Buying a Home in France: Your Complete Guide to Success

So, you're dreaming of buying a home in France. It’s an exciting prospect, but turning that dream into a set of keys in your hand means getting to grips with a property market and legal system that's likely very different from what you're used to. The process has a clear rhythm, from sorting out your finances to finding the right place and, eventually, signing the all-important compromis de vente.

This guide is your roadmap, designed to walk you through every step of the journey.

Your French Dream Home Is Within Reach

The idea of owning a little piece of France—maybe a rustic farmhouse in Provence or a chic apartment in Lyon—is incredibly romantic. But to make it happen, you need more than just romance; you need a practical plan. This isn't just about falling in love with a beautiful house. It’s about successfully navigating a market with its own distinct rules, timelines, and cast of characters.

Getting a Feel for the Current Market

The French property market has its own pulse. After a couple of sluggish years in 2023 and 2024, where sales volumes dropped and prices stayed flat, things are starting to find a new equilibrium. This shift is actually creating some interesting opportunities for buyers who are ready to act.

For example, by early 2025, the national average property price had settled at around €3,060 per square meter, which was only a tiny 0.1% dip from the year before. Of course, Paris is in a league of its own, with prices hovering around €9,355 per square meter, but even that figure represents a slight cooling from its peak. If you're curious about the nitty-gritty, you can find a more detailed analysis of the French property market outlook for deeper insights.

What does this mean for you? The frantic, high-pressure seller's market has calmed down. This doesn't mean French property has lost its appeal—far from it. It just means you have a bit more breathing room to make a smart choice without the crazy bidding wars of the past few years.

Key Takeaway: A market that's stabilizing is often a buyer's best friend. It gives you the space to think, negotiate, and focus on finding a home that's a great long-term investment, not just a panicked purchase.

The Key Milestones on Your Buying Journey

Buying a property in France follows a well-trodden path. While no two purchases are identical, the main stages are always the same. Getting familiar with them ahead of time takes the mystery out of the process and gives you the confidence to know what to do, and when.

To give you a bird's-eye view, here's a quick breakdown of what to expect.

The French Property Purchase Journey at a Glance

This table maps out the essential phases of buying a home in France. Think of it as your cheat sheet for understanding who does what, and when.

| Phase | Key Activity | Estimated Timeline | Primary Professional Involved |

|---|---|---|---|

| Preparation | Securing a mortgage agreement in principle; calculating your total budget. | 2-4 Weeks | Mortgage Broker, Bank |

| Search & Viewing | Finding properties online; visiting homes; choosing "the one". | 1-6 Months | Agent Immobilier (Estate Agent) |

| Offer & Initial Contract | Making a formal offer (offre d'achat); signing the compromis de vente. | 2-4 Weeks | Agent Immobilier, Notaire |

| Due Diligence & Cooling Off | 10-day cooling-off period; notaire conducts legal checks. | 2-3 Months | Notaire |

| Completion | Securing final mortgage offer; signing the final deed (acte de vente). | 1-2 Weeks | Notaire, Bank |

Each of these steps has its own set of documents and deadlines, but seeing them laid out like this helps clarify the entire sequence from start to finish. Let's dig into the details.

Building Your Financial Foundation

Before you fall in love with a sun-drenched villa or a quaint Parisian apartment, let's talk about what really matters first: the money. Getting your finances sorted is the absolute bedrock of a successful French property purchase. It’s the step that turns a fuzzy dream into a concrete plan, giving you the confidence and credibility to make it happen.

When you have your budget and financing lined up, you’re no longer just browsing. You become a serious, qualified buyer in the eyes of French estate agents and sellers, which can make all the difference, especially in a competitive market.

Get Your Financing Approved in Principle

One of the smartest moves you can make early on is to secure an accord de principe. Think of this as a mortgage agreement in principle from a French lender. It's not the final, binding offer, but it’s a formal signal from a bank that shows how much they're prepared to lend you based on an initial review of your finances.

Walking into a negotiation with an accord de principe in hand is a game-changer. It tells the seller you’re not a risk; you’ve done your homework and the funds are within reach. It's also worth noting that you should be ready with a hefty deposit. For non-residents, many French banks will ask for a down payment of at least 20% of the property’s value.

Expert Insight: Don't just go to your own bank. I always recommend using a French mortgage broker, or courtier. They have established relationships with a wide range of lenders and know the system inside and out. A good courtier can unearth better rates and terms than you'd ever find on your own, potentially saving you thousands over the life of your loan.

