Apartment for Sale in Porto, Portugal - Your Buying Guide

If you're looking for an apartment for sale in Porto, Portugal, you've landed on a city that offers a rare trifecta: it's affordable, provides an incredible quality of life, and holds serious investment potential. Porto masterfully blends its historic soul with modern energy, making it a hotspot for both homebuyers and investors who want real value in one of Western Europe's most exciting cities.

Why Porto Is Such a Smart Place to Buy an Apartment

Porto is so much more than its postcard-perfect terracotta roofs and breathtaking views over the Douro River. It's a dynamic economic hub that has caught the eye of international buyers, and for good reason. It offers a unique mix of rich culture and smart, strategic growth.

Unlike so many other Western European cities that have become financially out of reach, Porto strikes a perfect balance. You get an exceptional lifestyle at a cost that still makes complete sense.

Over the last decade, the city has done an incredible job of reinventing itself. Once known almost exclusively for its port wine trade, Porto is now a thriving center for tech, startups, and tourism. This economic boom has brought in new jobs, attracted a talented international workforce, and, naturally, increased the demand for great places to live.

A Market with Real Growth Potential

The local real estate market tells a powerful story of steady, sustainable growth. While property values have certainly climbed, they're still much more accessible than what you'd find in Lisbon or other major European capitals. This creates a fantastic opportunity for buyers. You’re stepping into a market that has a proven history of growth but hasn't yet hit its ceiling.

The apartment market for sale in Porto has shown impressive strength in recent years, making the city a magnet for both Portuguese and international buyers. As of June 2025, the average price for an apartment in Porto falls between €1,472 and €4,500 per square meter. That's a far cry from Lisbon's average of €3,644/m², yet it shows solid appreciation.

In fact, between 2024 and 2025, property values here jumped by approximately 7.8% to 8.6% annually, easily outpacing Lisbon’s growth rate of 4.7%. This trend really underscores Porto's value. You're not just buying a property; you're making a smart financial move in a city with a very bright future.

Beyond the Numbers: The Quality of Life

But let's be honest, what truly makes Porto special is the quality of life. It's the reason people from all over the world are drawn here. It’s no accident that Portugal consistently ranks as one of the best European countries to retire, and Porto is a huge part of that appeal.

Just picture what daily life is like here:

- Walkability: You can wander through many of Porto's most captivating neighborhoods on foot, from the historic riverside alleys of Ribeira to the hip boutiques in Cedofeita.

- Food Scene: The city is a dream for foodies. You can find everything from humble tascas serving up the freshest seafood to elegant, Michelin-starred restaurants.

- Cultural Buzz: With its rich history, countless museums, vibrant art galleries, and a fantastic live music scene, there's always something new to discover.

- Close to Nature: Stunning beaches are just a quick tram ride away, and the world-famous Douro Valley wine region is the perfect spot for a weekend getaway.

For many people, choosing Porto isn't just a real estate transaction—it's an investment in a lifestyle. It’s about embracing a slower, more connected way of living without giving up the excitement and opportunities of a thriving city. That's a rare balance, and it’s what makes Porto an incredible place to call home.

Getting to Grips with Porto's Apartment Market and Prices

Before you can make a smart move on an apartment for sale in Porto, Portugal, you need to get a feel for the market's pulse. Think of it like a sailor learning the local currents before heading out to sea—understanding the trends and price dynamics will help you navigate your purchase with real confidence.

Porto’s property scene isn't just growing; it's coming of age. For years, it was a bit of a hidden gem, offering incredible value compared to other Western European cities. While that value is still there, the secret is definitely out, creating a dynamic market driven by both strong local demand and a steady stream of international buyers.

The city’s economic revival, powered by a booming tech scene and relentless tourism, is the main engine behind property appreciation. As more global companies set up shop and remote workers discover Porto's charms, the demand for quality housing just keeps climbing. This has created healthy, sustainable growth, not a speculative bubble.

What's Fuelling Porto's Property Market?

A few key factors are shaping apartment prices and investment potential right now. Getting your head around them is the first step to spotting a genuine opportunity.

