Cost of Living in Portugal for Retirees: A Practical Retirement Budgeting Guide

One of the biggest draws for retirees flocking to Portugal is, without a doubt, the cost of living. It's significantly more manageable than in the US, UK, or much of Northern Europe, which is why it consistently ranks as a top retirement spot.

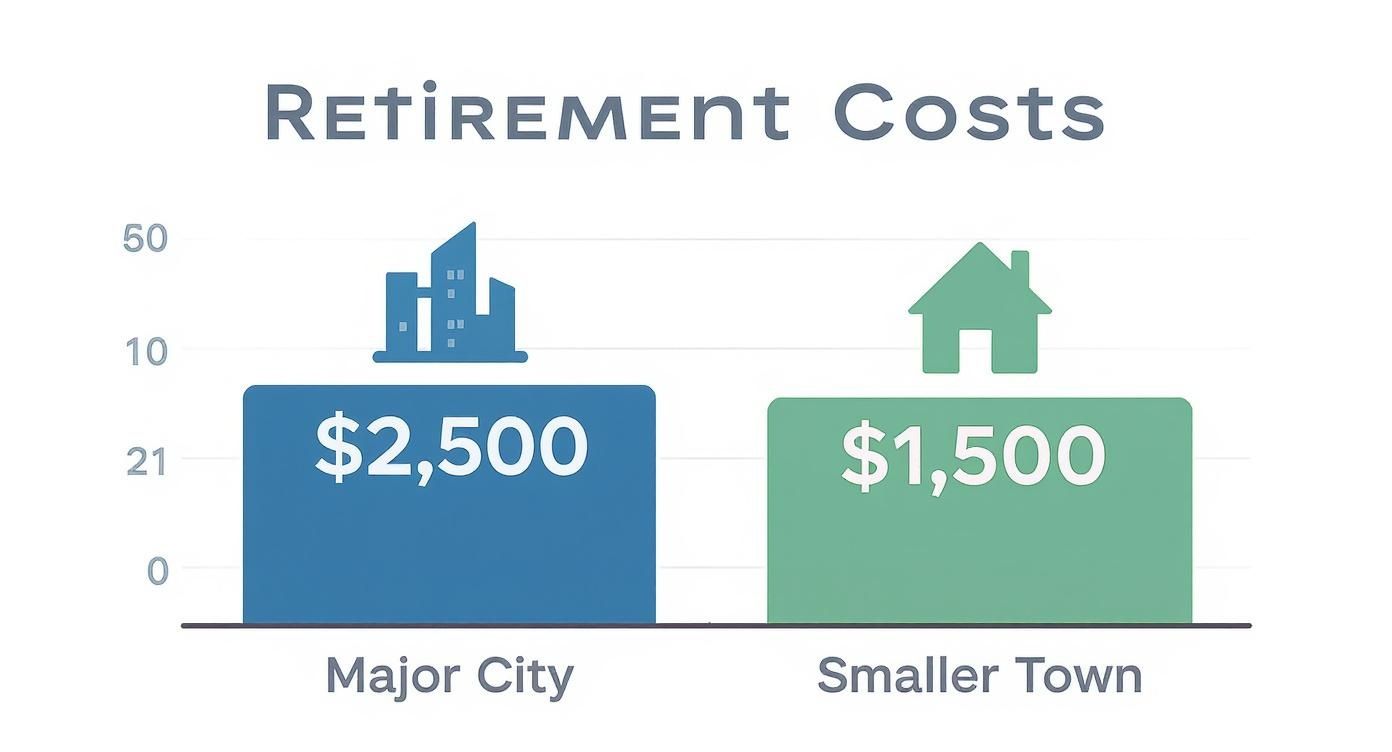

So, what are we talking about in real numbers? A retired couple can live a very comfortable life on a monthly budget of around $1,500 to $2,000 in a smaller town. If you have your heart set on a bigger city like Lisbon or Porto, that figure realistically goes up to about $2,500 to $3,000. Of course, your final tally will always circle back to where you decide to plant your roots and the kind of lifestyle you lead.

