Master Property Taxes In Spain For Buyers And Investors

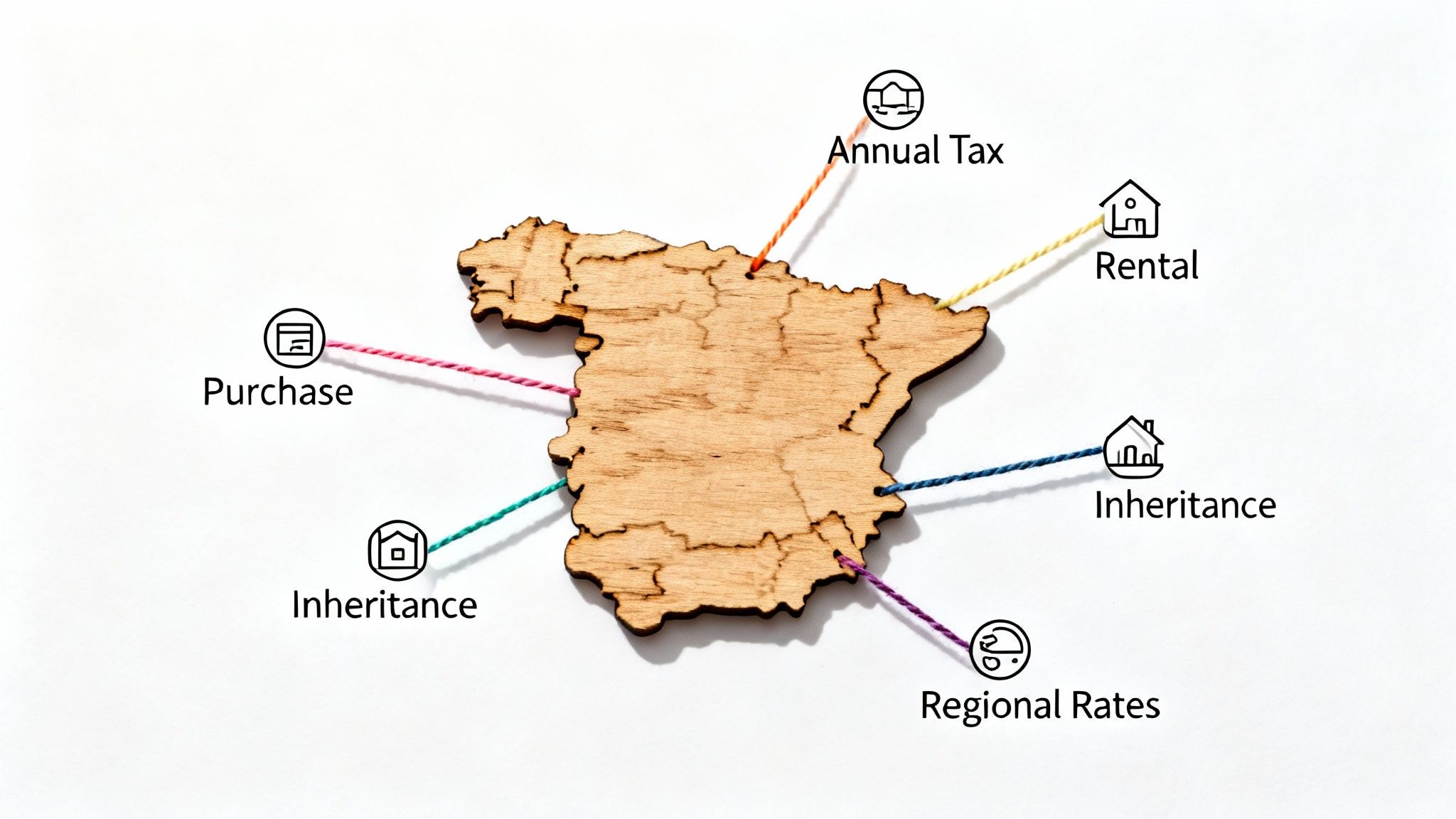

Spain’s property taxes form a regional mosaic, covering charges at purchase, yearly ownership, rental income and inheritances.

Each layer adds its own color to the overall picture, so understanding them in order makes planning a lot easier.

