatility.

- Choose Your Path: Select a strategy that aligns with your goals and resources. Common options include long-term rentals (buy-and-hold), short-term vacation lets, or property flipping (buy-to-sell).

3. Master Real estate Financing Options

One of the most powerful real estate investment tips for beginners is understanding how to use leverage effectively. Securing the right financing is not just about getting a loan; it’s about choosing a strategy that aligns with your investment goals, whether that’s a traditional mortgage for a long-term rental or a creative solution for a unique opportunity. Mastering financing unlocks the ability to scale your portfolio and maximize returns.

The world of property finance extends far beyond a standard bank loan. Options range from government-backed loans with low down payments, like an FHA loan, to flexible arrangements such as seller financing, where the property owner acts as the lender. For short-term projects like a fix-and-flip, a hard money loan might provide the necessary speed, while a Home Equity Line of Credit (HELOC) on your primary residence can fund a down payment for a second property.

Why Understanding Financing is Non-Negotiable

Choosing the wrong financing can cripple an otherwise great investment by eroding your cash flow with high interest rates or unfavorable terms. Conversely, the right loan structure can significantly amplify your returns. For instance, using a low-down-payment loan allows you to acquire an asset with minimal initial capital, freeing up cash for renovations or other investments. This strategic use of debt is a cornerstone of building real estate wealth.

Key Insight: Leverage is a double-edged sword. While it can magnify gains, it also increases risk. The goal is to secure financing with terms that support positive cash flow from day one.

Actionable Steps for Your Financing Strategy

- Boost Your Credit Score: Aim for a credit score of 740 or higher to qualify for the most competitive interest rates. This single factor can save you thousands over the life of a loan.

- Shop Multiple Lenders: Don't accept the first offer you receive. Compare terms from at least three to five different lenders, including national banks, local credit unions, and specialized mortgage brokers.

- Explore Creative Options: Look beyond conventional loans. Investigate seller financing for off-market deals or partner with private money lenders who may offer more flexibility than traditional institutions.

- Build Banking Relationships: Establish a connection with local portfolio lenders. They often hold loans in-house, which can mean more lenient qualifying criteria, especially as you acquire more properties. For more details on this topic, explore these second home financing options.

4. Focus on Cash Flow and the 1% Rule

While market appreciation is an exciting prospect, one of the most vital real estate investment tips for beginners is to prioritize immediate returns. This means focusing on properties that generate positive cash flow from day one, ensuring your rental income not only covers but exceeds all your monthly expenses. A popular guideline to quickly assess a property's potential is the 1% rule, which suggests the gross monthly rent should be at least 1% of the property's purchase price.

For example, a property purchased for $200,000 should ideally rent for at least $2,000 per month to meet this benchmark. While this rule is a great starting point for filtering opportunities, especially in high-yield markets, it doesn't replace a detailed expense analysis. True positive cash flow is what's left after paying the mortgage, taxes, insurance, and accounting for maintenance and vacancies.

Why Cash Flow is Non-Negotiable

Relying solely on future appreciation is speculative and risky. Positive cash flow provides a financial cushion, making your investment resilient to market downturns, unexpected repairs, or periods of vacancy. This steady income stream can cover operating costs and even fund future property acquisitions, creating a self-sustaining investment portfolio. It transforms your property from a liability that depends on market growth into a productive asset that pays you every month.

Key Insight: Appreciation is the bonus, but cash flow is the foundation. An investment that pays for itself and generates a surplus is a sustainable business, not a gamble.

