What Is Property Depreciation for Real Estate Investors

Property depreciation is one of the most powerful tools in a real estate investor's toolkit. It’s a tax deduction that lets you write off the cost of your investment property’s building over a set period.

The best part? It's a non-cash expense. This means you get to lower your taxable income—and your tax bill—without actually spending a dime.

Understanding Property Depreciation and Its Value

Think of it like this: if you buy a van for a delivery business, you know that with every mile driven, it's losing value from wear and tear. The tax code allows you to deduct that loss in value as a business expense.

Property depreciation works on the same principle, but with a fantastic twist for real estate investors.

While your delivery van is almost certainly losing real-world value, your investment property is hopefully doing the exact opposite—appreciating. This is a common point of confusion for newcomers. You have to separate the idea of market value from tax rules. Depreciation is purely a tax concept. Tax authorities know that buildings, plumbing, and electrical systems don't last forever, even as the land they sit on grows more valuable.

Depreciation is the financial equivalent of acknowledging that even the strongest structures don't last forever. It allows investors to recover the cost of an income-producing asset over its expected lifespan, creating a significant tax shield in the process.

This powerful accounting tool lets you create a "paper loss" that can significantly reduce the taxes you owe on your real rental income.

The Key Elements of Depreciation

At its heart, the concept is built on a few core principles. It's not a random number you pick; it’s a structured calculation based on specific rules.

To get started, here’s a quick rundown of the essential components that every investor needs to get right.

Key Components of Property Depreciation

| Component | What It Means for Investors | Example |

|---|---|---|

| Cost Basis | This is your starting line for the calculation. It’s what you paid for the property, plus certain closing costs, but—and this is critical—minus the value of the land. Land is forever, so it can't be depreciated. | You buy a property for €250,000. An appraisal determines the land is worth €50,000. Your cost basis for depreciation is €200,000. |

| Useful Life | The time period, set by the tax authority, over which you can claim the depreciation deduction. It varies by country. For example, in the U.S., it's 27.5 years for residential rental properties. | A residential building is depreciated over its mandated "useful life," regardless of its actual physical condition. |

| Depreciation Method | The formula you use to calculate how much you can deduct each year. For real estate, the most common approach is the straight-line method, which means the deduction is spread evenly across the asset's useful life. | Using the €200,000 cost basis and a 27.5-year useful life, your annual deduction would be €7,272.73 (€200,000 / 27.5). |

These components work together to provide a consistent and predictable tax benefit for property owners.

Globally, the wear and tear on buildings is a cornerstone of tax strategy for investors. In a major market like the United States, for instance, structural depreciation accounts for about a 3% reduction in value annually as a share of the total capital stock. That’s a much slower and steadier rate than business equipment (around 13% per year) or intellectual property (a whopping 24%). You can explore more of these economic trends on the St. Louis Fed's research site.

How Property Depreciation Is Calculated

So, you understand what depreciation is. Now for the good part: learning how to calculate it. While it might sound like something you'd need an accounting degree for, the process for most real estate investors is surprisingly logical.

The go-to approach is called the Straight-Line Method. Think of it as evenly spreading out the total tax deduction over the property's lifespan. It's the most common and straightforward way to do it, giving you a predictable tax benefit year in and year out.

Let's walk through it step-by-step.

Step 1: Determine the Property's Cost Basis

First things first, you need to find your property's cost basis. This isn't just the price tag on the sales agreement. It’s a more complete number that includes what you paid for the property plus any extra costs to acquire it, like legal fees, title insurance, and recording fees.

But here’s the critical part: you have to subtract the value of the land.

Why? Because land doesn't wear out, get old, or become obsolete. Tax authorities only let you depreciate the actual building or structure. To figure out the land's value, you can typically find it on a property tax assessment or get a professional appraisal.

Let’s see it in action: You buy a rental property for €300,000. Closing costs add another €5,000. A recent appraisal says the land itself is worth €60,000.

- Total Acquisition Cost: €300,000 + €5,000 = €305,000

- Value of Land: €60,000

- Your Depreciable Basis: €305,000 - €60,000 = €245,000

That €245,000 is the magic number you'll use for the rest of the calculation.