Navigating the process from abroad has its own quirks. For a more detailed look, our guide on securing a mortgage for a foreign property breaks down the specific hurdles you might face.

Understanding the True Cost of Buying

The asking price you see on a listing is never the final number. This is a classic pitfall for international buyers—the hidden costs can add a surprisingly large sum to your total outlay. Budgeting for them from day one is non-negotiable.

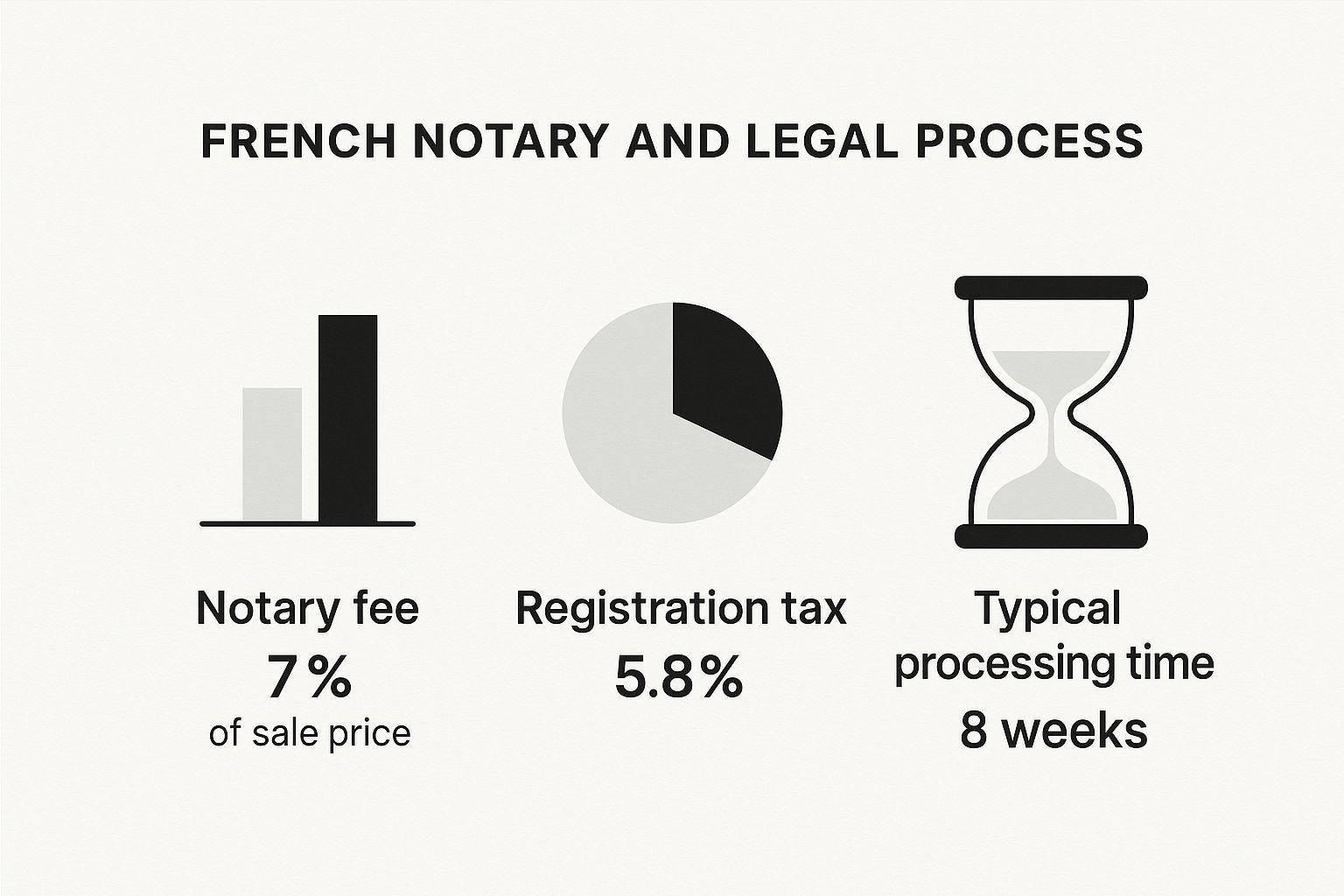

The biggest chunk of these extra costs is wrapped up in what’s called the frais de notaire, or notary fees. This isn't just the notary's salary; it’s a package of taxes and administrative charges.