- Foreign Investment: International buyers are a huge piece of the puzzle. They’re drawn to the city for its affordability and high quality of life, which keeps demand strong and steady.

- The Tourism Effect: Porto’s status as a top travel destination creates a huge appetite for short-term rentals. This, in turn, pushes up apartment values, especially in the central, tourist-friendly areas.

- Urban Renewal: The city is constantly improving. Ongoing projects to restore historic buildings and upgrade public spaces are making different neighborhoods more attractive and valuable every year.

- A Stronger Local Economy: A growing local economy means more jobs and better wages. This empowers more locals to buy property, adding another layer of demand to the market.

Porto's market really hits a sweet spot. You get the stability and infrastructure of an established European city, but with the kind of growth potential you'd normally find in an emerging market. That unique balance is what makes it so compelling.

What Should You Expect to Pay?

While Porto is still easier on the wallet than Lisbon, prices have been climbing steadily for years. The final cost of an apartment for sale in Porto, Portugal will swing wildly depending on its location, size, condition, and perks. A renovated apartment in the historic center or a new build with all the modern comforts will, of course, be at the top end of the price scale.

To put it in perspective, Portugal’s entire real estate market kicked off an impressive growth spurt in early 2025, with Porto right at the heart of it. National property prices shot up by 15.8% year-on-year, blowing past the EU average of 4.5%. This was largely fueled by keen foreign investors and resilient local demand. In fact, a 2024 survey revealed that 84% of foreign investors were planning to expand their operations in Portugal, confirming the country's rising star status. You can dive deeper into this trend by reading the full analysis of Portugal's real estate market on GlobalCitizenSolutions.com.

This is all part of a bigger picture, as savvy international buyers are constantly scouting the best countries to buy property for both lifestyle and investment returns.

Porto vs Lisbon Apartment Price Snapshot

Putting Porto side-by-side with Lisbon really drives home the value on offer. Both cities deliver an amazing lifestyle, but your money can often stretch much further up north.

| Metric | Porto | Lisbon |

|---|---|---|

| Avg. Price per m² (City Center) | €3,200 - €4,500 | €4,500 - €6,000 |

| Avg. Price per m² (Outside Center) | €2,000 - €3,000 | €2,800 - €4,000 |

| Typical Gross Rental Yield | 4.5% - 6.5% | 3.5% - 5.0% |

| Annual Price Appreciation (2024-25) | ~8.2% | ~4.7% |

The numbers don't lie. Porto not only offers a lower barrier to entry but has also delivered stronger price growth and better rental yields recently. This potent mix makes it a magnet for both lifestyle buyers and serious investors looking for a solid return. The trick, as always, is to zero in on specific neighborhoods to find the perfect fit for your budget and your goals.

Discovering Porto's Top Neighborhoods to Live and Invest

Choosing where to buy an apartment for sale in Porto, Portugal isn't just about the four walls and a roof; it's about plugging into the right lifestyle. Every neighborhood in Porto—or freguesia, as the locals call them—has its own beat, its own unique flavor. The real secret to a great purchase is matching your personal goals, whether that's a smart investment, a place to raise a family, or a vibrant city adventure, to the right address.

Think of Porto as a mosaic of distinct villages, each with its own story. You’ve got the ancient, cobblestone streets of the historic center humming with life, and then you have the breezy, upscale avenues right by the Atlantic. It’s a city of contrasts. This guide is your inside look at Porto's most sought-after districts, helping you picture exactly what life could be like.

Ribeira and Miragaia: The Historic Heart

If you’ve ever dreamed of living inside a postcard, Ribeira is it. This is Porto’s historic soul, a UNESCO World Heritage site where colorful, skinny buildings tumble down the hillside to meet the Douro River. Life here is electric. It’s a constant buzz of tourists, street performers, and the happy chatter spilling out of riverside cafes.

Apartments in Ribeira are all about character. They're often tucked into beautifully renovated old buildings, full of charming quirks like exposed stone walls, original wooden beams, and incredible, if sometimes compact, views. Right next door, Miragaia offers a similar vibe but with the volume turned down a notch—it feels a bit more local, a bit more authentic.

