Your Guide to Cheap Homes in Europe

With all the headlines about soaring property prices, it’s easy to think that finding cheap homes in Europe is just a pipe dream. But I’m here to tell you that dream is very much alive. The secret is knowing where to look—and it's usually not in the famous capitals or tourist-packed coastal resorts.

Incredible value is waiting to be discovered in the beautiful, overlooked regions of countries like Portugal, Italy, and Bulgaria.

Is an Affordable European Home Still a Realistic Dream?

Let's be honest: affordability has become a massive conversation across the continent. For many, especially in bustling cities where prices just keep climbing, the idea of owning a home feels further away than ever.

But that popular narrative only tells one side of the story. While a chic Parisian apartment or a central London flat might be out of reach for most, countless opportunities for affordable homeownership are hiding just beyond the city limits. It all comes down to a simple shift in perspective.

Instead of getting discouraged by saturated markets, the real value lies in uncovering Europe’s hidden gems. I’m talking about charming villages, serene countrysides, and up-and-coming coastal towns that haven't been hit by the tourist tidal wave yet. Think of it like finding that perfect little local restaurant before it gets a Michelin star and the crowds rush in.

Understanding the Bigger Picture: The European Housing Climate

It's important to know what you're walking into. There’s a genuine housing affordability crisis across Europe, made worse recently by higher construction costs and rising mortgage rates. This has squeezed many middle-income households and essential workers right out of major cities.

The good news? This has become a top priority for the European Union, which has ramped up efforts to improve housing availability for 2024 and 2025. You can read up on the specifics of these EU housing initiatives to get a feel for the continent-wide strategy.

This very challenge, however, creates a unique opening for buyers like you. As city living gets more expensive, it puts a spotlight on the incredible value offered in less-populated regions. This guide is designed to help you see past the scary headlines and find the places where your budget can truly stretch.

The secret to finding an affordable European property isn't about chasing the lowest price tag; it's about finding that sweet spot where location, lifestyle, and long-term value all meet.

To give you a quick overview, here's a snapshot of some of the most promising countries where you can find genuine bargains.

Top Affordable European Countries At A Glance

| Country | Average Price (per sq. meter) | Key Selling Point | Best For |

|---|---|---|---|

| Portugal | €1,500 - €2,500 | Beautiful coastlines and a relaxed lifestyle, with very affordable inland regions. | Sun-seekers and retirees looking for a high quality of life on a budget. |

| Italy | €900 - €1,900 | Rich culture, amazing food, and incredibly cheap rural properties (including €1 homes). | Dreamers who want a rustic home to renovate and a slice of la dolce vita. |

| Bulgaria | €600 - €1,200 | The lowest property prices in the EU, with both mountain and beach destinations. | Budget-conscious buyers and investors looking for maximum value for their money. |

| Romania | €1,000 - €1,700 | Historic cities and beautiful, untouched countryside with a very low cost of living. | Adventurous buyers seeking authentic culture off the beaten path. |

| Greece | €1,200 - €2,200 | Stunning islands and ancient history, with many affordable options away from tourist hotspots. | Those who dream of island life or a historic village home without the celebrity price tag. |

This table shows that fantastic opportunities are out there if you know where to focus your search.

Your Roadmap to an Affordable European Property

Making this happen isn't about luck; it’s about having a smart strategy. We’ll show you how to zero in on these amazing deals. It all comes down to a few key steps:

- Look Beyond the Obvious: We’ll dive deep into regions in Portugal, Italy, and Eastern Europe where homes cost a tiny fraction of what you'd pay in a major capital.

- Understand Real Value: Learn how a lower purchase price, when paired with a low cost of living, can lead to a much richer and more fulfilling lifestyle.

- Embrace the Adventure: Finding and buying your home is a journey. It has its steps and challenges, but with the right guidance, it’s an exciting and completely achievable goal.

This guide will give you the practical knowledge and introduce you to platforms like Residaro, which are designed to help you find, vet, and secure that charming, affordable European home you’ve been dreaming of.

