Retirement Homes Portugal: Your Ultimate Guide to Retirement

Portugal has become one of the world's most sought-after spots for retirees, and it's easy to see why. It's a place that perfectly balances affordability, safety, and an incredible quality of life. For anyone dreaming of retirement homes in Portugal, the country delivers on all fronts: fantastic weather, top-notch healthcare, and a culture that welcomes you with open arms. It’s the full package for a peaceful and rewarding retirement.

Why Portugal Is a Premier Retirement Destination

Picture this: you wake up to a soft Atlantic breeze, wander through historic cobblestone streets in the afternoon, and cap off the day with unbelievably fresh seafood and a glass of local wine. This isn't just a postcard fantasy—it's the daily reality for countless retirees who've made Portugal their home. The country’s magic isn't just one thing; it's a powerful mix of factors that create an almost perfect setting for your golden years.

At its heart, Portugal offers an exceptional quality of life that’s becoming harder and harder to find. It’s consistently ranked among the safest countries on the globe, which brings a priceless sense of security and calm. That peace of mind lets you dive headfirst into the vibrant local culture and connect with the warm, friendly communities.

A Climate for Well-Being

With over 300 days of sunshine a year, especially in the beloved Algarve region, the weather is a huge draw. This isn't just about comfort; the temperate Mediterranean climate encourages you to get outside and stay active all year long. Whether you love golfing on world-class courses, hiking breathtaking coastal trails, or just sipping a coffee at a sunny sidewalk café, the climate is on your side.

The Financial Advantage

Beyond the beautiful scenery, the math just works. The cost of living here is noticeably lower than in most other Western European countries and North America. This means your retirement nest egg goes much further, paving the way for a comfortable life without the constant financial stress. In practical terms, that translates to more travel, more meals out, and more freedom to explore your hobbies.

It's not just word-of-mouth, either. Global Citizen Solutions Intelligence Unit officially named Portugal the world's best retirement destination for 2025, giving it an impressive score of 92.61 out of 100. This top honor was earned for its high marks in quality of life, safety, and how well expats integrate. Discover more about Portugal's top retirement ranking.

This unique combination of real-world benefits makes a powerful argument for choosing retirement homes Portugal. It's a country where you can live well, stay active, and truly feel at home as you start an exciting new chapter.

Discovering Portugal's Top Retirement Regions

Choosing where to put down roots is easily one of the most exciting parts of planning a move to Portugal. The country’s incredible diversity means you can find a place that perfectly suits your rhythm, whether that’s the nonstop energy of a capital city or the quiet calm of a fishing village.

Each region has its own distinct personality and lifestyle. So, let's dive into some of the most popular spots for retirees to help you find the perfect backdrop for your next chapter. This is about more than just finding a house; it's about discovering a community where you feel you truly belong.

Lisbon: The Vibrant Cultural Heart

Portugal's capital is a city that’s constantly buzzing. Lisbon is a captivating mix of historic soul and modern, cosmopolitan flair, making it an incredible choice for retirees who want to stay active and engaged. Picture yourself wandering its famous cobblestone streets, pausing in grand plazas, and soaking in the stunning hilltop views over the Tagus River.

Life here is never dull. Your days could be filled with exploring world-class museums, getting lost in the sound of Fado music in the Alfama district, or grabbing a bite at the incredible Time Out Market. Thanks to Lisbon's fantastic public transport, you really don't need a car, and the international airport puts all of Europe at your doorstep.

Lisbon is a perfect fit for the energetic, culture-hungry retiree. While the cost of living is a bit higher than elsewhere in Portugal, it's still refreshingly affordable compared to most other major European capitals.

The Algarve: Sun-Soaked Coastal Living

When most people dream of retiring to Portugal, the Algarve is usually what they’re picturing. This southern-most region is legendary for its golden beaches, dramatic cliffs, and an almost unbelievable 300+ days of sunshine a year. It’s an absolute haven for anyone wanting a relaxed life centered around the outdoors.

The Algarve is also home to a huge and well-established international community, which makes settling in and making friends incredibly easy. English is widely spoken, and the entire area is geared toward expats, with fantastic golf courses, marinas, and social clubs.