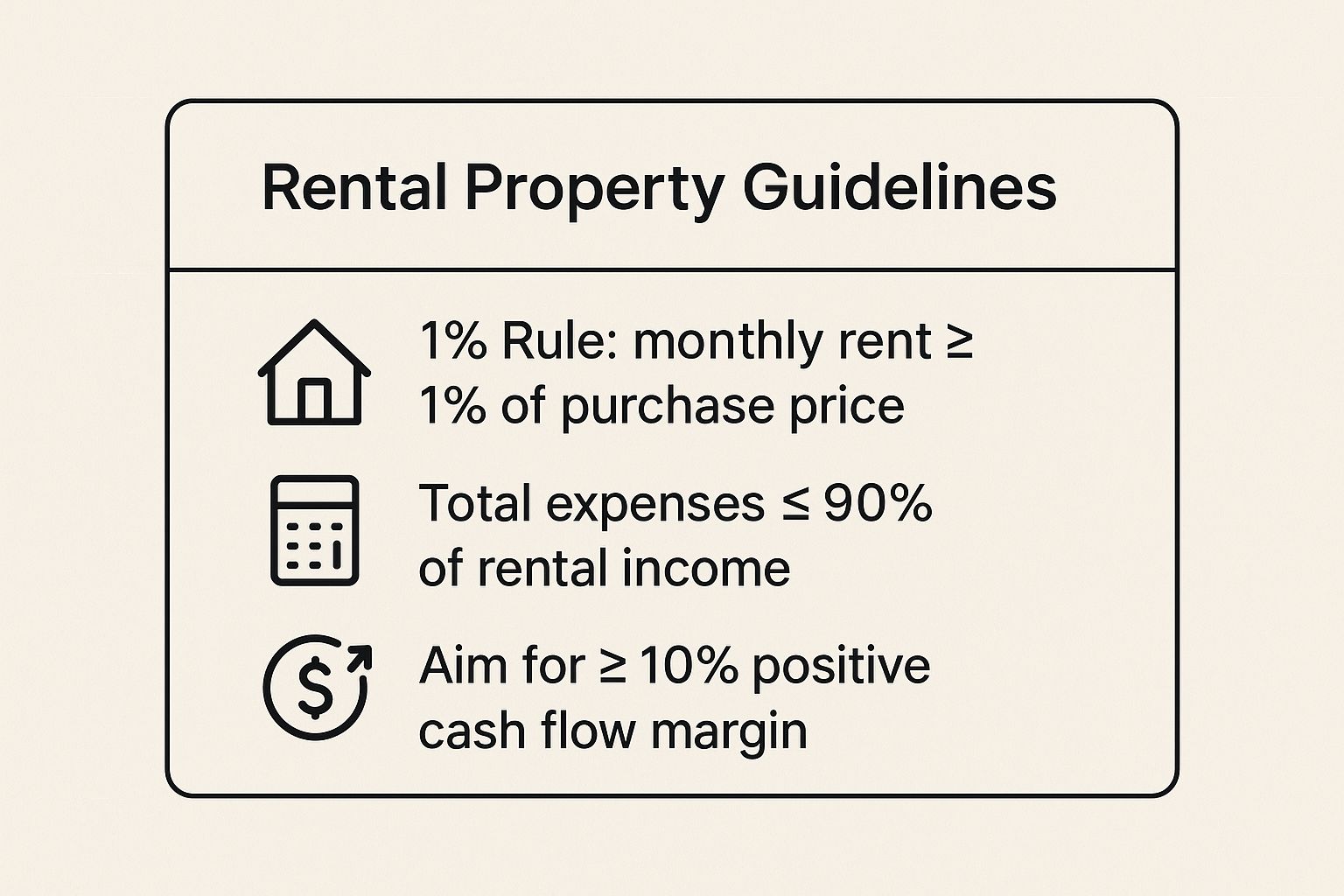

The infographic below summarizes the key financial metrics to keep in mind when evaluating a potential rental property for its cash flow potential.

These benchmarks provide a clear framework for evaluating deals, ensuring you select properties with strong financial fundamentals and a built-in safety margin.

Actionable Steps for Your Analysis

- Calculate All Expenses: Go beyond the mortgage payment. Factor in property taxes, landlord insurance, HOA fees, and budget 5-10% of the rent for maintenance and another 5-8% for potential vacancy.

- Use Conservative Estimates: When projecting rental income, base your figures on current, verifiable rents for comparable properties in the immediate area, not optimistic "what-if" scenarios.

- Account for Management: Even if you plan to self-manage, include a property management fee (typically 8-12% of rent) in your calculations. This keeps your analysis realistic and prepares you for scaling your portfolio.