Why Portugal Is a Top Retirement Destination

Portugal didn't become one of Western Europe's most popular retirement havens by accident. Beyond the beautiful beaches and incredible history, there's a real, tangible financial benefit to living here. For many retirees, this translates into a much higher quality of life for a fraction of what they were paying back home, all without giving up the modern comforts and great healthcare they're used to.

The financial appeal is crystal clear. When you stack it up against its neighbors, Portugal stands out for its affordability. In fact, most studies show that a retired couple can do more than just get by—they can truly thrive on a modest budget. This means your pension and savings stretch a lot further, freeing up money for travel, hobbies, or simply enjoying a nice bottle of vinho verde at a sidewalk café. For a deeper dive into the numbers, these insights on retiring in Portugal from Get Golden Visa are a great resource.

Understanding the Key Budget Factors

When you start to map out your own budget, a few key things will immediately influence your monthly spending. Thinking through these early on is like drawing up a blueprint; it helps you build a financial plan that's both realistic and comfortable. The two biggest drivers are always going to be your location and your lifestyle.

- Location: It’s no surprise that renting an apartment in the heart of Lisbon will cost more than in the peaceful Alentejo countryside or a historic university city like Coimbra.

- Lifestyle: Your daily choices also add up. Are you someone who loves trying new restaurants every week, or do you prefer cooking at home with fresh produce from the local mercado? Will you need a car, or are you happy using Portugal's excellent and affordable public transport?

Here’s a simple way to look at it: Your fixed costs, like rent, are set by where you live. Your variable costs, like food and fun, are shaped by how you live.

Ultimately, there isn't one single magic number for the cost of living in Portugal. It’s a flexible range that you have a surprising amount of control over. This guide will walk you through each expense category, giving you the clarity you need to plan your perfect Portuguese retirement with complete financial confidence.

Estimated Monthly Budget for a Retired Couple in Portugal

To give you a clearer picture, let's compare what a typical monthly budget might look like for a retired couple in a major city versus a smaller town. This is just an estimate, but it's a great starting point for your own planning.

| Expense Category | Major City (e.g., Lisbon) | Smaller Town (e.g., Coimbra) |

|---|---|---|

| Rent (1-2 bedroom apt) | $1,200 - $1,800 | $600 - $900 |

| Utilities (electric, etc) | $100 - $150 | $80 - $120 |

| Groceries | $400 - $500 | $300 - $400 |

| Eating Out & Entertainment | $300 - $500 | $200 - $300 |

| Transportation (public) | $80 - $100 | $50 - $70 |

| Healthcare (private) | $200 - $300 | $150 - $250 |

| Total Estimated Monthly Cost | $2,280 - $3,350 | $1,380 - $2,040 |

As you can see, your choice of location makes a massive difference, especially when it comes to housing. A smaller city or town can cut your biggest monthly expense nearly in half, leaving much more room in your budget for the things you enjoy.

Breaking Down Your Monthly Retirement Budget in Portugal

Alright, let's get down to the brass tacks. Broad estimates are a good starting point, but a solid retirement plan is built on real-world numbers. Think of it like putting together a puzzle—you need to see how each piece, from housing to groceries, fits together to form your complete financial picture in Portugal.

The goal here is to move past the vague figures and start building a budget that actually matches the retirement you've been dreaming of. Let's dig into what you can realistically expect to spend each month.

First, a quick visual to show you just how much location matters. It’s the single biggest factor affecting your cost of living.

As you can see, choosing a smaller town over a major hub could easily shave $1,000 off your monthly expenses. That’s a huge difference, and most of it comes down to one thing: housing.

Housing and Utilities: The Core of Your Budget

No surprise here: your biggest monthly expense is going to be keeping a roof over your head. This is the anchor of your budget, whether you decide to rent or buy. In hotspots like Lisbon or Porto, a nice one-bedroom apartment will likely run you somewhere between €900 and €1,500 a month. Head to a smaller, charming city like Coimbra or Braga, and you could find a similar place for just €600 to €900.

Now for the good news—utilities are refreshingly affordable compared to what you might be used to.