From the lively resort town of Albufeira to the quieter, more traditional village of Tavira, the Algarve offers a whole spectrum of experiences. It's the ideal spot for sun-seekers, golfers, and anyone whose heart belongs to the sea.

Towns like Lagos, for example, offer that perfect blend of history and stunning coastline. If that sounds appealing, you can explore the real estate market in Lagos to get a feel for what’s available.

Porto: Traditional Charm on the Douro

Head north and you’ll find Porto, Portugal's second city, which offers a completely different but equally enchanting retirement. Known for its world-famous Port wine, the beautiful Ribeira riverside district, and stunning baroque architecture, Porto moves at a gentler, more thoughtful pace than Lisbon.

It’s a city with a deep, authentic soul. Retirees here fall in love with the strong sense of community, the phenomenal food scene, and a cost of living that's noticeably lower than the capital's. Plus, the breathtaking Douro Valley—a UNESCO World Heritage site—is right on your doorstep, offering endless opportunities for weekend exploring.

Porto is for those who appreciate history, art, and a more traditional Portuguese way of life. It’s a place where you get all the benefits of city living without the frantic pace.

Cascais: Sophisticated Seaside Elegance

Just a short and scenic train ride from Lisbon, the old fishing village of Cascais has blossomed into a chic and sophisticated coastal town. It truly offers the best of both worlds: you get the relaxed vibe of a beach town with a quick, easy connection to all the cultural action in the capital.

Cascais is known for its elegant marina, pristine sandy beaches, and gorgeous public parks. It draws a discerning crowd of locals and expats who appreciate its polished yet laid-back atmosphere. While it's definitely one of the pricier areas in Portugal, the exceptional quality of life it delivers is undeniable.

Breaking Down the Cost of Retiring in Portugal

One of the most powerful draws of retiring in Portugal is, without a doubt, its affordability. It’s a country where your retirement savings can stretch much further, all without forcing you to skimp on the quality of life you've worked so hard for. So, what do the numbers actually look like on the ground? Getting a handle on the real-world costs is the first step to crafting a solid financial plan for your move.

Generally speaking, life here is significantly less expensive than in North America or much of Western Europe. A retired couple can live quite comfortably in most parts of the country for somewhere between €1,800 and €3,200 per month. Of course, this is a ballpark figure—your actual spending will hinge on your lifestyle and, most importantly, where you decide to plant your roots. Living in a bustling hub like Lisbon will naturally push you toward the higher end of that range, while life in a smaller town offers a more relaxed pace for your wallet.

This financial breathing room is a huge part of why Portugal has shot to the top of so many retirement wish lists. You can genuinely enjoy a high standard of living—think regular dinners out, weekend trips, and indulging in hobbies—without the constant financial strain you might feel back home.

Daily Expenses and Your Buying Power

Your day-to-day spending is where you'll really feel the difference. Groceries, utilities, and hopping on public transport are all refreshingly affordable. A typical weekly grocery run for two people might set you back around €120, and that often includes a few bottles of excellent local wine, which you can easily find for just €3-€8 a bottle at the supermarket.

This affordability gives your money some serious local purchasing power. Portugal isn't just cheap; it offers incredible value, even when stacked against other popular retirement spots. As of 2025, over 70,000 American retirees call Portugal home, many drawn by this very benefit. To put it in perspective, consumer prices (not including rent) are about 15% lower than in Costa Rica. Even better, groceries are roughly 35% cheaper, and your overall local purchasing power in Portugal is nearly 20% greater. You can explore more comparisons on retirement living costs to see the full picture.

What these numbers really mean is that your pension or retirement income simply has more muscle here, paving the way for a more comfortable and financially secure life.

The Property Market: Renting Versus Buying

Housing will almost certainly be your biggest line item each month, whether you choose to rent or buy one of the fantastic retirement homes Portugal has available. The market is incredibly diverse and changes dramatically from one region to the next, so doing your homework is key.