- Evaluate Rent Growth Potential: Look for properties in areas with strong economic drivers, such as job growth or infrastructure improvements, which are likely to support future rent increases.

5. Build a Strong Real Estate Team

Successful real estate investing is rarely a solo endeavor, especially for beginners navigating complex European markets. A crucial real estate investment tip is to assemble a dedicated team of local professionals who can guide you through every stage of the process. This network is your on-the-ground support system, providing the specialized knowledge needed to find deals, manage assets, and avoid costly pitfalls.

Think of this team as your personal board of directors. A real estate agent specializing in investment properties in Portugal can provide off-market opportunities, while an accountant familiar with Spanish tax law can structure your purchase for maximum efficiency. Similarly, having a reliable contractor in France for renovation estimates and a responsive property manager in Italy is essential for long-term success.

Why a Professional Team is Non-Negotiable

Assembling your team early saves you time, money, and stress. These experts help you vet opportunities, perform due diligence, and operate your investment legally and profitably. An experienced attorney can spot red flags in a purchase agreement, while a good mortgage broker can unlock financing options you might not find on your own. This network transforms you from an isolated buyer into a well-supported investor.

Key Insight: Your investment is only as strong as the team behind it. The right professionals don't just facilitate transactions; they actively contribute to your portfolio's growth and security.

Actionable Steps for Building Your Team

- Interview Multiple Candidates: Don't settle for the first professional you find. Interview at least three real estate agents, property managers, and attorneys to compare their expertise, communication styles, and fee structures.

- Seek Investor-Focused Experts: Look for professionals who specialize in working with real estate investors. They will understand your goals, such as cash flow and appreciation, better than those who primarily serve homeowners.

- Verify Credentials and References: Always ask for references from past clients, particularly other foreign investors. Verify their licenses and check online reviews or local business associations.

- Leverage Your Network: Attend local real estate meetups or join online forums like BiggerPockets to get referrals from other successful investors in your target area. A trusted referral is often the best starting point.

- Delegate Management Wisely: For remote investments, a great property manager is vital. For more guidance, learn how to choose the right property management company to protect your asset and ensure steady returns.

6. Start Small and Scale Gradually

Jumping into real estate investing by acquiring a large portfolio can be overwhelming and financially risky. A far more prudent strategy, especially for newcomers, is to start with a single, manageable property. This approach allows you to learn the ropes of property acquisition, tenant management, and local market dynamics in a controlled environment before committing more significant capital.

This method isn't about limiting your ambition; it's about building a solid foundation for long-term success. For instance, purchasing a duplex in a familiar neighborhood allows you to master the landlord role with just one or two tenants. Similarly, buying a small, turnkey apartment in a stable rental market lets you focus on the financial and operational aspects without the added complexity of a major renovation.

Why Starting Small is a Winning Strategy

This gradual approach minimizes your initial financial exposure and provides invaluable hands-on experience. Mastering one property teaches you critical lessons about everything from screening tenants and handling maintenance requests to understanding local rental laws and tax implications. This first-hand knowledge is far more valuable than any theoretical learning and prepares you to handle a larger portfolio later.

Key Insight: Your first property is your real estate education. Treat it as a learning opportunity to master the process, document your mistakes, and build the confidence and systems needed to expand your portfolio successfully.

Actionable Steps for Your First Investment

- Choose a Familiar Market: Begin by investing in a city or neighborhood you know well. Your local knowledge of schools, amenities, and employment trends gives you an immediate advantage.

- Select a Simple Property Type: Focus on straightforward investments like a single-family home, a condo, or a small multi-family building (2-4 units). These are typically easier to finance and manage.

- Prioritize Turnkey Properties: For your first deal, look for properties that require minimal to no renovation. This allows you to focus on learning property management rather than project management.

- Stabilize Before Scaling: Ensure your first property is cash-flowing positively and operating smoothly for at least six to twelve months before you even begin looking for your next investment.

7. Understand Tax Benefits and Depreciation

One of the most powerful wealth-building aspects of real estate investing is its unique tax advantages. A crucial real estate investment tip for beginners is to look beyond cash flow and appreciation and understand how tax benefits like depreciation can significantly boost your net returns. These mechanisms allow you to legally reduce your taxable income, effectively letting you keep more of your earnings.