Understanding Key Property Tax Concepts

Picture Spain’s tax system as a tapestry: every thread is a different levy, woven into a larger fiscal framework.

By 2023, Spain’s tax-to-GDP ratio climbed from about 33.0% in 2000 to 37.3%, placing it above the OECD average.

- Purchase Levies: ITP, VAT and stamp duty act like variable toll fees, changing by autonomous community.

- Annual Taxes: IBI and plusvalía municipal depend on cadastral values and local rates.

- Rental Income Tax: Rules split between residents and non-residents, with different deductions and withholding rates.

- Wealth & Inheritance: Regional thresholds, reliefs and planning tools can trim the bill for cross-border owners.

Each category has its own rules, so let’s break them down step by step.

Why Regional Differences Matter

Imagine comparing Madrid with Valencia: on a €400,000 purchase you might pay €24,000 in one region or as much as €40,000 in another.

You might be interested in our detailed guide on foreign real estate tax obligations to explore non-resident nuances.

“Understanding ITP versus VAT is as crucial as picking the right toll gate on a roadway—each checkpoint has its own fee.”

Ongoing reforms aim to smooth out regional gaps and introduce reliefs for non-EU buyers.

Watching these policy tweaks helps you plan ahead, leverage targeted reliefs and stay competitive in a shifting market.

Next, we’ll dive into Initial Purchase Taxes to decode what first-time buyers need to know.

Initial Purchase Taxes

Diving into Spain’s real estate market brings a handful of upfront levies that can quickly reshape your budget. First up, you’ll face transfer duties on resale homes and VAT (IVA) plus stamp duty on brand-new builds.

On top of those main charges, don’t forget notary fees, land registry costs and legal adviser expenses. For non-resident buyers in particular, every euro counts.

ITP On Resale Properties

The Impuesto sobre Transmisiones Patrimoniales (ITP) is the regional transfer tax you pay when buying a previously owned property. Think of it like tolls on different highways—each autonomous community sets its own rate.

Rates range from 6% to 11% of the purchase price. For instance, on a €400,000 home, Madrid’s 6% ITP comes to €24,000, whereas Catalonia’s 10% rate jumps to €40,000. Discover more insights about transfer tax variation on lawants.com

Key steps to handle ITP:

- Obtain the authenticated deed and verify the cadastral reference.

- Calculate your regional ITP rate and total tax liability.

- Submit Form 600 and pay the tax within 30 days of signing.

- Keep proof of payment to register the title at the land registry.

Comparison Of Regional ITP Rates

To see how this plays out in numbers, here’s a snapshot of common rates across Spain:

| Region | ITP Rate | Tax on €400,000 |

|---|---|---|

| Madrid | 6% | €24,000 |

| Catalonia | 10% | €40,000 |

| Andalusia | 7% | €28,000 |

| Valencia | 8% | €32,000 |

Even a 2% swing can translate to €8,000 on a mid-range property.

VAT And Stamp Duty On New Builds

If you’re buying off-plan or a newly built home, VAT (IVA) hits at 10% for residential units and 21% for land or commercial spaces. Then there’s Actos Jurídicos Documentados (AJD), the stamp duty that typically ranges from 0.5% to 1.5%, depending on region.

“VAT and stamp duty can add thousands to your upfront costs so factor them in early.”

Related Costs To Consider

Beyond taxes, these additional fees can’t be ignored:

- Notary and signing charges: €500–€1,000 per transaction

- Registry fees: €200–€600

- Legal adviser costs: usually 1% of the sale price

Read also our deep dive on property transfer tax in Spain for a detailed walkthrough.

Regional Incentives And Discounts

Some communities offer reduced ITP rates for first-time or young buyers, cutting your bill by 1% to 2%. Energy-efficient homes, green certifications and historic restorations may unlock extra relief. Always confirm deadlines and criteria with local tax authorities before counting on any discount.

The map above highlights how regions like Madrid tend toward lower rates while Catalonia sits at the higher end of the scale.

Tips For Smooth Purchase

- Secure your NIE and open a local bank account as early as possible.

- Consult a regional tax adviser to navigate local quirks.

- Build a 5%–7% buffer beyond the purchase price for all upfront costs.

