Retire in Spain: Ultimate Guide to Your Dream Retirement

Picture this: your retirement years spent enjoying long, sun-soaked afternoons, savoring fantastic meals that don’t break the bank, and soaking in centuries of history and culture. For a growing number of people, this isn't a daydream—it's the reality when they retire in Spain.

Spain offers a rare blend of high-quality living, world-class and affordable healthcare, and a famously welcoming culture, making it one of the best retirement spots on the planet.

Why Does Everyone Want to Retire in Spain?

When you’re deciding where to spend your retirement, you're looking for that perfect mix of practical benefits and the lifestyle you've always wanted. Plenty of countries have sunshine, and others offer a low cost of living. But Spain? Spain consistently delivers on both, plus a whole lot more. It’s not just about finding a pretty place to live; it's about making a smart financial move that also guarantees a rich, fulfilling life.

For anyone weighing their options, the case for Spain is incredibly strong. It’s not just anecdotal, either. A recent 2025 study from the Global Intelligence Unit officially named Spain the number one country in the world for retirement, giving it a perfect score of 100. It outranked other popular destinations like Portugal and Costa Rica, highlighting just how exceptional it is, especially for retirees from the US.

Spain's Winning Combination

So, what’s the secret sauce? What really sets Spain apart goes far beyond beautiful beaches and tasty tapas. The advantages are tangible and make a real difference in daily life.

- Top-Tier Healthcare: Spain ranks 2nd globally for healthcare quality. This gives retirees incredible peace of mind, knowing they have access to excellent medical care, often at a fraction of what it would cost back home.

- A Climate That Can't Be Beat: With a global rank of 5th for climate, it's easy to see the appeal. We're talking about mild winters and more than 300 days of sunshine a year. This means you can enjoy an active outdoor lifestyle all year round, whether that's hiking in the mountains or just taking a leisurely stroll along the coast.

- Feeling Welcome and at Home: Moving to a new country can be daunting, but Spain makes it easier, ranking 7th for cultural integration. The Spanish are known for being friendly and open, and you'll find vibrant expat communities ready to welcome you.

To give you a clearer picture, here’s a quick breakdown of what makes Spain such a standout choice.

Spain's Retirement Appeal at a Glance

| Factor | Global Ranking/Score | What This Means for Retirees |

|---|---|---|

| Overall Retirement Score | #1 (Score: 100) | The best all-around destination, balancing cost, lifestyle, and security. |

| Healthcare | #2 | Access to world-class medical facilities without the high price tag. |

| Climate | #5 | More sunshine and mild weather for an active, year-round outdoor lifestyle. |

| Cultural Integration | #7 | A welcoming atmosphere and strong expat networks make it easy to settle in. |

Ultimately, what makes Spain so attractive is that you don't have to choose between a low cost of living and a high standard of living—you get both.

The real magic of Spain is that it delivers on all fronts. You get the lifestyle you’ve dreamed of without having to sacrifice your financial security.

This powerful combination makes the idea to retire in Spain not just an appealing fantasy, but a truly achievable goal. If you're looking at different options across Europe, it helps to see the full picture. For a broader comparison, check out our detailed guide on the best places to retire in Europe to see how Spain stacks up against other top contenders.

Securing Your Spanish Residency and Visa

Alright, let's talk about the paperwork. Getting your Spanish residency is the first real hurdle you'll clear on your journey to retirement here. It might seem daunting, but I've seen countless people navigate it successfully. With a bit of prep, it's completely doable.

For most non-EU retirees, the golden ticket is Spain's Non-Lucrative Visa (NLV). Think of it as a residence permit designed specifically for people who can support themselves without needing to work in Spain. It's essentially Spain's way of welcoming financially independent folks who just want to soak up the sun and enjoy the lifestyle.

Cracking the Code of the Non-Lucrative Visa

At its core, the NLV application is all about proving you won't be a financial burden. Spain needs to know you can live comfortably on your own dime.

The magic number here is tied to a Spanish benchmark called the IPREM (Indicador Público de Renta de Efectos Múltiples). For 2025, the main applicant needs to show an annual income or savings of at least 400% of the IPREM. This comes out to €28,800 per year, or roughly €2,400 a month.

