Is It Cheaper to Rent or Buy a Home?

Let's be honest, the real answer to whether it's cheaper to rent or buy is... it depends. The right choice is deeply personal and hinges entirely on your location, how long you plan to stay put, and your current financial situation.

Buying a home can be a fantastic way to build wealth over the long haul, but renting gives you a level of freedom and protects you from the shock of a sudden, expensive repair bill. The best path for you comes down to which of these benefits you value most at this stage in your life.

The Immediate Financial Tradeoffs

Choosing between renting and buying often feels like trying to solve a complex puzzle. It's not as simple as comparing a monthly rent check to a mortgage payment. You have to consider the upfront cash required, the potential for building wealth, and who's on the hook for all the ongoing costs. Getting a handle on these key differences is the first step to making a smart decision.

Recent years haven't made this any easier. We're in the middle of a serious housing affordability crisis across the globe, a lingering effect of the pandemic's economic shake-up. By mid-2024, soaring mortgage rates pushed the cost of owning a home to heights we haven't seen since before the 2007-08 financial meltdown. This has tipped the scales for many, making renting the more financially sensible option, even as rents continue to climb. The IMF has detailed analysis on this global housing crunch if you want to dig deeper.

To make things clearer, let's look at the immediate financial commitments of each option.

Renting vs Buying At a Glance

This table breaks down the high-level financial commitments you'll face right away and over time, whether you sign a lease or a mortgage.

| Financial Aspect | Renting | Buying |

|---|---|---|

| Upfront Cash Needed | Security deposit (usually 1-2 months' rent) plus the first month's payment. | Down payment (3-20% of the home's price), closing costs, and inspection fees. |

| Typical Monthly Payment | A fixed rent payment that's predictable for the lease term. | Mortgage payment (principal and interest), plus property taxes and homeowners insurance. |

| Maintenance Costs | Your landlord covers these. A broken water heater isn't your financial problem. | You're responsible for everything. Budget 1-4% of your home's value annually for upkeep. |

| Long-Term Outcome | You build zero equity. Your payments secure a place to live, not an asset. | You build equity with every payment, creating a valuable asset that can grow over time. |

Ultimately, this comparison highlights the core decision you need to make.

The fundamental tradeoff is between flexibility and wealth creation. Renting buys you the freedom to move easily and avoid unexpected repair bills, while buying is a disciplined way to invest in a tangible asset that can grow in value over time. Your personal timeline and risk tolerance are key to determining which path is cheaper for you.

Uncovering the True Cost of Owning a Home

It’s easy to fall into the trap of comparing a monthly mortgage payment directly to monthly rent. But that simple comparison is dangerously misleading. The reality of homeownership comes with a long list of costs that renters simply never see, and ignoring them can turn the dream of owning a home into a financial nightmare.

The mortgage is just the tip of the iceberg. As a homeowner, you're on the hook for a whole suite of recurring, and often unpredictable, expenses. These aren't just suggestions; they're essential costs for protecting your property and staying on the right side of the law.

Beyond the Mortgage Payment

To get a real sense of your monthly financial commitment, you need to look past the principal and interest. Several other major costs are baked into homeownership, and they can inflate your total outlay significantly.

- Property Taxes: These are paid directly to your local government and are based on your home's assessed value. This money funds public services like schools and roads, and the amount can change from year to year.

- Homeowners Insurance: Your lender will insist on this. It protects their investment—and yours—against catastrophic events like fires, theft, or major storms.

- Private Mortgage Insurance (PMI): If you put down less than 20% on your home, you'll almost certainly be paying PMI. It’s important to remember this insurance protects the lender, not you, if you can no longer make your payments.

These three costs are often bundled with your principal and interest into a single monthly payment known as PITI. Understanding each piece of that puzzle is vital. If you're exploring ways to structure these costs, looking into different second home financing options can sometimes offer creative strategies, even for a primary residence.

