House Paris Sale A Buyer's Guide

If you're searching for a house paris sale, you’re stepping into one of the most exciting and resilient property markets in the world. The last few years have been a rollercoaster, but recent trends are pointing towards a solid recovery. For a buyer who’s done their homework, this shift opens up some fantastic opportunities.

Decoding The Paris Property Market

Before you fall in love with a charming Haussmannian apartment online, it's crucial to get a real feel for the city's property landscape. Paris isn't one single market; it’s a mosaic of 20 different micro-markets, or arrondissements. The price, vibe, and demand in the artsy 18th are worlds away from the chic 7th.

After a period where prices cooled off, the market is now showing clear signs of bouncing back. This creates a sweet spot for buyers. The slight price dip over the past year, coupled with a surge in buyer confidence, means you can find value that was much harder to find just a couple of years ago.

The Current Market Vibe

The data from early 2025 really tells the story. After a slow period, the first quarter saw home sales within Paris proper jump by a staggering 25% compared to the previous year. That’s a serious comeback. This isn’t just a city-center phenomenon, either—the broader Île-de-France region saw sales of existing homes climb by 21%.

To give you a quick snapshot, here’s what the current market looks like.

Paris Property Market At A Glance

| Metric | Current Status | Outlook |

|---|---|---|

| Transaction Volume | Strong rebound, up 25% in Paris | Positive, expected to continue |

| Property Prices | Stabilizing after a slight dip | Modest growth expected |

| Buyer Demand | High, fueled by pent-up demand | Strong, especially for quality properties |

| Interest Rates | Stabilizing, providing clarity | Favorable for securing financing |

This table really paints a picture of a market that has found its footing and is starting to move forward again.

The big takeaway here is that the market isn't in a nosedive anymore. We're seeing stability and the start of a healthy recovery. This is an ideal time to make your move before prices begin their next climb.

What's driving this? It's a mix of a few key things:

- Sellers have become more realistic with their pricing.

- Interest rates have settled, so buyers know what they can afford.

- A lot of people who were waiting on the sidelines are now jumping back in.

What This Means For Your Search

For anyone seriously looking at a house paris sale, the conditions are ripe. You’re walking into a market that’s busy but not frantic, which gives you a bit more breathing room to negotiate and make smart decisions.

Beyond the immediate trends, France’s reliable property laws and the city’s timeless appeal make it a solid long-term investment. It's consistently ranked among the best countries to buy property for a reason.

Getting a handle on these dynamics—understanding why a flat in Le Marais costs what it does, how interest rates affect your mortgage, and the general mood of the market—is your first and most important step. It transforms a potentially overwhelming search into a strategic hunt for your perfect piece of Paris.

Finding Your Ideal Parisian Arrondissement

Paris isn't just one city. It’s a vibrant patchwork of 20 distinct districts, known as arrondissements, and each one has its own unique lifestyle, architecture, and pulse. When you’re looking for a house paris sale, the real task isn't about finding the "best" area—it's about discovering the one that feels like your Paris.

Think of it like choosing a village. Are you picturing yourself sipping an espresso at a bustling café in the heart of an artistic hub? Or do you dream of quiet, tree-lined streets with a park just around the corner for weekend strolls? Your daily routine, family needs, and, of course, your budget are the most important things to consider. For a moment, set aside the tourist maps and get practical about what your day-to-day life will actually look like.

Matching Lifestyle To Location

Before you even start scrolling through listings, grab a notebook and make a list of your absolute must-haves. This simple exercise is the foundation of a smart property search. It’ll keep you grounded and prevent you from falling for a beautiful apartment in a neighborhood that just won’t work for your life.

Start by thinking through these key factors:

- Green Spaces: Do you need easy access to big parks like the Bois de Boulogne or Parc des Buttes-Chaumont for jogging or just relaxing? The 16th and 19th arrondissements are fantastic for this.

- Family Amenities: Are top-tier schools, playgrounds, and a family-friendly vibe your main priority? The 15th and 17th are well-known for their residential, family-oriented character.

- Cultural Buzz: If you come alive surrounded by art galleries, independent theaters, and historic charm, then iconic areas like Le Marais (which straddles the 3rd and 4th) or Saint-Germain-des-Prés (6th) are famous for a reason.

