Property for Sale Sweden: Your Ultimate Buying Guide

Thinking about buying property in Sweden? It's a fantastic move, and getting a handle on the current market is your first, most important step toward a smart purchase. Right now, the market for property for sale in Sweden is seeing a solid recovery, and buyer confidence is on the rise. For anyone poised to jump in, this creates some really interesting opportunities.

Getting a Feel for the Swedish Property Market

Before you start scrolling through listings on a platform like Residaro, it's incredibly helpful to understand what's actually driving the real estate scene in Sweden. The market isn't just one big thing; it's a mix of moving parts—economic policies, interest rate shifts, and what buyers are looking for.

Knowing this backstory gives you a real edge, whether you're dreaming of a summer cottage out in Småland or a stylish flat in the middle of Stockholm.

After a bit of a slump, the Swedish property market is showing clear signs of bouncing back. This shift opens up a compelling window for potential buyers. The previous correction has settled into a more balanced and resilient market, meaning if you know what you're looking for, you can find some excellent value.

The Market's Comeback and What’s Trending

Recent data really paints a picture of a market on the rebound. This isn't just news for economists; it directly impacts your search for property for sale in Sweden. The numbers point to a much more optimistic climate, making it the perfect time to start paying close attention.

For starters, the Swedish house price index has bounced back nicely. We've seen a 2.86% year-over-year increase in the first quarter, which is a huge turnaround after seven straight quarters of decline. This is the best inflation-adjusted performance we’ve seen since early 2022, largely thanks to friendlier mortgage rates and inflation starting to cool off. You can dig deeper into these encouraging trends in the Swedish housing market.

This renewed confidence is also showing up in the number of sales. With transactions for homes jumping by about 12-16%—that’s roughly 90,000 properties sold—it’s obvious that buyers are coming back to the market with real intent.

Here's a key takeaway from someone who's watched this market for years: keep an eye on the supply. New construction has dropped significantly, by 26-46%. This could easily lead to a shortage of available homes down the road, which would naturally push prices up for existing properties. Buying now could mean getting in before the competition gets even tougher.

How This Shapes Your Property Hunt

So, what does all this mean for you, the buyer? These trends give you a strategic advantage. The market's behavior tells us that properties are selling faster, and competitive bidding is becoming the norm again. In fact, 28% of properties are now selling for more than their asking price—a clear sign of how active buyers are.

This kind of environment calls for being prepared and ready to act. Here’s how you can use this insight:

- Move with Confidence: The data shows a market that's recovering well. You can feel confident in your search, knowing the fundamentals are strong.

- Get Your Finances Lined Up: In a competitive market, having your financing sorted (like a mortgage promise, or lånelöfte) is non-negotiable. It lets you move quickly and decisively when you find the one.

- Expect a Bidding Process: With more sales happening above the asking price, be ready for a bidding situation (budgivning). It’s crucial to set your maximum budget and stick to your strategy before you get started.

The massive 66% year-over-year jump in investment activity just reinforces how attractive the market is right now. Investors from Sweden and abroad see the potential for growth. For you as an individual buyer, this means you're entering a market that the experts feel good about. Using a platform like Residaro helps you efficiently sift through all the options and put yourself in a great position to take advantage of these favorable conditions.

Where to Find Your Dream Home in Sweden

Sweden’s property market is a beautiful mix of contrasts. You can find everything from sleek, modern apartments in the heart of a bustling city to charming, red-painted cottages tucked away by a serene lake. So, when you start looking for a property for sale in Sweden, you’re not just choosing a location on a map; you’re picking a lifestyle.

The first big decision most people face is the classic trade-off: the non-stop energy of a major city versus the quiet and open space of the countryside. Each path has its own set of financial realities and personal perks.

For instance, if you're a tech professional who thrives on urban life, Stockholm or Malmö would be a natural fit, putting you close to career opportunities and a vibrant cultural scene. On the other hand, if you work remotely or you’re raising a family, a region like Småland or Dalarna could offer that idyllic backdrop with a lot more house for your money.

Urban Hubs And Major Cities

Sweden's big cities—Stockholm, Gothenburg, and Malmö—are the nation’s economic and cultural engines. They're where you'll find top-tier amenities, diverse job markets, and a dynamic social life. Of course, all that demand means you'll be dealing with premium property prices.