- Property Transfer Tax (droits de mutation): This is the main component, typically running at 5.8% of the purchase price for an existing home.

- Notary's Fee (émoluments): This is the fee for the notary's work, which is fixed by the government on a sliding scale based on the property's price.

- Administrative Costs: A smaller amount that covers the miscellaneous expenses of registering the sale and handling paperwork.

As a solid rule of thumb, you should budget an extra 7-8% on top of the purchase price for these frais de notaire when buying an older property. If you’re looking at a new-build, the costs are much lower, usually around 2-3%.

A Real-World Budget Breakdown

Let's make this tangible. Say you've found a gorgeous stone farmhouse in the Dordogne for €300,000. Here’s how the numbers would actually stack up:

| Cost Item | Estimated Amount | Notes |

|---|---|---|

| Purchase Price | €300,000 | The advertised price of the home. |

| Deposit (20%) | €60,000 | Your initial down payment for the lender. |

| Frais de Notaire (7.5%) | €22,500 | All bundled taxes and fees. |

| Estate Agent Fees | Often included | Usually paid by the seller, but always double-check. |

| Total Funds Needed | €322,500 | The real amount you need before mortgage fees or furnishings. |

As you can see, you need an additional €22,500 just to cover the closing costs. This simple bit of math is crucial for understanding what you can truly afford.

On a positive note, the market is showing signs of becoming more buyer-friendly. The Conseil supérieur du notariat (CSN) has suggested that the recent slide in prices may be leveling off. With falling interest rates and easing inflation in the Eurozone, affordability is improving. Some experts even predict a potential 6% increase in transaction volumes soon.

Finding the Right Property in the Right Place

Alright, you’ve sorted your budget and have a handle on your finances. Now for the fun part: the actual hunt for your dream French home. This is where the vision in your head—that rustic longère in Brittany or a chic apartment overlooking the sea in Nice—starts to become a tangible reality.

But finding a home that truly fits isn't just about browsing listings. It's about a smart, strategic search that aligns your dream with the practicalities of daily life in France.

Most people’s journeys understandably start online. Big property portals like SeLoger, Logic-Immo, and Green-Acres are fantastic launching pads. They give you a brilliant overview of what your money can buy in different regions, letting you filter by property type, size, and location.

But here’s a crucial piece of advice from my experience: don’t stop there. If you only look at these major sites, you’re likely to miss some of the best opportunities. The French property market is still wonderfully old-school in many ways, and local relationships are everything.

Beyond the Big Property Portals

To really get an edge, you need to go local. Finding a good agent immobilier (estate agent) in your target area can be an absolute game-changer. They are your eyes and ears on the ground and often know about properties before they're ever listed online. Think of it as gaining access to the "off-market" world.

A local agent offers so much more than just property viewings. They understand the soul of a place—the nuances between villages, the reputation of the local schools, which areas buzz in the winter and which ones go quiet. That’s insight you simply can’t get from a property description.

My Two Cents: Don't hesitate to register with a few different agencies in your preferred region. Make it clear you're a serious, pre-qualified buyer. A good agent will prioritise you, sending you properties that fit your brief before they're snapped up on the open market.

Thinking Beyond Bedrooms and Bathrooms

It's easy to get bogged down in the specifics—so many bedrooms, a certain square meterage. And while those things matter, the most successful property searches I've seen are the ones that focus on lifestyle first.

To really zero in on the right place for you, ask yourself some deeper questions:

- What’s the Vibe? Are you after a bustling village with a year-round community and a weekly market, or is the peaceful seclusion of a rural hamlet more your speed?

- How Connected Do You Need to Be? Think about how you’ll travel. Proximity to an airport, TGV station, or major motorway can be critical, both for you and for friends and family coming to visit.

- What Are Your Daily Essentials? Do you dream of a morning walk to the boulangerie? Or perhaps easy access to specific healthcare facilities is a non-negotiable?

Focusing on how a location supports the life you want to live is a much more powerful filter than just the physical attributes of a house. And if you're still weighing your options, our article on the best countries to buy property provides some excellent context on how France compares to other popular destinations.

The Art of the Property Viewing

Once you have a shortlist, it’s time to see the properties in person. This is your chance to play detective and look beyond the beautifully staged photos. When buying in France, especially an older property, you need to look with a critical eye.