- Market Life: Do you love the idea of strolling to a classic Parisian street market for fresh produce and cheese? Nearly every arrondissement has one, but neighborhoods like the 11th and 12th have some of the most vibrant.

One of the biggest mistakes I see buyers make is choosing a "prestigious" address over a practical fit. A stunning apartment is a lot less enjoyable if your daily commute is a nightmare or you can't find local shops that meet your needs. Be brutally honest with yourself about what truly matters, day in and day out.

Once you have your priorities straight, you can start mapping them onto the Parisian landscape. And this is where your budget comes face-to-face with reality.

Understanding Price Variations Across Paris

The price differences between arrondissements are massive, and getting your head around this early on will save you a world of time. That dream of a sprawling Haussmannian apartment in a prime central district might need to be balanced against what the market is actually doing. For example, the price gap between the most sought-after central areas and other compelling neighborhoods is stark. A property in the 6th arrondissement might average €15,500/m², which is a world away from a neighborhood like the 18th, where you can find great opportunities around €6,610/m². You can dive deeper into what's driving these prices with this detailed analysis of the Paris housing landscape.

This gap isn't just about what you can afford today; it's also about different investment potentials. An established, expensive area offers stability, while an up-and-coming neighborhood could offer a much better chance for your property's value to grow.

The Growing Importance Of Energy Performance

Lately, one factor has become incredibly important in the buying process: the Diagnostic de Performance Énergétique (DPE), or the Energy Performance Certificate. This is a mandatory report that grades a property’s energy efficiency from A (excellent) down to G (terrible).

So, why does this little report matter so much?

- Your Future Bills: A poor rating, especially an F or G, is a red flag for high energy bills. It also means you’re likely looking at expensive renovations for things like insulation, windows, or the heating system down the line.

- Rental Restrictions: This is a big one for investors. French law now heavily restricts renting out properties with the worst energy ratings. An apartment you can't legally rent out becomes a much less attractive asset.

- Negotiating Power: On the flip side, a bad DPE gives you, the buyer, real leverage. It's a legitimate, data-backed reason to negotiate the asking price down to cover the cost of necessary upgrades.

When you're viewing a property, always ask to see the DPE report right away. It’s a straightforward, standardized tool that helps you understand a building's efficiency and spot potential hidden costs, turning a complex issue into something you can really use to your advantage.

Securing Your French Mortgage and Finances

Let's talk money. Mastering the French financial system is a non-negotiable step in your property journey. I know this part of the process can feel intimidating, especially for international buyers, but with the right preparation, it’s entirely manageable. Whether you're a French resident or buying from abroad, securing funds really comes down to proving your stability and presenting a clear, organized case to the bank.

The foundation of any successful mortgage application in France is your dossier de financement, or application file. This isn't just a simple form—it's a comprehensive portfolio that paints a full picture of your financial health. French banks are traditionally conservative and risk-averse, so a meticulously prepared dossier is your best tool for building their confidence.

What French Banks Want to See

When you apply for a loan for your Parisian home, lenders scrutinize your ability to manage debt. They follow a strict rule where your total monthly debt payments—including the proposed new mortgage—cannot exceed 35% of your gross monthly income. This is a hard-and-fast rule, so calculating this ratio is your very first step.

Your file needs to be complete and transparent. Think of it as telling your financial story.

- Proof of Income: Get ready to provide your last three months of pay stubs, your last two years of tax returns, and an employment contract if you’ve recently started a new job.

- Bank Statements: You'll need the last three to six months of statements from all your bank accounts. This shows your spending habits and savings patterns.

- Proof of Down Payment: Lenders need to see exactly where the funds for your down payment, or apport personnel, are coming from.

This apport personnel is incredibly important. While it's sometimes possible to get 100% financing, French banks strongly prefer buyers who can contribute a down payment. A typical amount is at least 10% of the purchase price, which is generally enough to cover the notary fees and other closing costs. If you can put down 20% or more, you’ll significantly strengthen your application and likely get better interest rates.

Don't underestimate the power of a well-organized file. From my experience, a clean, complete dossier signals to the bank that you are a serious and reliable borrower. It can genuinely make the difference between a swift approval and a drawn-out, stressful process.