As the capital, Stockholm is predictably the most expensive market. Buying there is a major investment, but it puts you right in the center of the action. Malmö, with its direct link to Copenhagen, has a more continental feel and slightly more approachable prices, while still delivering all the benefits of a major city.

For many buyers I've worked with, the key is striking a balance between ambition and budget. Sometimes, a smaller apartment in a fantastic city neighborhood makes more sense than a larger house further out, especially if walkability and culture are at the top of your list. It's a choice that truly shapes your day-to-day life.

Emerging Regions And Hidden Gems

The rise of remote work has been a game-changer for the Swedish property market. All of a sudden, places that once seemed too far from the office are now in high demand. This shift is opening up some incredible opportunities in regions that deliver an amazing quality of life at a fraction of the big-city cost.

And this isn't just a feeling; the numbers back it up. We’re seeing a clear rebalancing in the market. While prices in major hubs like Stockholm County have cooled off a bit, some of the less urbanized areas are seeing incredible growth. Upper Norrland, for example, saw a jaw-dropping 12.6% jump in average property prices, fueled almost entirely by people moving for a better lifestyle. Other regions like Northern Central Sweden and South Sweden have also posted solid gains of 8.5% and 6.4%, respectively. It’s clear that space and value are becoming bigger priorities.

Here are a few regions that are getting a lot of attention right now:

- Småland: Famous for its deep forests, thousands of lakes, and the classic red stuga (cottage) aesthetic. This is the storybook Sweden many people dream of, and it comes with real affordability and a deep connection to nature.

- Dalarna: Often called "Sweden in miniature," this region has rich cultural traditions, stunning scenery around Lake Siljan, and a wonderful community spirit that’s perfect for families.

- Upper Norrland: For those chasing true adventure and breathtaking natural beauty, the north is unbeatable. You get vast landscapes, the Northern Lights, and a growing hub for green industries, which is creating new economic opportunities.

Swedish Property Market Regional Snapshot

The data shows a fascinating story of regional divergence. While Stockholm remains the benchmark for price, the most significant growth is happening elsewhere, driven by new lifestyle priorities. This table breaks down what's happening in key areas.

| Region | Average Price (SEK) | Year-Over-Year Price Change | Key Driver |

|---|---|---|---|

| Greater Stockholm | 6,500,000 | -1.5% | Economic hub, international appeal |

| Greater Gothenburg | 4,800,000 | +2.1% | Strong industrial base, port city |

| Greater Malmö | 3,900,000 | +3.5% | Proximity to Europe, diverse economy |

| Upper Norrland | 2,100,000 | +12.6% | Remote work, green tech boom |

| South Sweden | 2,750,000 | +6.4% | Agricultural heartland, lifestyle appeal |

This snapshot really highlights the shift. The impressive growth in Upper Norrland and South Sweden shows that buyers are increasingly looking beyond the traditional urban centers for value and quality of life.

Matching Location To Your Lifestyle

At the end of the day, the "best" place to find a property for sale in Sweden is completely personal. Before you even start scrolling through listings, I always advise clients to sit down and define what their "dream home" actually means to them.

Try making a simple priority list. Is a short commute an absolute must-have? Or is a big garden for the kids the most important thing? Maybe you're an investor looking for solid rental yields near a university city like Uppsala or Lund.

Once you have that clear picture of your ideal life, you can begin exploring specific regions that match your vision. This focused approach will make your search on Residaro much more efficient, helping you cut through the noise and filter the many beautiful properties available for sale across Sweden to find the one that’s genuinely right for you.

Getting to Grips with the Swedish Property Buying Process

If you're looking to buy property in Sweden, get ready for a system that's a world away from what you might be used to. The whole process is incredibly structured, but it also moves at lightning speed. Getting your head around these stages is the key to acting confidently and making smart moves when it counts.

