Your Guide to Second Home Financing Options

Owning a second home often feels more like a dream than a realistic goal, but the right financing strategy can absolutely bring it within reach. For most people, this means choosing between a conventional mortgage for the new property or tapping into the equity of their current home.

Getting clear on how these options work is the first real step toward unlocking the door to your vacation spot or investment property.

Charting Your Financial Path to a Second Home

Let's cut through the financial jargon and lay out a clear roadmap. Think of this as your compass for navigating the world of second-home financing, helping you find the path that truly fits your budget and ambitions. It’s important to know upfront that getting a loan for a second property is a different ballgame than your first mortgage. Lenders see it as a higher risk, which translates to tougher requirements for you.

Before we get into the nitty-gritty, it helps to understand the two main avenues you can take. You can either get a brand-new loan specifically for the second home, or you can use your primary residence as a financial launchpad.

No matter which path you explore, lenders will be looking closely at a few key things:

- Stricter Qualification: You'll generally need a stronger financial profile. Lenders often look for credit scores above 680 and a debt-to-income (DTI) ratio that’s comfortably under 43%.

- Larger Down Payment: Get ready for a bigger down payment. A minimum of 10% is typical, but putting down 20% or more is common. This not only helps you secure a better rate but also lets you avoid private mortgage insurance (PMI).

- Cash Reserves: Lenders need to see that you have a safety net. You'll have to prove you have enough cash in the bank to cover several months of mortgage payments on both homes.

A Quick Comparison of Second Home Financing

To help you see the landscape more clearly, here’s a quick breakdown of the most common financing methods. This table summarizes what you can generally expect from each option.

| Financing Method | Typical Down Payment | Credit Score | Best For |

|---|---|---|---|

| Conventional Second Home Mortgage | 10% - 20%+ | 680+ | Buyers with strong credit and savings who want a straightforward, separate loan for their new property. |

| Cash-Out Refinance | N/A (Uses existing equity) | 620+ | Homeowners with significant equity who want to lock in a fixed interest rate on the cash they pull out. |

| Home Equity Line of Credit (HELOC) | N/A (Uses existing equity) | 680+ | Those who need flexible, as-needed access to cash and are comfortable with a variable interest rate. |

| Home Equity Loan | N/A (Uses existing equity) | 660+ | People who need a lump sum of cash for a specific purpose (like a down payment) and prefer a predictable, fixed-rate payment. |

Each path has its own set of pros and cons, so the "best" choice really depends on your personal financial health and long-term goals.

The good news for buyers is that the market is showing some positive signs. As of spring 2025, the second-home market in the U.S. has started to find its footing after a bit of a rollercoaster ride. With mortgage rates settling in the mid-6% range and a 33% year-over-year increase in housing inventory, buyers have more choices and a bit more room to negotiate.

Navigating second home financing is less about finding a single "best" option and more about identifying the smartest strategy for your unique financial situation. It requires a realistic assessment of your budget, long-term goals, and risk tolerance.

Securing a Conventional Second Home Mortgage

The most familiar path to buying a second home is the one most people know: a conventional mortgage. This is a brand-new loan, separate from your primary residence, taken out specifically for that vacation spot or weekend retreat. But don't mistake familiarity for simplicity—getting a mortgage for a second home is a different ballgame.

From a lender's point of view, a second home loan carries more risk. It’s just common sense. If someone hits a financial rough patch, they’re far more likely to miss a payment on their holiday cottage than on the roof over their family's head. Because of this, lenders will put your finances under a microscope to make sure you can comfortably juggle both mortgages.

Understanding the Stricter Requirements

To account for that extra risk, lenders set a higher bar. Before you fall in love with a property, it’s smart to see how your own financial situation stacks up against these tougher standards.

Here’s a look at what most lenders will want to see:

- A Higher Credit Score: While you might get by with a 680, a credit score of 740 or higher is really the sweet spot. A strong score shows a history of responsible borrowing and will get you the best interest rates.