The Role of the Mortgage Broker

Navigating the French banking system can be a maze. Each bank has slightly different criteria, especially when it comes to international applicants. This is where a courtier, or mortgage broker, becomes an invaluable ally. A good courtier has established relationships with multiple banks and understands their specific appetites for risk and their preferred client profiles.

Instead of you applying to each bank individually, the courtier presents your single, polished dossier to a range of lenders at once. They know which banks are most likely to approve your type of profile and can often secure more favorable terms than you could on your own. For a fee—which is often only paid upon success—they handle the heavy lifting and translate the banking jargon, saving you immense time and stress.

Understanding the French system is key, but it's also helpful to see how it fits into the broader European context. For those looking at a wider investment strategy, you can explore our guide on the best countries for property investment to compare different markets.

Choosing the Right Loan Type

French mortgages come in several forms, but the most common are fixed-rate loans (prêt à taux fixe). These are popular for a reason: they offer predictability. Your monthly payment remains the same for the entire loan term, which can be up to 25 years. While variable-rate loans exist, they are far less common for residential purchases because of their inherent uncertainty. Taking the time to secure your finances properly is the bedrock of a successful and stress-free search for your perfect home in Paris.

Understanding the French Property Buying Timeline

Buying a home in Paris isn't like buying one in the UK or the US. The process here is a well-choreographed dance of legal steps, and knowing the rhythm is key to a smooth transaction. From the moment you make an offer to finally getting the keys, every stage is governed by French law and guided by a legal expert.