Step 2: Identify the Useful Life

Next up is the property's "useful life." This is a standard timeframe set by tax law that represents how long an asset is expected to be in service. This period isn't a guess—it’s a fixed number that changes based on the property type and the country you're in.

For example, in the U.S., the IRS sets very clear timelines. A residential rental property has a useful life of 27.5 years, while a commercial building is depreciated over 39 years. It's worth noting that recent tax reforms have introduced accelerated options like bonus depreciation for certain assets, a topic you can dive into on the St. Louis Fed's research blog.

Using the correct useful life is non-negotiable for staying compliant.

Step 3: Calculate the Annual Deduction

You’ve done the hard work. This last step is simple division. With the straight-line method, you just take your depreciable basis from Step 1 and divide it by the useful life from Step 2.

The formula looks like this:

Annual Depreciation Deduction = Depreciable Basis / Useful Life

Let's finish the example we started:

- Depreciable Basis: €245,000

- Useful Life: 27.5 years (we'll assume it's a residential rental)

- Calculation: €245,000 / 27.5 years = €8,909.09

And there you have it. You can deduct €8,909.09 from your taxable rental income every single year for the next 27.5 years. This "on-paper" expense reduces your tax bill without taking a single euro out of your pocket, which is precisely why it’s so powerful. Getting a handle on this is just as fundamental as knowing how to calculate rental yield when you’re sizing up a deal.

What About Other Parts of the Property?

The building itself gets depreciated over a long stretch, but what about everything inside it? Many other assets that come with your property have much shorter useful lives and can be depreciated faster.

These are often classified as personal property and can include:

- Appliances: Things like refrigerators, stoves, and dishwashers usually have a 5-year useful life.

- Flooring: Carpeting is a great example, also typically depreciated over 5 years.

- Land Improvements: Fences, driveways, or major landscaping projects often fall into a 15-year schedule.

Writing these items off over a shorter period gives you bigger tax deductions in the early years of owning the property. To really get this right, many serious investors use a cost segregation study to professionally break down these components and squeeze every last drop of tax-saving potential out of their investment.

How Depreciation Supercharges Your Investment Returns

Knowing how to calculate property depreciation is one thing, but understanding its real-world impact on your bottom line is where the magic happens. This isn't just an abstract accounting concept; it's a powerful tool for legally slashing your tax bill and boosting your annual cash flow.

Think of it as a "paper expense." Even when your property is putting cash in your pocket every month, depreciation allows you to show a lower profit—or even a loss—on your tax return. This effectively shields your rental income from taxes, letting you keep more of the money you earn.

Turning a Real Profit Into a Paper Loss

Let's look at a quick example to see this in action. Say you own a rental property that’s cash-flow positive, meaning you have money left over after paying the mortgage, insurance, and other real-world expenses.

To make this clear, let's compare how your finances look with and without depreciation.

Depreciation's Effect on Annual Cash Flow vs Taxable Income

| Financial Metric | Without Depreciation | With Depreciation |

|---|---|---|

| Annual Rental Income | €24,000 | €24,000 |

| Operating Expenses | -€18,000 | -€18,000 |

| Net Operating Income | €6,000 | €6,000 |

| Depreciation Deduction | €0 | -€8,909 |

| Final Taxable Income | €6,000 | -€2,909 |

As you can see, the actual cash you have (€6,000) doesn't change. But with the depreciation deduction, your profitable property now reports a tax loss of €2,909.

The result? You legally owe zero income tax on your rental earnings for the year. This is a game-changing concept for investors and a crucial factor in any serious rental property ROI calculator.