Unlike other investments, the government allows you to deduct the cost of a rental property over time through a process called depreciation. For example, a residential investment property valued at $200,000 (excluding land) can be depreciated over 27.5 years, allowing you to deduct approximately $7,273 from your taxable income annually, even if the property is profitable and increasing in value.

Why Understanding Tax Strategy is Non-Negotiable

Failing to leverage these tax benefits is like leaving money on the table. Beyond depreciation, investors can deduct mortgage interest, property taxes, insurance, and maintenance costs. A strategy like the 1031 exchange allows you to sell a property and defer all capital gains taxes by reinvesting the proceeds into a new, similar property. This powerful tool enables your investment to grow tax-free.

Key Insight: Depreciation is a "phantom expense." It reduces your taxable income on paper without you actually spending any cash, directly increasing your after-tax profit from the investment.

Actionable Steps for Tax Optimization

- Hire a Real Estate CPA: Partner with a Certified Public Accountant who specializes in real estate. Their expertise is essential for navigating complex tax codes and maximizing your deductions.

- Maintain Meticulous Records: Use accounting software or a spreadsheet to track every single income and expense item related to your property. This documentation is your proof for deductions.

- Distinguish Repairs from Improvements: Understand the difference. Repairs (like fixing a leaky faucet) are typically deductible in the year they occur, while improvements (like a new roof) must be depreciated over time.

- Plan for 1031 Exchanges: If you plan to sell and reinvest, start the process well in advance. Strict timelines and rules apply, so preparation with your CPA and a qualified intermediary is key.

8. Have Adequate Cash Reserves and Exit Strategies

Successful real estate investing isn't just about acquiring properties; it's about having the financial resilience to hold them through any market cycle. One of the most vital real estate investment tips for beginners is to maintain adequate cash reserves for unforeseen expenses and to have clearly defined exit strategies before you even close the deal. This dual approach protects your capital and ensures you remain in control of your investment, rather than letting circumstances dictate your moves.

This means setting aside dedicated funds to cover everything from a sudden boiler failure in your Berlin apartment to an extended rental vacancy at your Spanish villa. A common guideline is to hold 3-6 months' worth of total property expenses (mortgage, taxes, insurance, utilities) in a liquid account. For a property with total monthly expenses of €1,500, this would mean having €4,500 to €9,000 readily available.

Why Reserves and Exits are Non-Negotiable

Without a financial safety net, a single unexpected repair or a tenant departure can turn a profitable asset into a cash-draining liability. This is especially true for foreign investors who can't simply drive over to fix a leaking pipe. Planning your exits from the start also instills discipline. It forces you to define what success looks like for each property, whether that’s achieving a certain cash flow, refinancing to pull out equity after three years, or selling if it fails to meet performance targets within 12 months.

Key Insight: Your cash reserves buy you time and options, while your exit strategies provide a clear roadmap for realizing your profits or cutting your losses.

Actionable Steps for Your Financial Planning

- Calculate Your Reserve Needs: Base your reserve amount on the property's age and condition. An older building in a historic Italian village will likely require more reserves than a new-build condo in Portugal.

- Establish Your Exit Plans: For each property, outline at least two potential exit strategies. This could be a "hold and rent" plan for long-term cash flow, a "renovate and sell" plan, or a "refinance and hold" strategy to access equity for your next purchase.

- Set Up Backup Funding: Beyond cash, consider establishing a Home Equity Line of Credit (HELOC) or a business line of credit. These can serve as a secondary emergency fund without tying up all your liquid cash.

- Annual Financial Review: Re-evaluate your reserve levels and exit strategies annually. Market conditions, rental income, and your personal financial situation can all change, requiring adjustments to your plan.