Pay close attention to the big-ticket items that could spell trouble later. Look at the roof for missing tiles or any signs of sagging. Inside, scan for damp patches on walls or ceilings—and be suspicious of a fresh coat of paint in just one area, as it might be hiding a problem.

Try opening and closing all the windows and doors; if they stick, it could point to structural movement. And always, always ask about the age and state of the plumbing, the electrical system, and, if it’s not on mains drainage, the fosse septique (septic tank). Getting these details upfront can save you a world of headaches and expense down the line.

Making an Offer and Navigating the French Legal System

So, you’ve found it. After weeks, maybe even months, of searching, one property has stood out from the rest. This is where the real excitement begins, but it's also where the process shifts gears from searching to securing the deal. The French legal side of things might seem daunting at first, but it’s a well-trodden path designed to protect everyone involved.

Your first official move is making a written offer, or an offre d'achat. Don't underestimate this step. While a casual verbal agreement won't hold up, a written offer, once the seller signs it, becomes a serious commitment for both of you. Your offer should clearly state the price you're willing to pay and, crucially, can include a time limit for the seller to respond. You can also add in specific conditions, known as clauses suspensives, which are your key safety nets.

From Handshake to Keys in Hand

Once your offer is accepted, things get real. The process moves quickly to signing the first of two major contracts, which is nearly always the compromis de vente. Think of this as the main preliminary sales agreement that locks in all the details of the sale.

This is also when you'll pay your deposit, which is typically between 5-10% of the purchase price. A key point here: this money doesn't go to the seller. It’s held safely in an escrow account managed by a public official called the notaire. The compromis de vente is legally binding, meaning you can only back out under the protection of your cooling-off period or if one of your specific conditions isn't met.

The grand finale is signing the acte de vente, the final deed of sale. This usually happens about two to three months after the compromis. At this meeting in the notaire's office, you'll pay the remaining balance of the house price plus all the associated fees. Once the ink is dry, the notaire registers the sale, and the keys are officially yours. It’s a fantastic feeling.

The image above really highlights how the notaire manages all the financial moving parts. Those fees and taxes can add a significant chunk to your overall budget, so it's vital to factor them in from day one.

The Role of the Notaire: Your Guide and Guardian

In the French property world, the notaire is the central figure. It’s a common mistake for buyers to think of them as just a lawyer representing one side. They aren't. A notaire is a public official appointed by the state, acting as a neutral party to ensure the entire transaction is above board for both buyer and seller.

Their job is incredibly comprehensive:

- They draft the legally binding contracts (compromis de vente and acte de vente).

- They carry out all the essential due diligence—checking property ownership, searching for any debts or mortgages on the title, and verifying local planning permissions.

- They are the trusted holder of funds, managing your deposit and the final payment with total security.

While a single notaire can handle the transaction for both parties, you absolutely have the right to hire your own. The best part? It doesn’t cost you a penny extra, as they simply split the standard fee. For many international buyers I've worked with, having their own notaire provides an invaluable layer of confidence and personalized advice.

Understanding the paperwork is half the battle. When you're buying a home in France, you'll come across three main documents that move the process forward. Each has a distinct purpose and legal weight.

Key French Property Purchase Documents Explained

| Document | Purpose | When It's Signed | Is It Legally Binding? |

|---|---|---|---|

| Offre d'Achat | A formal written offer from the buyer to the seller, stating the proposed price and any conditions. | At the very beginning, to initiate the purchase process. | Yes, for both parties once the seller signs to accept it. |

| Compromis de Vente | The comprehensive preliminary sales contract that locks in all terms, conditions, and the price. | After the offer is accepted, usually within a few weeks. | Yes, it's a strong binding agreement, subject to cooling-off rights and any clauses suspensives. |

| Acte de Vente | The final deed of sale that officially transfers ownership of the property to the buyer. | Typically 2-3 months after the compromis de vente. | Yes, this is the final, definitive legal document. |

Navigating these documents with your notaire is the key to a smooth transaction. They are there to ensure you understand exactly what you're signing and when.

Your Built-In Buyer Protections

The French system has some fantastic, non-negotiable protections for buyers. These are your safety nets.

First up is the 10-day cooling-off period (délai de rétractation). This clock starts ticking the day after you receive the fully signed compromis de vente. During these ten days, you can walk away from the deal for any reason at all, no questions asked, and get your full deposit back.