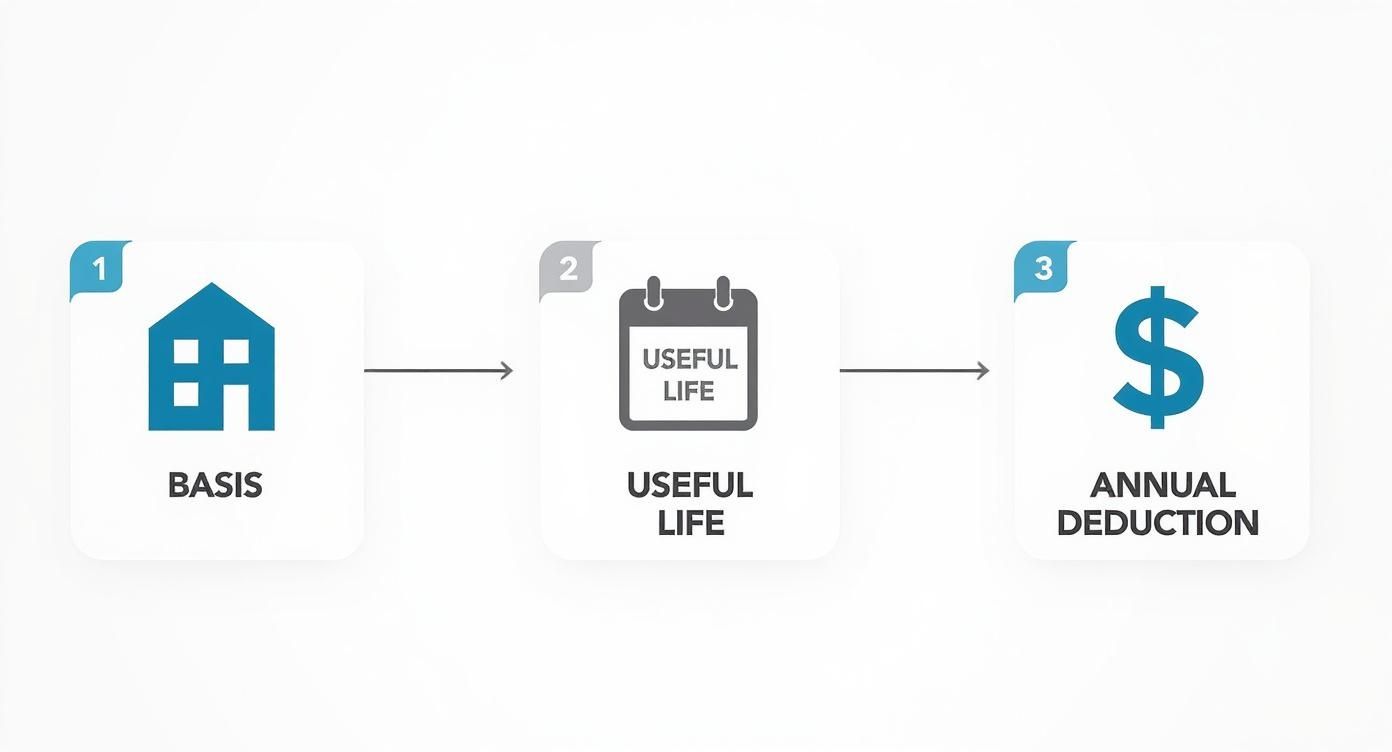

This simple visual breaks down the core steps to getting that annual deduction.

It's a straightforward path from establishing your property's basis to calculating a deduction that can save you thousands each year.

The Catch: Understanding Depreciation Recapture

While depreciation is a fantastic benefit year after year, it’s not exactly a free lunch. When you eventually sell the property, tax authorities want to "recoup" the tax savings you enjoyed along the way. This is known as depreciation recapture.

Basically, the government's stance is: "We let you write off the building's supposed loss in value for years. Now that you're selling it for a profit, we need to tax those deductions you took."

Here’s the breakdown of how it works:

- Total Depreciation Claimed: First, you add up all the depreciation deductions you've claimed over the years you've owned the property.

- Adjusted Cost Basis: You then subtract that total from your original purchase price to get your "adjusted cost basis." This new, lower number is what the tax office uses to measure your profit.

- Calculating the Gain: The difference between your sale price and your adjusted cost basis is your total taxable gain.

- The Recapture Tax: The part of your gain that equals the depreciation you claimed gets taxed at a special depreciation recapture rate. This rate is often higher than the standard capital gains rate—in the U.S., for instance, it can be up to 25%.