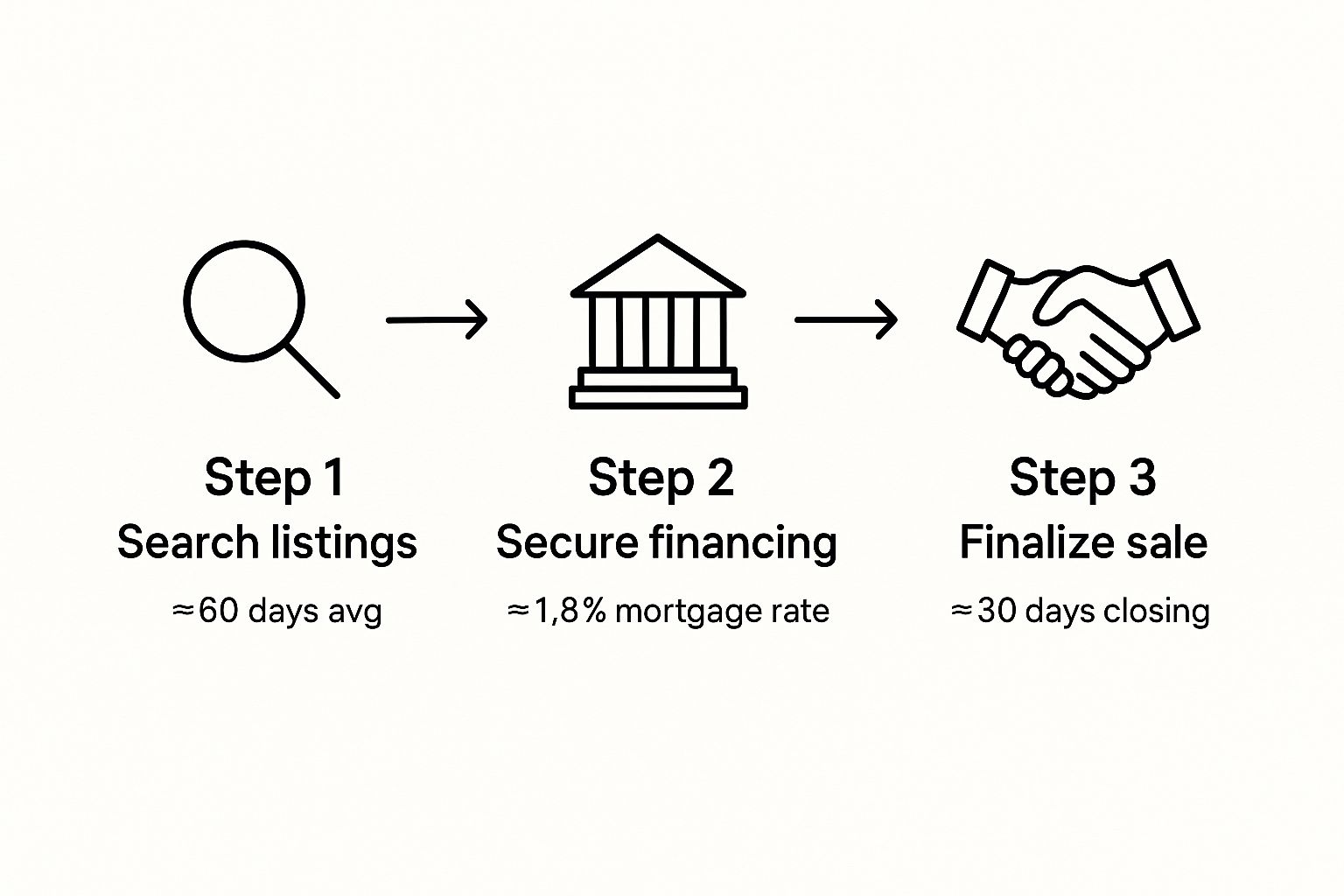

This visual guide gives you a quick snapshot of the typical timeline for buying a home in Sweden, from the initial search to getting the keys in your hand.

As you can see, finding the right place takes up the most time. Once you do, the actual purchase and closing happen surprisingly fast. This is why it’s so important to have all your ducks in a row before you even think about attending a viewing.

Getting Ready to Make an Offer

Before you even start dreaming about specific homes, your first stop is the bank. You absolutely must get a mortgage promise, called a lånelöfte. This isn't just a piece of paper; it’s your entry ticket to the market. It tells sellers and real estate agents (mäklare) that you’re a serious buyer with the funds to back up an offer.