Renting is a smart move when you first arrive. It gives you the flexibility to test out an area and get a real feel for the local lifestyle before making a long-term commitment. In Lisbon's city center, a one-bedroom apartment can go for €800 to €1,500 a month. Head to a charming village in the Algarve or a smaller city up north, and you could find a similar place for a much more palatable €600 to €900.

Buying property as a foreigner is a relatively straightforward process here, but be aware that prices have been climbing steadily, particularly in popular expat-heavy areas.

Estimated Monthly Cost of Living for a Retiree Couple

To give you a clearer idea of how these costs break down, we've put together a sample monthly budget for a retired couple. Keep in mind that this is just an estimate—your personal spending habits will be the biggest factor.

| Expense Category | Lisbon (Capital City) | Porto (Northern Hub) | The Algarve (Coastal Region) |

|---|---|---|---|

| Rent (1-Bed Apt) | €1,000 - €1,500 | €800 - €1,200 | €700 - €1,100 |

| Utilities & Internet | €150 - €200 | €140 - €180 | €160 - €220 |

| Groceries | €450 - €550 | €400 - €500 | €400 - €500 |

| Dining & Leisure | €400 - €600 | €350 - €500 | €350 - €550 |

| Transportation | €50 - €100 | €40 - €80 | €100 - €150 (Car) |

| Estimated Total | €2,050 - €2,950 | €1,730 - €2,460 | €1,710 - €2,520 |

As you can see, your choice of location plays a huge role in your monthly budget. Portugal truly offers a financially viable path to an incredible retirement. With some careful planning and by choosing a region that fits your budget, you can build a wonderful and sustainable life in the sun.

Navigating the Property Buying Process

Buying a home in a foreign country can feel like trying to solve a complex puzzle, but the good news is that Portugal's system is well-established and incredibly friendly to outsiders. With the right people in your corner, landing that dream retirement home is more than just a possibility—it's a very achievable goal.

The secret is to take it one step at a time and work with pros who know the local system inside and out. Think of it as putting together your own expert team. Your two most important players will be a reputable real estate agent and a qualified lawyer. An agent who’s used to working with expats won't just show you houses; they'll get what you're looking for and anticipate your concerns. At the same time, an independent lawyer is your non-negotiable safeguard, there to protect your interests, dig into the property's history, and make sure every legal box is ticked.

With this team in place from the start, you’ve built a solid foundation for a smooth and secure purchase.

First Things First: Getting Your Paperwork in Order

Before you even think about making an offer, there's one crucial piece of paperwork you absolutely must have: the NIF (Número de Identificação Fiscal). This is your personal Portuguese tax ID number, and you can't do any major financial transaction—like opening a bank account or buying a property—without it.

Getting a NIF is pretty straightforward. You can pop into any local Finanças (tax office) to apply, or you can have a lawyer or fiscal representative handle it for you. My advice? Get this sorted out as early as possible. It will save you from frustrating delays down the road.

Understanding the Key Legal Documents

Once you've found a place you love and shaken hands on a price, the legal gears start turning. The whole process really boils down to two main contracts that make the sale official. Getting your head around what they are will make you feel much more confident as things move forward.

- Promissory Contract (CPCV): Officially called the Contrato de Promessa de Compra e Venda, this is the initial binding agreement between you and the seller. It locks in all the important details: the price, how and when you'll pay, and the target date for the final handover. When you sign the CPCV, you'll also pay a deposit, which is usually between 10% and 30% of the purchase price.

- Final Deed (Escritura): This is the grand finale. The Escritura de Compra e Venda is the final deed of sale, and it's always signed in front of a public notary. The moment this document is signed and registered, the property is officially yours. Congratulations!