Where to Find the Most Affordable Homes in Europe

Alright, so you’re convinced that an affordable European property isn't just a fantasy. The next step—the fun part—is figuring out where your money will stretch the furthest. The secret to finding cheap homes in Europe isn’t magic; it’s about looking beyond the capital cities and tourist traps to discover the incredible value hidden in lesser-known regions.

This is where the real adventure begins. Let's take a tour through the quiet coastlines, rustic countrysides, and up-and-coming hotspots where even a modest budget can land you a dream lifestyle.

Portugal Beyond the Algarve

When you picture buying in Portugal, your mind probably jumps straight to the sun-drenched (and pricey) Algarve. It's beautiful, no doubt, but the real deals are found elsewhere. Think of this as your inside track to Portuguese affordability.

The Silver Coast (Costa de Prata) Just north of Lisbon, you'll find the Silver Coast. It’s a stunning stretch of dramatic cliffs, wild beaches, and authentic fishing towns like Nazaré and Peniche. Property prices here are a world away from the south, yet you’re still getting that gorgeous coastline and a wonderfully relaxed way of life. It's the perfect spot for anyone who wants to live by the sea without paying a premium for it.

Central and Northern Portugal Head inland, and you'll discover a completely different Portugal—one of rolling hills, ancient vineyards, and charming stone villages. Regions like Castelo Branco or Coimbra have some of the most affordable real estate in all of Western Europe. You could find a classic village townhouse or even a small farm (a 'quinta') for what you might pay for a tiny studio apartment back home. It's an authentic, peaceful lifestyle deeply tied to the land.

Italy and the Famous 1 Euro Homes

The romance of Italy is undeniable, but many people write off the property market as too expensive. Sure, cities like Rome and Florence will cost you, but huge parts of the country offer amazing deals—including those famous €1 homes you've heard about.

So, what’s the deal with the €1 homes? They're real, alright. These are official programs run by small towns trying to breathe life back into their communities. The catch is that you have to commit to renovating the property, usually on a set timeline. It’s a golden opportunity if you're up for a project, but you absolutely must have a clear renovation budget from the start.

But you don't need a massive project to find a bargain. Let's look at where to find genuinely affordable, move-in-ready (or close to it) homes.

- Abruzzo: Often called the "green heart of Europe," this region is packed with stunning national parks and a rugged Adriatic coastline. You can find habitable village homes here for under €50,000.

- Sicily: Once you get away from the tourist centers, the Sicilian countryside is full of affordable farmhouses and townhouses. The culture is incredible, and the cost of living is exceptionally low.

- Puglia (Apulia): The coastal parts of the "heel" of Italy's boot are getting popular, but head inland and you'll still find plenty of affordable trulli (those iconic cone-roofed houses) and farmhouses ripe for restoration.

Of course, Spain has its own share of incredible deals. For a closer look at its most affordable regions, check out our dedicated guide to finding cheap houses in Spain.

Emerging Gems in Eastern Europe

If you want the absolute lowest property prices on the continent, it’s time to look east. Experienced buyers are turning their attention to countries like Bulgaria and Romania, which offer an unbeatable mix of low living costs, stunning scenery, and truly rock-bottom real estate prices. This is where you’ll find some of the best deals for cheap homes in Europe.

Bulgaria: The EU’s Most Affordable Market Year after year, Bulgaria holds the title for the cheapest country in the EU to buy property. Whether you dream of a ski cabin near Bansko or a summer house on the Black Sea, your money goes an incredibly long way. It's not unusual to find rural houses needing a bit of work for less than €15,000, making homeownership a reality on almost any budget.

Romania: Authentic and Untouched Beauty Romania feels like stepping back in time, a land of medieval towns, Dracula-esque castles, and vast, unspoiled forests in regions like Transylvania. Property in the countryside is extremely cheap, offering a chance to live a life that feels a world away from the modern hustle. It’s a perfect match for adventurous souls seeking authenticity and a deep connection to history and nature.