Planning on bringing your spouse or partner? For every extra family member, you'll need to add another 100% of the IPREM (€7,200 annually) to that total.

Here’s a real-world example: A retired couple applying for the NLV together must prove they have a combined passive income (from pensions, investments, you name it) or savings of at least €36,000 for the year. That's the €28,800 for the first person plus €7,200 for the second.

Of course, it's not just about the money. You'll need to gather a stack of documents for your appointment at the Spanish consulate in your home country. Here's a quick rundown of the essentials:

- Proof of Private Health Insurance: This is non-negotiable. You need a comprehensive Spanish policy with no co-payments (sin copagos) that covers you for the entire first year.

- A Clean Criminal Record: You’ll need a background check from your home country, which must be officially authenticated with an apostille.

- Medical Certificate: A recent letter from a doctor stating you're in good health.

- Proof of Accommodation: Spain wants to see you have a place to live. This could be a 12-month rental agreement or the deed to a property you've purchased.

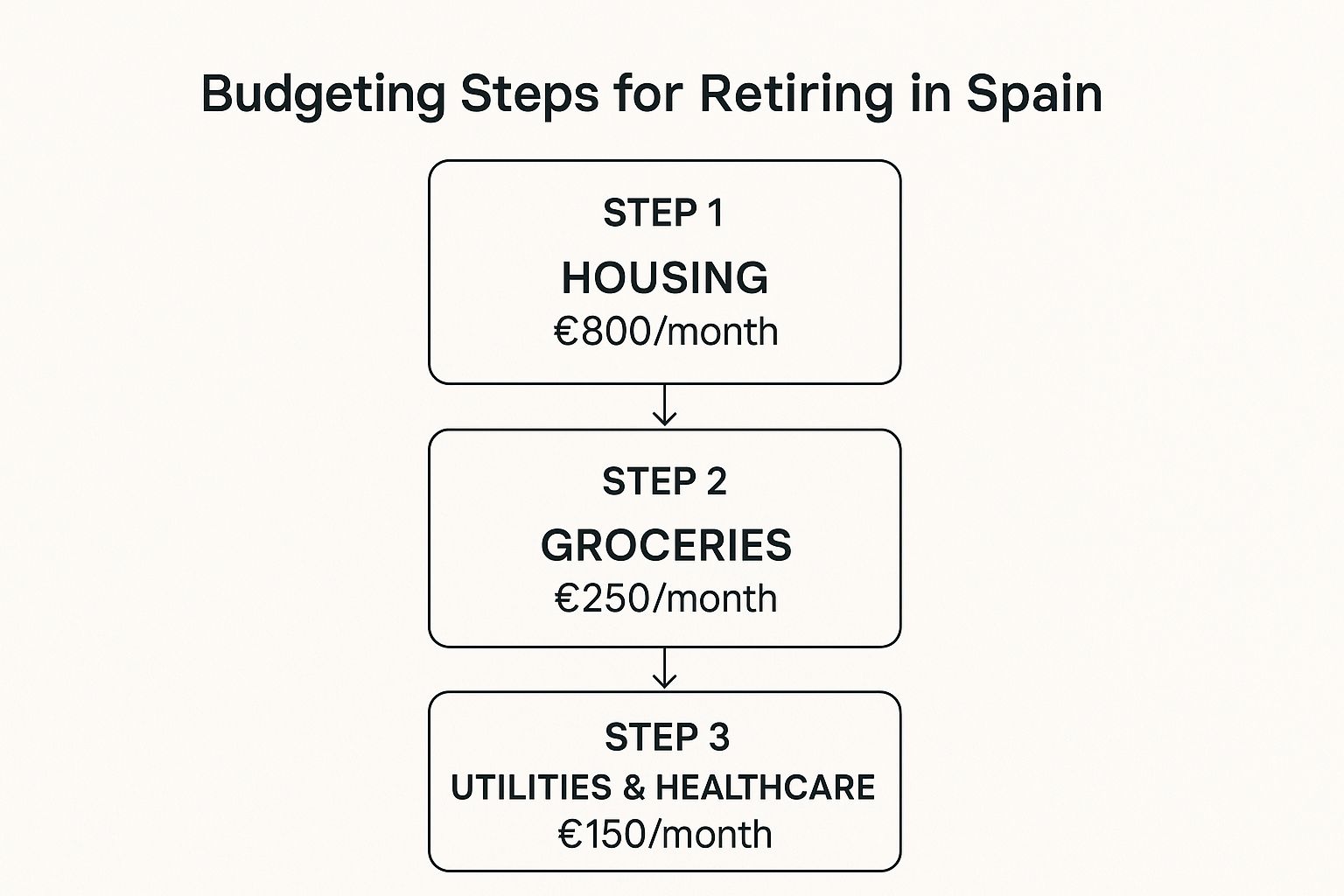

This visual gives you a practical idea of how that required income stacks up against typical monthly costs.