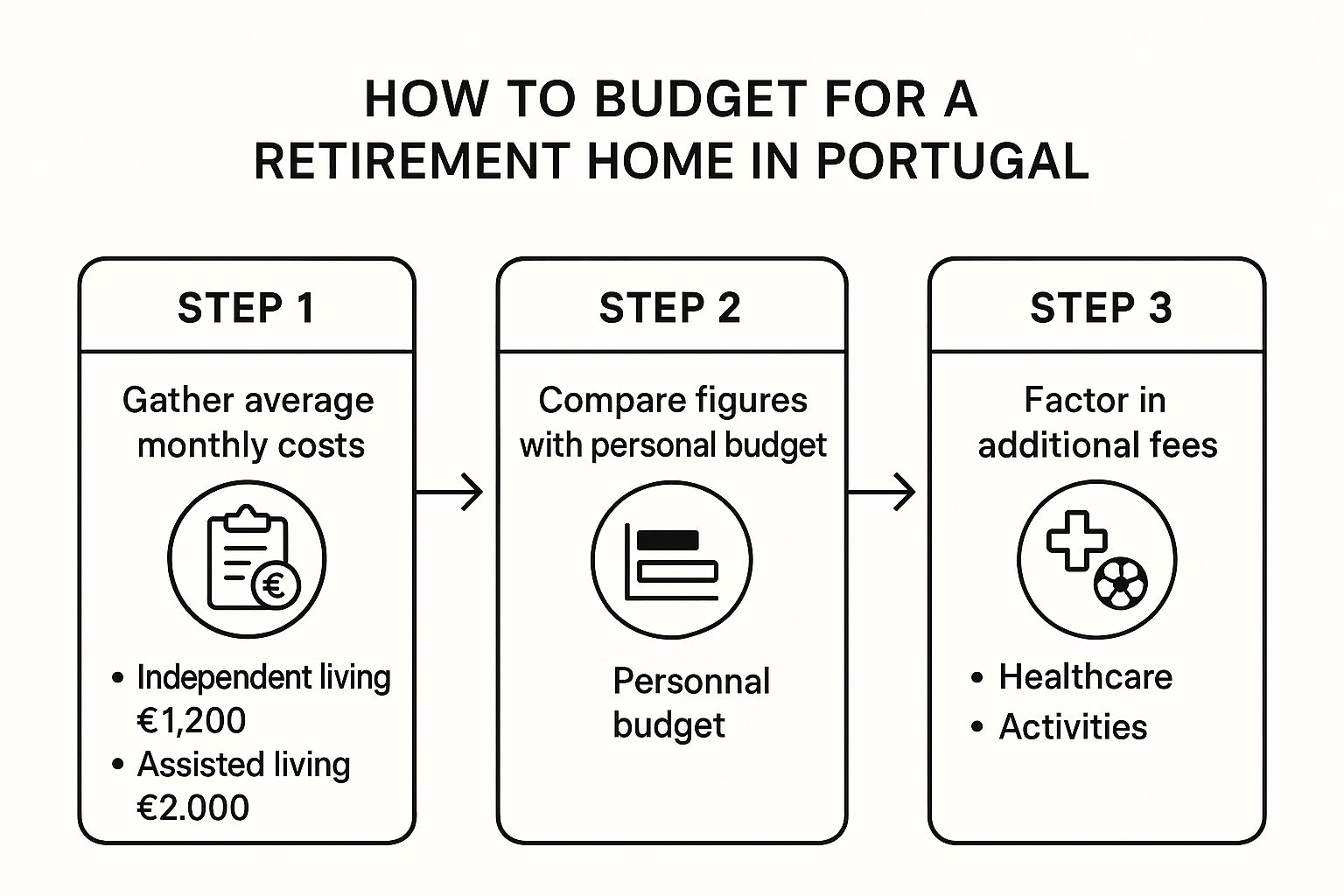

The image below gives you a great overview of how to budget for your new home, which is a huge part of this initial planning stage.

As you can see, a smart budget looks beyond the sticker price, factoring in all the living costs and extra fees to give you the full financial picture.

Due Diligence and the Extra Costs

Before you put pen to paper on the CPCV, your lawyer will get to work on due diligence. This is an absolutely critical safety check. They'll scour the records to make sure there are no hidden debts, legal claims, or other nasty surprises attached to the property. It’s all about confirming the seller truly has the right to sell and that all the paperwork is in perfect order. For a much deeper dive into what this involves, our detailed real estate due diligence checklist is a fantastic resource.

Now, let's talk about money. The purchase price isn't the final number. You'll need to budget for several other costs that are just a standard part of buying property in Portugal.