- A Lower Debt-to-Income (DTI) Ratio: Lenders need to know you aren't overextended. They’ll calculate all your monthly debt payments—including your current mortgage plus the new one—and compare it to your pre-tax income. You'll want this ratio to be below 43%, and some lenders prefer it to be under 36%.

- A Substantial Down Payment: Forget the low-down-payment options from your first home. For a second property, 20% down is pretty much the standard, though some programs may allow as little as 10%. A larger down payment demonstrates your financial commitment and helps you avoid Private Mortgage Insurance (PMI).

- Verified Cash Reserves: After your down payment and closing costs, lenders want to see that you still have a healthy safety net. You'll need to prove you have enough liquid cash to cover several months of payments for both homes, typically anywhere from two to six months' worth.

Getting Your Financial Paperwork in Order

The mortgage application process is all about documentation. The more organized you are upfront, the smoother things will go. Lenders need a complete, verifiable picture of your financial life.

Start gathering these documents early:

- Two years of tax returns

- Recent pay stubs and perhaps a letter from your employer

- Bank and investment statements from the last few months to prove you have the funds for the down payment and reserves

- Details on all your existing debts (primary mortgage, car loans, student loans, credit card balances, etc.)

A key benefit of a conventional mortgage is that it keeps your primary home’s equity completely separate. While you might pay a slightly higher interest rate—often 0.25% to 0.75% more than for a primary residence—it’s a clean, straightforward way to finance the purchase that many buyers find appealing.

Choosing Between Fixed-Rate and Adjustable-Rate Mortgages

Just like with your first home, you have a big decision to make about your interest rate. Your choice here will directly affect your monthly payment and how much you pay over the life of the loan.

A fixed-rate mortgage is the go-to for predictability. Your interest rate is locked in for the entire loan term, so your principal and interest payment will never change. This is a great option if you value budget certainty and plan on keeping the second home for many years.

An adjustable-rate mortgage (ARM), on the other hand, offers a lower "teaser" interest rate for an initial period—usually five or seven years. After that, the rate can change based on the market. An ARM can be a savvy move if you think you'll sell the property before the introductory period ends or if you're confident that interest rates will be lower in the future.

Using Your Home Equity to Fund Your Next Purchase

What if the key to your dream second home isn't in a new loan application, but locked inside the walls of your current one? For many homeowners, the equity they've carefully built over the years is their most powerful financial tool. It's the slice of your home you actually own, and it can be a fantastic way to fund your next property purchase.

Think of your home equity like a savings account that’s grown right alongside your property's value. Instead of starting from scratch, you can tap into this existing wealth. This strategy opens up a few distinct financing options, each with its own structure, benefits, and potential risks.

Let's break down the three main ways you can put your home equity to work.

Home Equity Loans: A Predictable Lump Sum

A home equity loan is probably the most straightforward way to get your hands on that value. It works a lot like a traditional loan: you borrow a fixed amount against your home’s equity and get it all at once in a single, lump-sum payment. This makes it a great choice if you know exactly how much you need for a down payment or an all-cash offer.

The main draw here is predictability. With a home equity loan, you get:

- A fixed interest rate that won't change for the entire term.

- Consistent monthly payments, which makes budgeting a breeze.

- A clear repayment schedule, so you know exactly when you'll be debt-free.

That stability is a huge plus, but remember, you're adding a second lien on your primary residence. This means you'll have two separate housing payments each month—your original mortgage and the new home equity loan.

Home Equity Lines of Credit (HELOCs): Flexible, On-Demand Funds

If a home equity loan is like a one-time withdrawal, a Home Equity Line of Credit (HELOC) is more like a credit card backed by your house. Instead of a lump sum, you’re approved for a specific credit limit. You can then draw funds as you need them, paying interest only on the amount you’ve actually used.

This flexibility is perfect for buyers who might have ongoing expenses, like renovations on their new vacation home. The initial "draw period" typically lasts 5-10 years, and during this time, you can borrow and repay funds as you wish.

