Secure Your Mortgage for Foreign Property Today

So, you're dreaming of a home abroad? A place to escape, invest, or maybe even retire. That's a fantastic goal, and it’s one you can absolutely achieve. The biggest hurdle for most people is figuring out the money side of things, specifically getting a mortgage for foreign property. It might seem like a maze, but with a good map, it's more than manageable.

Your Dream Home Abroad Is Closer Than You Think

When you picture that sun-drenched villa in Spain or a cozy farmhouse in the Italian countryside, the question that quickly follows is, "But how on earth do I pay for it?" Many potential buyers hit this wall and assume getting a mortgage as a non-resident is out of reach. The good news is that it's a well-trodden path. People do it all the time, and this guide is here to walk you through exactly how it works, step by step.

Right from the start, you need to know that an international mortgage isn't just a copy of the one you'd get back home. Lenders in another country will naturally see you, a non-resident borrower, as a slightly higher risk. It’s nothing personal—just a business reality. They're dealing with different legal systems, potential currency swings, and the simple fact that you live somewhere else.

What to Expect on Your Journey

This difference in perceived risk shows up in the loan terms you'll be offered. For starters, get ready for a larger down payment. While you might be used to putting down 10-20% at home, a mortgage for foreign property typically requires a deposit somewhere between 30% and 50%.

Key Takeaway: Lenders want to see you have more "skin in the game." A bigger down payment proves you're financially solid and gives the bank a much larger safety net.

You might also find that interest rates are a tick higher than what you could get domestically. But don’t let that discourage you. If you come prepared with a strong financial profile, you can still land very competitive terms. Knowing these realities from the get-go is half the battle—it means no nasty surprises and helps you budget properly for the entire purchase.

Setting the Stage for Success

The secret to successfully financing a property overseas is all in the preparation. Your journey will break down into a few key stages, and we'll dive deep into each one throughout this guide:

- Finding a Lender: You have choices here. You could go to a local bank in the country you're buying in, work with a major international bank that has a presence everywhere, or hire a specialist mortgage broker who lives and breathes this stuff.

- The Paperwork: Getting your documents in order is absolutely critical. Lenders will want to see everything—proof of income, detailed asset statements, and a clear trail showing where your deposit funds came from.

- Expert Advice: This is a big one. Cross-border property deals come with their own unique legal and tax rules. You'll need pros in your corner to guide you through them.

By arming yourself with this information, you can turn what feels like an intimidating process into an exciting, well-planned project.

Navigating the World of International Mortgages

Buying property abroad is an exciting prospect, but securing the financing is a whole different ball game compared to getting a mortgage in your home country. The moment you cross a border, the rules change. Lenders view these transactions through a lens of higher risk, and understanding their perspective is the key to a successful application.

It's not personal; it's simply a matter of financial logic. For a lender, financing a property for a non-resident buyer introduces variables they don't face with domestic loans. They're weighing currency fluctuations, unfamiliar legal systems, and the economic pulse of another nation. This extra layer of caution means you can expect stricter terms.

Why You'll Need More Skin in the Game

The most significant difference you'll encounter right away is the down payment. Lenders need a bigger financial cushion to offset their perceived risk, which translates directly into a lower loan-to-value (LTV) ratio. Don't be surprised if the amount you can borrow is less than you're used to.

Historically, getting a mortgage as a foreigner has always been a bit more expensive and restrictive. In many popular European markets, lenders often cap their lending at 50% to 70% LTV for non-residents. That’s a far cry from the 80% or 90% often available to locals. You might also see interest rates that are 0.5% to 2.0% higher, all depending on the specific country and the lender's policies.