- Electricity, Water, and Gas: For a typical two-person home, you can budget around €80 to €150 per month. This will fluctuate a bit with the seasons, but it’s very manageable.

- Internet and Mobile: Staying connected is cheap. A package with high-speed internet and a mobile plan will usually land between €40 and €60 a month.

Groceries and Daily Living

One of the absolute best parts of living in Portugal is the food. The access to incredibly fresh, high-quality ingredients for a low price is a game-changer. Your monthly grocery bill will depend on your shopping habits—do you lean towards big supermarkets like Continente or the local mercados? Either way, a couple can eat very well on a budget of €300 to €500 per month.

Pro tip: embrace the local markets. It’s not just a way to save money; it’s a core part of the culture. You'll find the best seasonal produce, fresh-off-the-boat fish, and amazing local cheeses for much less than you'd pay at a large grocery chain.

For many retirees, the food culture is a major budget advantage. A lifestyle rich in fresh, locally sourced ingredients is not a luxury here—it's the norm.

Transportation: Getting Around Affordably

How you get around will also play a role in your monthly budget. The big cities have fantastic public transportation that’s also incredibly cheap. A monthly pass for the metro, buses, and iconic trams in Lisbon or Porto costs only about €40.

Of course, owning a car gives you the freedom to explore every hidden corner of the country. But it comes with its own set of costs you'll need to plan for:

- Fuel: Gas prices are quite a bit higher here than in the US, so this is a key expense to track.

- Insurance: Car insurance is required by law, and the price will depend on your car and driving record.

- Maintenance: You'll need to budget for regular servicing, the annual inspection (known as IPO), and any unexpected repairs.

A lot of expats find a happy medium. They rely on the great public transit for day-to-day life and just rent a car for those weekend trips to the coast or wine country. It’s a smart way to get the best of both worlds without the full-time cost of car ownership.

How Location Shapes Your Retirement Costs

When you're mapping out your retirement in Portugal, think of location as the master dial on your budget. It's the single most powerful factor that will shape your monthly expenses. While the country is famously affordable, the financial gap between a lively coastal city and a quiet inland village is significant.

This isn't just about the price of a house, though that’s a huge piece of the puzzle. It’s about the entire economic feel of a place. The popular, sun-drenched coastal spots have intense demand, and that naturally pushes up the price of everything—from your morning coffee and weekly groceries to a nice dinner out.

Getting a handle on this dynamic is the first step to finding a place that fits both your wallet and your dream lifestyle.

Coastal Charm: The Algarve and Lisbon Coast

There's no denying the magnetic pull of Portugal's coastline. Regions like the Algarve or the sophisticated towns near Lisbon, such as Cascais and Estoril, are legendary for their golden beaches, top-tier golf courses, and bustling expat communities. That popularity, however, comes at a premium.

Living here means you're paying for convenience, stunning scenery, and access to a well-oiled international scene. In practical terms, that looks like:

- Higher Housing Costs: Both rent and property prices can easily be double what you might pay just an hour or two inland.

- Increased Daily Expenses: Restaurants, cafes, and local services are often priced with tourists in mind, which affects your day-to-day spending.

- A Buzzing Atmosphere: You’ll find an energetic, social environment with endless things to do, but it feels less like traditional, quiet Portugal.

A recent analysis of retiree budgets throws this financial divide into sharp relief. For a retired couple, monthly expenses in the popular coastal hubs can range from €2,300 to €4,550. This budget allows for a very comfortable life, but it clearly reflects the higher cost of living in these sought-after spots.

Inland Tranquility: The Alentejo and Central Portugal

Head away from the coast, and the entire financial picture changes. Inland regions like the Alentejo—famous for its rolling plains, cork forests, and wonderfully slow pace of life—offer a far more affordable retirement. The same is true for the beautiful towns of Central Portugal, like Castelo Branco or Viseu.

Opting for an inland location allows your retirement savings to stretch significantly further. The trade-off is often a quieter, more authentically Portuguese lifestyle, which for many retirees, is exactly what they came for.

Here, the cost of living drops across the board. The same budget analysis shows that a retired couple could live very well in an inland region for €1,550 to €2,970 a month. This isn't about making sacrifices; it's about a shift in priorities.