- Best for: Investors eyeing the lucrative short-term rental market and anyone who craves being in the absolute middle of everything.

- Lifestyle: Fast-paced and tourist-focused. The city's best restaurants, landmarks, and views are literally on your doorstep.

- Property Style: Mostly smaller, renovated apartments (T0 or T1 studios/one-bedrooms) in historic buildings that command premium prices for their unbeatable location.

Cedofeita, Santo Ildefonso, and Bonfim: The Creative Hub

Just a stone's throw from the historic core, you’ll find the city’s creative pulse. The cluster of neighborhoods including Cedofeita, Santo Ildefonso, and Bonfim is where Porto’s bohemian and artistic energy really shines. It’s a landscape of independent art galleries, cool little boutiques, and fantastic specialty coffee shops. Rua de Miguel Bombarda in Cedofeita, known as the "Arts Block," is the undeniable heart of this scene.

This part of town pulls in a younger, more international crowd—think students, artists, and digital nomads. The rental market for apartments in Porto is fierce here, reflecting a demand that, while stabilizing, remains strong. As of 2025, the city-wide average rent hovers around €17 per square meter, a number that definitely holds true in these trendy districts. This is fueled by the city’s growing popularity and solid economy. For a deeper dive, you can explore detailed insights into Portugal's rental market on SavvyCatRealty.com.

These areas give you a fantastic mix of classic Portuguese architecture and stylishly renovated apartments, perfect for those who want old-world charm with modern comforts.

This creative quarter strikes the perfect balance. It’s close enough to feel central but has its own distinct, less tourist-packed identity. This is where you come to feel the city's modern, artistic heartbeat.

Foz do Douro and Nevogilde: The Coastal Escape

Head west to where the Douro River kisses the Atlantic Ocean, and you’ll find Foz do Douro and its elegant neighbor, Nevogilde. These are Porto's most exclusive and peaceful residential areas, trading historic hustle for a sophisticated, coastal calm. The whole vibe shifts to breezy seaside living, defined by beautiful promenades, upscale dining, and sandy beaches.

This is the go-to spot for affluent families and discerning buyers looking for more space, tranquility, and stunning ocean views. The properties here are generally larger and more modern, including luxury apartment buildings with amenities like pools and private gardens. It feels a world away from the city buzz, yet you're just a scenic tram ride or a quick bus trip from the center.

Boavista: The Modern Business District

Boavista represents Porto's modern, cosmopolitan face. It’s a major business and commercial hub centered on the huge Rotunda da Boavista roundabout. This is where you’ll find corporate headquarters, high-end hotels, and the architectural marvel that is the Casa da Música concert hall. The keywords here are convenience and contemporary living.

Apartments in Boavista tend to be in newer, well-equipped buildings with all the modern trimmings you'd expect—elevators, central heating, and underground parking. It’s a top choice for professionals and families who value having services, international schools, and fantastic transport links, including a key metro station, right at their fingertips.

Porto Neighborhood Buyer's Guide

To help you sort through your options, we've put together this quick-glance guide to Porto's prime neighborhoods. It’s designed to help you easily see which area might be the best fit for your budget and lifestyle.

| Neighborhood | Vibe & Lifestyle | Average Price (€/m²) | Best For |

|---|---|---|---|

| Ribeira & Miragaia | Historic, Tourist-Centric | €4,000 - €5,500+ | Short-Term Rentals & City Lovers |

| Cedofeita & Bonfim | Artsy, Bohemian, Hip | €3,500 - €4,800 | Young Professionals & Creatives |

| Foz do Douro | Upscale, Coastal, Calm | €4,500 - €6,000+ | Families & Luxury Buyers |

| Boavista | Modern, Convenient | €3,200 - €4,500 | Professionals & Expats |

At the end of the day, finding the perfect apartment for sale in Porto, Portugal is about picturing your life there. Do you see yourself sipping an espresso in a historic square? Taking a morning walk along the ocean? Or popping into an art gallery on your way home? By exploring these diverse neighborhoods, you’re sure to find the corner of Porto that feels just right.