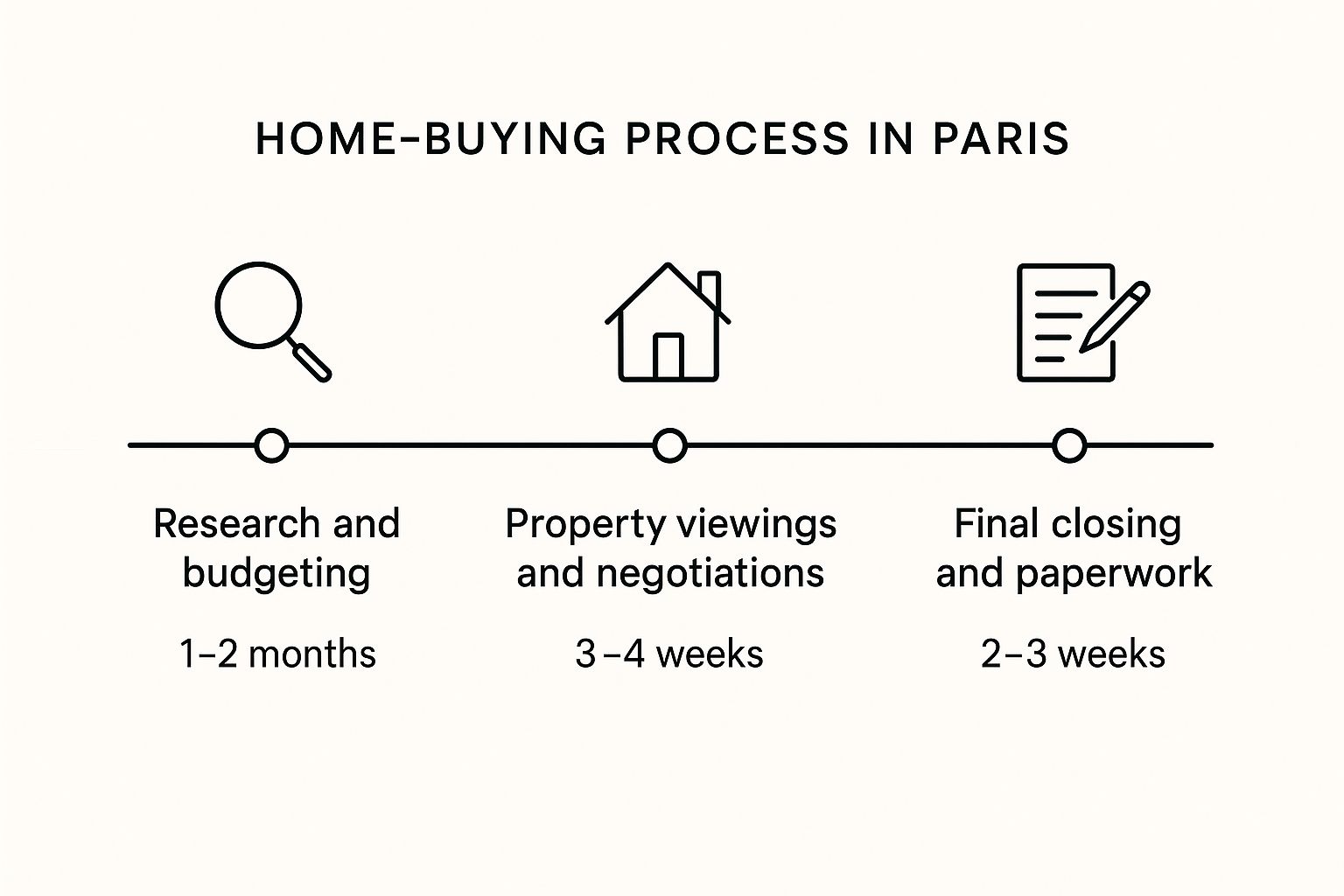

This visual gives you a great snapshot of the entire journey, from that initial dream to the final closing.

As you can tell, once the excitement of finding your perfect apartment subsides, the real work—the legal and financial paperwork—truly begins.

From Your Offer to the First Contract

So, you've found the one. The first official move is to submit a written offer, known as an 'offre d'achat'. This isn't just a number; it's a formal document where you lay out your price and any specific conditions, or clauses suspensives. The most common condition, by far, is making the purchase contingent on securing your mortgage.

When the seller accepts, you move on to the next major milestone: signing the 'compromis de vente'. This is the preliminary sales agreement, and once signed, it legally binds the seller to you. It's an incredibly important document that locks in all the sale details, including:

- A complete description of the property

- The final, agreed-upon price

- All your conditional clauses (like getting financing)

- An estimated date for the final sale

- The stack of mandatory diagnostic reports, called the Dossier de Diagnostic Technique (DDT)

This is also when you'll pay the deposit, which is usually between 5% and 10% of the purchase price. Don't worry, your money doesn't go to the seller directly; it’s held securely in an escrow account managed by the notaire.

The Cooling-Off Period and the Notaire's Vital Role

After you and the seller have both signed the compromis de vente, French law gives you, the buyer, a fantastic piece of protection: a 10-day cooling-off period, or délai de rétractation. During these ten days, you can walk away from the deal for any reason at all—no questions asked—and get your full deposit back. The seller, however, doesn't get this luxury. Once they sign, they're committed.

The entire transaction is overseen by a 'notaire'. A notaire isn't just a lawyer; they are a public official appointed by the Ministry of Justice to ensure the whole process is legal and above board. They act as a neutral party, drafting the legal documents, doing the due diligence (like checking the property title is clean), and making sure all taxes are paid.

I often get asked if the buyer and seller need their own notaires. While you absolutely can have your own, it’s very common for both parties to use a single notaire to streamline the process. The fees are fixed by law, so if you do use two, they simply split the fee. No extra cost to you.

Sealing the Deal with the Acte de Vente

The gap between signing the compromis and the final sale usually takes about two to three months. This period gives you the breathing room to finalize your mortgage and for the notaire to complete all the necessary legal checks and balances.

Once all your conditions have been met and the notaire has done their work, you'll be called to their office to sign the final deed of sale: the 'acte de vente'. This is the big moment. The property officially becomes yours. On this day, you'll transfer the remaining purchase price, along with the notaire's fees and related taxes.

Speaking of those fees, make sure you budget for them. These costs, often bundled together as frais de notaire, typically run about 7-8% of the property's price for an existing home. They're a mix of state taxes and the notaire's actual payment. After the signing ceremony, the notaire registers the deed with the French land registry, and you'll finally be handed the keys to your new Paris home.