As you can see, even a modest monthly budget of €1,200 can easily cover the essentials in many parts of the country. This leaves plenty of breathing room within the NLV's income requirement for travel, hobbies, and enjoying everything Spain has to offer.

The Journey from Visa to Permanent Resident

Think of your residency as a multi-stage process. Your initial NLV is valid for one year. From there, you'll renew it for a two-year period, and then for another two-year period, as long as you continue to meet the financial and insurance requirements.

The big milestone comes after five continuous years of living in Spain. At that point, you can apply for permanent residency. This is a game-changer. It grants you the right to live—and even work, if you choose—in Spain indefinitely, with far less renewal paperwork.

What if the NLV Isn't the Right Fit?

While the NLV is the go-to for most retirees, it’s not the only path. Your personal situation might point you toward a different option.

- Golden Visa: If you have the capital for a significant investment, like buying a property worth €500,000 or more, the Spanish Golden Visa is worth a look. It comes with more flexibility, including the right to work and much lighter requirements for how much time you must spend in Spain each year.

- Digital Nomad Visa: Are you a retiree who still earns active income from remote work for clients outside of Spain? This newer visa could be your ticket. The financial proof is based on your active remote income rather than passive savings or pensions.

Taking the time to choose the right visa is one of the most important steps you'll take. For the vast majority of people planning to retire in Spain, the NLV is the perfect solution. Just be sure to weigh all the options against your own financial picture and long-term goals for a smooth transition.

Getting Your Finances Ready for Spain

Let's talk about money. At the end of the day, a comfortable and stress-free retirement in Spain hinges on having a solid financial plan. This isn't just about ticking a box for your visa application; it’s about making sure your money actually supports the life you’ve been dreaming of, whether that involves daily tapas, weekend trips, or new hobbies.

Spain’s affordable cost of living is a huge draw for retirees, but it’s not a one-size-fits-all situation. Your budget in a bustling city like Madrid or Barcelona will look very different from a quiet life in a coastal Andalusian town or even a vibrant city like Valencia.

As a general rule of thumb, a retired couple might aim for €2,500-€3,000 per month to live comfortably in a major city. But if you settle in a smaller city or town, you could have an amazing quality of life on €1,800-€2,200 per month. That's a significant difference.

Crafting a Realistic Monthly Budget

Of course, your personal spending habits are the real wild card. To help you visualize it, here’s a sample budget I've put together based on what a retired couple might spend in an affordable, desirable area like the Valencian Community or parts of Andalusia.

| Expense Category | Estimated Monthly Cost (for a Couple) | My Notes & Observations |

|---|---|---|

| Rent (2-bedroom flat) | €750 - €1,000 | Good, well-kept apartments outside the main city centres are surprisingly affordable. |

| Utilities (electric, water, gas, internet) | €150 - €200 | Expect this to tick up in winter for heating and in summer for air conditioning. |

| Groceries | €400 - €500 | This is where you can really save. The fresh produce at local markets is fantastic and cheap. |

| Healthcare (private insurance) | €150 - €250 | Varies with age and coverage, but it's generally a pleasant surprise for many. |

| Dining Out & Entertainment | €300 - €400 | This covers regular meals out, coffees with friends, and enjoying local culture. |

| Transportation (public transport/fuel) | €100 - €150 | So many Spanish cities are incredibly walkable, which helps keep this cost low. |

| Total Estimated Monthly Cost | €1,850 - €2,500 | This is a comfortable range that leaves some wiggle room for those unexpected expenses. |

As you can see, a comfortable retirement in Spain is often far more accessible than in places like the US or the UK.

