Buy Property in Costa Brava: Your Ultimate Guide

So, you’re thinking about buying property in Costa Brava. It’s an incredible choice, but it's also a fiercely competitive and desirable market. We're talking about a place where breathtaking sea views and centuries-old charm come with a premium price tag. What makes it so unique is the mix of intense international demand and some of the strictest building regulations in Spain, which creates a very particular investment environment. You'll need a good dose of local insight to navigate it successfully.

Decoding the Costa Brava Property Market

Before you even think about scrolling through listings, it’s vital to get a feel for the unique dynamics of the Costa Brava real estate scene. This isn't just any old stretch of Spanish coastline. It’s a mosaic of fiercely protected landscapes and exclusive enclaves, and that has a direct impact on both property availability and value.

The market here really tells a tale of two different worlds. You have the ultra-premium, "front-row" hotspots, and then you have areas that offer much better value without forcing you to give up that authentic Catalan lifestyle you're probably dreaming of.

The Premium Hotspots

Towns like Begur, with its iconic clifftop castle, and the famously artistic village of Cadaqués are the poster children for the high-end market. Here, strict building laws are rigorously enforced to preserve the region's raw natural beauty and historic character. This deliberate limit on new construction is a double-edged sword for anyone looking to buy.

The big plus? Properties in these areas tend to hold their value incredibly well, almost acting as a shield against wider market wobbles. The downside, of course, is that you'll face intense competition and prices that are noticeably higher than the regional average.

This scarcity, coupled with unwavering demand, is what makes the market so resilient. The Costa Brava property market has shown steady growth through 2024 and into 2025, particularly in these coveted locations like Begur, Cadaqués, and Platja d’Aro, which pull in affluent buyers from both Spain and abroad.

Finding Value and Opportunity

If you're looking for a more accessible way in, don't worry, there are fantastic options. Vibrant towns like the fishing port of Palamós or the charming inland villages of the Baix Empordà region present really compelling opportunities.

These areas often have a more authentic, year-round community feel and a gentler price tag. Best of all, you still have excellent access to the coast’s best beaches and amenities. It's a smart compromise.

Understanding these local nuances is absolutely crucial when you buy property in Costa Brava. Your budget will stretch much, much further in a lively town than it will in a secluded, high-demand cove.

A huge chunk of the demand comes from international buyers, especially from France, the Netherlands, Germany, and the UK. This global interest adds another layer of competition, but it also solidifies the region's reputation as a world-class destination. If you're weighing your options globally, it can be useful to see how different countries stack up. For a wider view, take a look at our guide on the best countries to buy property.

Ultimately, the most powerful tool you have is a set of realistic expectations. Property value growth here is steady and sustainable, not speculative. It's driven by an enduring appeal that has captivated people for generations, not by fleeting trends. You're investing in a lifestyle and a location with a proven track record.

Finding Your Perfect Costa Brava Town

The Costa Brava, or "Wild Coast," isn't one uniform place. It's a vibrant tapestry of individual towns and villages, each with its own distinct character. When you decide to buy property costa brava, you're not just picking a house; you're choosing a lifestyle. The experience of living in glamorous, buzzing Platja d’Aro is worlds away from the quiet, artistic soul of Cadaqués.

Getting a feel for this place is key. It's about finding the spot that clicks with you.