8 Essential Real Estate Investment Tips Comparison

| Aspect | Start with Education and Market Research | Set Clear Investment Goals and Strategy | Master Real Estate Financing Options | Focus on Cash Flow and the 1% Rule | Build a Strong Real Estate Team | Start Small and Scale Gradually | Understand Tax Benefits and Depreciation | Have Adequate Cash Reserves and Exit Strategies |

|---|---|---|---|---|---|---|---|---|

| Implementation Complexity | High - requires extensive learning and analysis | Moderate - involves goal setting and planning | High - understanding diverse financing options | Moderate - requires financial calculations and monitoring | Moderate - building and managing professional relationships | Low to Moderate - start simply, scale gradually | High - complex tax rules and record keeping | Moderate - requires financial discipline and planning |

| Resource Requirements | Time-intensive research and market data access | Time for planning and regular reviews | Access to lenders, credit optimization, financial knowledge | Financial data, rent and expense tracking tools | Network connections and professional services costs | Initial capital for one property, local market knowledge | CPA or tax professional, detailed financial records | Cash reserves (3-6 months expenses), monitoring tools |

| Expected Outcomes | Reduced risk, informed decisions | Clear investment focus and measurable goals | Optimized financing, leverage for greater purchasing power | Immediate positive cash flow, predictable income | Access to expertise, deal flow, risk reduction | Manageable risk, learning curve mastery | Significant tax savings and deferrals | Financial security, flexibility, prepared exit plans |

| Ideal Use Cases | Beginners seeking foundation in real estate | Investors needing clear direction and strategy | Investors leveraging debt for acquisitions | Investors prioritizing cash flow and income | Investors scaling portfolios requiring expert support | First-time investors or cautious builders | Investors with taxable income looking to optimize taxes | Investors needing safety net and contingency planning |

| Key Advantages | Builds confidence, prevents costly mistakes | Maintains discipline, improves financing planning | Multiple financing options, improved ROI | Reduces reliance on appreciation, stabilizes income | Saves time, offers professional insights, scales portfolio | Minimizes risk and mistakes, easy to manage | Tax deductions, depreciation benefits, capital gains deferral | Prevents forced sales, handles emergencies, market adaptability |

Taking the Next Step in Your Investment Journey

Embarking on your European real estate investment journey can feel like a monumental undertaking, but it is far from an impossible one. The path from aspiring investor to a confident portfolio owner is paved with strategic action, not just ambition. Throughout this guide, we've unpacked the essential building blocks for success, moving beyond generic advice to provide a concrete framework for your first acquisition.

The journey starts not with a property viewing, but with dedicated education and a clearly defined strategy. It’s about understanding the nuances of financing in different European markets, building a reliable local team you can trust from afar, and always having a clear exit plan before you even make an offer. These foundational steps transform you from a passive observer into an active, informed investor capable of spotting genuine opportunities.

From Theory to Tangible Action

Mastering the concepts we've discussed is what separates successful investors from those who remain on the sidelines. The true value of these real estate investment tips for beginners lies in their application. It's time to transition from reading and learning to doing.

Your immediate next steps should be tangible and focused:

- Define Your "Why": Revisit your investment goals. Are you seeking long-term rental income in a stable market like Sweden, a vacation property with appreciation potential in Portugal, or a "fix-and-flip" opportunity in an emerging French neighborhood? Your "why" dictates your "where" and "what."

- Stress-Test Your Finances: Don't just get pre-approved. Build a detailed budget that includes your down payment, closing costs, and at least six months of cash reserves for every potential property. This financial discipline is your best defense against unexpected challenges.

- Begin Your Search with Intent: Start actively analyzing real-world listings. Apply the 1% rule to properties you find, calculate potential cash flow, and research the specific legal and tax implications in your target country. This practical exercise will sharpen your analytical skills immensely.

Ultimately, building a property portfolio is a marathon, not a sprint. The principles of starting small, focusing on positive cash flow, and scaling gradually are your keys to sustainable, long-term wealth creation. Each small, well-researched step you take builds the momentum needed to achieve your larger financial goals, turning the dream of owning European property into a profitable reality. Your journey forward is about consistent, informed action.

Ready to put these strategies into practice? Start exploring curated property listings across Europe on Residaro. Our platform is designed to help you discover and analyze investment opportunities, connecting you with the properties that match your specific goals. Find your first European investment property today at Residaro.