Navigating Pensions and Taxes

Getting a handle on how your retirement income will be taxed in Spain is absolutely critical. Once you live in the country for more than 183 days a year, you're considered a tax resident. This means Spain will tax your worldwide income, which includes your pensions, social security payments, and any investment returns.

Spanish income tax rates are progressive, climbing from 19% up to 47%. But don't panic. The US-Spain tax treaty is designed to prevent double taxation. You can use the Foreign Tax Credit to offset the taxes you pay in Spain against what you owe back in the US.

My Two Cents: I've seen it time and again—most retirees discover that even after paying Spanish income tax, they're in a better financial spot overall. The lower cost of living and affordable healthcare make a huge difference. The key is to plan ahead with a tax advisor who knows both the US and Spanish tax systems inside and out.

It's also worth noting that the Spanish government is making moves to support its pensioners. Starting January 1, 2025, non-contributory pensions are set for a major boost, increasing by as much as 18.24%. This reform is a big deal and aims to provide a stronger safety net. You can read up on the specifics of these pension changes and what they mean for retirees in Spain.

Smart Banking and Currency Exchange Strategies

One of your first to-dos on the ground will be opening a Spanish bank account. It's non-negotiable for paying bills, setting up utilities, and just handling day-to-day life. The good news is that most Spanish banks offer non-resident accounts that you can open even before your residency is finalized, which makes the transition much smoother.

From then on, managing currency exchange will be a regular part of your financial routine. Your pension and savings are likely in dollars or pounds, so you'll constantly be moving money into Euros.

To avoid letting currency fluctuations eat into your retirement funds, here’s my advice:

- Don't Use Your Bank for Big Transfers: Banks are notorious for their high fees and less-than-great exchange rates. It really adds up.

- Use a Specialist: Services like Wise or Spartan FX are built for this. They offer much better rates and lower fees, which could easily save you thousands of dollars over the course of a year.

- Think About a Forward Contract: This is a savvy move. It lets you lock in a good exchange rate for future transfers, giving you peace of mind and protecting you from any sudden drops in your home currency's value.

By putting in a bit of financial homework upfront, you can make sure your move to Spain is not just exciting but also financially secure. This frees you up to truly soak in everything your new life has to offer.

Getting to Grips with the Spanish Healthcare System

Let's talk about healthcare. It's a huge consideration when you retire in Spain, and for good reason. The country's system is consistently ranked among the best in Europe, but navigating it as a new arrival has a few nuances.

Let's talk about healthcare. It's a huge consideration when you retire in Spain, and for good reason. The country's system is consistently ranked among the best in Europe, but navigating it as a new arrival has a few nuances.

When you first land, especially if you're on a Non-Lucrative Visa (NLV), you'll be relying on private insurance. This isn’t optional—it's a non-negotiable part of your visa approval. You must have a comprehensive private health policy that covers you completely in Spain for your entire first year.

Choosing the Right Private Insurance for Your Visa

When the Spanish consulate looks at your application, they have a very specific checklist for health insurance. They need to see a ‘sin copagos’ policy. In plain English, that means zero co-payments and no deductibles.

The logic here is simple: the government wants assurance that you won't be a financial burden. Your policy needs to cover everything without you paying out-of-pocket for each visit or procedure. You'll also have to prove that the policy is fully paid for the first 12 months.

Critically, the coverage must be on par with Spain's public system, the Sistema Nacional de Salud (SNS). This means your plan absolutely must include:

- Visits to general practitioners and specialists

- Hospital stays and any surgical procedures

- Lab work and diagnostic tests

- Complete emergency services

Stick with well-known Spanish insurers like Sanitas, Adeslas, or DKV. Consulates are familiar with their policies, which smooths out the approval process. Budget-wise, you should expect to pay somewhere between €100 to €250 per person, per month, with the final cost depending on your age and any pre-existing conditions.

Moving Over to the Public System

After you've been a legal resident for a year, a new door opens. You may become eligible to join the public healthcare system through a special pay-in agreement known as the Convenio Especial. This is a fantastic path for long-term retirees who want access to the state-run network.

To get started, you'll need to register at your local social security office (Tesorería General de la Seguridad Social). Once enrolled, you pay a flat monthly fee that grants you the same high-quality care that Spanish citizens enjoy.