By zeroing in on these specific areas, your dream of living in Europe starts to feel less like a dream and more like a plan. Each region offers its own unique blend of culture, lifestyle, and price point, putting you in the driver's seat to find the perfect place to call home.

Understanding the True Cost of Buying a Cheap Home

The sticker price on a property listing is only the first page of a much longer financial story. Finding attractively priced cheap homes in Europe is an exciting first step, but a savvy buyer knows the real cost goes far beyond that initial number. It’s a bit like buying a classic car—the purchase price might seem manageable, but you have to budget for insurance, maintenance, and the occasional surprise repair to truly enjoy it.

To avoid any nasty financial shocks down the road, you need the full picture of all the associated expenses. From one-time transaction fees to the potential for ongoing renovations, understanding these costs is the secret to creating a realistic budget. Getting this clarity from the start means you can move forward with your purchase confidently, fully prepared for the journey ahead.

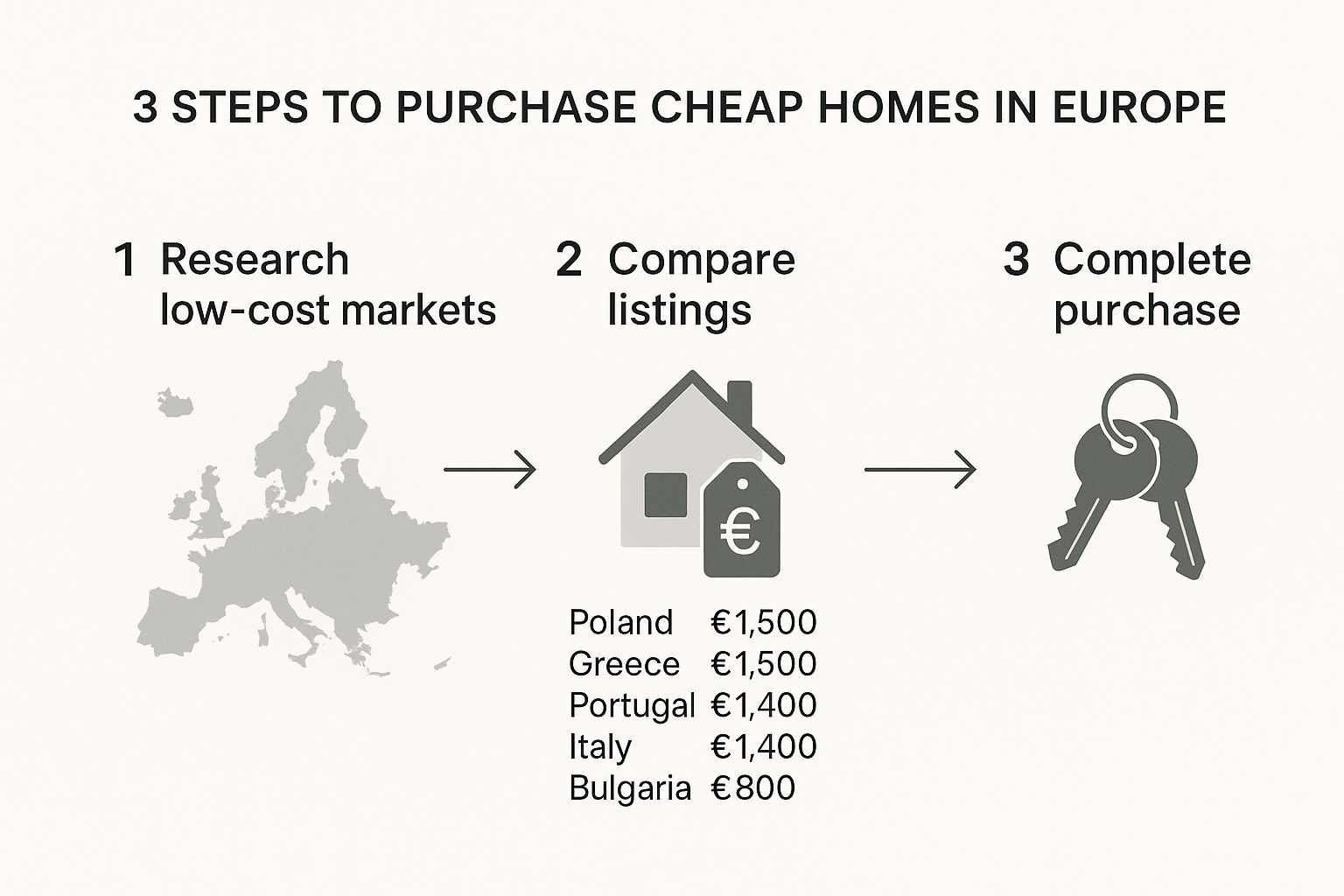

This image breaks down the initial process, showing the core steps from finding affordable markets to finally getting the keys.

As you can see, a successful purchase starts with smart research into low-cost regions, followed by a careful comparison before you even think about making an offer.

Decoding Your Transaction Costs

Once you agree on a price, a series of mandatory fees—often called closing or transaction costs—come into play. These can add a significant chunk to your total outlay, typically ranging from 7% to 15% of the property’s purchase price, depending on the country. It is absolutely crucial to factor these into your budget from day one.

These costs generally include a few key components:

- Property Transfer Tax (PTT): This is a government tax on the transfer of property ownership, and the rates vary dramatically. For example, Spain’s ITP tax can range from 4% to 11% depending on the region, while in Portugal, the IMT can go up to 7.5%.

- Notary Fees: A public notary is required in most European countries to witness and formalize the deed of sale. Their fees are often set by a government scale based on the property's value, typically falling between 0.5% and 2.5%.

- Legal Fees: Hiring an independent lawyer who represents your interests is non-negotiable. They conduct due diligence, review contracts, and ensure the sale is legally sound. Expect to pay between 1% and 2% of the purchase price for their services.

- Land Registry Fees: This is a smaller but essential fee for officially registering the property in your name at the local land registry office.