Second, and perhaps the most powerful tool at your disposal, are the clauses suspensives. These are "get-out-of-jail-free" clauses you add to the compromis de vente.

An Expert's Take: Think of these clauses as your personal escape hatches. They protect your deposit if things don't go according to plan. The most common one by far is the mortgage clause (clause d'obtention de prêt), which lets you cancel the contract without penalty if your bank turns you down for a loan. You can also add conditions for getting planning permission for an extension or even for a clean structural survey report.

Finally, the seller is legally obligated to provide a thick file of technical reports called the Dossier de Diagnostic Technique (DDT). This folder is a goldmine of information, with reports covering everything from asbestos and lead paint to energy efficiency and the state of the gas and electrical systems. Poring over these with your notaire is essential to know exactly what you're buying. These protections are just as critical when looking for a house for sale in Paris as they are for a rustic farmhouse in the countryside.

From Signed Contract to Moving Day

You’ve signed the compromis de vente. Pop the champagne and take a deep breath. The hardest parts—the searching, the viewing, the tense negotiations—are behind you. Your dream home in France is officially under contract.

Now, the final stretch begins. This is typically a two-to-three-month period where the focus shifts from finding the right place to making it legally and practically yours. Think of it less as the romantic part of the journey and more as the essential administrative phase. Getting these details right is what guarantees a smooth, stress-free handover. While your notaire is busy in the background, meticulously checking property titles and local planning rules, you've got a few key jobs of your own to tackle.

Finalizing Your Finances and Funds Transfer

If you're getting a French mortgage, it's go-time. You need to work closely with your bank or broker to secure that formal, binding mortgage offer. The compromis de vente includes a non-negotiable deadline for this, so stay on top of any paperwork and be ready to respond quickly to your lender's requests.

Once the financing is squared away, you'll need to organize the transfer for the rest of the money. This covers your remaining deposit and the all-important frais de notaire (notary fees and taxes). Moving large sums of money across borders isn't something to leave to chance.

An Insider's Tip: Please don't just use your high-street bank for the currency transfer. Specialist currency exchange firms almost always offer far better exchange rates and lower fees. On a property purchase, the difference can easily run into thousands of euros. A good firm can also lock in an exchange rate for you, which is a lifesaver. It protects you from any nasty surprises if the market moves against you between signing the compromis and the final closing date.

Arranging Mandatory Home Insurance

Here’s a detail that catches many foreign buyers off guard: in France, home insurance (assurance habitation) is not just a good idea, it's a legal requirement. You simply cannot sign the final deed of sale—the acte de vente—and collect the keys without proof of a valid insurance policy.

On the day of the final signing, the notaire will ask to see your insurance certificate, the attestation d'assurance. The policy has to be active from the very day you officially become the owner.

To get this sorted, you’ll need to provide an insurer with some basic details:

- The number of main rooms (pièces) in the house.

- The total living area in square meters.

- Any special features, like a swimming pool, outbuildings, or a fancy security system.

My advice? Start getting quotes at least a few weeks before your scheduled completion date. The last thing you want is a frantic, last-minute scramble to find an insurer.

The Final Signing Meeting

This is the big day—the moment you sign the acte de vente. It all happens at the notaire's office, usually with you, the sellers, your agent, and the notaire all present.

Be prepared for a lengthy meeting. The notaire is legally required to read the entire deed of sale out loud. If your French isn't quite up to legal-document level, it’s a very smart move to bring a translator. Some buyers even hire their own bilingual notaire to ensure they understand every clause.

Once the reading is done, you’ll sign the document, the seller will hand over the keys, and that's it. The property is yours. Congratulations, you're officially a homeowner in France!

Your First Steps as a Homeowner

Getting the keys isn't the finish line; it's the start of a new chapter. A couple of quick administrative tasks will help you settle in properly.

First, make a point to visit your local Mairie (the town hall). Just popping in to introduce yourself is a fantastic way to start integrating into the local community. The staff there are also an incredible source of practical information on everything from bin collection days to local festivals and clubs.

Next up, utilities. You'll need to get the electricity, water, and (if applicable) gas accounts transferred into your name. Your estate agent or the previous owner can usually give you the contact details for the current suppliers, which makes this much simpler. Just remember to take meter readings on the day you take possession to ensure you’re only paying for what you use.