Honestly, without a lånelöfte, you stand almost no chance in a bidding war. It clearly states the maximum you can borrow, so you can bid with confidence and know your limit.

With your finances sorted, the next step is to learn how to read a property description, or objektsbeskrivning. These documents are packed with vital details about the property's condition, the housing association's finances (for apartments), and running costs. You need to pay close attention here, as these details can hide potential red flags.

From personal experience, the single biggest mistake buyers make is just skimming the objektsbeskrivning. A high monthly fee (avgift) for an apartment could be a sign of a poorly managed housing association, which might mean steep fee increases down the road. Always dig into those numbers.

The Viewing and the Bidding War

The property viewing, known as a visning, is your opportunity to see if the home lives up to the photos. Viewings in Sweden are often open-house style, usually held over a single weekend. This is where you’ll register your interest with the agent if you want to join the bidding.

And this is where the action really starts. The bidding process, or budgivning, is typically a transparent, open auction.

- The agent texts every new bid to all registered bidders in real time.

- The back-and-forth continues until no one is willing to go higher.

- Crucially, bids are not legally binding in Sweden until the final contract is signed. This means a bidder can pull out at any moment.

This non-binding rule adds a fascinating psychological element to the whole affair. The seller also isn't forced to sell to the highest bidder. They can pick any offer they like, for any reason, right up until the moment a contract is signed.

Navigating the market starts with good research. Platforms like Residaro let you browse everything from city apartments to country farmhouses, making it easy to compare your options before you go to a viewing. If you're looking for something specific, you can even explore niche collections like our curated list of luxurious penthouses for sale in Sweden to see what the high-end market has to offer.

From Winning Bid to New Homeowner

Once a seller accepts your offer, things move very quickly. You’ll meet with the agent to sign the purchase contract, or köpekontrakt. This is the point where the deal becomes legally binding. You'll also pay the down payment (handpenning), which is almost always 10% of the purchase price.

The final stage is the closing day, or tillträdesdag. On this day, you pay the remaining 90%, get the keys, and the property is officially yours.

It’s also essential to know the two main types of ownership you’ll encounter:

- Fastighet (Freehold): This is what you probably think of as traditional ownership. You own the building and the land it sits on. You're responsible for all taxes, maintenance, and costs.

- Bostadsrätt (Housing Co-operative): This is much more common for apartments. You're not buying the physical apartment but the right to live in it indefinitely. You become a member of the co-op that owns the building and pay a monthly fee (avgift) to cover shared expenses like maintenance, heating, and water.

Mastering the Bidding and Negotiation Process

Alright, let's talk about the most exhilarating—and frankly, nerve-wracking—part of buying a property for sale in Sweden: the bidding process, or budgivning. This is where your careful preparation goes head-to-head with pure psychology. Having a cool head and a clear strategy isn't just an advantage; it's essential.

Unlike the slower, more private negotiations you might be used to, Swedish bidding is a whirlwind. It's fast, surprisingly transparent, and can be over in just a couple of days. The key to coming out on top is understanding the rules of the game before you start playing. Most bids are "open," meaning the real estate agent keeps everyone in the loop, usually with a stream of text messages updating the latest offer. This creates a very dynamic, high-stakes environment where it's easy to get carried away.

Getting Your Head in the Game

The transparency of a Swedish bidding war is a double-edged sword. On one hand, you always know what you have to beat. On the other, it creates an intense feeling of direct competition. It’s incredibly easy to get swept up in the heat of the moment and start thinking of the other bidders as rivals you have to defeat, rather than just focusing on what the property is worth to you.

This is the classic trap. Your goal isn't to "win" an auction; it's to secure the right home at a price you can comfortably afford. Before you even think about placing your first bid, you need to set your absolute maximum price based on your lånelöfte (mortgage promise) and what your personal budget can handle. Seriously, write that number down and stick to it. No exceptions.

The most common mistake I see buyers make is shifting from a logical evaluation to an emotional battle. They start bidding against another person instead of bidding for the home. The moment you feel that personal rivalry kick in, it’s time to take a step back and reassess.

Common Bidding Tactics

There’s no single magic bullet for winning a budgivning, but there are a few tried-and-true approaches you can adapt. The best strategy for you will depend on how popular the property is, how many people are bidding, and your own personality.