To help you visualize this journey, here’s a simplified breakdown of the key stages you’ll encounter.

| Stage | Key Document/Action | Typical Duration |

|---|---|---|

| Offer and Acceptance | Submit written offre d'achat |

1-2 weeks |

| Preliminary Contract | Sign the compromis de vente & pay deposit |

2-4 weeks after offer |

| Cooling-Off Period | Buyer has délai de rétractation |

10 days post-compromis |

| Due Diligence | Buyer secures financing; notaire performs checks |

2-3 months |

| Final Closing | Sign the acte de vente & transfer final funds |

At the end of due diligence |

| Receiving the Keys | Keys handed over upon signing the acte de vente |

Immediately |

This table maps out the main milestones, giving you a clear path from your initial offer to unlocking your new front door. Each step is a crucial part of a system designed to protect both buyer and seller.

Insider Tips For A Successful Purchase

Knowing the official steps to buy property in Paris is one thing. Making a genuinely smart purchase is another art entirely. The real wins are found in the details—the unwritten rules, the cultural nuances, and the hard-won wisdom from those who have been through it before. This is where you move beyond the checklist and start thinking like a seasoned Parisian buyer.

Turning your search for a house paris sale into a rewarding investment means learning to see what others miss and understanding the subtleties of the local market. It’s about asking the right questions to avoid those common, costly mistakes that can quickly turn a dream into a financial headache.

Mastering The Art Of Negotiation

Forget what you might have seen in other markets; negotiating on a property in Paris is rarely an aggressive, low-ball affair. It's more of a delicate dance, one that’s guided by market realities, the property's true condition, and the seller's personal situation. A stabilizing market, like the one we're seeing now, definitely offers more room for discussion than a rapidly climbing one.

Having solid data is your best tool. The Chambre de Notaires de Paris recently reported that while the city saw a 10% dip in annual home sales compared to 2023, that's still less severe than the 13% drop across the greater Île-de-France region. With average prices settling around €9,470 per square meter and experts pointing to an "end of the correction phase," your negotiation strategy has to be grounded in these current values. You can get a deeper dive into this shift in the 2024-2025 analysis by Paris Property Group.

Use objective facts to build your case. A poor DPE (Energy Performance Certificate) rating, for example, isn't just a talking point—it's a quantifiable future expense. Go out and get actual quotes for necessary upgrades, like replacing old windows or adding insulation. Presenting these figures gives your offer a logical foundation that’s much harder for a seller to dismiss.

What To Look For During Viewings

When you step inside a potential home, your job is to look right past the staged furniture and fresh coat of paint. You need to focus on the building’s bones and the practical realities of actually living there.

Train your eye to spot these critical details:

- Signs of Dampness: Look for stained ceilings, peeling paint, or a musty smell. This is especially important in ground-floor or top-floor apartments.

- Window Quality: Are the windows single or double-glazed? Old, single-paned windows are a huge source of heat loss and will drive up your energy bills.

- The Electrical System: Take a peek at the fuse box. If it's an old-fashioned one with ceramic fuses, that's a red flag. It almost certainly means the entire electrical system needs a costly, modern update.

- Noise Levels: Don't just visit once. The quiet, charming street you saw on a Tuesday morning might transform into a noisy hotspot on a Friday night.

A classic pitfall is falling for the "charm" of an old building while completely ignoring the practical costs. That beautiful, centuries-old parquet floor might look incredible, but if it comes with an ancient plumbing system and drafty windows, your budget has to reflect that reality.

Navigating Copropriété Complexities

Most apartments in Paris are part of a 'copropriété', or co-ownership. When you buy a flat, you're not just buying a home; you're buying into a community with shared responsibilities, rules, and finances. Before you even think about making an offer, you absolutely must review the minutes from the last three years of the annual general meetings (assemblées générales).

This paperwork, while often dense and entirely in French, is a goldmine of crucial information. It reveals things like:

- Upcoming Major Works: Is the building planning an expensive facade renovation (ravalement de façade) or a new roof? These costs are passed directly to the owners.

- Internal Disputes: Are there ongoing legal battles between residents or with the managing agent (syndic)? This can signal a poorly managed and stressful living environment.

- Financial Health: Does the copropriété have a healthy reserve fund, or is it struggling with debt?