A Quick Rule of Thumb: Plan on setting aside an extra 6% to 10% of the purchase price to cover all the taxes and fees. If you factor this in from the get-go, you won’t have any unwelcome surprises when it's time to close the deal.

So, what are these extra expenses? They mainly break down into three categories:

- Property Transfer Tax (IMT): The Imposto Municipal sobre Transmissões Onerosas de Imóveis is the biggest one. It's calculated on a sliding scale that depends on the property's value and whether it will be your main home.

- Stamp Duty (IS): Known as the Imposto do Selo, this is a straightforward tax set at a fixed rate of 0.8% of the property’s value.

- Notary and Registration Fees: These fees cover the notary's services for witnessing the final deed signing and the cost of officially registering the property in your name at the Land Registry Office.

Walking through these steps with a clear plan and the right professional support can turn what seems like a daunting process into an genuinely exciting journey toward your new life in Portugal.

Getting Your Paperwork in Order: Visas and Taxes

Let's talk about the logistics. Sorting out the legal and financial side of moving to Portugal is a necessary step, but it's a well-trodden path. Getting a handle on your visa options and tax situation from day one will make the whole process much smoother, freeing you up to focus on the fun stuff—like finding that perfect home.

Your visa is your golden ticket to living in Portugal long-term. For most retirees coming from outside the EU, the go-to option has always been the D7 Passive Income Visa. It’s practically built for people who have a steady income from things like pensions, social security, or rental properties and don't plan on working in Portugal.

The D7 Visa: Your Key to Retirement in Portugal

The D7 is tailor-made for the retirement lifestyle. The main thing you need to prove is that you have a reliable, ongoing income from sources outside of Portugal. The good news is that the financial bar is set pretty reasonably, tied to the local minimum wage.

As of 2024, a single person needs to show a monthly passive income of at least €820. The figures can change, so always check the latest requirements. If you're moving as a couple, the second person needs an additional 50% of that amount. So, a couple would need to demonstrate a combined income of about €1,230 per month.

The process itself is straightforward:

- Get your documents ready: You'll need to gather proof of your income, a background check, proof you have a place to live in Portugal (a lease agreement works), and private health insurance.

- Apply from home: You’ll submit your initial application at the Portuguese consulate or embassy in your home country.

- Finalize in Portugal: Once you get the green light, you'll receive a temporary visa. This allows you to travel to Portugal, where you'll have an appointment to get your official residence permit.

This permit is usually good for two years and can then be renewed for another three. After you've been a legal resident for five years, you can apply for permanent residency or even Portuguese citizenship.

Making Sense of the Portuguese Tax System

Once you're a resident, you're also a tax resident. For a long time, Portugal was famous for its Non-Habitual Resident (NHR) program, which was a huge draw for retirees. It offered a sweet deal: a flat 10% tax on foreign pension income for a decade.

Heads Up: The original NHR program as we knew it closed to new applicants in 2024. While a new version exists for certain skilled professionals, most new retirees should plan their finances based on standard Portuguese tax rules. To get a broader perspective on why these kinds of legal and tax environments shift, our guide on the best places to retire in Europe often touches on these evolving policies across the continent.

But don't let that news discourage you. Portugal still has plenty of tax-friendly aspects. The country has a Double Taxation Agreement with many nations, including the US, so you won't get taxed twice on the same income. Your pension, social security, and other retirement funds will fall under Portugal's progressive income tax scale.

The smartest move you can make is to sit down with a financial advisor who knows the ins and outs of both your home country's tax code and Portuguese regulations. They can help you structure everything in the most efficient way possible. Getting on top of your visas and taxes from the start is the foundation for a truly worry-free retirement in the sun.

Accessing Quality Healthcare in Portugal

Let's be honest: when you're looking at retirement homes Portugal, healthcare isn't just a box to check—it's a top priority. The good news is that Portugal’s system is not only high-quality but also incredibly flexible. It’s a dual system, giving you access to both public and private care, so you can build a health plan that fits you perfectly. This approach consistently lands Portugal’s healthcare among the world's best, offering retirees some serious peace of mind.