So, what does that lower budget get you?

- Spacious and Affordable Housing: You can often rent or buy a much larger property, sometimes with a bit of land, for the price of a small coastal apartment.

- Lower Day-to-Day Costs: Local markets, family-run restaurants, and everyday services are priced for locals, not tourists, which saves you money constantly.

- Deeper Cultural Immersion: Living inland is a fantastic opportunity to really become part of a traditional Portuguese community.

Ultimately, the choice is deeply personal. Do you dream of ocean views and a ready-made social circle, or does the thought of a peaceful country home and a lower cost of living appeal more? Portugal offers both, making it one of the most flexible and affordable places to retire in Europe.

Navigating The Portuguese Housing Market

Finding the right place to call home is probably the single most important decision you'll make when you retire to Portugal. It's the anchor for your new life and, let's be honest, the biggest line item in your budget. The classic dilemma—to buy or to rent—will have a massive impact on both your finances and your freedom.

This isn't just about what you prefer; it's about getting to grips with a market that’s very much alive. Portugal’s housing scene has been growing steadily, thanks in large part to its magnetic pull for retirees and expats. A smart move here means taking a hard, honest look at current trends, what you can afford upfront, and what you want your life to look like in five or ten years.

Recent numbers really drive this point home. The median house price in Portugal just hit €1,736 per square meter, which is a 6.6% jump from last year. With prices climbing in 21 out of 26 sub-regions, it's clear that high demand is shaping the cost of living in Portugal for retirees. If you want to dive deeper into the data, this detailed analysis by Portugal Homes breaks it down nicely.

Buying A Home In Portugal

For a lot of people, owning a home in Portugal feels like planting roots. It’s a solid investment and a real commitment to your new chapter. The good news is that the process for foreigners is surprisingly straightforward. The key is to be fully prepared for the extra costs that come with it, as they can add a hefty chunk to the sticker price.

Here's what you need to budget for beyond the sale price:

- Property Transfer Tax (IMT): This is the big one. It's calculated on a sliding scale based on the home's value and can run anywhere from 0% to 8%.

- Stamp Duty (Imposto do Selo): This is a flat tax of 0.8% of the property's declared value, applied to the purchase.

- Notary and Registration Fees: Think of these as the administrative costs to make it all official. They typically add another 1% to 2% to the total.

A good rule of thumb? Plan on adding 8% to 10% of the property’s purchase price to cover all these taxes and fees. Factoring this in from the very beginning means no nasty surprises down the road.

The Flexibility Of Renting

Renting offers a completely different approach. It’s a lower-commitment, more flexible option that’s perfect for anyone who wants to "try before they buy." It gives you the freedom to explore different towns and regions without tying up a large amount of capital in a single property.

To get a leg up in the rental market, especially in sought-after spots, you need to be organized. Landlords will almost always ask for a security deposit (usually one or two months' rent) plus the first month upfront. Having all your paperwork ready—proof of income from pensions or social security, your Portuguese tax number (NIF), and maybe a few references—can make all the difference.

Rental prices are just as varied as purchase prices. You might see a one-bedroom apartment in Lisbon going for €1,200 a month, while a similar place in a charming inland city like Évora could be closer to €700. This is where you can really manage your retirement budget. For more insights, our guide on securing a long-term rental in Spain has some fantastic tips that apply just as well to the Portuguese market.

Buying vs. Renting in Portugal A Retiree's Checklist

Deciding whether to buy or rent really comes down to your personal finances, your long-term vision, and the kind of lifestyle you're after. There's no single right answer, but this table can help you think through the pros and cons of each path.

| Consideration | Buying a Property | Renting a Property |

|---|---|---|

| Upfront Cost | High (down payment, taxes, fees) | Low (security deposit, first month's rent) |

| Investment | Builds equity; potential for appreciation. | No equity; rent is a fixed expense. |

| Flexibility | Low; selling can be a slow process. | High; easy to move after the lease ends. |

| Maintenance | You're responsible for all repairs and upkeep. | The landlord handles most maintenance issues. |

| Monthly Costs | Mortgage (if any), property taxes, insurance. | Fixed monthly rent, maybe renter's insurance. |

At the end of the day, whether you decide to put down roots or stay light on your feet, understanding the local market is the key to making a choice that supports a happy and financially secure retirement in Portugal.