Failing to review these documents—or misinterpreting them—is one of the single biggest risks in the Parisian market. If your French isn't up to the task, hiring a professional to review them for you is an investment that can save you from unforeseen expenses that easily run into the tens of thousands of euros. This is the kind of diligence that separates a good purchase from a truly great one.

Common Questions About Buying In Paris

Jumping into the Parisian property market for the first time? It's natural to have a lot of questions, especially when you're dealing with a system that might be completely new to you. Getting solid answers to the most common concerns is the best way to build the confidence you need to find that perfect house paris sale.

Let's walk through some of the questions I hear most often from buyers just like you.

Can Foreigners Actually Buy Property in Paris?

Yes, absolutely. This is usually the first question people ask, and the answer is a resounding yes. There are no restrictions stopping foreigners from buying property in France. That dream of owning a slice of Paris is open to everyone, no matter your nationality.

That said, the path can look a little different, especially if you're not an EU resident. Banks might scrutinize your financial paperwork more closely and want more details about where your down payment is coming from. This is where having the right team is crucial. I can't stress this enough: work with a real estate agent and a notaire who have real, hands-on experience with international buyers. It makes all the difference.

What’s the Real Cost, Beyond the Listing Price?

The number on the property listing is just the starting point. The biggest additional cost you'll face is what the French call the frais de notaire, or notary fees. For a pre-owned home, you can expect these to add 7-8% to the purchase price.

Now, a lot of people think that entire 7-8% goes into the notaire's pocket, but that's a common misunderstanding. The truth is, the vast majority of that fee is actually a bundle of taxes paid directly to the government, like the property transfer tax. The notaire's personal fee is only about 1% of the total.

On top of that, remember to budget for potential mortgage broker fees and always, always have a contingency fund for those inevitable immediate repairs or small renovations.

How Important Is the Preliminary Contract?

The compromis de vente is a huge milestone in the buying process. This is the first legally binding agreement you’ll sign, and it essentially locks in both you and the seller. It’s a serious commitment, but it comes with some powerful protections for you, the buyer.

Once everyone has signed, you are legally granted a 10-day cooling-off period. This is your get-out-of-jail-free card. During these 10 days, you can walk away from the deal for any reason at all, with no questions asked and no financial penalty.

After that window closes, pulling out means you'll almost certainly lose your deposit, which is typically between 5-10% of the purchase price. The only way you’d get it back is if one of the specific conditions in the contract—like getting your mortgage approved—isn't met.

Think of the compromis de vente as the point of no return for the seller, but a final chance for reflection for the buyer. It solidifies the deal while giving you a last, penalty-free opportunity to be absolutely certain of your decision.

Understanding these kinds of legal steps is a key part of planning a future in Europe. If you're weighing your options, you might find our guide on the best places to retire in Europe helpful, as it explores similar lifestyle and legal details in other countries.

Why Is Everyone Talking About the Energy Certificate?

The Diagnostic de Performance Énergétique (DPE), or Energy Performance Certificate, has quickly become one of the most vital documents in a property sale. It grades a home’s energy efficiency on a scale from A (excellent) down to G (terrible).

This isn't just bureaucratic red tape; this rating has serious real-world consequences. Here’s why it’s so important now:

- Your Future Bills: A poor rating, especially an F or G, is a huge red flag for high energy costs down the line. It also signals that the property will likely need expensive, mandatory upgrades to its heating, windows, or insulation.

- Your Ability to Rent: French law is cracking down hard on energy-inefficient properties. Apartments rated G are already banned from being rented out, and F-rated properties are next. If you're thinking of this as an investment, the DPE can make or break your plan.

- Your Negotiating Power: A bad DPE isn't just a problem; it's leverage. It gives you a solid, data-backed reason to negotiate the asking price down to account for the money you'll have to spend on upgrades.

My advice? Always ask to see the DPE report as early as possible. It gives you an instant snapshot of the property's hidden costs and long-term viability.

At Residaro, we’re committed to making your search for a home in Europe an exciting and transparent journey. Our platform features a curated selection of properties across France, Italy, Spain, and Portugal, giving you all the details you need to buy with confidence. Explore our extensive portfolio of European properties and let's get started.