-

The Aggressive Opener: Sometimes, coming in with a strong first bid that’s a bit over the asking price can work wonders. It shows you’re serious and can scare off buyers who are just testing the waters.

-

The Slow and Steady: Making small, consistent increases keeps you in the running without driving the price up too quickly. It’s a good way to feel out the competition, but be warned, it can drag out the process.

-

The Knockout Punch: My personal favorite in the right situation. You wait until the bidding seems to be losing steam—the bids get smaller, the pauses get longer—and then you drop a significantly larger bid. It completely disrupts the rhythm and can push other bidders past their mental limit, ending the auction right then and there.

Imagine a popular apartment in Gothenburg with five active bidders. The bidding is crawling up in small increments. A smart bidder waits patiently. Once the bidding slows, they jump in with an offer 100,000 SEK higher than the last. That decisive move often breaks the will of the remaining bidders and secures the property.

The Pre-emptive Strike: A High-Stakes Gamble

Feeling bold? You could try to bypass the bidding war entirely with a pre-emptive offer, known as a förtur. This means making an offer to the seller before the first open house even happens.

For this to have any chance of working, your offer needs to be compelling. We’re talking well above the asking price. You might also sweeten the deal with attractive conditions, like a quick closing date or waiving an inspection contingency (though that’s a risky move you should think carefully about).

Sellers are under no obligation to accept a pre-emptive bid; many will prefer to wait and see what a competitive auction brings in. But for a seller who just wants a quick, clean sale, a strong early offer can be very tempting. It's a high-risk, high-reward play best reserved for when you've found your absolute dream home and are willing to pay a premium to avoid the stress of a bidding war.

Looking at Swedish Property Through an Investor's Eyes

When you start looking at property for sale in Sweden as an investment, your perspective completely changes. It’s no longer just about finding a place you love; it's about spotting a genuine financial opportunity. You're diving into market trends, long-term growth potential, and the economic pulse of the country.

You have to think like an investor, and that means paying close attention to the big picture. The Riksbank, Sweden’s central bank, is a major player here. Any tweak they make to interest rates can instantly affect your financing costs and what a property is ultimately worth.

It also pays to watch the country's overall economic health. Things like GDP growth and inflation trends aren't just abstract numbers; they directly influence tenant demand and the potential for your property's value to increase over time. A strong economy is your best friend.

Tapping Into Market Drivers and Capital Flow

The Swedish real estate market has proven to be incredibly resilient. After a bumpy period with high inflation, the economy has found its footing again. GDP is expanding, and inflation has cooled off, which is great news for investors.

This stability gave the Riksbank the confidence to start cutting its policy interest rate, making it cheaper to borrow money. The effect was immediate. Capital that had been sitting on the sidelines came flooding back into the market. Total real estate investment volume shot up to around SEK 138.5 billion—a staggering 66% increase from the previous year. You can dig into the numbers yourself in the Swedish market outlook for 2025.

This isn't just a recovery; it's a strategic shift. The conversation has moved from just managing risk to actively hunting for growth.

The question for investors is no longer, "Is it safe?" but rather, "Where can I put my money to work for the best returns?" Interestingly, the data shows domestic investors are leading the charge, making up 90% of all transactions.

Pinpointing the Hottest Property Types

Not all real estate is created equal, especially when you're investing. Following the money is a smart way to see which sectors are performing best.

Here's where investors are currently focusing their capital:

- Residential Properties: This is the biggest slice of the pie, accounting for 28% of total investment. People will always need a place to live, which makes residential real estate a stable, reliable source of long-term income.

- Office Spaces: Right behind residential, offices make up 27% of investment. Even with changes in how we work, premium office space in major business districts remains a very valuable asset.

- Industrial and Logistics: Capturing 19% of investment, this sector is booming. The relentless growth of e-commerce means there's a huge demand for modern warehouses and logistics hubs.

Don't overlook the niche opportunities, either. Unique properties, especially those offering a particular lifestyle, have become very popular. If you're curious about this corner of the market, take a look at our curated collection of beautiful farmhouses for sale in Sweden.