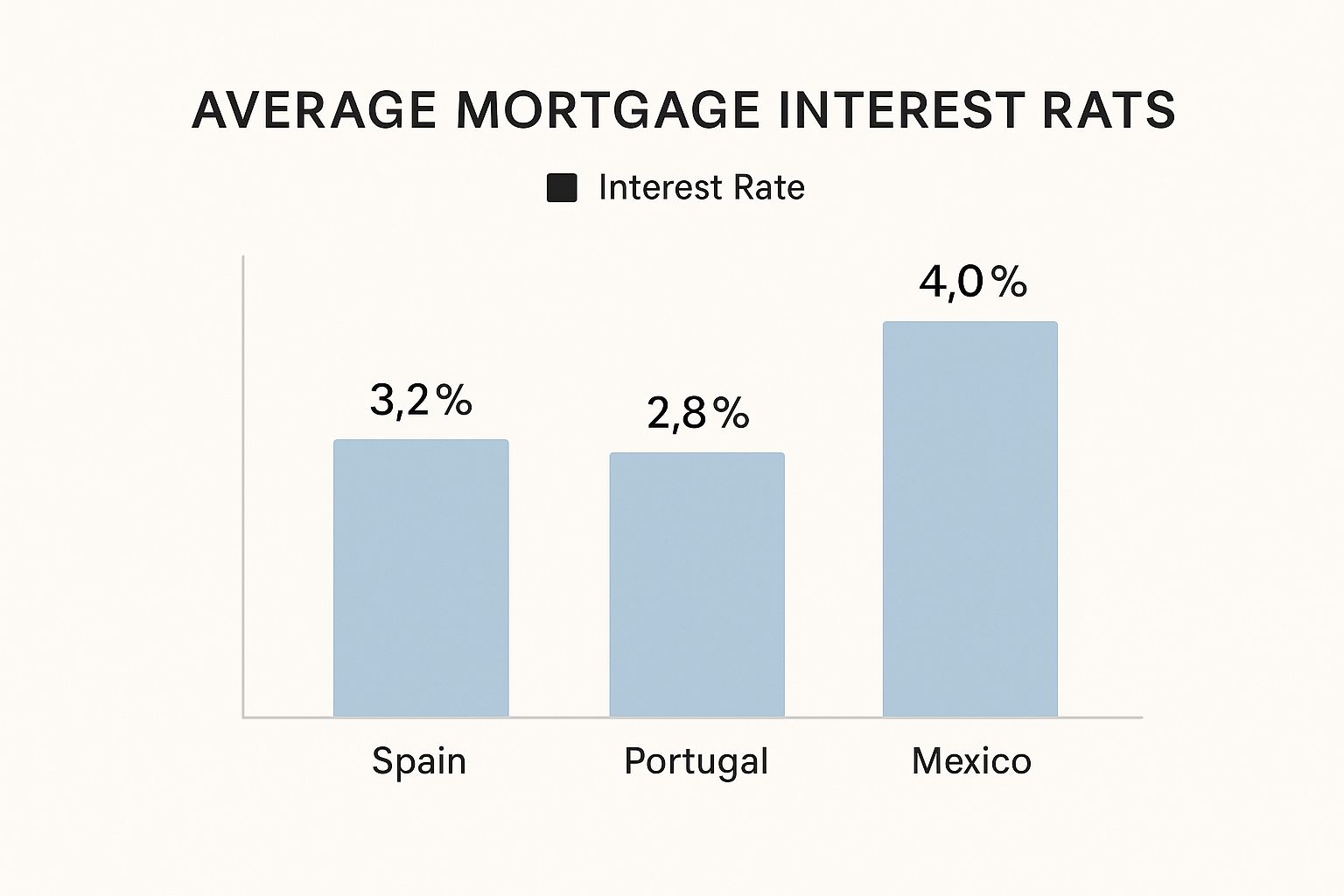

Here’s a snapshot of how average mortgage rates can differ across some popular European countries.

As you can tell, even neighboring countries can have vastly different rate environments. This really drives home the need to do your homework on your target market.

Domestic vs Foreign Mortgage Key Differences

To give you a clearer picture, it helps to see the differences side-by-side. The entire process, from what you pay to how much paperwork is involved, operates on a different set of assumptions.

| Feature | Typical Domestic Mortgage | Typical Foreign Property Mortgage |

|---|---|---|

| Down Payment | Often 10-20% (or less) | Typically 30-50% |

| Interest Rates | Standard market rates | Often 0.5% - 2.0% higher than domestic |

| Lender Pool | Wide variety of national banks | Fewer options; often specialized lenders |

| Documentation | Standard income and credit checks | Extensive, often requiring translation and notarization |

| Application Timeline | Typically 30-45 days | Can take 60-90 days or longer |

| Legal Process | Familiar and standardized | Requires local legal expertise (e.g., a notary) |

Thinking from the lender's point of view will help you anticipate their requirements and build a much stronger application from the start.