The Unpredictable Costs of Maintenance and Repairs

This is often the biggest shock for first-time buyers. When you're renting, a broken water heater is a phone call to the landlord. When you own the home, it's your problem—and your bill. Every leaky pipe, dead appliance, and creaky floorboard is now your financial responsibility.

A solid rule of thumb is to budget between 1% and 4% of your home's purchase price for maintenance every single year. So, for a €300,000 home, you should be putting aside anywhere from €3,000 to €12,000 annually to cover everything from routine upkeep to major, unexpected repairs.

Forgetting to budget for maintenance is one of the most common mistakes new buyers make. A new roof can cost upwards of €10,000, and an HVAC system replacement can be just as expensive. These aren't minor expenses; they are significant financial events that require planning.

On top of all that, many modern European communities have Homeowners' Association (HOA) fees. These monthly or annual payments cover the upkeep of shared spaces like parks, swimming pools, or private roads. When you're weighing whether it's cheaper to rent or buy, you absolutely must factor in these cumulative costs to avoid any nasty surprises down the line.

Deconstructing the Financials of Renting

You’ve probably heard it a million times: "renting is just throwing money away." That’s a massive oversimplification. While your rent check doesn't build equity in a property, it buys you something incredibly valuable: financial predictability and flexibility. That’s the real lens through which to view the renting vs. buying debate.

When you rent, you have a clear, fixed housing cost for the entire term of your lease. This stability makes budgeting a breeze, freeing you from the surprise expenses that can blindside homeowners. If a pipe bursts or the boiler gives out, that financial headache belongs to the landlord, not you. This buffer against unexpected, often crippling, repair bills is a significant financial benefit that’s too often overlooked.

The Upfront Costs and Long-Term Flexibility

Let’s talk about getting started. Unlike the massive down payment needed to buy a home, the initial outlay for renting is far more manageable. Usually, you’re looking at just the first month's rent and a security deposit, making it a much more accessible path for anyone who hasn't spent years stockpiling cash.

This lower barrier to entry gives you much greater financial agility. All the money that isn't locked into a down payment, closing costs, and immediate home improvements is free for you to use, which brings us to a crucial financial idea.

The Opportunity Cost of a Down Payment: That huge chunk of cash required for a down payment could be put to work elsewhere—invested in stocks, bonds, or a business venture that could potentially grow much faster than property values. For renters, this "opportunity cost" is a powerful tool for building wealth completely outside the real estate market.

Strategic Financial Advantages

Renting isn’t just a default option; for many, it's a deliberate financial strategy. It can be a ticket to living in prime, high-cost areas where buying is simply off the table. For instance, the steps involved to rent in Italy long term show how renting can unlock lifestyles and locations that would otherwise be completely unaffordable.

Here’s a quick rundown of the core financial perks:

- Predictable Monthly Outlay: Your rent is a fixed number, which makes managing your monthly finances simple and secure.

- Zero Maintenance Liability: All those repair and upkeep costs are the owner's problem, shielding your savings from sudden emergencies.

- Lower Entry Costs: A security deposit is a tiny fraction of a down payment, which keeps your capital liquid and available.

- Investment Freedom: The funds that would otherwise be tied up in a house can be invested, potentially generating significant returns over time.

Ultimately, renting protects you from property taxes, unpredictable insurance hikes, and the financial roller coaster of a fluctuating housing market. For anyone who values flexibility, mobility, and the freedom to pursue other investment strategies, it’s an incredibly sound financial choice.

How Market Conditions Shape Your Decision

The "rent or buy" question doesn't have a universal answer. The single most important factor is your local housing market—what makes perfect financial sense in one city could be a disastrous move just a few hundred kilometers away. To make the right call, you have to look beyond generic advice and understand the real-world forces at play.

Things like central bank interest rates, local supply-and-demand, and even zoning laws directly impact both property prices and rents. A booming local economy with not enough new homes will drive both costs up. A sluggish one might present a golden opportunity for buyers. Learning to read these signals is the first step.