Making it Official: Your Guide to Visas and Taxes in Portugal

Moving to Portugal is about more than just finding that perfect sunny spot for your morning coffee. You also need to handle the official side of things, which means getting the right visa and understanding how you'll be taxed. This part can feel a little intimidating, but it’s a well-traveled road, and with a bit of guidance, it's completely manageable.

The great news? Portugal has rolled out the welcome mat for retirees with visa options designed specifically for them. The most common choice by a long shot is the D7 Visa, often nicknamed the "retirement visa." It’s perfect for non-EU citizens who have a steady passive income—think pensions, Social Security, or even rental income. This is your key to unlocking legal residency.

First Step: Securing Your Residency with the D7 Visa

Think of the D7 Visa as your official invitation to live in Portugal. The whole point is to show the government you can support yourself without needing to find a job there. And you might be surprised at how reasonable the financial requirements are.

As of early 2024, a single person needs to prove a reliable passive income of at least €820 per month, which is tied to the national minimum wage. If you’re moving as a couple, the requirement for your partner is just 50% of that amount on top. It’s a clear signal from the government that the cost of living in Portugal for retirees is very accessible.

The D7 Visa isn’t about being wealthy; it’s about proving you're financially stable. The system is built to welcome people who can live comfortably on what they already have.

The process starts in your home country. You'll gather up your financial statements, get proof that you have a place to live in Portugal (like a 12-month lease), and apply at the nearest Portuguese consulate. Once they give you the green light, you head to Portugal to get your official residency card. We walk you through every single step in our complete guide on how to get residency in Portugal.

Next Up: Understanding the Portuguese Tax System

Once you become a resident, you also become a tax resident. This is where people’s ears perk up, but Portugal has a reputation for being quite friendly to retirees, largely thanks to a well-known tax program.

For a long time, the Non-Habitual Resident (NHR) program was a huge magnet for expats. It offered a flat 10% tax on most foreign pension income for your first ten years in the country. Now, the original NHR scheme was discontinued for new applicants at the end of 2023, but it's always smart to check for any new incentives or transitional rules that might have replaced it.

Even without the old NHR program, the tax situation is far from scary. Here’s what you should keep in mind:

- Pension Tax: Your pension and Social Security from back home will generally be taxed in Portugal. The rates are progressive, so the more income you have, the higher the rate.

- No Double Dipping: Portugal has tax treaties with dozens of countries, including the US, UK, and Canada. These agreements are designed to ensure you don't pay tax on the same income twice—once at home and again in Portugal.

- Don't Go It Alone: This is non-negotiable. Tax laws are complicated and they change. Hiring a local tax advisor who works with expats is one of the best investments you'll make. They'll save you headaches and almost certainly save you money.

Getting a handle on these two areas—your visa and your tax obligations—is a fundamental part of planning your move. By figuring this out early, you set yourself up for a smooth and worry-free new chapter in Portugal.

Living Well on a Budget in Portugal

Knowing the numbers is one thing, but the real secret to a happy retirement in Portugal is learning how to live a rich, full life without watching every single euro. It’s not about just getting by on your budget; it's about genuinely thriving. This means diving into the local culture, making smart choices, and discovering that many of the best things in Portuguese life cost very little.

Your mindset can shift from just paying the bills to actively creating a better lifestyle. It's all about thinking like a local. Instead of viewing your new home as a permanent vacation spot, you start to pick up on the daily rhythms and habits that help Portuguese people live so well for less. Simple tweaks to how you shop, eat, and enjoy your leisure time will not only save you a surprising amount of money but also connect you more deeply to your new community.

Everyday Savings The Portuguese Way

The most powerful tool for stretching your pension is to weave yourself into the local economy. The trick is simple: shop, eat, and live like the Portuguese do. This approach doesn't just cut your costs; it transforms your experience, turning you from a visitor into a real part of the neighborhood.