Seeing Things from the Lender's Side

So, what exactly keeps a lender up at night when considering an international loan? Understanding their key concerns helps you prepare an application that puts those fears to rest.

- Currency Risk: This is a big one. If your income is in US Dollars but your mortgage is in Euros, a sudden drop in the dollar's value could make your payments unaffordable. The bank carries a piece of that risk.

- Legal Hurdles: Every country has its own property laws. If a borrower defaults, the lender has to navigate a foreign legal system to foreclose, which can be complex and costly.

- Economic Stability: Lenders have to be confident in the foreign property market. Is it stable? Is there a risk of a housing bubble? A downturn in that country's economy threatens the value of their security—the property itself.

- Verifying Who You Are: It’s simply harder and takes more time to verify the income, assets, and credit history of someone living thousands of miles away.

By anticipating these issues, you can gather documents and build a narrative that directly addresses a lender's primary concerns. This proactive approach can make all the difference.

Choosing the right country is half the battle. Our guide on the best countries to buy property offers some great starting points to help you narrow your search. At the end of the day, approaching this process with a dose of realism is your greatest asset. Knowing what to expect empowers you to prepare thoroughly for the unique challenges of financing your dream home in Europe.

Finding the Right Lender for Your Overseas Purchase

Securing a mortgage for foreign property isn't just a box to tick; it's about finding the right financial partner for a complex journey. Honestly, the lender you choose will have the single biggest impact on your entire buying experience. It affects everything from the stress levels of the application process to the final terms you secure.

You essentially have three main paths to go down. Each has its own set of pros and cons, and the best choice really depends on your specific situation.

Exploring Your Lending Options

Let's break down the three primary avenues for financing your European dream home. Your personal circumstances—like where you're buying and how complex your finances are—will point you toward the best fit.

-

Local Banks in the Target Country Going directly to a bank in, say, Portugal or Italy can sometimes land you the most competitive local interest rates. They understand their home turf better than anyone. The big catch? They are often the least equipped to handle applications from non-residents. This can quickly turn into a frustrating maze of communication gaps, document mishaps, and painful delays.

-

Large International Banks Big names like HSBC or Santander, which have a footprint in both your home country and your target destination, can be a solid choice. They're built for cross-border transactions and usually have established processes for verifying foreign income, which can make the paperwork feel a bit more straightforward. The downside is that they can be rigid, with one-size-fits-all lending criteria that might not work for a unique property or a self-employed applicant.

-

Specialized Mortgage Brokers These are the true specialists in the field. A good broker who focuses on financing for expats and non-residents has seen it all before. They have deep connections with a whole panel of lenders, including private banks and niche institutions you'd never find on your own. They are absolute wizards at navigating tricky applications. Their expertise comes with a fee, of course, but the value they provide can be immense, especially if you're short on time or have a complex financial profile.

Expert Insight: I've seen it time and again: for a complicated purchase or if you've already been rejected by a mainstream bank, a broker is your best bet. They know exactly which lenders have an appetite for certain types of deals and how to package your application to get a 'yes'.

Vetting Potential Lending Partners

Once you've decided which path to take, the real work starts. You need to interview and vet potential lenders or brokers with a critical eye. Don't be shy about asking direct, challenging questions. How they answer will tell you everything you need to know about their competence.

Listen carefully to how they talk about your specific situation. If you're buying a rustic farmhouse that needs significant renovation, do they understand the financial implications? If your income comes from freelance projects, do they have a clear process for that? This is your opportunity to gauge their real-world experience, not just their sales pitch.

For a closer look at what the local process feels like on the ground, our detailed guide on buying a house in Italy offers some great context.

Key Questions to Ask Every Lender

Before you even think about committing, get on the phone and have a list of essential questions ready. This is how you compare your options apples-to-apples.

- Experience with Non-Residents: Ask them point-blank, "What percentage of your mortgage clients are non-resident buyers from my home country?" This cuts right through the fluff.

- Document Requirements: "Can you send me a preliminary checklist of all the documents you'll need?" A lender who can produce a clear, comprehensive list right away knows what they're doing.