Reading Your Local Market Signals

So, how do you get a read on your market? The best place to start is with a simple but powerful metric: the price-to-rent ratio. You calculate it by dividing the median home price in your area by the median annual rent.

It’s a quick way to gauge the financial climate:

- A high ratio (anything over 21): This is a red flag. It suggests home prices are inflated compared to rental costs, making renting the more financially sound choice.

- A low ratio (below 15): This is a green light. It usually means buying is the smarter long-term financial bet because ownership costs are more aligned with rental expenses.

Think of it as a financial health check for your city. It tells you which side of the fence the numbers currently favor.

The Impact of Affordability and Interest Rates

Beyond local ratios, you have to consider the bigger picture. National interest rate policies can change the game almost overnight. Low rates make borrowing cheap, which tends to fuel demand and push house prices higher. When rates climb, mortgages get more expensive, cooling the market and often putting downward pressure on prices.

We see this playing out across the globe. The 2025 Demographia International Housing Affordability report paints a stark picture of how some cities have become 'severely unaffordable.' In a place like Vancouver, for example, the median home price is a staggering 10.5 times the median income. With such a high barrier to entry, renting isn't just a preference; it's a necessity for most. You can dig into the full findings on global housing affordability to see how different markets stack up.

By looking at your local price-to-rent ratio, current interest rates, and broader affordability trends, you can get a data-driven answer. This isn't just about a gut feeling; it's about turning complex economic data into a clear insight for your situation.

Ultimately, your personal finances are just one part of the equation. They exist within the context of your local market. Ignoring these external factors is like setting sail without checking the weather—you might get lucky, but you're far more likely to run into trouble. A smart decision always starts with a clear-eyed look at the economic reality right outside your front door.

Finding Your Financial Break-Even Point

Here’s the single most important question you need to ask yourself: how long do you actually plan to stay put? Your answer is the key to figuring out your break-even point—that specific moment when buying a home becomes cheaper than renting a similar one.

This isn’t some abstract financial theory; it’s a hard calculation. It takes the emotional debate out of the equation and turns it into a clear, data-driven decision based on your personal timeline and finances. When you run the numbers, you can see exactly when owning a home starts to pay off.