- Schedule payments in advance to avoid any late-payment penalties.

Case Study Purchase Scenario

Imagine Maria, a German investor eyeing a €350,000 resale in Valencia. She calculates 8% ITP (that’s €28,000), adds €3,500 for notary and registry, and budgets €35,000 for VAT-related expenses. Comparing this to a similar €360,000 property in Madrid shows her a €4,000 saving on ITP alone. This side-by-side proves why digging into the numbers matters.

Next Steps

After closing, file all payment receipts with your tax adviser and store copies safely. Then book your AJD payment and land registry appointment within the legal deadlines. With this roadmap, you’ll sidestep surprise bills and enjoy your new Spanish home.

Key Takeaway: Early planning and regional fluency in taxes boost confidence and keep your budget on track.

Ongoing Recurring Taxes

Owning a property in Spain means planning for steady annual expenses. At the heart of these is the Impuesto sobre Bienes Inmuebles (IBI). This local tax is calculated using the cadastral value set by your town hall.

In practice, municipalities review cadastral values every few years and then apply an IBI rate—usually between 0.3% and 1.1%. On a €200,000 valuation, you could pay anywhere from €600 to €2,200. Discover more insights about IBI rates on globalpropertyguide.com

Understanding IBI

Think of cadastral value as an official “list price” that doesn’t always match the market rate. Once that baseline is fixed, the council picks a percentage rate to calculate your annual bill.

Below is a simple breakdown showing how a €200,000 cadastral valuation can translate into different IBI bills:

Sample Annual IBI Charges

Below is a breakdown of annual IBI charges based on a €200,000 cadastral valuation across several municipalities. This gives you a quick comparison of how rates vary by location.

| Municipality | IBI Rate | Annual Tax |

|---|---|---|

| Madrid | 0.6% | €1,200 |

| Valencia | 0.8% | €1,600 |

| Seville | 1.0% | €2,000 |

| Canary Islands | 0.4% | €800 |

As you can see, local councils set these rates, so your annual bill can swing considerably depending on where you buy.

The screenshot above shows how cadastral values appear on municipal portals. It highlights variations in property classification and possible adjustments that directly influence your tax bill.

Managing Rate Adjustments

Municipalities usually revisit cadastral values every ten years or after significant renovations. If you add an extension or if zoning rules change, your baseline can jump by up to 20%.

It’s a bit like a book getting reissued with extra chapters—suddenly, the “sticker price” goes up. To stay ahead, request a cadastral certificate (Nota Simple) before you finalize budgets.

- Major renovations trigger a reassessment date and raise your taxable base.

- Zoning changes can bump your property into a higher category.

- Mid-cycle market revisions sometimes occur when councils spot outdated valuations.

Other Local Levies

Beyond IBI, you’ll also see charges for services like waste collection—typically €100 to €300 per year. Some towns add an improvement contribution for projects such as road repairs.

Plus, don’t forget Plusvalía Municipal, the resale levy based on land value appreciation.

- Waste Collection Fee: Covers routine garbage and recycling pickups

- Improvement Contributions: Funds local upgrades like pavement works

- Plusvalía Municipal: Applied when you sell, reflecting land appreciation

“Plusvalía can be a surprise cost if you hold property long enough to see significant value uplifts.”

Exemptions may apply for large families, heritage properties or energy-efficient retrofits. Always check your local town hall for eligibility rules and application deadlines.

Budgeting Tips

Start by reviewing last year’s IBI receipt—it’s the fastest way to spot any rate changes. Then, speak with neighbors to learn about their payment timelines and informal tips.

Consider these steps:

- Review your last IBI receipt for rate tweaks

- Ask neighbors about local payment deadlines

- Include fee-passing clauses in your rental contracts

Group all recurring charges into a single annual review to avoid surprises. Early planning lets you build these costs into rental pricing or your personal budget.

Many councils split IBI payments into two installments—often in May and October—giving you extra breathing room. For example, Barcelona offers this split so you won’t face a large lump sum.

- Check deadlines on your town hall’s website

- Set up a direct debit to avoid late fees

- Monitor cadastral updates through your property portal

Consistent planning around these recurring charges keeps your property finances healthy and predictable.