- Full Cost Breakdown: Demand complete transparency. Ask for an itemized list of every single fee—arrangement fees, valuation costs, legal charges, and any broker commissions. No surprises.

- Language and Communication: "Who will be my day-to-day contact, and are they a fluent English speaker?" In a transaction this significant, crystal-clear communication is non-negotiable.

- Typical Timelines: "What's a realistic timeline from submitting my application to getting a final approval?" An experienced hand will give you an honest estimate based on today's market, not a vague promise.

Comparing these answers will give you a sharp, clear picture of who is truly equipped to handle your mortgage for foreign property. At the end of the day, you want to choose the partner who not only offers a great rate but also gives you the confidence that they can get the deal done smoothly.

Getting Your Mortgage Application Over the Finish Line

When you're applying for a mortgage on a property abroad, your application needs to do more than just check the boxes. It has to tell your financial story in a way a lender thousands of miles away can easily understand and trust. Honestly, putting in the work upfront is your best bet for turning a potentially frustrating process into a smooth one.

Think of it this way: you're creating the complete financial biography for someone who doesn't know you or your country's system. They need a crystal-clear picture of your income, your assets, and where your down payment is coming from. Ambiguity is your enemy here.

The paperwork will feel more intense than what you're used to back home, and that’s because it is. You'll need all the standard documents, but with an international spin. Lenders are legally bound to conduct strict anti-money laundering (AML) checks, so expect them to really dig into the origin of your funds.

Your Core Document Checklist

While every lender has its own specific list, you can get a huge head start by getting the essentials in order now. Showing up prepared proves you're a serious, organized borrower, and it can shave weeks off the approval time.

- Proof of Identity: Clean, legible copies of your passport for everyone on the application.

- Proof of Address: Recent utility bills or bank statements from your home country will usually do the trick.

- Proof of Income: Be ready with your last three to six months of pay stubs and your most recent annual tax returns.

- Proof of Down Payment: This is a big one. Lenders will want to see several months of bank statements to show the funds are legitimately yours. They'll also need a paper trail explaining the source, whether it's from savings, the sale of an asset, or a gift.

A Quick Heads-Up on Translations: If your documents aren't in the local language or English, you'll almost certainly need to get them professionally translated and notarized. This is a standard requirement that catches a lot of people off guard and can cause major delays if you aren't ready for it.

Telling Your Financial Story

Your real goal is to build a narrative that a foreign underwriter can approve without a second thought. That means thinking ahead, anticipating their questions, and proactively providing clear answers, especially for anything out of the ordinary.

For example, if you're a freelancer or own your business, tax returns alone won't cut it. You'll need to prepare profit and loss statements, maybe some future projections, and a letter from your accountant can add a lot of weight. The idea is to erase any potential confusion before it even comes up.

The same goes for your credit history. A lender in Spain can't just pull your US FICO score. You'll need to show them you're a reliable borrower in other ways. Think about getting reference letters from your bank at home or providing statements from other loans or credit cards that show a long, clean history of on-time payments.

The Source of Funds Declaration

This is easily one of the most scrutinized parts of getting a mortgage for foreign property. Lenders need undeniable proof of where every penny of your down payment came from. This isn't just a box-ticking exercise; it's a serious legal requirement to prevent money laundering.

You’ll be asked to provide:

- A Written Statement: A simple letter you write explaining where the funds originated.

- Supporting Evidence: If it's from savings, show bank statements over time. If it's an inheritance, you'll need the legal documents. If it came from selling another property, have the closing statement ready.

While getting a mortgage as an international buyer definitely involves more hoops, it’s a well-traveled path. Plenty of foreign buyers successfully finance their dream homes. In the United States, for instance, foreign buyers have made up as much as 7% of existing home sales annually over the last decade, with almost half of them using a mortgage. You can dig into more trends on this in this recent report on international buying.

By pulling together a complete and transparent application, you’re tackling the lender’s main concerns head-on. This proactive approach doesn't just cut down on delays—it dramatically boosts your chances of getting that approval.

Getting to the Finish Line: Closing Your Property Deal

Holding that mortgage approval letter feels like a massive victory, but you're not quite at the finish line yet. The final leg of this journey is less about big decisions and more about careful coordination. This is where you navigate the critical logistical steps that turn an approved loan into a set of keys in your hand, all while managing the complexities of a cross-border transaction.