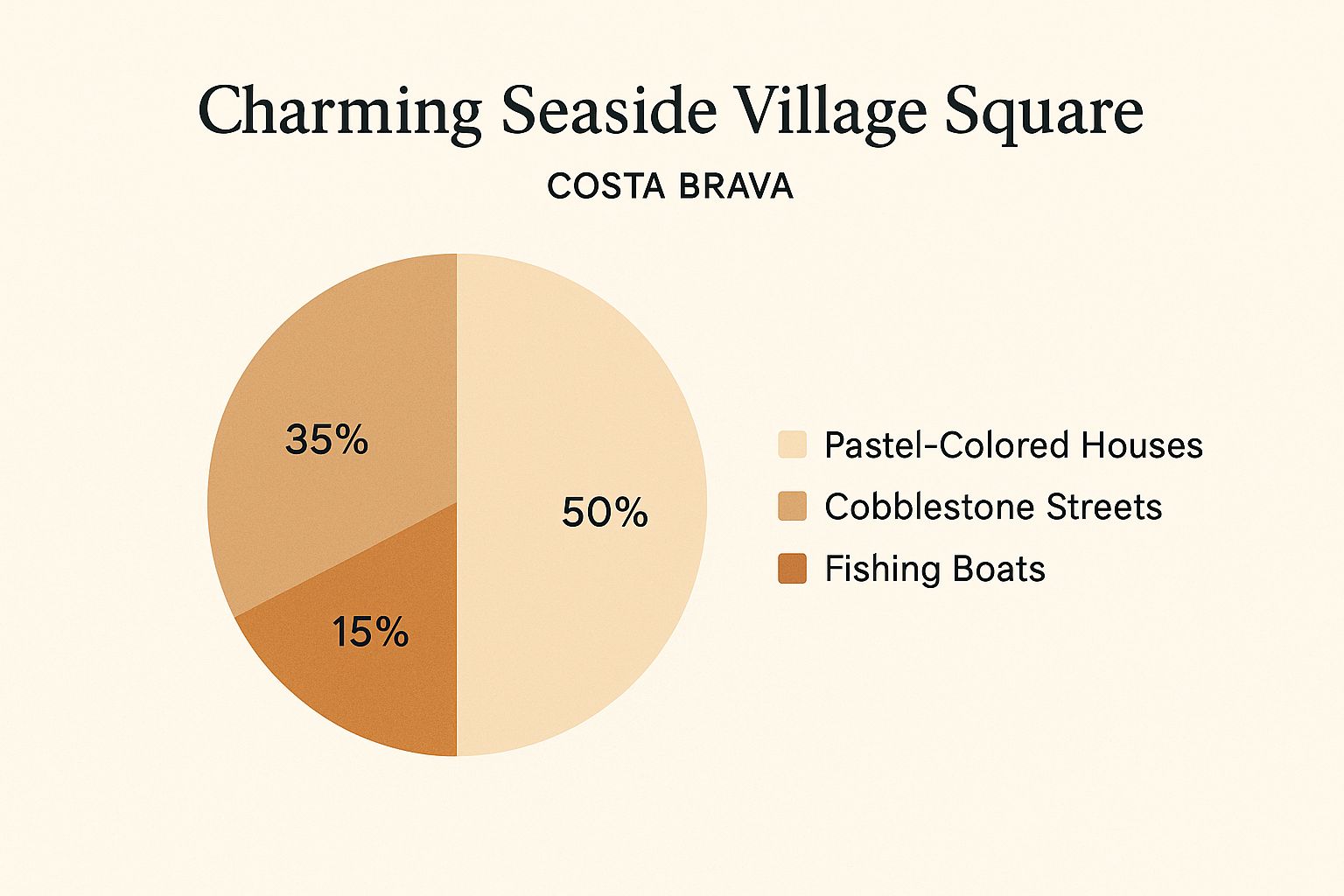

This image really captures that quintessential vibe—the old-world architecture, the sparkling sea just steps away, and that sense of a close-knit community that pulls so many people to this coastline. To find your perfect match, you need to dig deeper than just pretty pictures and think about what your daily life will actually look and feel like.

For the Lovers of Glamour and Buzz

If your perfect day includes boutique shopping, upscale dining, and a vibrant social scene that keeps going all summer long, then Platja d’Aro should be on your radar. It’s the coast's hub for modern, polished apartments and sleek villas. It absolutely buzzes with energy from June to September, but be aware that it quiets down significantly once the summer crowds head home.

For the History and Culture Aficionados

Do you picture yourself living among centuries of history, with medieval stone walls and dramatic castle views? Then Begur is your place. It sits majestically on a hilltop, offering incredible panoramic views and serving as a gateway to some of the coast's most beautiful hidden coves, or calas. The property here is on the premium side, mostly consisting of beautifully restored townhouses and private villas tucked into the hills.