Key Takeaway: For 2025, the monthly fee for the Convenio Especial is set at €60 for individuals under 65 and €157 for those 65 and older. This provides comprehensive coverage, making it a very compelling and affordable alternative to continuing with private insurance long-term.

Public vs. Private: Making the Call

Both systems provide excellent medical care, but they are built for different priorities. Knowing the trade-offs is key to figuring out what works best for your health and your wallet down the road.

| Aspect | Public System (Convenio Especial) | Private System |

|---|---|---|

| Cost | A fixed monthly fee (€60/€157) | Premiums vary by age & provider |

| Doctors | You're assigned a primary care doctor | Freedom to choose any doctor/specialist |

| Wait Times | Can be longer for non-urgent care | Generally much shorter wait times |

| Language | Staff will primarily speak Spanish | Easier to find English-speaking staff |

| Coverage | Fully comprehensive, covers pre-existing conditions | Pre-existing conditions are often excluded |

So, what do most expats do? Many of us actually find a hybrid approach is the sweet spot. We use the public system for routine care and emergencies but keep a basic private policy for perks like faster access to specialists or for things like dental and vision care, which the public system doesn't usually cover. It's a strategy that gives you the best of both worlds as you settle into your new life in Spain.

How to Find Your Dream Home in Spain

This is the part where the dream starts to feel real. Moving your plan to retire in Spain from a spreadsheet into a search for an actual front door is an exciting step. You’re not just looking for a house; you’re looking for a new local café, a community, and a place to truly call home.

Spain's regions are famously diverse, each offering a completely different way of life. The sun-bleached coasts of the Costa del Sol and Costa Blanca are retirement magnets for a reason, promising vibrant social scenes and endless beach days. But head inland to the rustic villages of Andalusia, and you'll find a slower, more traditional rhythm. Figuring out which one fits you is a personal journey.

Exploring Spain’s Retirement Hotspots

The big question usually boils down to lifestyle. Are you picturing yourself in a bustling expat hub with every international amenity at your fingertips? Or is your ideal a more immersive cultural experience in a classic whitewashed village?

Let's take a look at a few of the most popular areas to help you get a feel for what’s out there.

Regional Retirement Hotspots in Spain

The table below breaks down some of the most sought-after regions for retirees. It's a great starting point, but remember that even within these regions, the vibe can change dramatically from one town to the next.

| Region | Best For | Average Property Price (per sq. meter) | Lifestyle Vibe |

|---|---|---|---|

| The Costa del Sol | Social butterflies, golfers, and sun-seekers | €2,800 - €4,500+ | Lively, international, and glamorous, especially around Marbella. |

| The Costa Blanca | A balance of expat community and Spanish culture | €1,800 - €2,900 | Bustling but more affordable than the Costa del Sol, with beautiful beaches. |

| Inland Andalusia | Authentic cultural immersion and a slower pace | €1,000 - €1,800 | Historic, traditional, and deeply Spanish. Hot summers, quiet winters. |

Ultimately, choosing a region is about more than just numbers—it’s about the feeling you get walking down the street.

My best advice is always the same: plan a proper scouting trip. Don't just visit for a weekend. Rent an apartment for a few weeks in your top two or three locations to see which one genuinely feels like it could be home.

The Spanish Property Buying Process Explained

Once you’ve zeroed in on your perfect spot, it’s time to navigate the buying process. It’s definitely different from what you might be used to in the US or the UK, but it’s a secure and well-established path—as long as you have the right team and follow the key steps.

Your very first task is getting a Número de Identificación de Extranjero (NIE). This is your official ID and tax number in Spain. You literally can't do anything official without it—not buy property, open a bank account, or even sign up for utilities. You can apply at a Spanish consulate in your home country before you leave or at a designated police station once you're in Spain.

Next, you need to assemble your professional team. Two people are absolutely critical:

- The Abogado (Lawyer): Your independent lawyer is your most important ally. They work only for you, not the seller or the agent. They'll perform all the due diligence, checking for property debts, verifying permits, and ensuring the sale is 100% legal.

- The Notario (Notary): The notario is a public official who officiates the final sale. They ensure all legal formalities are met, witness the signing of the final deed (escritura), and register the property in your name.