Use these insights to refine your annual budget and discuss strategies with a trusted financial adviser.

Taxes On Rental Income And Non Resident Ownership

Owning and renting property in Spain can feel like juggling passports and paperwork. On one hand, you handle the Impuesto sobre la Renta de No Residentes (IRNR) if you live abroad; on the other, residents report through the regular income tax return (IRPF).

Here’s the lowdown on withholding rates and deductions:

- Withholding Rates: EU owners pay 19%; non-EU owners face 24%.

- Imputed vs Actual Income: Some non-residents may be taxed on rental receipts or on a notional 1.1% value.

- Deductible Expenses: Mortgage interest, maintenance bills, and community fees all lower the taxable base.

Consider a German owner renting a flat in Madrid. She deducts mortgage interest and repair costs, then claims a credit back home thanks to double-tax treaties.

How To Calculate Non Resident Withholding

There are two simple paths:

- Register in Spain’s non-resident census using Modelo 149.

- Secure your NIE and open a Spanish bank account.

- File Form 210 either quarterly or yearly depending on your rental portfolio.

- Settle the withholding tax within 20 days of each quarter’s end.

Non-EU owners see a flat 24% on gross rents. EU owners under 19% can deduct eligible costs before tax.

Resident Rental Income Deductions

If you live in Spain, your rental returns go on the IRPF. You unlock a broader range of deductions:

- Insurance premiums and local property taxes

- Advertising and professional management fees

- A 60% abatement on net income from long-term rentals

For example, Maria enters €2,000 in maintenance costs and then applies the 60% reduction, cutting her taxable base almost in half.

“Tracking every expense down to the café receipt can significantly boost your net yield,” notes a Madrid-based tax consultant.

Compliance And Census Registration

Non-resident landlords must join the Censo de Españoles Residentes en el Extranjero. This triggers your IRNR filing duties and ensures Spain’s tax office knows where to find you.

Miss a filing or payment and you could face fines up to €600.

The AEAT portal offers clear walkthroughs in both English and Spanish.

Top tips for staying on track:

- Set calendar reminders for all deadlines

- Work with a local gestor to handle filings and translations

- Keep a dedicated folder—digital or physical—for invoices and bank statements

| Owner Type | Tax Rate | Deductible Base |

|---|---|---|

| EU Resident | 19% | Net Income Minus Expenses |

| Non-EU Resident | 24% | Gross Income Or Imputed 1.1% |

Clear rules and careful planning turn Spain’s rental taxes from a headache into a predictable line item in your cash flow model. Next, we’ll explore how inheritance and wealth taxes fit into the equation.

Wealth And Inheritance Tax Considerations

Owning property in Spain is about more than just mortgage payments and rental returns. You also face net wealth tax (IWT) and inheritance duties that influence how you plan for the long term. To stay ahead, you need to know exactly where thresholds sit and which reliefs apply.

Most regions only tax net wealth once your declared assets exceed €700,000. That figure covers the market value of all your Spanish holdings. Yet, thanks to Spain’s autonomous communities, those rules can look very different from one province to the next.

Regional Relief Schemes Vary Widely

- Madrid, Andalusia and Extremadura grant 100% relief on net wealth tax.

- Galicia allows a 50% exemption, reducing your taxable base by half.

- Catalonia and Valencia stick to national rules, though Catalonia offers breaks for family-owned businesses.

These variations can make or break your investment strategy, so mapping your assets to the right region is critical.

Net Wealth Tax Calculation

Think of net wealth tax as a simple equation: value minus debts, then apply regional rates. Here’s how it works in practice.

“When you subtract mortgages or loans from the property’s market value, you uncover your true taxable wealth,” says a Madrid tax advisor.

Key Steps:

- Gather cadastral or market valuations for each property.

- Subtract outstanding debts—mortgages, loans, and other encumbrances.

- Apply any local deductions, such as the €300,000 primary residence discount in Madrid.

- Calculate using tiered rates from 0.2% up to 2.5%, depending on your total.

- File Form 714 before the 30th of June each year.