Your Step-by-Step Guide to Buying Property in Portugal

Navigating the legal side of buying an apartment abroad can feel daunting, a bit like trying to put together a puzzle without the picture on the box. But the good news is that in Portugal, the system is refreshingly structured and logical.

With the right team and a clear understanding of the steps, it's a lot more straightforward than you might expect. Let's break down the entire journey, turning what seems complicated into a clear path to owning your new home in Porto.

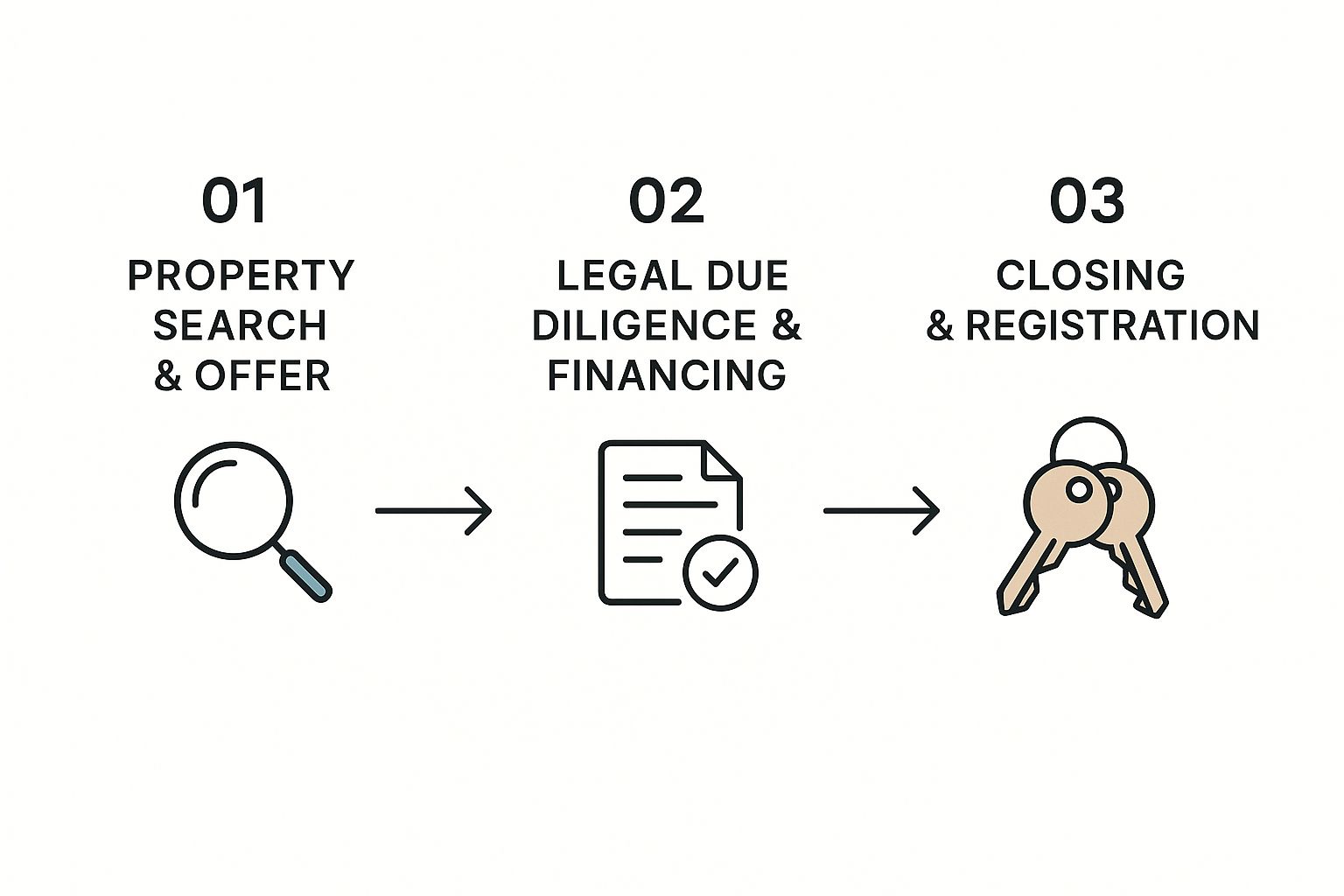

You can think of the whole process as a three-act play. Act One is all about getting your ducks in a row and making a commitment. Act Two is where your legal team takes over and does the heavy lifting. And Act Three? That’s the grand finale, where you officially become the owner.

Act One: The NIF Number and Promissory Contract

Before you can even think about making a formal offer on an apartment for sale in Porto, Portugal, you'll need to get your Portuguese tax identification number. It's called the Número de Identificação Fiscal (NIF), and it's absolutely essential. You'll need it for almost every major transaction in the country, from opening a bank account to signing the property contracts. A local lawyer can typically get this sorted for you in just a day or two.

Once you have your NIF and the seller has accepted your offer, it’s time for the Contrato de Promessa de Compra e Venda (CPCV). This is the Promissory Contract, and it's a serious, legally binding agreement that locks in the sale.

This crucial document lays out all the terms of the deal:

- The final purchase price you both agreed on.

- A full legal description of the property.

- The deposit amount, which is usually between 10% and 20% of the sale price.

- The target date for signing the final deed.

The CPCV is a major milestone. If you, the buyer, decide to pull out of the deal without a legitimate legal reason, you'll forfeit your deposit. On the flip side, if the seller backs out, they are required by law to pay you back double the amount of your deposit as a penalty.

Act Two: Due Diligence and Final Preparations

With the CPCV signed and the deposit paid, your lawyer steps into the spotlight. This is the due diligence phase, where they meticulously comb through every legal and financial detail of the property. Think of it as a complete health check-up for your future home, ensuring there are no nasty surprises waiting for you later.