The biggest trade-off? Variable interest rates. Your payments can rise and fall as market rates change, which adds a bit of uncertainty to your budget. Once the draw period ends, you enter a repayment phase where you can no longer borrow and must pay back the remaining balance.

A HELOC offers incredible flexibility, but it requires financial discipline. The temptation to use it for other expenses can be strong, and rising interest rates could significantly increase your monthly payments down the line.

Cash-Out Refinancing: A Single, Consolidated Loan

A cash-out refinance is a different play entirely. With this option, you replace your current mortgage with a new, larger one. You use the new loan to pay off the original, and you pocket the difference in cash. This consolidates all your housing debt into a single monthly payment, which many people find much easier to manage.

This can be a really smart move if current interest rates are lower than what you're paying on your original mortgage, as you could potentially lower your overall borrowing costs. The catch? A cash-out refinance resets your mortgage clock. If you were ten years into a 30-year mortgage, you're starting over with a new 30-year term, which could mean paying more in total interest over the long haul.

These equity-based strategies are popular financing options around the world. Homeowners often use HELOCs for their lower initial rates, while a cash-out refinance is a go-to for consolidating debt, even though it increases the total loan amount on the primary residence. Whether you're looking at properties down the road or considering international markets, understanding these options is crucial. For those exploring abroad, our guide on the best countries for property investment can offer some valuable insights.

Thinking Outside the Box: Specialized Ways to Finance Your Second Home

So, what happens when the well-trodden paths of conventional mortgages and equity lines don’t quite fit your financial picture? It’s time to get a little creative.

Plenty of alternative strategies can open doors for buyers who need a different approach to lock down their dream vacation property. Think of these as custom-tailored solutions, not off-the-rack loans. They often involve more direct negotiation and unique arrangements, paving the way for possibilities that a typical bank might dismiss.

Seller Financing: Your Seller as Your Lender

One of the most direct alternatives is seller financing, sometimes called an owner carry-back. In this scenario, the property owner essentially becomes your bank. Instead of getting a loan from a big financial institution, you make monthly payments directly to the seller who financed the purchase for you.

This can be a win-win. For buyers, it can mean a faster close, more wiggle room on the down payment, and a path to ownership even if you don't check every box on a traditional lender's list. For sellers, it opens up their property to a wider pool of buyers and creates a steady income stream. The interest rate, loan term, and down payment are all on the table for negotiation.

Just remember, this isn’t a handshake deal. It’s absolutely crucial to have a real estate attorney draft a formal agreement (a promissory note) to protect everyone involved.

Co-Ownership: Strength in Numbers

Another powerful strategy that’s really catching on is co-ownership. This is exactly what it sounds like: you pool your financial resources with friends, family, or other investors to purchase a property together. By splitting the costs, you might be able to afford a much nicer property or get into a hot market that would otherwise be out of reach.

With flexible work turning "workcations" into a reality, sharing the financial burden makes this lifestyle far more attainable. In fact, one recent survey found that about 15% of buyers now purchase homes jointly with friends or relatives.

Key Takeaway: Co-ownership is more than just splitting a mortgage payment. It's a shared investment that demands a crystal-clear legal agreement. This document should cover everything from usage schedules and expense sharing to an exit strategy for when an owner eventually wants to sell their share.

A Word on Government-Backed Loans

It’s a common question: can you use a government-backed loan, like an FHA or VA loan, for a second home? The short answer is almost always no, but there are a few very specific exceptions. These loans are designed to help people buy their primary residence, and the occupancy rules are strict.

You can't use an FHA or VA loan for a pure vacation home or an investment property. However, there are a few rare situations where it could work:

- Job Relocation: Your employer is moving you to a new area too far to commute from your current home.

- Growing Family: You can document that your current home is now too small for your family.

- Leaving a Joint Property: You are vacating a jointly owned primary home, often due to a divorce.