A crucial point about Begur is its year-round appeal. Unlike some resort towns that shut down in winter, Begur maintains a lively, charming community with local markets and restaurants staying open. This is a huge plus for anyone looking for more than just a summer home.

Another spot that's rich in culture is the iconic Cadaqués. Forever linked to Salvador Dalí, its maze of whitewashed buildings and bohemian vibe draws an artistic, international set. Its remote location and protected status mean properties are rare, exclusive, and always in high demand.

For Authentic Coastal Living

If you're after the charm of an authentic fishing village that's family-friendly and lively all year, look no further than Palamós. It's a genuine working town with a bustling port, a fantastic daily fish market, and a wonderful promenade for evening strolls. It feels real. Property here is varied, offering everything from modern apartments with bay views to traditional homes in quiet residential streets.

To help you visualize where you might fit best, I've put together a quick comparison of these popular towns. Each offers a different slice of Costa Brava life.

Comparing Popular Towns in Costa Brava

| Town | Vibe & Lifestyle | Typical Property Price | Best For |

|---|---|---|---|

| Platja d’Aro | Modern, high-energy, seasonal buzz | Mid to High | Summer residents, nightlife, modern amenities |

| Begur | Historic, chic, year-round charm | High | Stunning views, historic home lovers, access to coves |

| Cadaqués | Artistic, bohemian, exclusive | Very High | Creatives, privacy seekers, iconic scenery |

| Palamós | Authentic, family-friendly, working town | Mid-Range | Year-round living, families, authentic Spanish life |

Ultimately, choosing the right town is a deeply personal decision. While some are drawn to luxury and exclusivity, others are looking for great value. If budget is a primary concern, our guide on finding cheap houses in Spain provides some excellent tips that can help you narrow your search.

My best advice? There’s no substitute for firsthand experience. Visit these towns, not just in the sunny peak of August but in the quieter months, too. That’s the only way to truly discover which one feels like home.

Making an Offer and Navigating the Purchase Process

So, you've found the perfect spot in your chosen town. The dreaming part is over, and it's time to make it happen. While the Spanish purchase process has its own unique quirks, it’s a well-trodden path. It all kicks off the moment you decide to put an offer on the table.

Your first offer is more than just a number; it’s the opening line in a negotiation. Don't hesitate to make a serious, well-reasoned offer below the asking price. Most sellers, especially in a market as internationally diverse as the Costa Brava, anticipate a bit of haggling. This is where a sharp local agent proves their worth—they know the market's pulse and can help you craft a winning strategy.

The All-Important Deposit Contract

Once you get a verbal "yes" on your offer, things get serious with the 'Contrato de Arras', or the deposit contract. Honestly, this is probably the most critical document you'll sign before the final closing day.

When you sign this agreement, you'll hand over a deposit, which is almost always 10% of the final purchase price. This isn't just a simple holding fee; it’s a legally binding commitment from both you and the seller.

A Word of Caution: The 'Contrato de Arras' carries real legal teeth. If you, the buyer, decide to walk away after signing, you forfeit that entire 10% deposit. On the flip side, if the seller gets cold feet and backs out, they are legally required to pay you back double your deposit.

This contract effectively locks in the property for you, takes it off the market, and sets a deadline for the final sale. This gives your lawyer the breathing room they need to complete all the necessary legal checks.

Completion Day at the Notary's Office

The final step is the signing of the 'Escritura de Compraventa' (the public deed of sale) at a notary's office. This is the big day—the moment the property officially and legally becomes yours.

Here’s a quick rundown of what happens:

- Final Payments: You'll settle the remaining 90% of the property price. This is usually done with a Spanish banker's draft.

- Signing the Deed: You, the seller, and your legal reps will all sign the official deed in the notary's presence, who acts as an impartial official verifying the transaction.

- Getting the Keys: Once the paperwork is signed and the funds are confirmed, the seller hands over the keys. Congratulations, you're now a homeowner in the Costa Brava!

This procedure is fairly standard across all of Spain. Many of our clients also look at other beautiful coastlines, and it helps to know the processes are similar. If you're comparing your options, our guide to purchasing property on the Costa del Sol is a great place to see how things line up.