Your French Property Questions, Answered

As you get closer to actually buying a home in France, the big-picture dreams start giving way to very specific, practical questions. The French system has its own rhythm and a unique vocabulary, which can feel a little daunting for buyers coming from abroad.

Let's clear up some of the most common queries we hear. Think of this as your go-to guide for those nagging "what if" and "how does that work" moments that inevitably pop up.

Do I Really Need a French Bank Account to Buy a House?

While it’s not a strict legal requirement to finalize the purchase, I’d strongly advise against trying to buy property without a French bank account. It’s like trying to bake a croissant without butter – technically possible, but why would you? It just makes everything incredibly difficult.

A local account is the only truly practical way to handle all the financial moving parts. You'll need it for the deposit, paying the notaire's fees, and, crucially, for all the ongoing costs of being a homeowner in France.

For instance, utility companies almost exclusively use French direct debits (prélèvements). The same goes for paying your annual property taxes, the taxe foncière and taxe d'habitation. And if you’re getting a French mortgage? Forget about it. The lender will absolutely insist you have one.

My Advice From Experience: Start the process of opening an account the moment you get serious about buying. The paperwork can sometimes drag on for a few weeks, and you don't want that holding up your entire transaction. You’ll usually need your passport, proof of address (from your home country is often fine to start), and sometimes proof of income or your last tax return.

What's the Difference Between a Compromis and a Promesse de Vente?

You'll definitely come across one of these two preliminary contracts, but they are not the same thing. Getting your head around the difference is vital because it changes the level of commitment for both you and the seller.

-

Compromis de Vente: This is a two-way street, a binding agreement for both parties. The seller commits to selling to you, and you commit to buying from them, as long as all the pre-agreed conditions are met. It's by far the most common type of pre-sale contract you'll see in France.

-

Promesse de Vente: This is more of a one-way option. It only binds the seller, who promises to sell you the property at a set price for a fixed amount of time. In exchange for taking their property off the market, you, the buyer, pay a deposit, often up to 10%. You can still walk away during the option period, but you'll lose your deposit if you do.

For the vast majority of residential purchases, you'll be signing a compromis de vente. It provides real security for everyone involved.

Can People from Outside the EU Buy Property in France?

Yes, one hundred percent. There are absolutely no restrictions on foreign nationals owning property in France. It doesn't matter if you're from the UK, the US, Canada, Australia, or anywhere else—your nationality has zero impact on your legal right to buy a home. The purchase process is identical for everyone.

However, it is critically important to separate property ownership from residency rights. They are two completely different things.

Buying a house in France does not automatically give you the right to live there long-term. If you're a non-EU citizen and plan to spend more than 90 days in any 180-day period, you have to apply for a long-stay visa and residency permit (carte de séjour). This is a completely separate administrative journey you must undertake through the French consulate in your home country, well before you plan to move.

What Are Clauses Suspensives and Which Ones Do I Need?

Think of the clauses suspensives as your get-out-of-jail-free cards. These are conditional clauses written directly into the compromis de vente. If a specific, named condition isn't met, you can legally walk away from the deal and, most importantly, get your deposit back in full.

The most common and non-negotiable one for most buyers is the clause suspensive d'obtention de prêt. This simply makes the entire sale conditional on you successfully securing a mortgage. If the bank says no, the deal is off, and you're not penalized.

Beyond financing, you can and should tailor other clauses to protect yourself based on the specific property and your plans for it.

Other Smart Clauses to Consider Adding:

- Planning Permission: If your dream is to add a swimming pool or build an extension, you can make the sale conditional on getting a positive planning certificate (certificat d'urbanisme) from the local Mairie.

- Structural Survey: While not standard practice in France like in the UK or US, you have every right to request a clause making the sale dependent on a satisfactory report from a qualified building surveyor.

- Absence of Easements: This is a great one. It protects you by ensuring there are no hidden rights of way (servitudes) or other legal burdens on your land that could spoil your privacy or plans.

Your notaire is your best ally here. Work closely with them to figure out which clauses are most important for your situation and to make sure they are worded precisely to give you maximum protection.

Ready to turn your French property dream into a reality? At Residaro, we connect discerning buyers with exceptional homes across France's most beautiful regions. From sun-drenched villas in Provence to historic stone houses in the Dordogne, your perfect property is waiting. Start your search with Residaro today and discover a world of possibilities.