Inheritance Tax Rates And Allowances

Inheritance tax in Spain looks complex at first glance, but it boils down to who inherits and where the property sits. Central law sets base allowances, while each region can tweak them.

| Relation | National Allowance | Typical Rate Bands |

|---|---|---|

| Spouse | €15,000 | 7.65% to 34% |

| Child (Adult) | €15,000 | 7.65% to 34% |

| Sibling | €7,993 | 7.65% to 34% |

| Others | €7,993 | Up to 81.6% in some areas |

In practice:

- Catalonia raises the child allowance to €100,000.

- Asturias can push rates on distant relatives to 87.6%.

This patchwork of rules makes local advice indispensable.

Tip – Before you commit assets, always check your regional tax office’s latest guidance.

Wealth Planning Strategies

Rather than waiting for a large tax bill, many investors spread gifts over time. Imagine passing on a prized painting in slices instead of all at once—your tax bite remains manageable.

Consider these hands-on approaches:

- Gift smaller property shares over several years to stay under allowance limits.

- Add adult children as co-owners to divide the taxable base.

- Use a usufruct arrangement to protect your primary home while granting usage rights.

- Carry life insurance policies that cover future tax liabilities.

These tactics help you smooth out peaks in taxation and keep your family’s legacy intact. Don’t forget: update titles and legal documents each time you transfer an interest.

Next Steps

Once you’ve sketched out your wealth and inheritance framework, the next move is to team up with a regional tax specialist. Then, align all deeds, wills and trusts so everyone’s on the same page.

Regional Compliance Tips

Different autonomous communities have their own portals, deadlines and filing quirks. Some let you submit everything online via the Hacienda portal, while others still insist on in-person visits.

To stay organized:

- Verify thresholds directly with the Agencia Tributaria.

- Set reminders at least 30 days before each filing deadline.

- Keep both digital and paper copies of valuations, debt statements and gift deeds.

- Engage a local gestor or tax lawyer—especially if your properties span several regions.

By staying proactive and organized, you’ll navigate Spain’s wealth and inheritance taxes smoothly—and protect what matters most.

Calculation Examples And Timelines

Running through real figures and clear schedules helps you master Spain’s property taxes without guesswork. Below, each scenario builds from the basics to the details you’ll face at signing and beyond.

Purchase Tax Example

Say you buy a resale home in Madrid for €400,000. At a 6% ITP rate, you owe €24,000 within 30 days of signing the contrato. This up-front charge often surprises first-time buyers, so plan your financing accordingly.

- Register the deed and request the cadastral reference.

- Complete Form 600 on the Agencia Tributaria portal.

- Pay by bank transfer and save your receipt.

Tip: Late payment carries a 5% penalty interest.

Purchase Timeline Overview

Breaking tasks into clear dates keeps you on track. Most buyers handle four key steps in under two months.

| Task | Deadline | Note |

|---|---|---|

| Sign Sales Contract | Day 0 | Starts the 30-day ITP window |

| Submit Form 600 | Day 5 | Online via Agencia Tributaria |

| Payment Confirmation | Day 30 | Keep your bank receipt |

| Title Registration | Day 45 | Register after tax is paid |

Mapping these milestones in your calendar helps avoid fines and paperwork headaches.

Annual IBI Calculation

Imagine a Valencia property with a €200,000 cadastral value. At 0.8%, your annual IBI bill is €1,600.

| Municipality | IBI Rate | Annual IBI | Due Month |

|---|---|---|---|

| Valencia | 0.8% | €1,600 | May |

| Madrid | 0.6% | €1,200 | October |

| Seville | 1.0% | €2,000 | April |

Councils send notices in April, with payment due in May or October. A 3% late fee kicks in after the deadline.

Splitting IBI into two installments can ease your cash flow.

Councils review cadastral values every few years, so expect occasional rate tweaks.

Rate Review Scenario

Major renovations can bump your cadastral value by 15%, hiking IBI to about €1,840. Local authorities must reassess within three months of work completion.

- You receive a revised valuation notice from the town hall.

- The new rate applies at the next scheduled due date.

Planning upgrades? Request a provisional certificate first to forecast tax changes.

Rental Income Timeline

Non-resident landlords file Form 210 on gross rents. EU citizens pay 19%, non-EU pay 24%, with deadlines staggered throughout the year.