Looking ahead, 2025 is shaping up to show continued but more stable growth in Costa Brava. You can expect apartment prices to hover between €2,825-€2,988 per square meter, while houses are in the €2,473-€2,651 range. With international buyers making up a steady 29% of the market, it shows a healthy, mature demand. For a deeper dive, you can see the full Costa Brava price forecasts on Investropa.com.

Getting to Grips with Spanish Property Law and Finances

When you decide to buy a home in Spain, you're stepping into a completely different legal and financial world. Honestly, figuring this part out early on will save you a world of headaches later. It’s the key to making sure your dream of owning a place on the Costa Brava doesn't turn into a bureaucratic nightmare.

First things first: you absolutely must get a NIE (Número de Identificación de Extranjero). This is a tax ID number for foreigners, and you can't do anything significant—not even open a bank account—without one. My advice? Start this process the moment you get serious about buying. It can take a few weeks, and you don’t want it holding you up.

Checking the Paperwork and Bracing for Taxes

Once you’ve found a property that steals your heart, your lawyer’s first move should be to pull the 'Nota Simple' from the Land Registry. This document is non-negotiable. It gives you a complete snapshot of the property's legal health, confirming the official owner and, critically, flagging any debts or liens. A clean Nota Simple is your green light.

Now, let's talk about the biggest expense after the house itself: the taxes. The type of tax you pay depends entirely on whether you're buying a pre-owned home or one that’s brand new.

- Property Transfer Tax (ITP): This applies to resale homes. In Catalonia, the ITP is progressive. You’ll pay a 10% tax on the portion of the price up to €600,000, with higher rates kicking in for values above that.

- VAT (IVA) & Stamp Duty (AJD): If you're buying a new build directly from a developer, you'll pay 10% VAT (called IVA) plus a Stamp Duty tax (AJD), which usually comes in around 1.5%.

And that's not all. You’ll also have to cover the closing costs, which typically tack on another 2-4% of the purchase price. This bucket of fees includes what you’ll pay the notary, the property registry, and of course, your lawyer.

Here’s a piece of advice I give all my clients: budget for an extra 12-15% of the purchase price to cover all taxes and fees. That way, there are no nasty financial surprises when it's time to sign the final papers.

How Mortgages Work for Non-Residents

If you plan on financing your purchase, you’ll find that Spanish banks are quite open to lending to non-residents, but the rules are stricter. A Spanish resident might be able to borrow up to 80% of the property’s value, but as a non-resident, you should expect to be offered a loan-to-value (LTV) ratio closer to 60-70%.

This means you need to come to the table with a substantial down payment—at least 30-40% of the purchase price, plus all the funds for taxes and fees we just discussed.

To get the ball rolling on a mortgage application, you'll need to gather a stack of documents:

- Your NIE number

- Proof of your income (tax returns, employment contract)

- Bank statements going back at least 6-12 months

- A recent credit report from your home country

It's worth noting that the entire Catalan real estate market, including the Costa Brava, is buzzing right now. We’re seeing projections for investment growth of 15–20% in 2025, potentially reaching €3 billion. This energy is fueled by a return of international buyers and better financing conditions. You can read a detailed 2025 Catalan real estate market forecast to understand the dynamics. In a competitive market like this, having your finances sorted out from the very beginning puts you in a much stronger position.

Building Your Professional Support Team

When you decide to buy property in Costa Brava, the single most important investment you'll make isn't the villa or apartment itself—it's the team of professionals you assemble. Trying to navigate the process alone, or worse, relying on the people recommended by the seller's agent, is a recipe for disaster. You need your own crew of independent experts who have one loyalty: you.

Think of it as building your personal advisory board. The Spanish property system has its own unique quirks and legal maze. Having the right people in your corner is the difference between a smooth, secure purchase and a costly nightmare. This isn't just about making things easier; it's about protecting your investment from start to finish.

Your Key Players

Putting together your A-team means hand-picking specialists for a few critical roles. Each one brings something vital to the table, and it’s crucial they all work independently from the seller's side of the deal.

Here’s who you absolutely need in your corner:

- A Buyer-Focused Real Estate Agent (Inmobiliaria): Look for an agent who genuinely listens to what you want and is committed to representing your interests, not just pushing for a quick commission. They are your boots on the ground.