Budgeting for Renovations and Repairs

Let's be honest: many of the most affordable properties, especially those charming rural houses or historic village homes, will need some work. While this is a fantastic opportunity to add your personal touch and boost the property's value, it's also a major potential cost. Overlooking this can quickly turn your dream home into a financial nightmare.

Never take a seller’s word on the condition of a property. A professional building survey is your single best investment to avoid buying a money pit. It can uncover hidden issues with the foundation, roof, plumbing, or electrical systems that could cost tens of thousands to fix.

When looking at a potential purchase, be brutally honest about what needs doing. Are you looking at a simple cosmetic update, like a fresh coat of paint and new floors? Or does the property require a new roof, updated wiring, and a modern kitchen? Getting quotes from local builders before you finalize the purchase is the only way to create an accurate renovation budget.

The Importance of a Professional Survey

I can't stress this enough: always get a professional, independent property survey. While it’s an upfront cost, it provides priceless peace of mind and can save you from a catastrophic financial mistake. Think of it as a comprehensive health check for your future home.

A surveyor will spot structural problems that are invisible to the untrained eye. For a deeper dive into which countries offer the best overall value when all costs are considered, our guide on the best countries to buy property offers more detailed comparisons.

This expert report also gives you powerful negotiating leverage. If issues are found, you can ask the seller to fix them, or you can negotiate a lower price to cover the cost of repairs yourself. In the worst-case scenario, it gives you the concrete information you need to walk away from a bad deal.

Navigating the Legal Maze as a Foreign Buyer

Buying property abroad can feel like trying to solve a puzzle in a language you don't speak. But once you understand the key pieces, the picture becomes clear. The process for purchasing cheap homes in Europe isn't some bureaucratic nightmare to fear, but a structured path you can walk with the right professional on your side.

The single most important step you'll take, before you even think about making an offer, is hiring a local, independent lawyer. Think of them as your personal translator and guide for the entire journey. They work for you—and only you—ensuring your interests are protected, contracts are solid, and the property is free of hidden debts or legal claims. This is your most critical hire.