- January 20 – Annual filing for previous year

- April 20 – Q1 payment

- July 20 – Q2 payment

- October 20 – Q3 payment

Quarterly payments keep your tax profile clean. Missing one risks fines up to €600 per form.

Consistency here saves you both time and penalties.

Deduction Example

Maria earns €12,000 from renting her Madrid flat. She deducts €2,400 in maintenance and €1,200 in mortgage interest.

- Total deductions: €3,600

- Taxable base: €8,400

- Final tax at 19%: €1,596 (vs. €2,016 without deductions)

Documenting every expense—even a café coffee receipt—can significantly improve your net yield.

“Tracking each cost is as important as collecting rent,” says a Madrid-based consultant.

Inheritance Duty Flow

When you inherit real estate, regional rules and allowances determine your bill. In Madrid, a €300,000 allowance on a primary residence can slash your taxable base.

- Confirm your relation to the decedent and eligible allowances.

- Obtain a market valuation and any outstanding debt statements.

- File Form 650 within six months of the date of death.

Pro Tip: Spreading gifts over time helps limit sudden inheritance-duty spikes.

Regional Variance Note

Autonomous communities set wildly different rates and reliefs, so local guidance is essential.

- Asturias can tax distant heirs up to 87.6%.

- Galicia offers a 50% exemption.

- Catalonia raises child allowances to €100,000.

- Andalusia grants 100% net wealth relief.

- Balearic Islands bumped thresholds in 2025.

These contrasts make a regional tax adviser indispensable.

Actionable Worksheet

Here’s a quick checklist to keep you organised:

- Purchase ITP/VAT due within 30 days

- IBI payments in May and/or October

- Form 210 filings and quarterly deadlines

- Form 650 inheritance return due six months after death

Maintain this worksheet digitally or on paper, and share it with your gestor to stay ahead of each deadline.

Learn more about handling capital gains with non-resident property in our guide to capital gains taxation for foreign owners.

Next Steps

Plug all these dates into your calendar with reminder alerts. Then forward the checklist to your tax adviser or gestor.

By following these examples and timelines, you’ll handle Spanish property taxes confidently—avoiding last-minute stress and penalties.

Frequently Asked Questions

When you buy a resale property in Spain, you’ll pay the Impuesto de Transmisiones Patrimoniales (ITP). That rate changes by region.

If you choose a new build, you face 10% VAT plus stamp duty. For instance, on a €300,000 resale in Andalusia you’d incur 7% ITP (€21,000), whereas a new home at the same price carries €30,000 in VAT.

For a detailed regional breakdown, see the Initial Purchase Taxes section.

Key Rates at a Glance

- ITP Range: 6%–11% on resale

- VAT Rate: 10% on residential

- AJD Stamp Duty: 0.5%–1.5%

How To Calculate IBI For Urban Versus Rural Land

Local councils base IBI on the cadastral value multiplied by their rate.

- Urban rates typically fall between 0.3% and 1.1%

- Rural rates can be as low as 0.2%

For a cadastral value of €150,000:

- Urban at 0.6% → €900

- Rural at 0.4% → €600

Councils review these values every ten years or after major renovations.

Can Non-EU Owners Deduct Property Expenses

Non-EU owners file Form 210 to offset rental or imputed income. You can deduct:

- Mortgage interest

- Repairs and maintenance

- Community fees

After deductions, the taxable base is taxed at 24%.

“Document every invoice to defend your deductions during a review,” advises a Madrid tax advisor.

What Are The Deadlines For Declaring Rental Income

Non-residents use Form 210 on a quarterly or annual schedule:

- Q1 by April 20

- Q2 by July 20

- Q3 by October 20

- Annual by January 20

Tax rates: 19% for EU residents, 24% for non-EU, applied to net or gross income as appropriate. For step-by-step guidance, see the Rental Income section.

How Does Net Wealth And Inheritance Duty Work

Wealth tax applies once your assets exceed €700,000. Rates range from 0.2% to 2.5%, with notable reliefs in Madrid and Andalusia. Inheritance allowances vary by family relationship and region. Check the Wealth And Inheritance section for full details.

For curated property listings across Spain and expert tax insights, discover Residaro – plan your investment journey today with confidence.