At the core of it all is the Serviço Nacional de Saúde (SNS), the national public healthcare service. Think of it as a comprehensive safety net funded by the state. It’s available to every legal resident, and that includes foreign retirees. Once you have your residence permit sorted, you just need to register at your local health center (centro de saúde) to get your user number. That number is your golden ticket to the system.

While the SNS is mostly free, you might run into small co-payments for things like specific doctor's visits, lab tests, or prescriptions. But for the big stuff, the quality of care is fantastic and the cost is minimal.

The Public System: SNS

Getting signed up with the SNS is pretty straightforward once you’re officially a resident. The process generally looks like this:

- Get Your Residence Permit: This is your essential first step. No way around it.

- Head to Your Local Health Center: You'll need to bring your residence card and your NIF (Portuguese tax number).

- Get Your User Number: This number makes you official. It connects you with a family doctor and gives you access to all local health services.

The SNS covers almost everything you can think of, from routine check-ups and emergency room visits to specialist appointments and hospital stays. It’s a solid, reliable foundation for managing your health.

The Private Healthcare Option

Running parallel to the public system is a booming private healthcare sector. Many expats gravitate toward this route, and for good reason. You'll typically find shorter waiting times, faster access to specialists, and a much higher chance of finding doctors and staff who speak fluent English. The private hospitals and clinics are often brand new, with state-of-the-art equipment—some feel more like five-star hotels than medical facilities.

Of course, to use the private network, you’ll need private health insurance. But you’ll be pleasantly surprised by the cost, especially if you're coming from the US. Monthly premiums can be as low as €20 to €50, though your age and any pre-existing conditions will affect the final price.

A lot of retirees end up using a hybrid model. They register with the public SNS as their primary safety net and then take out a private insurance plan for extra convenience and speed. It really is the best of both worlds: you get the comprehensive, low-cost coverage of the public system, backed by the comfort and rapid access of the private sector. It's this flexibility that lets you design a healthcare strategy that feels secure, responsive, and just right for your new life in Portugal.

Got Questions About Retiring in Portugal? We've Got Answers.

Even after you've researched visas and picked out a few dream locations, a handful of practical questions always seem to surface. It’s often these little details that make the big move feel real. So, let’s tackle some of the most common things people ask when they’re looking for retirement homes in Portugal.

Think of this as your go-to FAQ for smoothing out the final wrinkles in your plan.

Do I Really Need to Speak Portuguese?

Honestly? Not always, especially at first. In the places where most expats tend to settle—like Lisbon, Porto, and all along the Algarve coast—you'll find that English is widely spoken. From ordering in a café to visiting a doctor, you can get by quite comfortably.

That said, learning even a little Portuguese is a game-changer. A simple "bom dia" (good morning) or "obrigado" (thank you) does more than just help you order coffee; it shows respect and opens you up to a much richer, more authentic experience. It’s the difference between just living in Portugal and truly being a part of it.

Can I Bring My Pets Along?

Of course! Portugal is very welcoming to four-legged family members, and the process is quite straightforward as long as you plan ahead.

To make the move seamless for your pet, you’ll need to make sure they have:

- An up-to-date microchip.

- A valid rabies vaccination, given after the microchip was implanted.

- An EU Pet Passport if you're coming from within the EU, or an official veterinary health certificate from your home country if you're not.

It's always a smart move to check the latest rules with the Portuguese authorities a few months before you travel. Regulations can change, and having everything in order will make your arrival day far less stressful for everyone, especially your furry companion.

How Hard Is It to Open a Portuguese Bank Account?

This is one of the first and most important things you'll do, and thankfully, it's not difficult. You'll need a local bank account for almost everything, from paying your utility bills to buying a property.

To open an account, you'll just need to bring three key items to the bank: your passport, your Portuguese NIF (tax number), and a proof of address. The major banks here are very accustomed to helping expats get set up, and you’ll usually find English-speaking staff ready to walk you through the paperwork. It’s a well-trodden path.

Ready to turn your Portuguese retirement dream into a reality? At Residaro, we specialize in connecting people with their perfect European properties. Explore our curated listings of beautiful homes across Portugal and find the place where your next chapter begins. Start your search with Residaro today!