Even in these cases, you’ll have to prove the new property is becoming your main home. These specialized options show that with a bit of flexibility, the path to a second home can be more accessible than you think. This is especially true when looking abroad; our guide on how to buy property in Costa Brava has great insights for navigating international purchases.

Financing a Vacation Getaway vs. an Investment Property

The very first thing a lender will ask when you're buying a second property is, "What's it for?" Your answer completely changes the conversation.

To a bank, a quiet lakeside cabin for your family's weekend escapes is a world away from a city condo you plan to rent out. This isn't just a casual question; it's the fork in the road that determines your loan terms, how much you need to put down, and even the interest rate you'll pay.

Lenders put properties into three simple buckets: your primary residence, a second (or vacation) home, and an investment property. A second home is your personal playground. Sure, you might rent it out for a couple of weeks a year to cover some costs, but its main job is to be there for you. An investment property, on the other hand, is all about the bottom line—it's purchased to generate income.

Why the distinction? It all comes down to risk. Lenders know that if times get tough, you’re far more likely to miss a payment on a property that isn't your primary shelter. That makes investment properties a higher risk, and higher risk always comes with stricter rules.

Qualifying for a Vacation Home Loan

When you're buying a personal vacation home, the lender has one main concern: can you afford it on your own? They need to see that you can comfortably handle the mortgage on your primary home and this new one, without relying on any potential rental income.

To get the green light, you'll generally need to clear these hurdles:

- A Strong Credit Score: Lenders are typically looking for a score of 680 or higher.

- A Lower Down Payment: You can often get away with as little as 10% down, but putting down 20% is the magic number to avoid private mortgage insurance (PMI) and lock in a better rate.

- Proof of Funds: You’ll need enough cash in the bank to cover several months of payments for both homes.

Proving the home is genuinely for your personal use is key. Lenders often look for it to be a reasonable distance from your main home—a common rule of thumb is at least 50 miles—and that it’s suitable for year-round living.

Securing a Loan for an Investment Property

Financing an investment property feels much more like a business deal. The lender will still look closely at your personal finances, but they're also laser-focused on the property's ability to make money. As you'd expect, the requirements get tougher.

Expect to see higher interest rates—often 0.50% to 1.00% more than a vacation home loan. You'll also need a bigger down payment, usually a minimum of 20% to 25%. Lenders want you to have more skin in the game.

But there's a huge upside here. You can often use the property’s future rental income to help you qualify. Lenders will typically let you add about 75% of the projected gross rent to your own income, which can make a big difference in your debt-to-income (DTI) ratio. To make this happen, you'll need to provide solid proof, like:

- A signed lease if you've already lined up a tenant.

- A professional rental analysis from an appraiser.

- Proof of what similar, nearby properties are renting for.

It's absolutely critical to be upfront with your lender about your plans from day one. Whether you’re picturing a serene family retreat or a profitable rental, your financing path begins with this simple distinction. And if your dream getaway is overseas, getting a handle on the local market is just as crucial, as we explore in our guide to buying properties in Sicily.