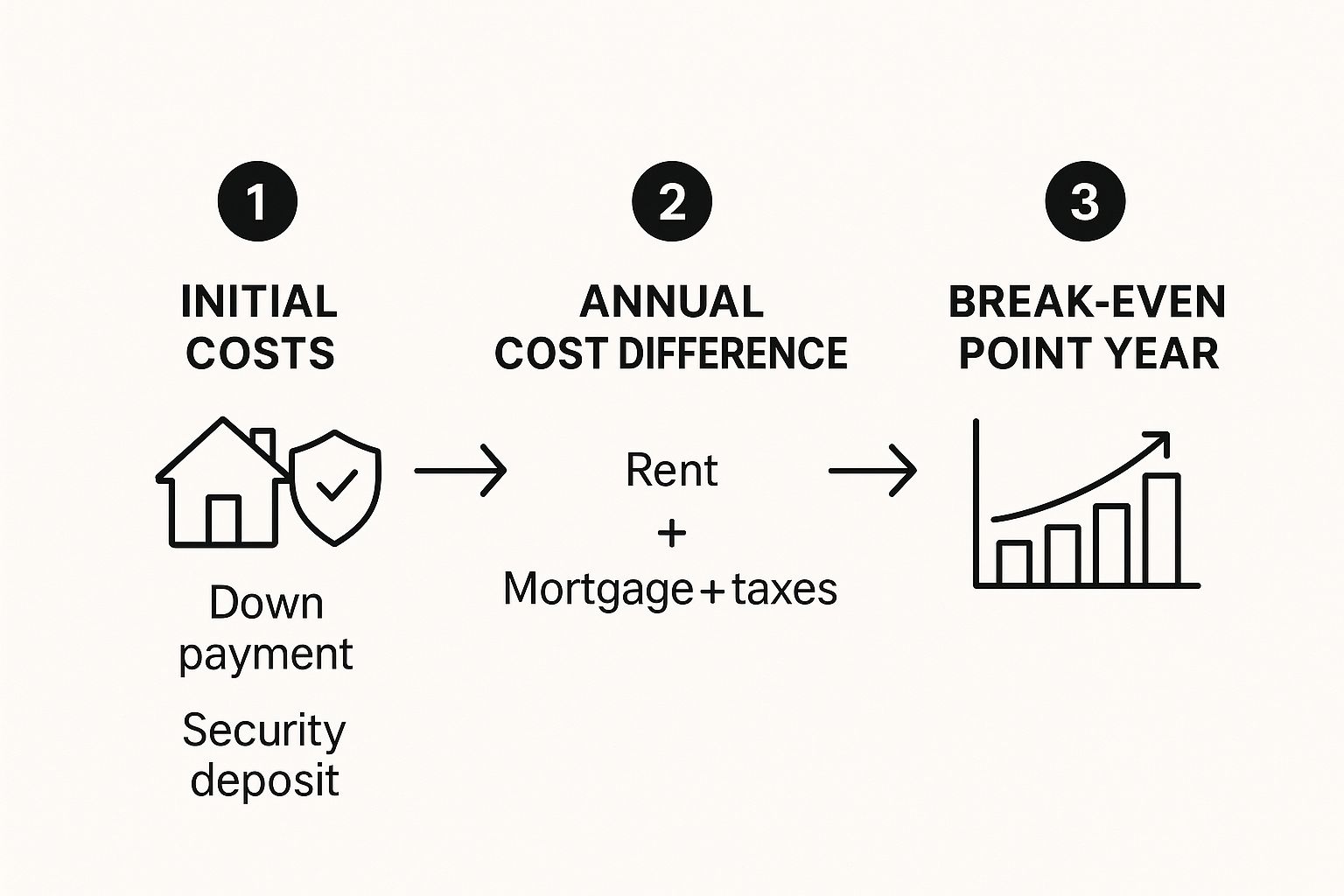

The whole process comes down to comparing the total costs of both options over time to find where the lines cross.

This visual gives you a great overview of how a break-even analysis works, from the heavy initial costs of buying to the point where it finally makes more financial sense.

As you can see, those big upfront buying costs put you in a financial hole at the beginning compared to renting. But over the years, building equity and having a fixed mortgage payment helps you close that gap and eventually come out ahead.

Calculating Your Personal Break-Even Horizon

To pinpoint your own break-even timeline, you'll need to pull together some key financial figures. Think of it like gathering ingredients before you start cooking—get these right, and the final result will be accurate.

You'll need a clear picture of all the variables involved to make an informed calculation.

The table below breaks down the essential information you'll need to collect.

Variables for Your Break-Even Calculation

| Variable | Description | Example Value |

|---|---|---|

| Upfront Buying Costs | Your down payment, closing costs (legal fees, taxes), and initial renovation budget. | €50,000 |

| Recurring Buying Costs | Monthly mortgage, property taxes, home insurance, and annual maintenance budget. | €2,000/month |

| Upfront Renting Costs | Security deposit and first month's rent. | €3,000 |

| Recurring Renting Costs | Your monthly rent and estimated annual rent increases. | €1,500/month |

| Financial Growth Factors | Expected property appreciation rate and potential investment returns (opportunity cost). | 3% appreciation |

Once you have these numbers, you can start putting the puzzle together.

The break-even point is hit when your home's appreciation plus the equity you've built surpasses the total costs of owning, making it cheaper than renting. For many people in European markets, this typically happens somewhere between four to seven years.