Getting a Handle on Financing and Taxes

Getting a loan for an investment property is a bit different from financing your own home. Lenders will want to see the numbers. They’ll dig into the property’s potential to generate income, so you need to have your projected rental yields and overall investment plan buttoned up.

Speaking of rental yields, this is your key metric for profitability. It’s a simple calculation—just divide the annual rental income by the property's total cost—but it tells you exactly how hard your investment is working for you.

Finally, don't forget about taxes. While Sweden doesn’t have an annual property tax, there is a municipal fee to consider. And when you eventually sell, you'll face a capital gains tax. Factoring these costs into your financial model from the very beginning is crucial for building a realistic, profitable, and successful investment.

Got Questions About Buying a Home in Sweden? We Have Answers

Diving into the Swedish property market for the first time? It's completely normal to have a ton of questions, especially if you're buying from abroad. Getting a handle on the local rules and quirks from the get-go will make the whole experience feel less intimidating and a lot more straightforward.

Let's walk through some of the most common questions we hear from aspiring homeowners looking at a property for sale in Sweden. The system here is actually quite transparent once you know what to look for.

Can a Foreigner Actually Buy Property in Sweden?

This is usually the first thing people ask, and the answer is a simple, resounding yes. Sweden doesn't put up any barriers for foreign nationals who want to buy property. The rules and the process are exactly the same whether you're a Swedish citizen or not.

The one practical piece you'll need to sort out is getting a Swedish personal identity number (personnummer) or a coordination number (samordningsnummer). You'll need one of these to get a mortgage from a Swedish bank and to handle all the final legal paperwork. For any non-resident buyer, securing this number is a crucial first step on your property journey.

What Are the "Hidden" Costs I Should Budget For?

While there's no longer a national property tax (fastighetsskatt) in Sweden, you definitely need to account for a few other key expenses. They aren't really "hidden," but they are essential to factor into your total budget to avoid any surprises.

- Municipal Fee (kommunal fastighetsavgift): Think of this as a replacement for property tax. It’s an annual charge paid by property owners.

- Stamp Duty (stämpelskatt): When you buy a freehold property (fastighet), you'll pay a one-time stamp duty tax. It’s calculated at 1.5% of the final purchase price.

- Housing Association Fees: If you buy a bostadsrätt (a co-op apartment), you skip the stamp duty. However, the housing association will likely charge a small administrative fee to transfer the membership to your name.

- Inspection Costs: Getting a professional property inspection (besiktning) isn't mandatory, but it’s a very smart move. This cost is covered by you, the buyer.

A common point of confusion for international buyers is the difference between a property tax and the municipal fee. Think of the municipal fee as a cap-limited charge for local services, making it much more predictable than a value-based property tax system.

What’s a Bostadsrätt? Is It Different From a House?

Understanding this concept is absolutely critical, because the bostadsrätt is the most common way people own apartments in Sweden. When you purchase one, you aren't buying the physical apartment itself. What you're actually buying is the right to live in that specific unit indefinitely.

This right comes with membership in the housing cooperative (bostadsrättsförening, or BRF) that owns the entire building. You'll pay a monthly fee (avgift) to the BRF, which covers shared costs like building maintenance, heating, water, and often even high-speed internet.

This is a completely different ownership model from a freehold house (fastighet), where you own the land and the building outright. With a house, you're on the hook for every single cost yourself.

How Does the Bidding Process Actually Work?

Get ready for something a little different. The bidding process (budgivning) in Sweden is famously open, transparent, and can move very quickly. After you attend a viewing and register your interest with the agent, you'll be looped into all communications.

Typically, the agent keeps all active bidders in the loop about every new offer, often through a running group text message. This continues in real-time until the bidding naturally fizzles out and no one is willing to go higher.

Here’s the most important part: bids are not legally binding on anyone until the final purchase contract (köpekontrakt) is signed by both the buyer and the seller. This means you can pull out of the bidding at any time before signing. It also means the seller isn't forced to sell to the highest bidder—they can choose whichever offer they prefer, creating a fascinating dynamic that’s part auction, part personal negotiation.

Ready to find your own property for sale in Sweden? Start your search with Residaro, where you can explore a wide range of beautiful homes across the country, from Stockholm apartments to countryside retreats. Discover your dream Swedish property today.