First Steps Your Lawyer Will Guide You Through

Before you can sign on the dotted line, you need to establish your legal and financial identity in the country. Don't worry, this is a standard procedure and a good lawyer makes it a straightforward process. It’s the foundation upon which your entire purchase is built.

Here’s what this typically involves:

- Getting a Fiscal Number: This is simply a tax identification number, and it's essential for any major financial transaction, from opening a bank account to buying a house. In Portugal, it’s the Número de Identificação Fiscal (NIF), while in Spain, it's the Número de Identificación de Extranjero (NIE).

- Opening a Local Bank Account: You'll need an in-country account to transfer purchase funds, pay taxes, and set up utilities down the line. Your lawyer can often point you toward reputable banks that are used to working with international buyers.

- Appointing Power of Attorney (Optional but Recommended): Granting your lawyer Power of Attorney is a huge time and stress saver. It allows them to handle crucial steps on your behalf, like signing preliminary contracts or finalizing paperwork if you can't be in the country for every little thing.

Residency Permits and Golden Visas

Here's something many first-time buyers misunderstand: buying a property in Europe doesn't automatically grant you the right to live there. If you're a non-EU citizen, you're usually limited to stays of 90 days within any 180-day period. If you dream of living in your new home for longer than that, you'll need to look into visas and residency options.

Some countries offer "Golden Visa" programs, which can provide residency in exchange for a significant property investment. However, these have become much stricter and more expensive in recent years, though they still exist in places like Greece and Malta.

It's crucial to distinguish between property ownership and residency rights. Owning a home gives you a physical asset, but a visa or residency permit is what allows you to legally live there long-term.

For most people buying affordable homes, the more common route is applying for a standard long-stay visa (like a D-Type visa), often by proving you have sufficient passive income to support yourself. Your lawyer can give you the lay of the land on which options might be open to you. For a really detailed breakdown of the process in a popular country, our complete guide on buying a house in Italy walks you through every step.

Securing a Mortgage as a Foreigner

So, can a non-resident even get a mortgage in Europe? The short answer is yes, absolutely. But the landscape is a bit different from what you might be used to back home. European banks tend to be more cautious when lending to foreign buyers, so you should be prepared for a few key differences.

Key Mortgage Considerations for Foreign Buyers

| Factor | Typical Requirement for Foreigners | Why It Matters |

|---|---|---|

| Deposit Amount | Expect to put down a larger deposit, often 30-40% of the property value. | Banks see foreign borrowers as a higher risk, so a bigger deposit shows your commitment and reduces their exposure. |

| Loan-to-Value (LTV) | The LTV ratio will be lower, typically between 60-70%. | This is just the other side of the deposit coin, limiting the total percentage the bank is willing to lend you. |

| Required Documents | You'll need to provide extensive proof of income, tax returns from your home country, credit reports, and bank statements. | The bank needs to be completely certain you have a stable and sufficient income to cover the mortgage payments. |

Navigating these legal and financial waters is far less daunting when you have an expert in your corner. With a trusted lawyer and a clear understanding of these steps, you can confidently turn the dream of owning a European home into a reality.

Common Myths About Buying Cheap Homes in Europe

The idea of snagging a cheap home in Europe is exciting, but it’s an idea that often comes with a lot of baggage. Misconceptions and half-truths can quickly turn the dream into a source of anxiety, making the whole process feel impossible before you even start.

It's time to clear the air. Let's tackle these common myths head-on, replacing the fear and uncertainty with a solid, realistic understanding of what to expect.

Myth 1: Foreigners Can’t Get a Mortgage

This is probably the biggest showstopper for potential buyers, but thankfully, it's just not true. While you can't just walk into a European bank and expect the same process as back home, getting a mortgage as a non-resident is absolutely possible in most countries. Banks are generally open to it, they just need a bit more convincing.

So, what does that "extra convincing" look like? You should be ready for a few things:

- A Larger Deposit: Lenders will want to see you have more skin in the game. Expect to need a down payment somewhere between 30% and 40% of the home's price.

- Thorough Paperwork: You'll need to prove your financial stability with documents like tax returns, pay stubs, and credit reports from your home country.