Your legal team will be checking several key documents:

- Land Registry Certificate (Certidão de Teor): This confirms who the legal owner is and uncovers any outstanding debts, mortgages, or claims against the property.

- Property Tax Document (Caderneta Predial): This document from the local tax office verifies the property's official tax records and makes sure all the taxes are paid up.

- Usage License (Licença de Utilização): This proves the property was built according to the approved plans and is legally cleared for residential use.

While the Portuguese process has some things in common with other European countries, every nation has its own quirks. For a bit of perspective, you can see how things are done in Italy by checking out our guide on how to buy property on the Amalfi Coast. During this stage, you'll also need to pay the Imposto Municipal sobre as Transmissões Onerosas de Imóveis (IMT), which is the property transfer tax. This has to be paid before the final signing.

This infographic lays out the three main stages of the buying journey.

As you can see, it's a logical flow. The legal checks and financial arrangements are the critical bridge connecting the moment you find your dream apartment to the day you finally own it.

Act Three: The Final Deed and Registration

The final act is the Escritura Pública de Compra e Venda—the final deed of sale. This is the official signing ceremony, which always happens at a notary’s office. A notary is a neutral, state-appointed official who verifies everyone's identity, confirms all the legal boxes have been ticked, and witnesses the signing.

At this meeting, you (or your lawyer, if you've given them power of attorney) will sign the last of the paperwork and transfer the remaining balance of the purchase price to the seller. As soon as the ink is dry on the deed, the keys to your new Porto apartment are yours.

There's just one last thing to do. Your lawyer will take the signed deed to the Land Registry Office (Conservatória do Registo Predial) to officially register your ownership. This updates the public record, securing your title and making it official. Congratulations—you now own a home in Portugal

Financing Your Porto Apartment Purchase

Getting the right financing is what turns the dream of a Porto apartment into a set of keys in your hand. The process here is straightforward, but it’s crucial to understand how Portuguese banks think and what they expect from you. The good news? You don’t have to be a resident—or even an EU citizen—to get a mortgage in Portugal.