Knowing these figures is incredibly empowering. It’s the same logic property investors use to gauge profitability. If you're curious about that side of things, our guide on how to calculate rental yield digs into similar financial inputs. By taking the time to run the numbers, you can stop guessing and start making a decision based on a realistic financial timeline.

Matching Your Housing Choice to Your Lifestyle

While the numbers and financial models give us a clear answer on paper, the "best" decision is worthless if it makes you miserable. The rent vs. buy question isn't just about what's cheaper; it's deeply tied to a powerful, non-financial factor: your lifestyle. A spreadsheet can't quantify the value of stability, the freedom of mobility, or the feeling of belonging to a community.

Ultimately, your housing choice should be a tool that supports your life goals, not a financial anchor that holds you back. Before you commit, it’s worth taking a hard, honest look at what you value most right now and where you see yourself in the years to come.

The Career-Focused Professional

If you’re laser-focused on climbing the career ladder, mobility is probably your greatest asset. Renting gives you the incredible advantage of being able to relocate for a dream job offer without the headache and financial drag of selling a property. That kind of flexibility keeps your options wide open, letting you chase opportunities across the country—or even internationally—without being tied down.

Let's not forget the time commitment, either. Renting frees you from the endless responsibilities of home maintenance. Instead of spending your precious weekends fixing a leaky tap or coordinating repairs, that time is yours to invest in your professional development.

The Growing Family

For a growing family, the priorities often flip entirely. Stability and a sense of permanence become paramount. Buying a home means you can truly put down roots in a community, build lasting relationships with neighbours, and secure a place in a consistent school district. This creates a stable foundation for children to thrive.

Homeownership also gives you the freedom to make a space your own. Want to renovate the kitchen, turn a spare room into a nursery, or plant a vegetable garden in the backyard? You can do it all without asking a landlord for permission. This ability to shape your home to fit your family's evolving needs is a powerful emotional driver.

The intangible value of "pride of ownership" is something you can't really put a price on. For many, a home is far more than just an asset; it's a personal sanctuary, a reflection of their identity and hard work. This emotional return on investment is a huge part of the homeownership experience.

In the end, aligning your housing choice with your personal values is just as important as running the financial numbers. The right option is the one that best supports the life you actually want to live.

Got a Few More Questions?

Even after running the numbers and thinking through your lifestyle, a few nagging questions can stick around. Getting clear on these final details is often the last step before you can really move forward with confidence.

Are There Hidden Costs When Renting?

Renting is usually seen as the more predictable option, but don't get caught off guard. Beyond the obvious security deposit, you might run into non-refundable application fees, monthly "pet rent," or charges for a designated parking spot. It's also not unheard of for leases to make tenants responsible for small maintenance jobs, like swapping out lightbulbs or air filters.

Your lease agreement is your best friend here. Read every single line before you sign it. That document spells out every financial obligation, so you know exactly what you’re on the hook for besides the rent itself.

How Much Do I Really Need for a Down Payment?

Forget the old "20% down" rule—it’s more of a myth than a mandate these days. In many European markets, you can find conventional loans with down payments as low as 3-5%. Some government-backed schemes might even let you get in the door with less.

But there's a catch. A smaller down payment means a bigger loan, and that translates to higher monthly mortgage payments. It also usually means you'll have to pay for mortgage insurance, an extra monthly fee that protects the lender, not you. The sweet spot is finding a down payment that you can afford now without crippling your budget for years to come.

Can I Actually Negotiate My Rent?

You bet. Rent is often more flexible than people think, especially if you're in a market with a lot of empty apartments or you're renting from an individual landlord instead of a big corporation.

To give yourself the best shot, come prepared with a solid credit history and glowing references from past landlords. A polite request can go a long way. Don't be shy about asking for a slightly lower monthly rate or seeing if they'll throw in a perk, like a free parking space or waiving the pet fee.

Ready to stop debating and start exploring? Residaro offers an extensive selection of properties for sale across Europe. Find your dream home with Residaro.