- An Independent Lawyer (Abogado): This is the one person you cannot skip. Your abogado must be 100% independent from both the seller and the real estate agency. Their sole job is to perform due diligence, scrutinize every contract, and verify that the property is clean—no hidden debts, no legal complications.

- A Mortgage Advisor: If you’re planning on financing your purchase, a sharp mortgage advisor is invaluable. They know the ins and outs of the Spanish banking system and can hunt down the best mortgage rates and terms for non-residents, which can be a tricky landscape to navigate on your own.

- A Notary (Notario): The notary is a neutral, state-appointed official, but their role is fundamental. The notario formally witnesses the signing of the final deed (escritura), certifies the legality of the entire transaction, and makes sure all the necessary taxes are calculated and paid correctly.

When you're interviewing a lawyer, ask this question point-blank: "Have you ever worked with or received referrals from the real estate agency or the seller involved in this deal?" If the answer is yes, that's a major red flag. You're paying for unbiased legal protection, not a cozy relationship.

Vetting Your Team and Spotting Red Flags

Choosing these people isn't something to rush. When you're interviewing candidates for your team, be direct. Ask them about their experience working with international buyers. Ask about their specific expertise in the Costa Brava market and get a clear, written breakdown of their fees upfront.

You should be wary of anyone who makes you feel pressured or seems annoyed by your questions. A real professional will be patient, transparent, and happy to explain things. The ultimate goal is to build a team that gives you total peace of mind, turning what can be a daunting process into a secure and genuinely exciting journey.

Your Costa Brava Questions, Answered

Even with the best-laid plans, buying property abroad always brings up those last-minute, nagging questions. It’s completely normal. After guiding countless clients through their Costa Brava purchases, I've heard them all. Let's walk through some of the most common ones to clear up any lingering doubts.

Think of this as our final chat over coffee before you take the plunge, making sure every little detail is crystal clear.

Do I Really Need a Spanish Bank Account?

In a word, yes. Trying to buy property here without one is nearly impossible. A Spanish bank account is the backbone of the entire transaction. You'll use it to transfer the final funds for the purchase, handle all the taxes and notary fees, and, just as importantly, set up your utilities like water, electricity, and internet.

The good news? It's not a huge hurdle. For non-residents, opening an account is usually straightforward. You'll just need your NIE number and passport. My advice is to get this done early on; it's a small step that prevents major headaches down the road.

What Should I Budget for Annual Running Costs?

Once you have the keys, your financial responsibilities don't just stop. It's crucial to have a realistic picture of what it will cost to maintain your new home year after year so there are no unpleasant surprises.

As a practical rule of thumb, I always tell my clients to budget around 1.5% to 2% of the property’s value annually. This figure generally covers all the recurring expenses comfortably.

Here’s what that budget typically includes:

- Property Tax (IBI): This is the local council tax, paid annually. It's the Spanish equivalent of property taxes you'd find in the UK or the US.

- Community Fees (Comunidad): If your property is part of a complex with shared amenities—like a pool, gardens, or tennis courts—you'll contribute to their upkeep through these fees.

- Non-Resident Income Tax (IRNR): This is a national tax that catches many people off guard. You have to pay it even if you don't rent out your property, as it's based on the "imputed" or potential rental value of your home.

Can I Still Get a Golden Visa Through Property?

Yes, for now, the Golden Visa program is still an option and a very popular one for non-EU buyers. It offers a path to Spanish residency for you and your immediate family when you purchase real estate worth €500,000 or more. The critical catch is that this amount must be invested free of any mortgage financing.

This visa is highly sought-after because it allows you to live in Spain and travel freely across the Schengen Area. However, the program has been a topic of political debate recently, and its rules could change. For this reason, it's absolutely essential to work with an immigration lawyer who specializes in this area. They'll have the most up-to-date information and can ensure your application is handled perfectly.

Ready to find your dream home on the Spanish coast? At Residaro, we offer a curated selection of beautiful properties across the Costa Brava and other top European destinations. Start your search today and let us help you turn your vision into reality.