Think of applying for a mortgage here as presenting your personal business case. The bank isn't looking for flash; they're looking for stability. They want to see a clear, low-risk picture of your ability to pay back the loan, year after year. They are fundamentally conservative, so documented proof of income and a clean financial history are your best friends.

Putting together a strong application is your first big win, especially when you’re hunting for that perfect apartment for sale in Porto, Portugal. The bank will put your finances under a microscope to decide if you're a good bet and how much they’re willing to lend.

What Portuguese Banks Look for in an Applicant

When you sit down to apply, Portuguese banks are going to focus on a handful of core areas to figure out their risk. Having all your paperwork ready isn't just a suggestion—it's non-negotiable. It shows them you're a serious, organized buyer.

Here’s the typical checklist of what you'll need to hand over:

- Proof of Identity: Your passport or national ID card.

- NIF (Número de Identificação Fiscal): This is your Portuguese tax number. You can't do anything financially significant in Portugal without one.

- Proof of Income: Get your last three to six months of payslips ready, along with your most recent annual tax return.

- Bank Statements: They’ll want to see the last three to six months of statements from your main bank account. This gives them a real-world look at your spending habits and cash flow.

- Credit Report: A credit history report from your home country is a must. It proves you have a solid track record of handling debt responsibly.

If you're self-employed, expect a little more homework. You’ll need to show two or three years of business accounts and tax returns to prove your earnings are consistent and reliable.

Key Mortgage Concepts Explained

A few key terms will pop up in every conversation with a bank or mortgage broker. The most important one to wrap your head around is the Loan-to-Value (LTV) ratio. This is simply the percentage of the property's value that the bank is willing to lend you.

In Portugal, non-residents can usually get an LTV between 60% and 70%. This means you need to be prepared with a down payment of at least 30% to 40% of the purchase price, plus extra cash for taxes and fees. If you're a resident, you might get a better deal, with an LTV up to 80% or even 90%.

You'll also need to decide between a fixed or variable interest rate. Each has its pros and cons.

- Fixed-Rate Mortgage: Your interest rate is locked in for a set period, like 2, 5, or 10 years. This offers fantastic peace of mind because your monthly payments won’t budge, making it super easy to budget.

- Variable-Rate Mortgage: This rate is tied to the Euribor (the European banking rate) plus the bank’s own margin. Your payments can go up or down as the Euribor fluctuates. You could save money if rates fall, but you also carry the risk of higher payments if they climb.

The Mortgage Application Process

Getting a mortgage in Portugal is a step-by-step journey. It starts with figuring out what you can realistically afford and ends with the bank releasing the funds to seal the deal.

Here's how it usually plays out:

- Pre-Approval: Before you fall in love with an apartment for sale in Porto, Portugal, it’s smart to get pre-approved for a mortgage. It gives you a solid budget and instantly makes you a more credible buyer in the eyes of sellers and agents.

- Formal Application: Once your offer on a place is accepted, it's time to submit the official application with all your meticulously prepared documents.

- Property Valuation: The bank will hire an independent appraiser to value the property. This is to make sure their investment is secure. Your final loan amount will be based on whichever is lower: the purchase price or the official valuation.

- Final Approval and Offer: If the valuation comes back looking good and your finances are solid, the bank will issue a formal mortgage offer.

- Signing the Deed: This is the final step. You'll sign the mortgage documents at the same time as the final property deed (the Escritura) in front of a notary.

A word of advice: working with an experienced, independent mortgage broker can be a game-changer. They know the system inside and out, can shop around for the best rates, and help you package your application to look as attractive as possible. It can honestly make all the difference.

Your Top Questions About Buying in Porto, Answered

As you get closer to making an offer, the big picture starts to fade and the practical, nitty-gritty questions come into focus. This is where the rubber meets the road. Let's tackle some of the most common queries we hear from buyers, covering everything from taxes and residency to finding the right local expert and budgeting for the true cost of ownership.

Think of this as your final pre-flight check. Buying property in a new country is a bit like learning a new board game—you need to know the rules, the penalties, and the winning moves before you can play confidently. These answers should fill in any remaining gaps and get you ready for the next step.