After your offer is accepted, you'll sign a reservation agreement (contrato de reserva) and pay a small deposit, typically between €3,000 and €6,000, which takes the property off the market. This is soon followed by the main private purchase contract (contrato privado de compraventa), at which point you'll usually pay 10% of the purchase price.

The final stage happens at the notario's office, where you'll sign the escritura, pay the remaining balance, and finally get the keys to your new home. Your abogado will then handle registering your ownership and ensuring all taxes, like the Property Transfer Tax (ITP)—which runs from 4% to 10% depending on the region—are settled.

The structure of this process is one of the reasons Spain is such an appealing place to invest. For a broader comparison, see our guide on the best countries to buy property for more global insights.

Answering Your Top Questions About Retiring in Spain

Planning a move to retire in Spain is exciting, but it’s completely normal to have a long list of questions. I hear the same ones all the time from people just starting their journey. Let’s tackle some of the most common "what ifs" and "how tos" so you can move forward with confidence.

What Are My Visa Options as a UK Citizen Now?

Things have certainly changed since Brexit. British citizens now need to apply for residency just like other non-EU nationals. The path most people take is the Non-Lucrative Visa (NLV). This one’s designed for retirees, as it requires you to prove you have enough passive income or savings to support yourself without working in Spain.

But the NLV isn't your only choice. A couple of other routes might fit your situation even better:

- The Golden Visa: If you're planning a significant investment, this is a fantastic option. Buying a property worth €500,000 or more qualifies you, and it comes with more flexibility and less strict residency rules.

- The Digital Nomad Visa: This is a newer visa perfect for the semi-retired. If you still earn money by working remotely for companies outside Spain, this could be your ticket.

Each visa has its own financial thresholds and residency requirements. It’s well worth taking the time to see which one truly aligns with how you picture your life in Spain.

How Much Money Do I Really Need to Live Comfortably?

This is the big one, isn't it? While the government sets a minimum for the NLV (currently €28,800 a year for one person), what you actually need for a comfortable life comes down to two things: where you live and how you live.

A retired couple could live very well in Andalusia or the Valencian Community on a budget of €1,800–€2,200 a month. But if you have your heart set on Madrid or Barcelona, you'll want to aim for closer to €2,500–€3,000 to enjoy the same lifestyle.

Housing and dining out will be your biggest line items. You could find a modern two-bedroom apartment for €750 in a smaller city, but expect to pay over €1,500 for something similar in a prime city location. The fantastic news is that your day-to-day costs, like groceries and public transport, are much lower than in the UK or the US. Your retirement savings will simply go further here.

If finding a great deal on a property is a major goal, our guide on finding cheap houses in Spain is packed with regional tips.

Can I Get By Without Speaking Fluent Spanish?

Yes, you can... but you'll have a much richer life if you learn some of the language. In the big expat hubs on the Costa del Sol or Costa Blanca, you can absolutely manage your daily life speaking only English. Many doctors, banks, and shops are well-versed in catering to the international community.

The moment you step outside those well-trodden areas, however, a little Spanish goes a long way. It makes everything easier, from sorting out paperwork at the town hall to haggling at the local market or just having a chat with your neighbors. You don’t need to be fluent overnight. Simply making an effort shows respect and opens doors. It’s the difference between just living in Spain and truly feeling at home.

What Is the Official Retirement Age in Spain?

Knowing Spain's official retirement age is useful context, especially if you ever plan to draw a Spanish state pension. Like many European countries, Spain is gradually increasing its retirement age to keep the pension system sustainable.

This isn't a sudden change; it's a planned, step-by-step increase. For example, in 2025, the standard retirement age for both men and women will be 66 years and 8 months. This is part of a schedule that will see the full retirement age reach 67 by the year 2027. This is key information for anyone doing long-term financial planning. You can track these evolving retirement age policies in Spain to see how they might factor into your own strategy.

Ultimately, a successful retirement in Spain is about matching your dream with practical planning. By getting clear on these key questions, you’re in a much better position to turn your vision of a sun-drenched Spanish life into a wonderful reality.

Ready to find your perfect home in Europe? At Residaro, we connect you with an extensive portfolio of properties in Spain, Portugal, France, and Italy. Start exploring villas, apartments, and country houses today and let us help you find the home you've always dreamed of at https://residaro.com.