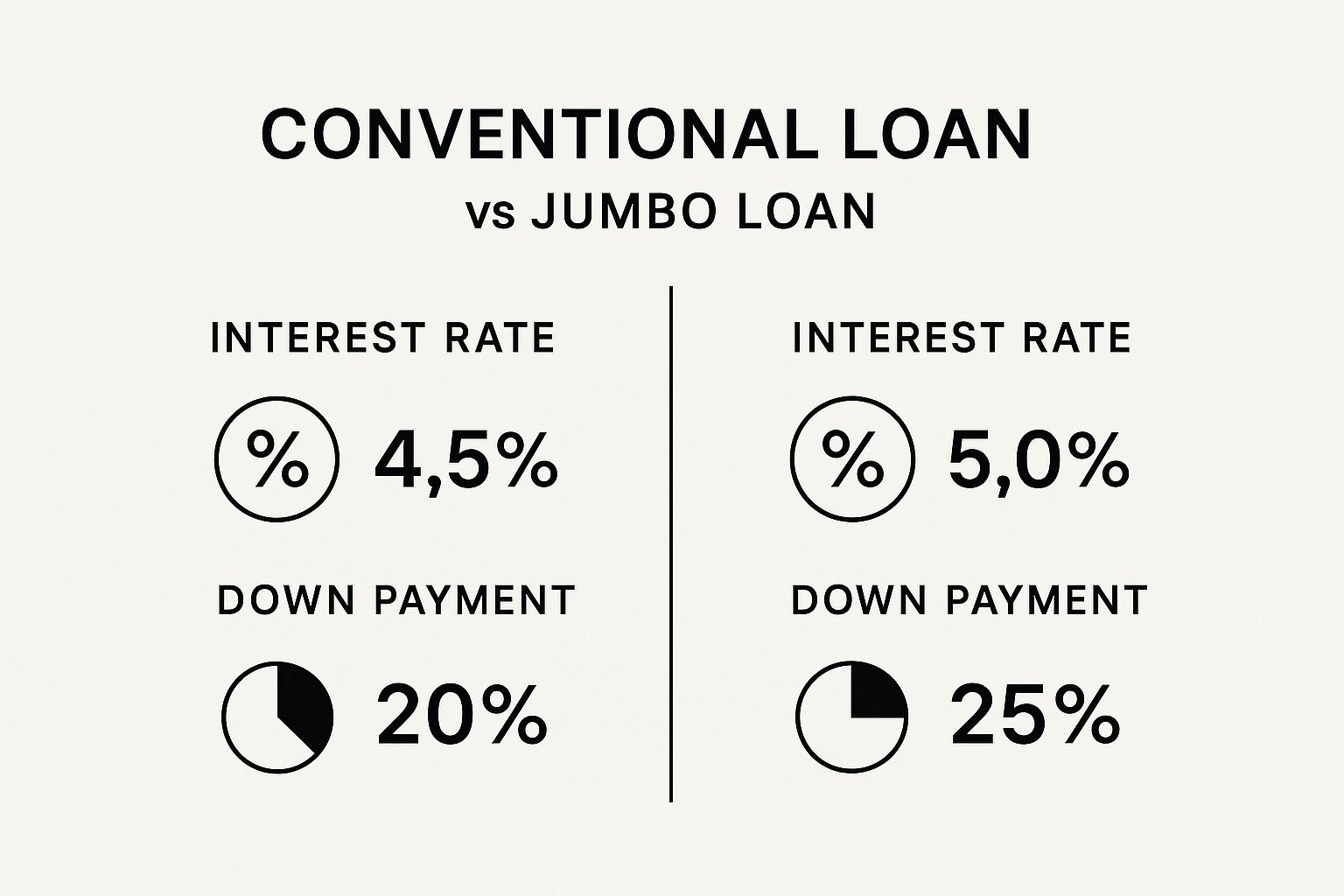

Navigating Jumbo Loans and All-Cash Offers

Once your second home search crosses into luxury territory, the financing game changes entirely. The standard mortgage products just won't cut it for high-value properties. Here, you'll run into two major players: jumbo loans and the undeniable power of an all-cash offer. These aren't your everyday financing tools; they operate on a different financial tier where the rules are tougher and the stakes are much higher.

A jumbo loan is exactly what it sounds like—a mortgage that’s too big to fit within the standard limits set by federal regulators. Because these loans are too large to be sold to government-backed entities like Fannie Mae or Freddie Mac, the lender is on the hook for the entire amount. This means they assume all the risk, which, as you can imagine, leads to some very strict qualification standards.

The Higher Bar for Jumbo Loans

Getting approved for a jumbo loan isn't a walk in the park. Lenders are putting a significant amount of their own money on the line, so they’re going to scrutinize every detail of your financial life.