Let’s walk through a sale scenario:

- Original Purchase Price: €300,000

- Total Depreciation Claimed (over 10 years): €89,090

- Adjusted Cost Basis: €300,000 - €89,090 = €210,910

- Selling Price: €450,000

- Total Gain: €450,000 - €210,910 = €239,090

Of that total gain, the €89,090 you wrote off over the decade would be taxed at the recapture rate. The rest of the profit (€150,000) would be taxed as a standard capital gain.

While this might feel like a penalty, remember you had the benefit of those tax savings for ten years, improving your cash flow that entire time. Smart investors plan for this from day one.

How Depreciation Works in European Markets

While the idea of property depreciation is a fundamental principle for real estate investors everywhere, how it's applied can change dramatically the moment you cross a border. The core concept—writing off an asset's cost over its useful life—is universal. But the rules, the rates, and even what you’re allowed to depreciate are all dictated by local tax law. For any international investor, getting these local nuances right is absolutely critical.

For instance, investors familiar with the U.S. system are used to a clear-cut 27.5-year schedule for residential properties. But that’s just one country's take on it. European markets have their own distinct approaches, each shaped by unique economic and legal landscapes.

A Look at Key European Differences

When it comes to property depreciation in Europe, you have to think country by country. A strategy that works wonders in Germany will fall flat in the UK, and France has its own specific set of rules that you need to know. There's simply no "one-size-fits-all" approach.

Let's look at a few high-level examples to see just how different things can be:

- Germany: Often considered an investor-friendly market, Germany generally allows a straight-line depreciation of 2% per year for residential buildings built after 1925. That works out to a 50-year useful life. For older buildings constructed before 1925, the rate is even better at 2.5% over 40 years.

- United Kingdom: The UK is a whole different ballgame. Here, you can't claim depreciation (known as 'capital allowances') on the residential building structure itself. Instead, investors can claim allowances on certain "plant and machinery," which includes things like fixtures, fittings, and integral features inside the property. This makes a detailed breakdown of assets incredibly important.

- France: In France, depreciation is a powerful tool, but it's mainly available to investors operating under a specific tax regime for furnished rentals, known as LMNP (Loueur en Meublé Non Professionnel). If you qualify, you can depreciate not just the building and improvements, but the furniture, too, which can massively reduce your taxable income.

These differences highlight why you can't just assume anything. Misinterpreting the local rules can turn a great investment into a tax nightmare. For a deeper look into this, our guide on foreign real estate tax provides more essential context for international buyers.

Local Market Dynamics and Their Impact

It’s not just about the tax code, either. The overall health of a local market shapes the entire investment picture. For example, recent data shows that European all-property rents jumped by 4% in the last year, with residential properties leading the charge. This kind of rental growth, often fueled by high demand and low supply, directly affects a property's value and, by extension, how important a tax deduction like depreciation becomes to your bottom line. You can see more on these trends in the latest global real estate market outlook.

The core takeaway for international investors is this: Depreciation is a universal concept, but its practical application is hyperlocal. Your strategy must be tailored to the specific tax laws of the country where you are buying property.

Ultimately, this is exactly why getting local, professional tax advice isn't just a good idea—it's non-negotiable for success. A local expert can guide you through the complexities of their specific market, making sure your investment is structured to be both fully compliant and financially optimized. They are the essential bridge between knowing the theory of depreciation and putting it to work effectively on the ground.

Common Misconceptions About Property Depreciation

The world of property depreciation is littered with myths, and they can trip up even the most experienced investors. Getting this stuff wrong can lead to costly mistakes or, just as bad, missed opportunities.

Let's clear the air and debunk three of the most stubborn myths out there.

Myth 1: You Can Depreciate Land

This one is probably the biggest and most fundamental error people make. It's a common assumption that when you buy a property, the entire purchase price—land and building—is fair game for a depreciation write-off.

Reality: Tax authorities have a very different view. They see land as an asset that doesn't wear out, get old, or break down. If anything, it usually goes up in value. For that reason, you can only depreciate the building and any other structures on the property. The land itself is off-limits. The very first thing you must do in any depreciation calculation is split the value of the structure from the value of the land.