First up, you’ll receive the official, binding loan offer from the lender. Don't just skim it. This document lays out every final detail—the interest rate, the repayment schedule, and any last-minute conditions the bank requires before they'll release the funds. Read the fine print carefully, because this is your last opportunity to flag any issues before you’re legally committed.

Handling Currencies and Final Payments

One of the biggest hurdles in this final stage is managing the money itself, specifically the currency exchange. You’re about to move a significant sum for the down payment and closing costs, and then you'll have ongoing mortgage payments for years to come. Currency rates are always in flux, and even a small shift can make a real difference to your bottom line.

Think about it: a €50,000 down payment might cost you $54,000 one week, but a slight market dip could see it jump to $55,500 the next. To avoid getting stung by this volatility, I always advise clients to look beyond their regular bank and work with a currency exchange specialist.

These firms usually offer a couple of key advantages:

- Better Exchange Rates: Their business is volume, so their margins are often much tighter than what high-street banks can offer, saving you a substantial amount on large transfers.

- Forward Contracts: This is a fantastic tool. It lets you lock in an exchange rate today for a transfer you’ll make in the future, removing all the guesswork and giving you total certainty on your final cost.

- Expert Guidance: They live and breathe currency markets and can offer insights to help you time your transfer for the most favorable rate.

At the same time, you’ll absolutely want to set up a local bank account in the country where you're buying. It will make everything from paying your monthly mortgage to handling local utility bills and property taxes infinitely simpler.

Building Your Cross-Border Advisory Team

Navigating an international property closing alone is a recipe for disaster. When you get a mortgage for foreign property, you're playing in two different legal and financial sandboxes. You need experts on the ground in both your home country and where the property is located. It’s non-negotiable.

Your essential team should include:

- A Local Lawyer or Notary: This person is your most important ally. They'll scrutinize the purchase contract, perform due diligence on the property, and ensure the title deed is transferred correctly according to local laws.

- A Tax Advisor: A specialist who understands cross-border taxation is worth their weight in gold. They can guide you on how the purchase affects your tax situation at home and abroad, helping you avoid double taxation and make use of any existing treaties or credits.

Key Insight: Think of your legal and tax advisors as your personal defense team. They protect your interests within a foreign legal system and ensure you don’t get hit with unexpected financial penalties later. Their fees aren't just a cost; they're an investment in your peace of mind.

Tying Up the Final Loose Ends

With your financing solid and your expert team in place, only a few practical tasks remain. You'll need to arrange property insurance, which is almost always a requirement from the lender. Make sure you get the lender's criteria in writing, as the policy will need to meet their specific requirements. This is particularly important when considering unique properties; for example, the insurance needs when you buy land in Ibiza will differ greatly from those for a city-center apartment.

Finally, get familiar with the title deed process. In many European countries, a public notary plays a central role in officially registering the property in your name. Your local lawyer will walk you through this formal procedure, which marks the official transfer of ownership. The good news is that the global outlook for foreign property financing looks positive, with many analysts pointing to rising home prices and stable mortgage rates. This is largely supported by strong demand and low default rates, which should create a more welcoming environment for buyers looking abroad. You can dive deeper into these global housing trends in this detailed Fitch Solutions analysis.

Your Top Questions About Mortgages for European Property, Answered

Buying a property overseas is exciting, but it’s natural to have a lot of questions. When you’re dealing with a mortgage for foreign property, you’re stepping into a different world of rules, banking norms, and financial details. Getting good, clear answers upfront is the key to making a smart investment and avoiding those "I wish I'd known" moments down the road.

I've helped hundreds of buyers navigate this process, and the same questions come up time and again. Let's walk through the most common concerns I hear.

"Will My Great Credit Score from Home Help Me Get a Loan?"

This is probably the most frequent question I get, and the honest answer is: not directly. A lender in Spain or France simply can't pull or properly interpret a credit score from the U.S., Canada, or the UK. While your fantastic credit history is a great testament to your financial responsibility, it won't be the main factor in their lending decision.

So, what do they look at? Lenders who specialize in financing for non-residents have a different playbook. They focus on tangible proof of your financial stability.