Here’s what you should be prepared for:

- Larger Down Payments: Forget the low down payments you see advertised elsewhere. For a jumbo loan, a 20% to 25% down payment is usually the starting point.

- Excellent Credit: Your credit score needs to be rock-solid. Lenders will be looking for a score well above 700, and the best rates often go to those with scores closer to 740.

- Multiple Appraisals: To be absolutely certain about the property's value, some lenders will even require two separate appraisals before they sign off.

- Substantial Cash Reserves: You'll need to show you have plenty of liquid assets left over after closing. We’re talking about enough cash to cover a full year of mortgage payments in some cases.

The Power and Pitfalls of All-Cash Offers

In a hot luxury market, nothing speaks louder than cash. An all-cash offer instantly tells a seller you are a serious, well-capitalized buyer, giving you immense negotiating power. Sellers often prefer cash deals because they close faster and completely remove the risk of the buyer's financing falling through.

But going all-cash isn't a simple decision. It forces a tough conversation about opportunity cost. Is tying up hundreds of thousands, or even millions, in a single property the smartest move? That same capital could be working for you in the stock market, bonds, or other investments. It’s a classic balancing act between securing the home you want and maximizing your long-term financial growth.

The luxury second-home market often moves to its own rhythm, less influenced by typical interest rate fluctuations. This resilience is a key factor for buyers in this segment to consider.

Even when the broader economy faces headwinds, the high-end market has proven remarkably tough. In the first half of 2024, sales of U.S. homes over $1 million actually grew by 5.2%. Even more telling, nearly half of all luxury home sales in the first quarter were all-cash deals. This trend really underscores how many affluent buyers are choosing to bypass the lending process altogether. You can dig deeper into these luxury market trends to watch in 2025 to get a better sense of the landscape.

Got Questions About Financing a Second Home? We've Got Answers

Stepping into the world of second-home financing can feel a little like learning a new language. You'll likely have a lot of questions as you get closer to turning that dream into a reality. Let's clear up a few of the most common ones that pop up for buyers.

Can I Use Potential Rental Income to Help Me Qualify?

You can, but there are a few hoops to jump through. Lenders are understandably cautious when it comes to income you haven't earned yet, so they won't simply take your word for it.

Typically, a lender will let you count about 75% of the projected gross rental income and add it to your own when they run the numbers for your debt-to-income ratio. They’ll want to see some solid proof, though. You'll need to provide something like a signed lease agreement, a professional rental analysis from an appraiser, or at least some strong data on what comparable properties in the area are renting for. It’s a great way to boost your application, but be prepared to show you can afford the property even without that extra cash flow.

Is the Down Payment Bigger for a Second Home?

Yes, it almost always is. If you bought your primary home with a low down payment, get ready for a different conversation this time around. Lenders see a second home as a higher risk—if financial trouble hits, it's the property people are more likely to walk away from.

For a conventional second home mortgage, you're looking at a 10% down payment at the bare minimum. The real sweet spot, however, is 20%. Hitting that number usually gets you a better interest rate and lets you skip paying Private Mortgage Insurance (PMI). If you're buying the property purely as an investment, expect that minimum to climb to 20-25%.

Does It Matter How Far the Second Home Is From My Main House?

It's a detail that catches many people by surprise, but yes, it absolutely matters. For a property to be officially classified as a "second home" (which comes with better loan terms) and not an "investment property," lenders need to believe you'll actually use it for personal enjoyment.

There isn't a hard-and-fast rule written in stone, but a common benchmark is that the property should be at least 50 miles away from your primary residence. This helps the lender feel confident you’re buying a vacation spot, not just a rental down the street. It's always best to be upfront with your lender about the location and how you plan to use the home—their internal policies might differ, and honesty is key to a smooth process.

Ready to find your perfect European retreat? From sun-drenched villas in Spain to charming chateaux in France, Residaro makes discovering your dream second home simple and secure. Explore thousands of listings and connect with local agents today at residaro.com.