What Are the Main Property Taxes I Need to Know About?

Getting a handle on the tax situation is absolutely critical for setting a realistic budget. When you buy a property in Portugal, you’ll run into a few key taxes both during the purchase and annually after that.

First, there's the big one: IMT (Imposto Municipal sobre as Transmissões Onerosas de Imóveis). This is the property transfer tax, and it's the largest one-time cost you'll face. It's calculated on a sliding scale based on the property's value, usually falling somewhere between 1% and 8%. You have to pay this before you sign the final deed.

Next up is Stamp Duty, or Imposto do Selo. This is a straightforward flat tax of 0.8% of the property’s value, also paid before you get the keys. If you’re taking out a mortgage, plan for an additional Stamp Duty of 0.6% on the loan amount.

Once the apartment is yours, you’ll have an annual property tax called IMI (Imposto Municipal sobre Imóveis). This rate is set by the local Porto municipality and typically lands between 0.3% and 0.45% of the property's tax value each year.

Does Buying Property Grant Me Portuguese Residency?

This is a huge question, especially for non-EU citizens, and the answer is a little nuanced. Simply buying an apartment in Porto does not automatically make you a resident. The property purchase and the residency application are two separate processes.

However, owning a home here can be a massive plus for your application. It strongly supports visas like the D7 (for those with passive income) or the Digital Nomad Visa by proving you have deep ties to the country and a stable place to live—a major factor for immigration authorities.

You might have heard about Portugal's "Golden Visa" program. While it once had a popular real estate investment option, the program has changed significantly, and residential property purchases no longer qualify for this specific path. Your best bet is always to chat with a qualified immigration lawyer to get the latest, most accurate advice on securing residency.

How Do I Find a Reliable Real estate Agent?

Finding a great real estate agent is like finding a trusted local guide for a challenging expedition. They don't just unlock doors to apartments; they offer crucial market intel, fight for you in negotiations, and help you sidestep common mistakes.

My advice? Start by seeking out agents who specialize in working with international buyers. They're already familiar with the hurdles you'll face, can anticipate your questions, and almost always have English-speaking staff ready to help.

Here are a few practical tips to help you vet potential agents:

- Check Their Credentials: Make sure the agent and their agency are licensed with Portugal's official real estate association, the Associação dos Mediadores do Imobiliário de Portugal (ASMIP).

- Ask for References: Don't be afraid to ask for testimonials or to speak directly with other international clients they've helped. A good agent will be proud to connect you.

- Test Their Local Knowledge: A great agent should be a true expert on the specific Porto neighborhoods you're eyeing, not just a generalist for the whole city.

And remember, in Portugal, the seller is the one who pays the agent's commission. This means a buyer's agent provides their expertise at no direct cost to you.

What Are the Ongoing Costs of Owning an Apartment?

Beyond the annual IMI tax, owning an apartment for sale in Porto, Portugal, involves a few other regular expenses that you need to build into your monthly budget.

First are the condominium fees, known locally as condomínio. If your apartment is in a building with shared spaces—think elevators, hallways, a garden, or a lobby—you'll pay a monthly fee for maintenance. This can be anywhere from €30 to over €150 per month, depending on how fancy the building's amenities are.

Utilities are another given. Here's a rough idea of what to expect:

- Electricity and Gas: This will naturally depend on your usage, but a typical two-person household might see bills of around €80-€120 per month combined.

- Water: Much more affordable, usually in the €20-€40 range per month.

- Internet and TV: You can usually find a good bundle for about €35-€50 a month.

Finally, it’s always smart to have a little cash set aside for routine maintenance and unexpected repairs. A small "rainy day" fund means a leaky pipe or a broken appliance is just a minor inconvenience, not a financial crisis, helping you keep your new home in perfect shape.

Ready to turn your dream of owning a European property into reality? At Residaro, we connect you with stunning apartments, villas, and homes across Portugal and beyond. Explore our curated listings and find your perfect property today by visiting us at https://residaro.com.