- Lower Loan Amounts: Banks will typically finance a smaller piece of the pie, usually around 60-70% of the property's value.

It's a higher bar to clear, for sure. But with the right financial preparation, securing a mortgage is a very realistic goal.

Myth 2: You'll Get Drowned in Bureaucracy

The thought of wrestling with foreign red tape is enough to make anyone second-guess their plans. And yes, there’s paperwork involved—there is for any property purchase, anywhere in the world. But it doesn't have to be the bureaucratic nightmare you might be imagining.

Here’s the secret: don’t go it alone. The single best thing you can do is hire a reputable, local, independent lawyer. They know the system inside and out and can navigate it for you. They’ll handle everything from getting your tax ID number to checking the property for old debts and making sure every contract is airtight. With an expert on your side, the process transforms from a confusing maze into a series of clear, manageable steps.

The notion that affordable European real estate is some kind of myth is often fueled by a lack of real, on-the-ground knowledge. The truth is, while big cities like Paris and London are facing affordability crises, countless other regions offer incredible value if you’re willing to look past the headlines.

Myth 3: Those 1 Euro Homes Are a Total Scam

Ah, the "1 Euro Home." It sounds far too good to be true, so it’s easy to write it off as a marketing gimmick or a flat-out scam. But these programs are actually real. They're legitimate initiatives run by towns and villages trying to breathe new life into communities that have seen their populations dwindle.

So what's the catch? The €1 price tag is just the beginning. The real commitment is the renovation. Buyers must agree to restore the property, usually within a set timeframe and to a certain standard. The true cost isn't one euro; it's the full renovation budget. For someone with a vision and the means to execute it, it's a fantastic opportunity. But if you're looking for a move-in-ready home, this isn't the path for you.

The broader conversation about affordability is complex. In fact, many major European markets are becoming less affordable due to restrictive land use policies that limit housing supply. You can read the full 2025 Demographia report on international housing affordability to understand these wider economic trends. However, this only reinforces the value found in the less-publicized regions where these myths don't apply.

A Few Common Questions About European Property

Dipping your toes into the European property market for the first time? It's completely normal to have a lot of questions. Let's tackle some of the most common ones that come up when people start looking for cheap homes in Europe. The idea here is to give you clear, practical answers so you can move ahead with your search feeling informed and confident.

What Is the Absolute Cheapest Country in Europe to Buy a House?

If you're looking strictly at the price tags, countries like Bulgaria and Romania often come out on top within the EU. It's not unheard of to see rural properties listed for what seems like pocket change.

But the "cheapest" place isn't just about the initial purchase price. A home with a rock-bottom price might need a mountain of cash for renovations. You also have to think about the long game: property taxes, annual maintenance, and the local cost of living. Often, a home that costs a bit more upfront in a place with solid infrastructure can save you a lot of money and headaches down the road.

Can UK Citizens Still Buy Property in Europe After Brexit?

Yes, you certainly can. The rules for buying property haven't really changed for UK citizens. The real shift is in how long you can stay there.

Since Brexit, UK citizens are treated as non-EU nationals. This means you're generally limited to visa-free stays of 90 days within any 180-day period. If you're dreaming of living in your European getaway for more than just short holidays, you'll need to look into getting a long-stay visa or residency permit, following the same process as any other non-EU citizen.

How Long Does the Property Buying Process Take in Europe?

This one really varies. The timeline can be wildly different from one country to the next, and even from one sale to another. As a general rule of thumb, plan on it taking anywhere from three to six months from the moment your offer is accepted to the day you get the keys.

Some countries are known for a more efficient legal process—Portugal, for instance, can be on the faster side. On the other hand, if you're buying an old property with a complicated history or in a region known for its red tape, things can drag on. Your best friends in this process will be patience and a good local lawyer.

Ready to turn that European dream into a real address? Start your search on Residaro, where you can browse a huge selection of properties across Spain, Italy, France, and Portugal. Find your perfect villa, country house, or apartment today by visiting Residaro's property listings.