-

Embrace the Mercado: For your daily groceries, try swapping the big, expat-heavy supermarkets for the local municipal market (mercado). This is where you'll find the freshest produce, fish, and meat. You can expect prices to be 20-30% lower, the quality is often incredible, and you get the bonus of supporting local farmers and fishermen.

-

Master the Prato do Dia: Eating out doesn't have to break the bank. At lunchtime, almost every local restaurant and café offers a prato do dia, or "plate of the day." For about €8 to €12, you'll typically get a complete meal—a main course, a drink (like wine or water), and sometimes even a coffee. It's a fantastic value and the best way to taste authentic, home-style Portuguese food.

-

Take Advantage of Senior Discounts: As soon as you have your residency card, you can access discounts for seniors (terceira idade). This can lead to some serious savings on public transport, tickets to museums and cultural sites, and even cinema trips.

Living affordably in Portugal isn't about cutting back; it's about discovery. It’s about finding that little neighborhood café with the perfect €0.70 espresso or the weekly farmer's market with the sweetest figs. These small daily choices add up to a life that feels abundant, not restrictive.

Connecting with Your Community for a Richer Life

A great retirement is built on more than just financial security—it's about connection, community, and having a sense of purpose. Getting involved in your new town is not only good for your well-being but also great for your budget, as many local activities are low-cost or even free. And a quick tip: learning even a little bit of Portuguese goes a long way and opens up so many doors.

A great place to start is by looking for local clubs or groups that match your hobbies. It could be a hiking group, a choir, or a volunteer organization—all are fantastic ways to meet like-minded people and practice your Portuguese. Most towns also host a steady stream of free cultural events, from lively summer festivals to outdoor concerts, providing endless entertainment without the price tag. Before you know it, your social calendar will be full, making your retirement in Portugal a vibrant and genuinely rewarding new chapter.

A Few Final Questions Answered

Even with all the planning, a few questions always pop up when you're thinking about a move this big. Let's tackle some of the most common ones I hear about the cost of living for retirees in Portugal so you can move forward with confidence.

What's the Real Number I Need to Retire Comfortably in Portugal?

Everyone's "comfortable" is different, but a great target for a retired couple is somewhere between €2,000 and €2,500 a month. That's a solid budget that will let you live very well in most parts of the country without having to pinch pennies.

Of course, you can absolutely make it work on less. I've seen people live happily on about €1,500 a month in smaller towns and more rural spots. On the flip side, if you've got your heart set on a high-end lifestyle in central Lisbon, Porto, or a prime Algarve resort, you'll probably want to budget for €3,000 or more. The key is that the €2,000-€2,500 figure generally covers your rent, bills, food, healthcare, and leaves enough for fun.

How Worried Should I Be About Healthcare Costs?

This is one of the best parts about retiring in Portugal: the healthcare is excellent and surprisingly affordable. Once you're a legal resident, you get access to the public system, the Serviço Nacional de Saúde (SNS). Most of what you'll need is either free or comes with a very small co-pay.

Many expats also opt for a private health insurance plan to get quicker appointments with specialists or to guarantee an English-speaking doctor.

You'll be pleasantly surprised by the cost. Unlike the US system, for example, comprehensive private plans here are very reasonable. You can expect to pay between €50 to €150 per person each month, which gives you incredible peace of mind without breaking the bank.

Can I Get by on Just My US Social Security?

For many American retirees, the answer is a definite yes. Your Social Security benefits can absolutely fund a comfortable life in Portugal, particularly if you settle down outside of the expensive city centers.

The big hurdle is proving you have enough income for your residency visa, like the D7. The current minimum for one person is about €820 per month. Your Social Security check, especially if you have a small pension or some savings to go with it, should easily clear that bar and set you up for a fantastic retirement under the Portuguese sun.

Finding the right home is the first real step in turning this dream into a reality. Residaro is a great place to start exploring beautiful properties all over Portugal, whether you're picturing a sunny coastal villa or a quiet country home. Start your search and see what your new life could look like at https://residaro.com.