Myth 2: Depreciation Is an Optional Tax Strategy

Another idea that sounds logical but is completely wrong is that claiming depreciation is just a choice. You might think you can just claim it in the years you really need a bigger deduction. But from a tax standpoint, that’s a dangerous game to play.

Reality: Tax offices operate on what's known as an "allowed or allowable" basis. This means they assume you're taking the depreciation deduction you're entitled to, whether you actually claim it on your tax return or not. The real pain comes when you sell. They will "recapture" the depreciation you should have taken over the years, even if you never saw a penny of benefit from it.

By not claiming depreciation, you truly get the worst of both worlds. You miss out on years of valuable tax deductions that could have improved your cash flow, yet you still have to pay the tax bill for depreciation recapture when you sell.

Failing to claim depreciation is like turning down free money, but still having to pay it back later.

Myth 3: Tax Depreciation Means Your Property Is Losing Value

The word "depreciation" itself is the problem here. It immediately makes us think of something losing value. So it’s no surprise that many investors worry that by claiming a depreciation deduction, they're somehow telling the tax man—and themselves—that their investment is actually worth less.

Reality: This is where you have to separate the tax world from the real world. Tax depreciation is an accounting concept, not a market reality. It’s a deduction on paper that’s supposed to account for the theoretical wear and tear on a building over its useful life. Meanwhile, your property's actual market value is being driven by things like location, demand, and local market conditions. It's entirely possible, and very common, for a property to be appreciating in value while you're claiming depreciation on it every single year.

This distinction is precisely what makes understanding what is property depreciation so important for investors. The rules that govern this tax tool are constantly evolving as governments use them to incentivize investment. Recent global reforms have expanded these deductions, with some countries now allowing businesses to deduct 20% of new asset costs upfront. You can discover more insights about these business tax changes on deloitte.com.

Got Questions? Here Are Some Common Ones About Depreciation

Even when you've got the basics down, property depreciation can get tricky in the real world. Let's tackle some of the most frequent questions I hear from investors to clear up the confusion.

When Does the Depreciation Clock Actually Start (and Stop)?

This is a big one. You don't start depreciating the property the day you get the keys. The official start date is when the property is "placed in service," which is tax-speak for when it's ready and available to be rented out.

That could be the day your first tenant signs the lease, or it could be the day you list it for rent—even if it stays empty for a while. As long as it's officially on the market, the clock is ticking.

The depreciation deductions continue every year until one of two things happens:

- You’ve deducted the entire cost basis over the property's useful life (for example, after 27.5 years for a residential rental in the U.S.).

- You sell the property or take it out of service.

Can I Depreciate My Own Home?

A hard no on this one. Depreciation is strictly a business deduction for income-producing assets. Since your primary residence doesn't generate rental income, it doesn't qualify.

The only exception? If you use a part of your home exclusively for business, like a true home office. In that case, you might be able to depreciate that specific portion. The rules are incredibly strict here, so it's a conversation you absolutely need to have with a tax advisor.

The bottom line is always about its use. Depreciation is directly tied to income generation. If a property isn't being used to earn money, you generally can't claim this deduction.

What Is a Cost Segregation Study?

Think of a cost segregation study as a way to put your depreciation on steroids. It's a highly detailed engineering-based analysis that dissects your property into its individual components.

Instead of treating the entire building as one big asset that depreciates slowly over 27.5 or 39 years, the study identifies parts that can be written off much faster.

For instance, a study might break down a property like this:

- Personal Property (5-year life): Things like carpets, appliances, and certain light fixtures.

- Land Improvements (15-year life): Fencing, parking lots, and landscaping.

- Building Structure (27.5 or 39-year life): The foundation, roof, and walls that are left over.

By reclassifying these items, you can front-load your depreciation deductions into the first few years of owning the property. This means bigger tax savings right away. While the study itself has a cost, for many serious investors, the immediate boost to cash flow makes it a brilliant financial move.

Ready to find your next investment property in Europe? With listings across Spain, Italy, France, and beyond, Residaro makes it easy to discover homes that match your financial goals. Explore properties today.