- Your Overall Net Worth: They want to see a strong portfolio of assets, which gives them a huge comfort level.

- Solid, Stable Income: They need to see consistent, verifiable income that can easily handle the new mortgage payments without a problem.

- A Significant Down Payment: This is your most powerful negotiating tool. Putting down 30% or more dramatically lowers the bank's risk and makes you a much more attractive borrower.

Here’s a real-world example: I worked with an American client who had an 800+ FICO score but was getting stuck with local Portuguese banks. We shifted strategy. Instead of focusing on a score they didn't understand, we built a file that highlighted his substantial investment portfolio and a very stable six-figure salary. We told a story of wealth and reliable cash flow, and that's what got the deal done.

Some huge, multinational banks might have internal ways to assess credit across borders, but that's rare. The winning strategy is to come prepared with meticulous documentation of your income and assets.

"How Do Currency Swings Affect My Mortgage?"

Currency risk is the silent partner in every international property deal, and it’s something you absolutely can't ignore. It can affect your initial purchase costs and, just as importantly, every single monthly payment you make for years to come.

Think about it: if you earn in U.S. dollars but your mortgage is in euros, you're exposed to the daily ups and downs of the exchange rate. If the dollar weakens against the euro, your mortgage payment suddenly costs you more.

For instance, a €2,000 monthly payment costs you $2,100 when the rate is 1 EUR = 1.05 USD. But if the dollar slips and the rate becomes 1 EUR = 1.12 USD, that same €2,000 payment now costs you $2,240. That might not seem like much in one month, but over 20 or 30 years, those fluctuations can add up to tens of thousands of dollars.

Here’s how experienced buyers manage this:

- They work with a currency exchange specialist to get much better rates than a typical bank offers. These specialists also provide tools like forward contracts, which let you lock in an exchange rate for your down payment transfer, removing all uncertainty.

- They often keep a buffer of cash in a local bank account. This way, they can ride out short-term currency dips without stress.

- In some rare cases, they might find a lender who will offer a mortgage in their home currency, though this isn't common.

"What's Involved When I Decide to Sell the Property?"

When it's time to sell, you'll be dealing with that country's specific real estate and tax laws. The biggest financial piece of the puzzle is almost always capital gains tax.

You could potentially owe capital gains tax in two places: the country where the property is and your home country. The good news is that many nations have double-taxation treaties to prevent you from being taxed twice on the same profit. These agreements usually let you claim a credit for taxes you paid abroad against what you owe at home.

Calculating the gain itself can be tricky. For a U.S. citizen, for example, the calculation isn't just the sale price minus the purchase price. You have to convert the original purchase price into U.S. dollars using the exchange rate from the day you bought it. Then, you convert the sale price into dollars using the rate on the day you sell. The currency's movement alone can create a taxable gain or loss, completely separate from the property's change in market value.

My most important piece of advice: Before you even think about listing your property, talk to a tax advisor who specializes in cross-border transactions. They can map out your potential tax liabilities and help you structure the sale in the smartest way possible.

"What Are the Biggest 'Hidden' Costs I Should Plan For?"

The sticker price is just the beginning. A lot of first-time international buyers get caught off guard by the other costs involved in the transaction. Budgeting for these from day one is essential.

Be sure to account for these common expenses:

- Legal Fees: You'll absolutely need a local lawyer to represent you, and their fees are a significant part of the closing costs.

- Property & Transfer Taxes: Sometimes called "stamp duty," these government fees can be shockingly high and often vary by region. They can also be higher for non-resident buyers.

- Lender & Broker Fees: Your lender will charge an arrangement fee for setting up the mortgage for foreign property. If you use a mortgage broker, they will have a separate success fee.

- Currency Conversion Spreads: Every time you send money abroad, your bank or transfer service takes a small slice. Over multiple transfers for the down payment and ongoing payments, this adds up.

- Translation & Notary Costs: Any of your official documents—birth certificates, bank statements, tax returns—that aren't in the local language must be professionally translated and notarized. These are out-of-pocket expenses you'll pay upfront.

Ready to turn your dream of a European home into reality? Let Residaro be your trusted partner. You can explore our handpicked properties across Spain, Italy, France, and Portugal to find the one that’s waiting for you. Start your property search with Residaro today!